1/9 Precious Metals:

It stinks more than you think,

Let's stop & think for a minute.

What was happening in markets?

From Feb 21st the Nasdaq was already in trouble while

the Precious Metals Gold and Silver were ramping.

D-I-V-E-R-G-E-N-C-E

@DerivativesDon

It stinks more than you think,

Let's stop & think for a minute.

What was happening in markets?

From Feb 21st the Nasdaq was already in trouble while

the Precious Metals Gold and Silver were ramping.

D-I-V-E-R-G-E-N-C-E

@DerivativesDon

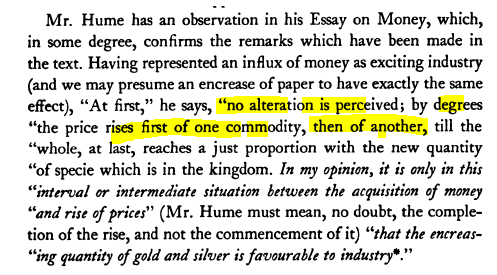

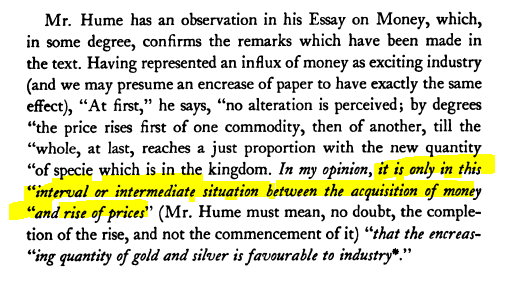

2/9 We have notorious velocity problems with an insolvent Fed, and a quasi fiscal deficit. Meaning that the Fed has to pay Banks for not using reserves. IORB..

That's a sterilization short-term but inflationary long term.

A QFD as explained by Rodriguez at the World Bank is a very nasty condition of sterilization costs

documents1.worldbank.org/curated/en/465…

That's a sterilization short-term but inflationary long term.

A QFD as explained by Rodriguez at the World Bank is a very nasty condition of sterilization costs

documents1.worldbank.org/curated/en/465…

3/9 Now you know what signal it meant. In a situation where stocks are dumped and precious metals are rallied it means "we don't trust the Financial assets, nor the currency".

So when the real issue is sterilization problems and velocity at the Fed. It was just not authorized to happen let me explain....

So when the real issue is sterilization problems and velocity at the Fed. It was just not authorized to happen let me explain....

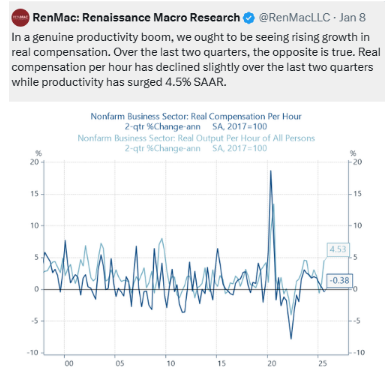

4/9 As I have explained many times #BTC is non-inflationary liquidity decoy to absorb this excessive liquidity without creating inflation. As explained in a previous post, if the liquidity was going into food and metals, this would create inflation with 2nd & 3rd consequences.

5/9

#BTC is most likely a Gov sponsored program.

It has a SECOND impact as a non-inflationary liquidity decoy.

If the liquidity were to go into

Foods and Metals =>

higher prices =>

higher inflation numbers =>

higher interest costs for the gov =>

higher deficit interest burden =>

higher cost of sterilization for the #Fed via IORB and more negative equity at the FEd (compromising the other components that is M0)

#BTC is therefore a way to protect the USD and UST.

x.com/GraphCall/stat…

#BTC is most likely a Gov sponsored program.

It has a SECOND impact as a non-inflationary liquidity decoy.

If the liquidity were to go into

Foods and Metals =>

higher prices =>

higher inflation numbers =>

higher interest costs for the gov =>

higher deficit interest burden =>

higher cost of sterilization for the #Fed via IORB and more negative equity at the FEd (compromising the other components that is M0)

#BTC is therefore a way to protect the USD and UST.

x.com/GraphCall/stat…

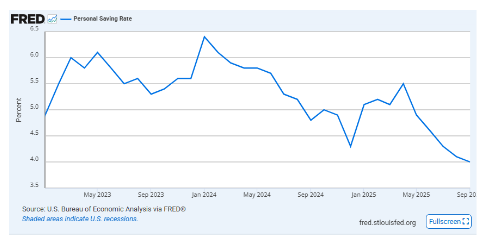

6/9 Except that the liquidity was going into PM until the 3td of April, while stocks were going down hence of course the necessary intervention on April 3rd and raising the margins.

IT HAD TO BE STOPPED. MARGINS.

IT HAD TO BE STOPPED. MARGINS.

https://x.com/profitsplusid/status/1907895158173217089

7/9

Can you imagine margins increased on April 3rd at brokers on Stocks?

What would have been the plunge in stocks?

Well the authorities did EXACTLY THAT on Precious Metals.

Why for the reasons explained before.

Sterilization and velocity control.

THE FLOWS CAN NOT BE ALLOWED TO GO INTO COMMOs (BECAUSE IT's INFLATIONARY)

Can you imagine margins increased on April 3rd at brokers on Stocks?

What would have been the plunge in stocks?

Well the authorities did EXACTLY THAT on Precious Metals.

Why for the reasons explained before.

Sterilization and velocity control.

THE FLOWS CAN NOT BE ALLOWED TO GO INTO COMMOs (BECAUSE IT's INFLATIONARY)

8/9 Liquidity fleeing the financial assets and the currency into commodities (inflationary)? NOT ALLOWED.

#BTC, the non-inflationary decoy since April 2nd? Miraculously flat.

lol...

#BTC, the non-inflationary decoy since April 2nd? Miraculously flat.

lol...

9/9

People are being fooled into thinking that the primary risk is deflation. The condition of the Fed and primary deficit point to the complete opposite direction.

This market A JOKE

People are being fooled into thinking that the primary risk is deflation. The condition of the Fed and primary deficit point to the complete opposite direction.

This market A JOKE

• • •

Missing some Tweet in this thread? You can try to

force a refresh