Connect the Financial dots.

Analysis organized & presented in proprietary big-data & augmented web.

Patent US 11,327,775 B2

ex hedgie

👇 get a free account

2 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/michaeljburry/status/1990171815155752976

2/10

2/10

2/14

2/14

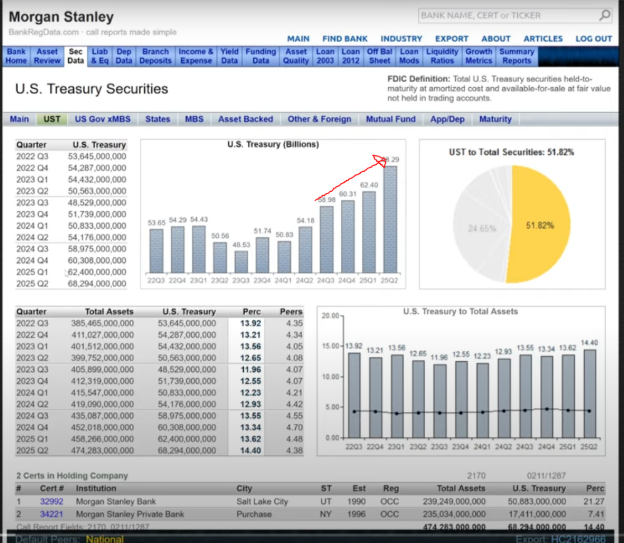

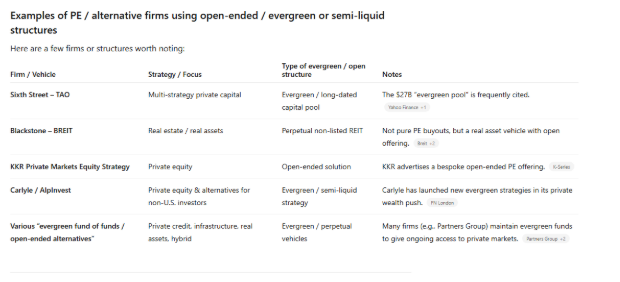

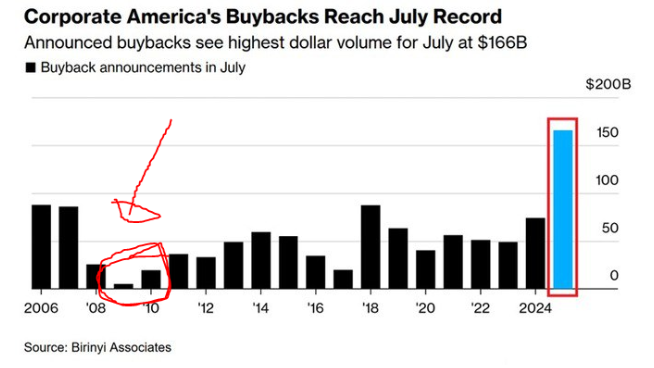

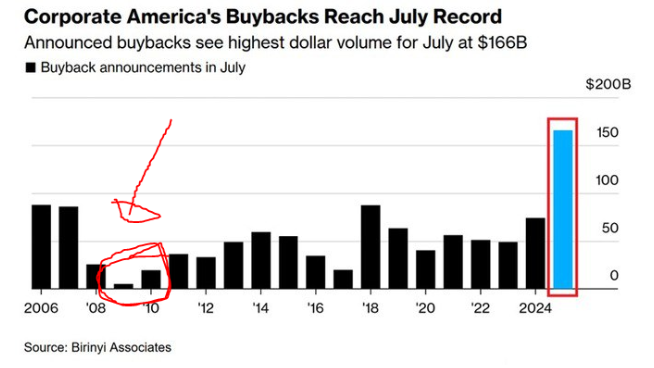

https://twitter.com/GraphCall/status/1987932209278234960FALSE LIQUIDITY FROM MANY PARTIES:

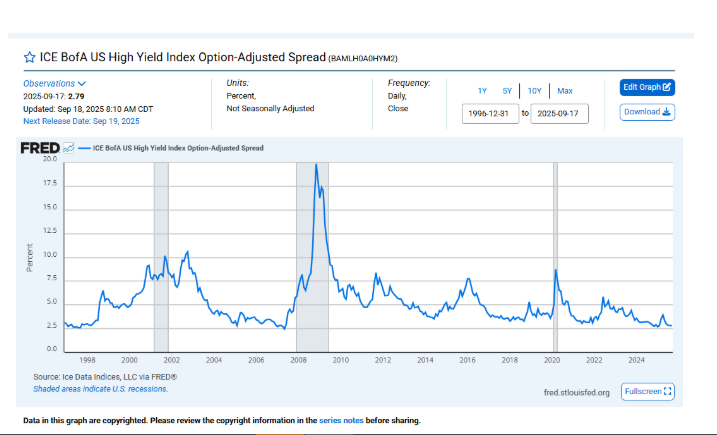

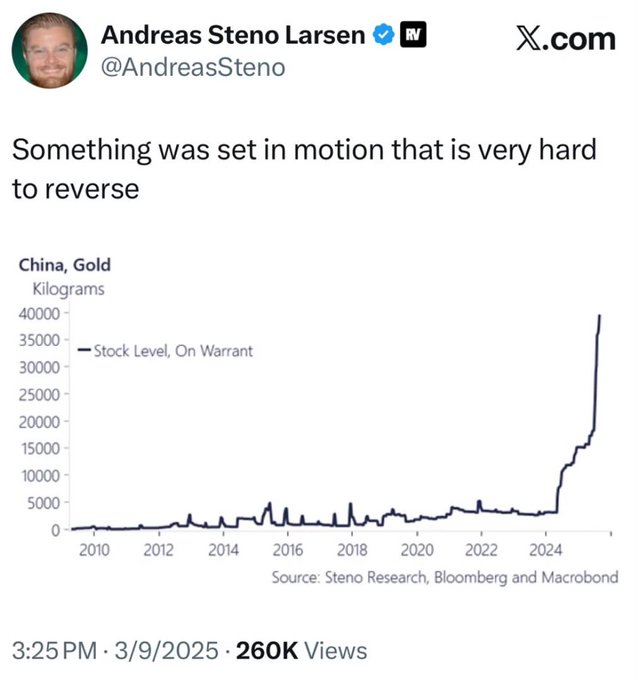

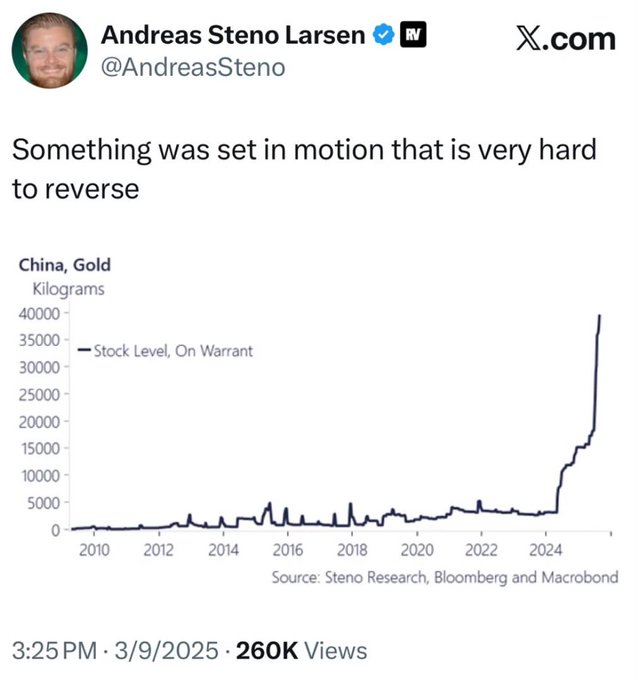

Why would any central bank be crazy enough to stimulate a bubble?

Why would any central bank be crazy enough to stimulate a bubble?

https://x.com/MacroEdgeRes/status/1981503533271671039

2/18

2/18

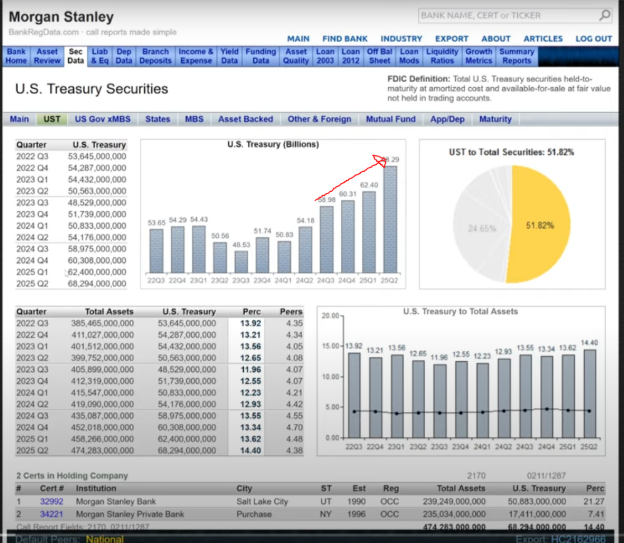

2/15 Morgan Stanley is not the only one to be stuffed with U.S. Treasuries,

2/15 Morgan Stanley is not the only one to be stuffed with U.S. Treasuries,

2/25

2/25

2/8 (quick reminnder context)

2/8 (quick reminnder context)