So, this announcement is interesting since it commits to greenlight (or at least work with proponents and First Nations to approve) ten specific projects. I thought it was worth taking a look at a few of them (they are shown below): 1/

https://twitter.com/shuvmajumdar/status/1909433104122490942

The first one is pretty easy: LNG Canada Phase 2. The project has federal approval for the full two-phase capacity. The proposed emissions cap would not place output restrictions on LNG Canada. And, the power supply questions are provincial.

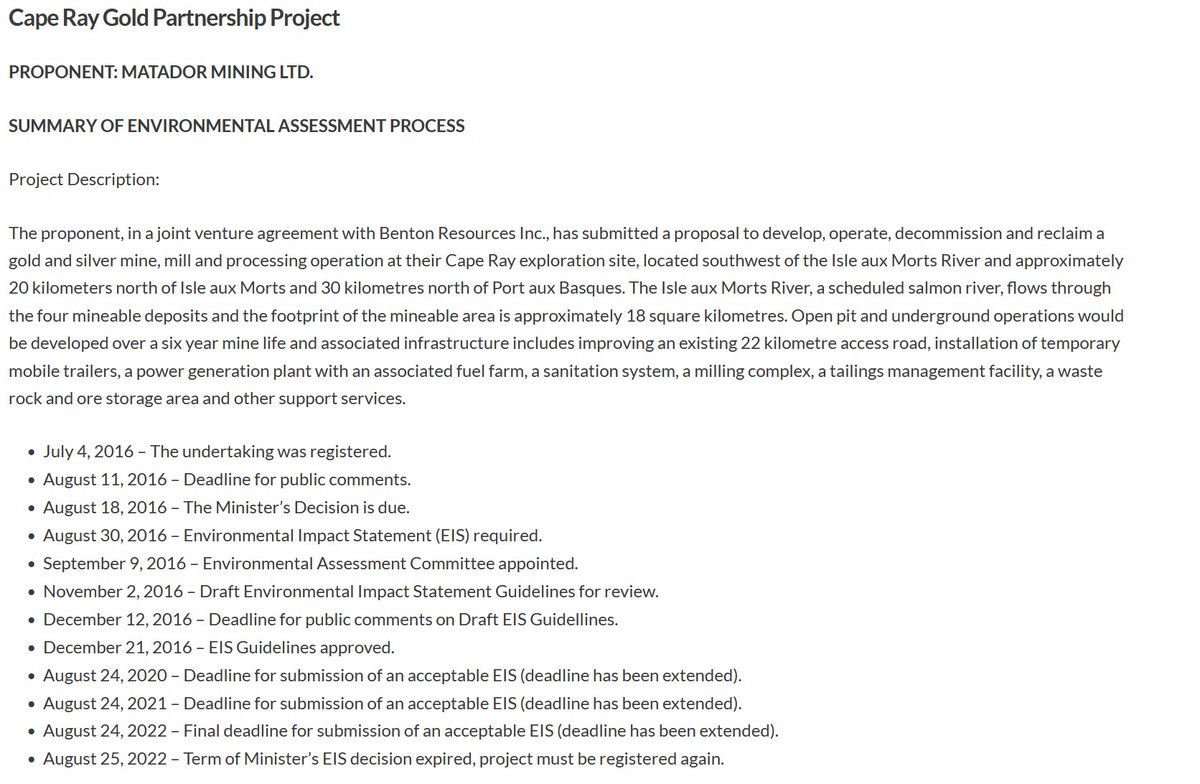

The last one on the list is where things get fun: Cape Ray. Cape Ray is listed as under assessment since 2017. That's true, but let's dig into why. Well, from 2017 until 2022, no environmental impact assessment documents were provided by Matador. There was nothing to assess.

In August of 2022, the proponent requested a three year extension of the time limit - TO SUBMIT THEIR MATERIALS - until August of 2025. The extension was granted and that's all we know for now from the IAAC. The project is being assessed under 2012 legislation though.

But, it gets more interesting. As far as I can tell, this project has been withdrawn from consideration in Newfoundland and Labrador? Since 2022? Oh, but it gets better still from here...

So, the project was originally proposed in Newfoundland and Labrador in 2016 too. Guess what happened then? Oh, right: NL set up and environmental assessment, approved guidelines, etc and then, after 3 deadline extensions, the project was kicked out of the process.

So, tell me dear readers: how is a @PierrePoilievre government going to overcome this hurdle? How, in a year, are they going to approve a project that, for 8+ years, has refused to submit a single environmental assessment document and has officially withdrawn it's project in NL?

@PierrePoilievre Do we want to do another one? Which one, I wonder?

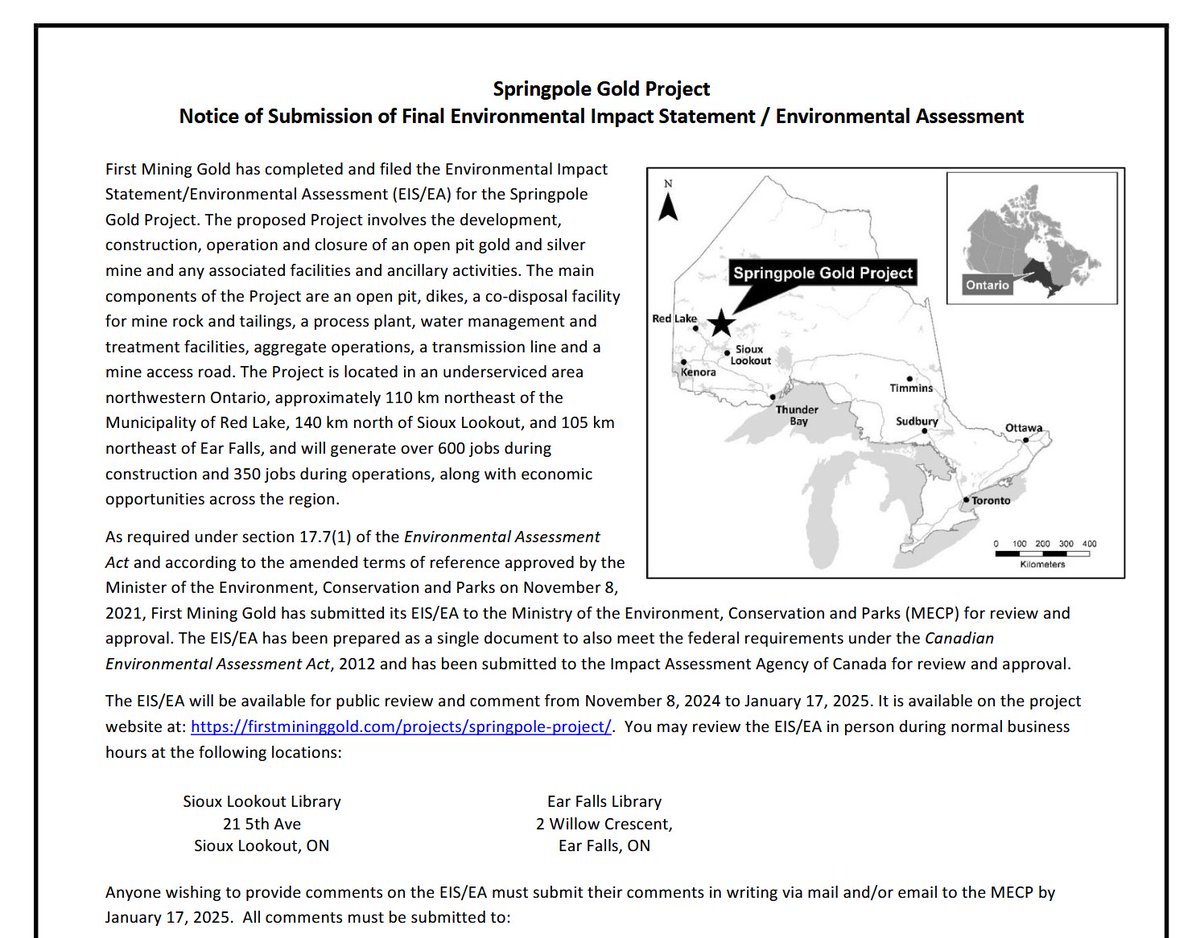

@PierrePoilievre Springpole Lake Gold is a good one, since this one actually appears to be moving. They have, at the end of last year, finally submitted their Environmental Impact Statement. You can see it here: iaac-aeic.gc.ca/050/evaluation…

@PierrePoilievre This project too had requested a time extension to provide required documents, extending the regulatory process (again under the Harper-era CEAA 2012 rules) by three years before it even really began.

@PierrePoilievre Here's the timeline as envisioned initially by the proponent (again, this is under the IAAC but it's using the terms of the 2012 regs). This process was delayed 2+ years by the proponent, not by Trudeau.

@PierrePoilievre There's also a parallel process on this mine in Ontario (you know, section 92A and what not) which recently went through a public comment phase and is moving to a decision. Not sure how a federal government would ensure a particular decision here?

@PierrePoilievre Another, since I was curious: Upper Beaver Lake. This is probably an example of how the federal process can drag along. If @PierrePoilievre wants an example of the challenges, this might be it. The IAAC decided, in December of 2021 an assessment was needed iaac-aeic.gc.ca/050/evaluation…

@PierrePoilievre As of now, we're working away on an Impact Statement, leading to Impact Assessment, and working toward a decision timeline in March 2026. That's almost 5 years from beginning to end, and that does not get the mine all of its *FEDERAL* permits. The IAAC doesn't issue those.

@PierrePoilievre So, honestly, if @PierrePoilievre wants to talk about a project, this one might be it. Gold mining has a lot of environmental consequences, don't get me wrong, but I have to agree that we can get to a general answer (yes, with broad conditions or no) faster than this.

Rook 1 is perhaps similar. This one is a uranium mine in Saskatchewan. This one is moving through to hearings in November after an environmental impact statement was finalized in January. You can really see the back-and-forth on the timeline though iaac-aeic.gc.ca/050/evaluation…

I don't know a lot about this project, but it seems to be moving through the regulatory process smoothly but slowly. That means that the proponent is likely looking at 8 years from application to final decision though (2019-2027) in the best case scenario now.

• • •

Missing some Tweet in this thread? You can try to

force a refresh