Professor of Economics and Law. Nobody cares what I say except Andrew Coyne, the Food Dude, and a few other minions. Blocks anonymous reply guys quickly.

How to get URL link on X (Twitter) App

https://twitter.com/shuvmajumdar/status/1909433104122490942

The first one is pretty easy: LNG Canada Phase 2. The project has federal approval for the full two-phase capacity. The proposed emissions cap would not place output restrictions on LNG Canada. And, the power supply questions are provincial.

The first one is pretty easy: LNG Canada Phase 2. The project has federal approval for the full two-phase capacity. The proposed emissions cap would not place output restrictions on LNG Canada. And, the power supply questions are provincial.

https://twitter.com/PierrePoilievre/status/1907111954440692112

This might give you a sense: markets changed. They were a little worried that shale gas might be an issue, but were still counting on a North American market served by *NET LNG IMPORTS*. This is from the NEB Reasons for Decision in 2010. Wonder if the market might have changed?

This might give you a sense: markets changed. They were a little worried that shale gas might be an issue, but were still counting on a North American market served by *NET LNG IMPORTS*. This is from the NEB Reasons for Decision in 2010. Wonder if the market might have changed?

Oh, but why is no one applying for a new pipeline? CER has seen the Mainline expanded, the TMX pipeline built (and running under capacity) and there is an outstanding permit for KXL. Any new line has to justify need beyond that.

Oh, but why is no one applying for a new pipeline? CER has seen the Mainline expanded, the TMX pipeline built (and running under capacity) and there is an outstanding permit for KXL. Any new line has to justify need beyond that.

https://twitter.com/PierrePoilievre/status/1907111954440692112The updated application for the project came in 2015, which is why it was assessed under CEAA, 2012 not CEAA 1992. In 2019, the review panel *finally* delivers a report. The report () finds the project to be in the public interest, but subject to conditions iaac-aeic.gc.ca/050/documents/…

https://twitter.com/PierrePoilievre/status/1907111954440692112How did the Liberal government block Carmon Creek? It was cancelled before they were elected. And Mackenzie Valley? Not even @PierrePoilievre can believe that was going to happen after gas prices collapsed from 2008 onward. And Frontier? After Teck lost money on Fort Hills? Nope.

He next talks about how the trucking companies will continue to pay carbon taxes on fuel. Again, with a zero rating, there is (ex -QC) no carbon taxes payable by trucking firms. He talks about mills. Some mills and other food processors are large enough to hit industrial pricing.

He next talks about how the trucking companies will continue to pay carbon taxes on fuel. Again, with a zero rating, there is (ex -QC) no carbon taxes payable by trucking firms. He talks about mills. Some mills and other food processors are large enough to hit industrial pricing.

The Joint Review Panel Report was delivered on December, 20 2013. It recommended approving the project. Harper govt had 6 months to make a decision on the pipeline and direct the NEB to issue the permits. Any idea how long that took? They issued the decision on June 17, 2014.

The Joint Review Panel Report was delivered on December, 20 2013. It recommended approving the project. Harper govt had 6 months to make a decision on the pipeline and direct the NEB to issue the permits. Any idea how long that took? They issued the decision on June 17, 2014.

It's almost as if there is something else driving price increases over than carbon taxes?

It's almost as if there is something else driving price increases over than carbon taxes?

https://twitter.com/FoodProfessor/status/1861043005060272446When reviewing a paper, I start with a summary of what the paper does and why that's important. This paper purports to assess the impact of Canadian carbon pricing on food prices. That's an important topic and an area of substantial political and policy discussion in Canada.

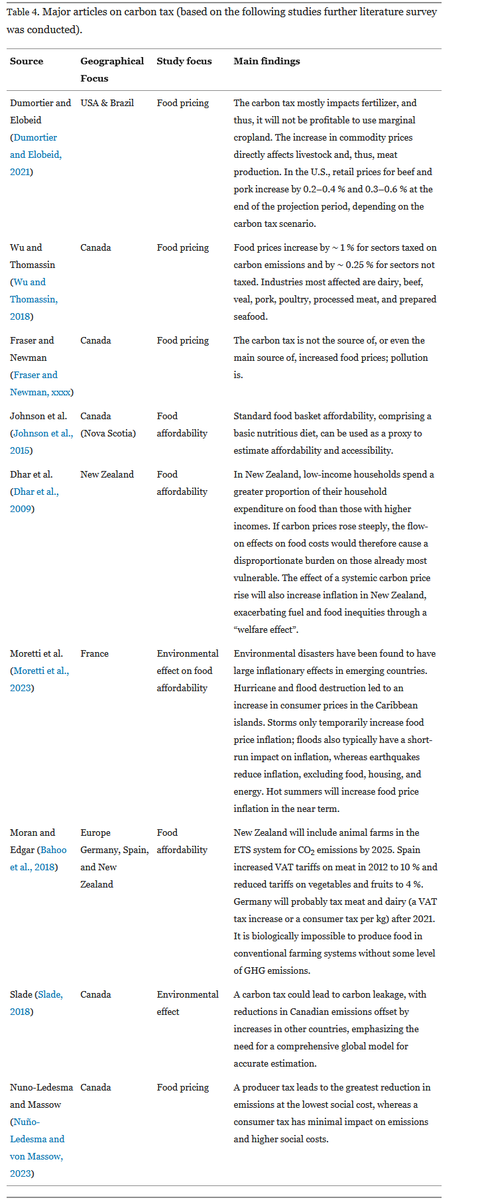

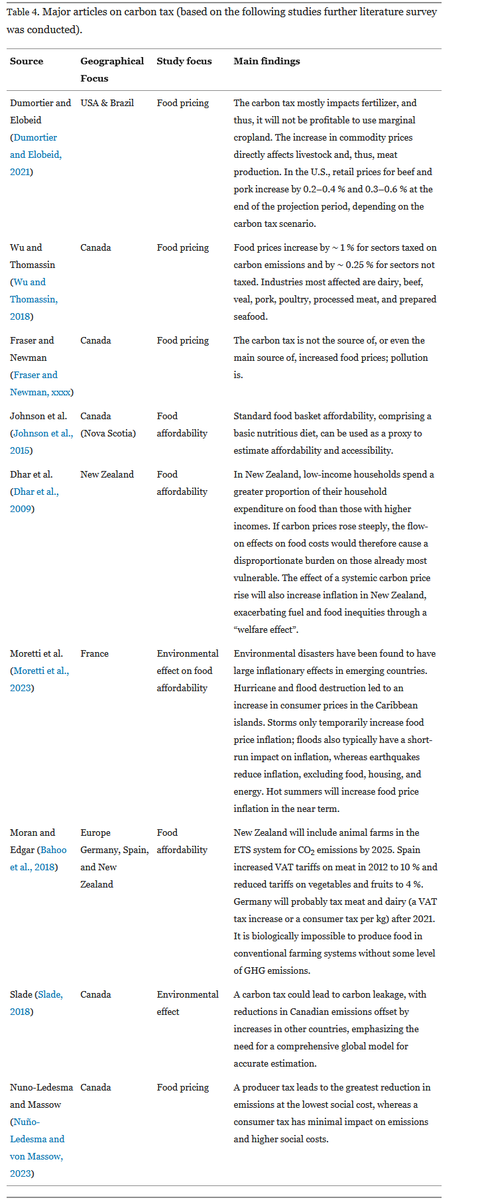

https://twitter.com/FoodProfessor/status/1856407513794826609Table 4 lists "Major articles on carbon tax" and talks about their country of focus. Five of the papers listed focus on Canada.

https://twitter.com/David_Moscrop/status/1773777905664852345Don't like a "sector by sector regulatory approach" w more stringent targets on oil and gas than any other? Talk about how experts favour economy-wide carbon pricing. Don't like carbon pricing? Maybe regulation would be better. Experts say we could get more stringent policies. 2/

https://twitter.com/andrew_leach/status/1750672750560379086And, if you're wondering "yeah, but what about those emissions beyond the farm gate," they are small for most foods. For a great interactive look at this, see @_HannahRitchie's interactive graph here: 2/ ourworldindata.org/grapher/food-e…