Joel Greenblatt is one of the best investors in the world

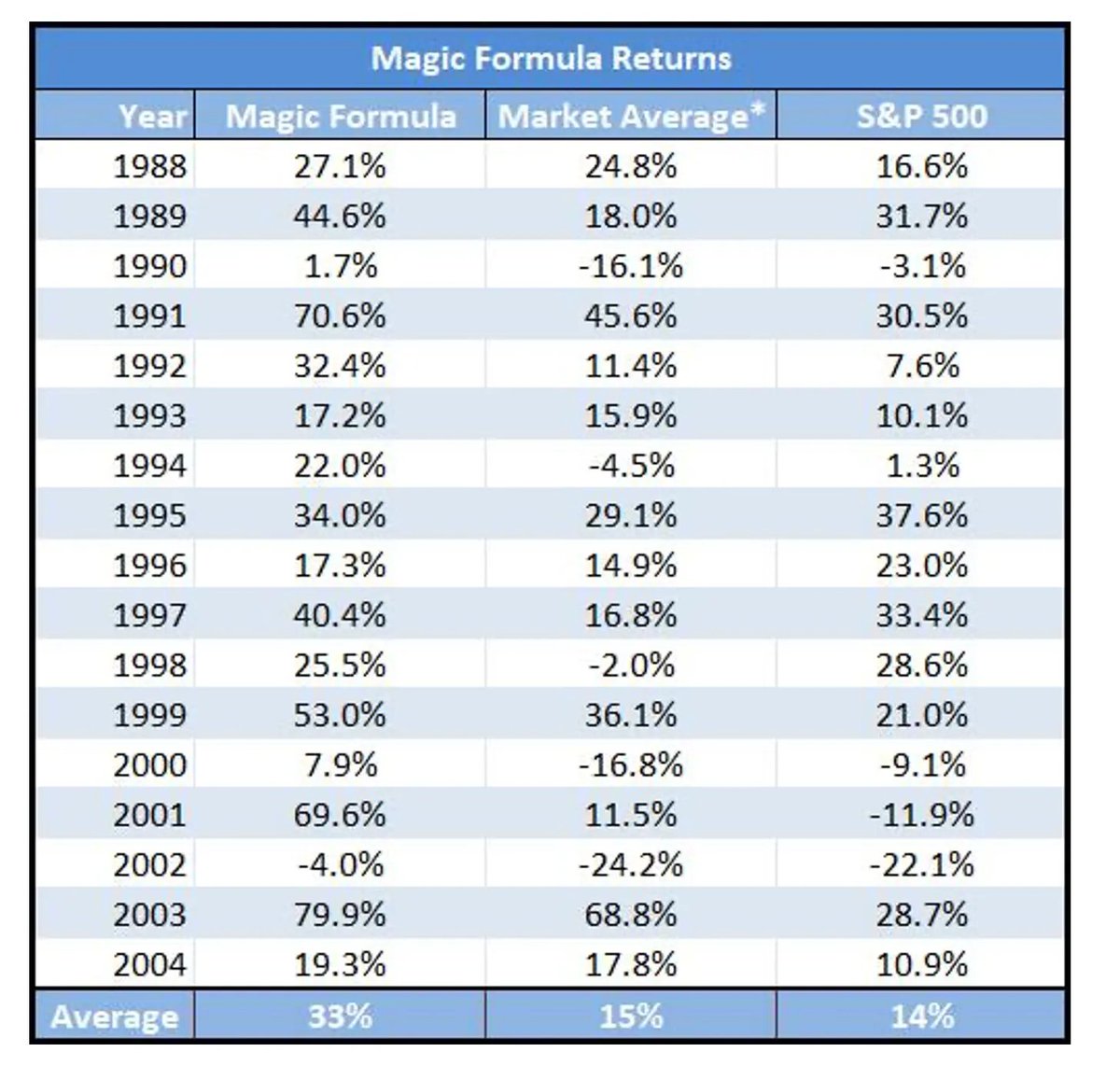

Between 1985 and 2005, his Magic Formula compounded on average with 33% (!) per year

Today, I'll teach you everything you should know about the Magic Formula:

Between 1985 and 2005, his Magic Formula compounded on average with 33% (!) per year

Today, I'll teach you everything you should know about the Magic Formula:

1. In 2006, Greenblatt wrote a book called The Little Book That Beats The Market.

He wanted to explain investing so simply that even his kids could understand it.

The key idea:

Buy good companies at cheap prices.

He wanted to explain investing so simply that even his kids could understand it.

The key idea:

Buy good companies at cheap prices.

2. In his book, he introduces The Magic Formula.

Between 1988 and 2004, this simple formula returned 33% annually.

Way more than the average investor.

But how does it work?

Between 1988 and 2004, this simple formula returned 33% annually.

Way more than the average investor.

But how does it work?

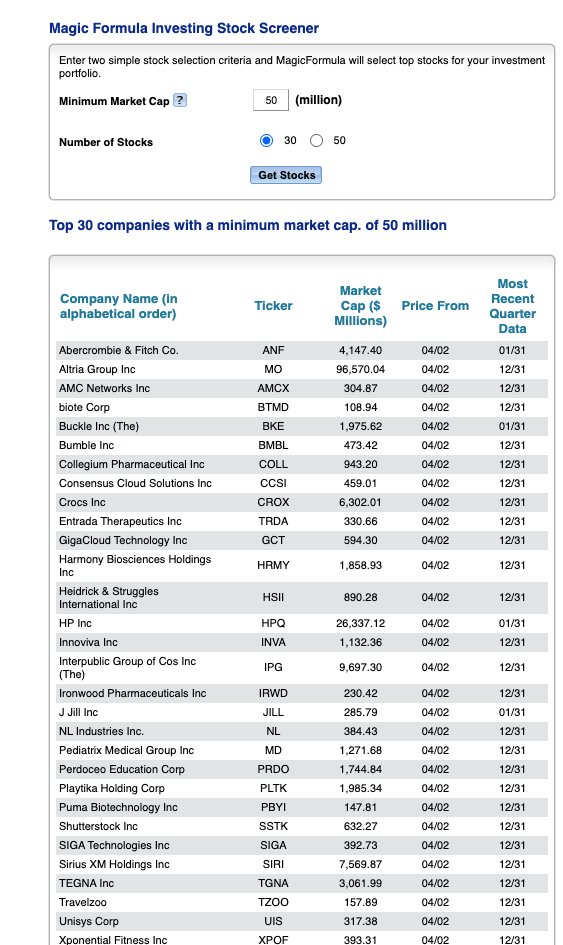

3. The Magic Formula works in 8 steps:

📌 Pick your investment universe

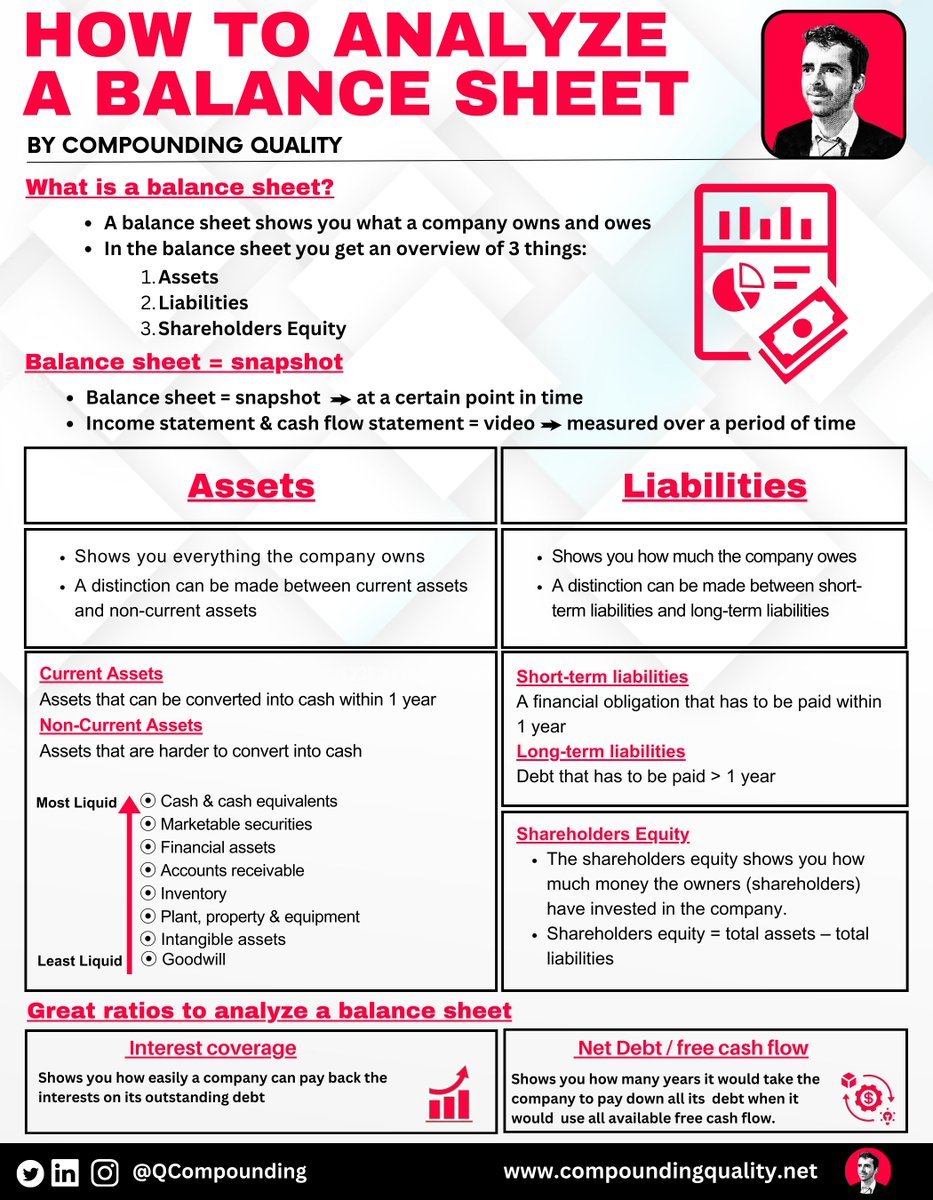

📌 Calculate Earnings Yield for each company

📌 Calculate Return on Capital

📌 Rank all companies by both metrics

📌 Buy the top-ranked ones

📌 Rebalance once a year

📌 Repeat for at least 5 years

📌 Pick your investment universe

📌 Calculate Earnings Yield for each company

📌 Calculate Return on Capital

📌 Rank all companies by both metrics

📌 Buy the top-ranked ones

📌 Rebalance once a year

📌 Repeat for at least 5 years

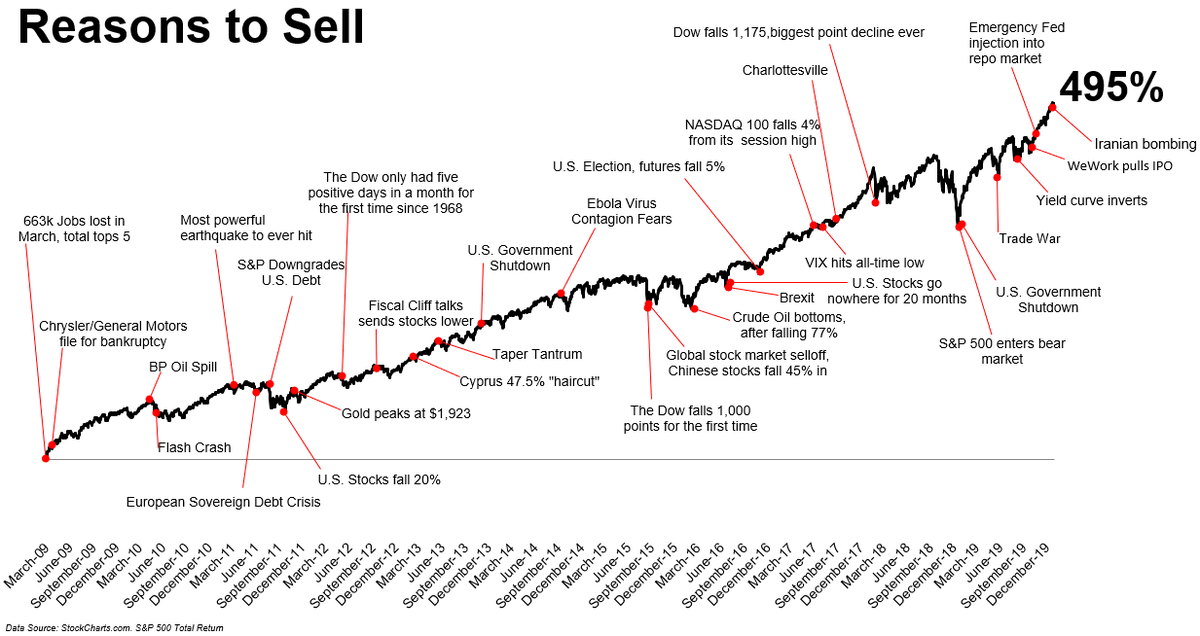

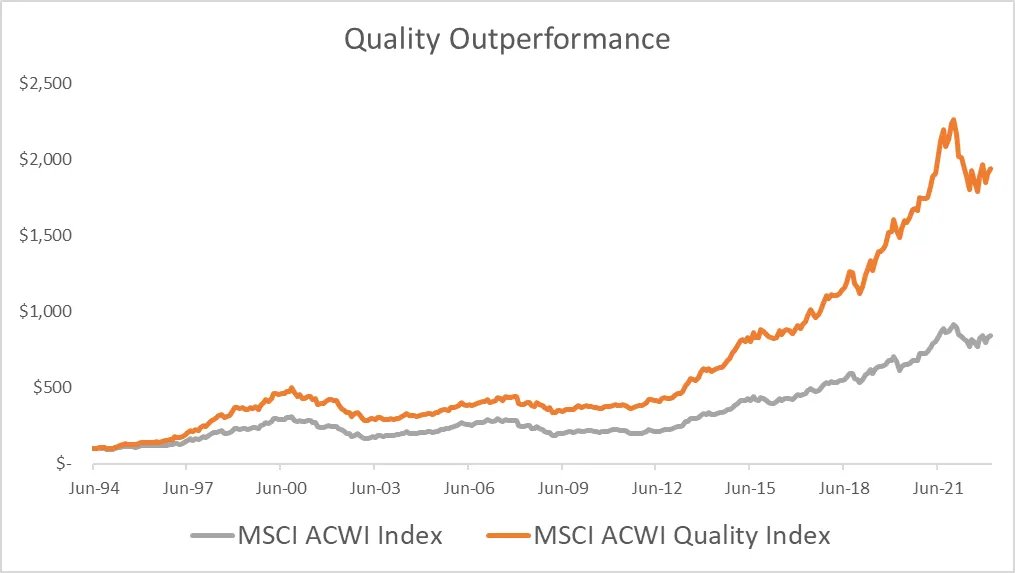

4. It can beat the market.

But… there’s a catch.

Imagine this:

You follow the Magic Formula and buy small, unknown companies.

After 2 years, your return is -28%.

Meanwhile, the S&P 500 is up +15%.

Would you stick with the strategy?

But… there’s a catch.

Imagine this:

You follow the Magic Formula and buy small, unknown companies.

After 2 years, your return is -28%.

Meanwhile, the S&P 500 is up +15%.

Would you stick with the strategy?

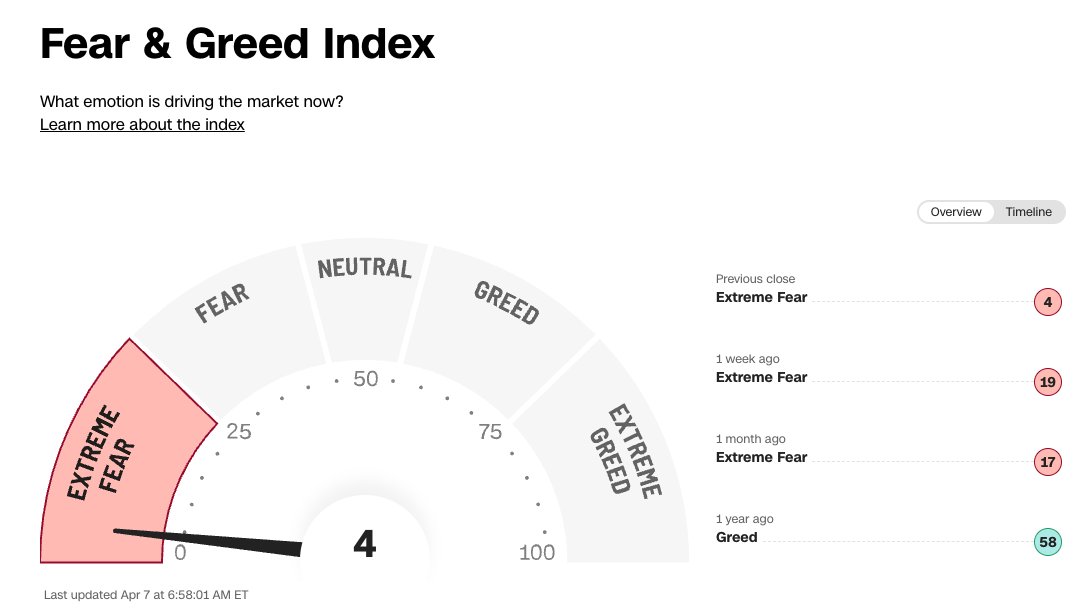

5. That’s the real test.

Staying disciplined when things look bad.

Greenblatt says:

“Most investors won’t (or can’t) stick with a strategy that hasn’t worked for several years in a row.”

Staying disciplined when things look bad.

Greenblatt says:

“Most investors won’t (or can’t) stick with a strategy that hasn’t worked for several years in a row.”

Joel Greenblatt is a stock market genius. Everyone can lear from him.

How? Start with this summary of ALL public writings: compounding-quality.kit.com/e3f59a4723

How? Start with this summary of ALL public writings: compounding-quality.kit.com/e3f59a4723

• • •

Missing some Tweet in this thread? You can try to

force a refresh