A thread on tariffs

🧵

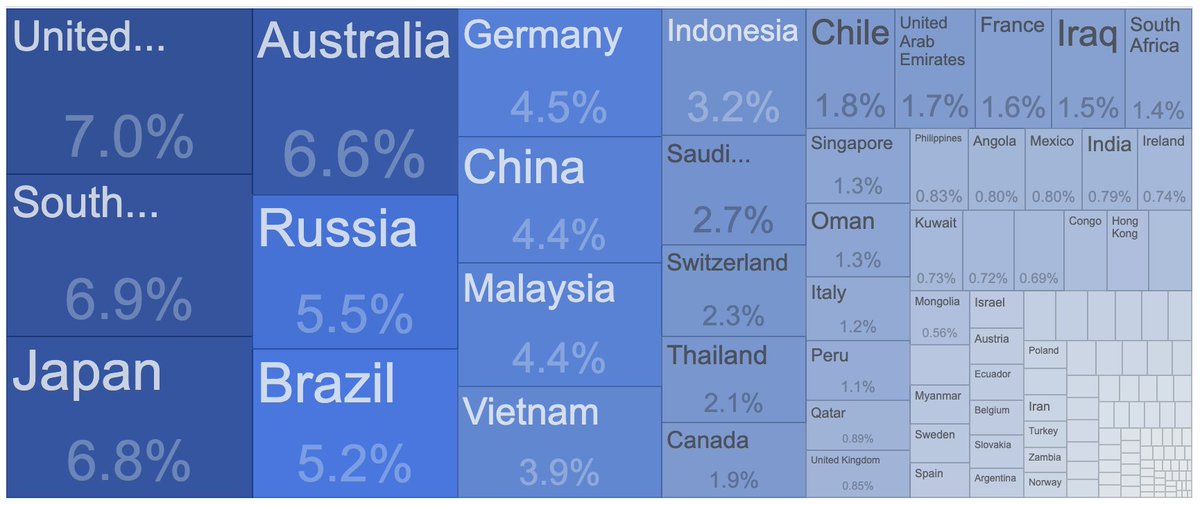

Only 7.1% of total US exports make their way to China, while 15% of Chinese exports make their way to the US.

So, China will get hurt more, right?

🧵

Only 7.1% of total US exports make their way to China, while 15% of Chinese exports make their way to the US.

So, China will get hurt more, right?

Not at all. Brazilian soybeans will replace US soybeans. It's a commodity after all. Airbus will replace Boeing.

The same can't be said for all the items the US imports from China. Foxconn doesn't have a factory in Salt Lake City.

US farmers and consumers will pay a far heavier price than Chinese tofu eaters and air passengers.

The same can't be said for all the items the US imports from China. Foxconn doesn't have a factory in Salt Lake City.

US farmers and consumers will pay a far heavier price than Chinese tofu eaters and air passengers.

Now look at it from China's perspective.

The US makes up for only 7% of China's total imports. An 84% tariff on US goods, which are easy to replace from other sources, barely hurts. As a bonus, their other trading partners get to export more to China and reduce their own reliance on the US market.

The US makes up for only 7% of China's total imports. An 84% tariff on US goods, which are easy to replace from other sources, barely hurts. As a bonus, their other trading partners get to export more to China and reduce their own reliance on the US market.

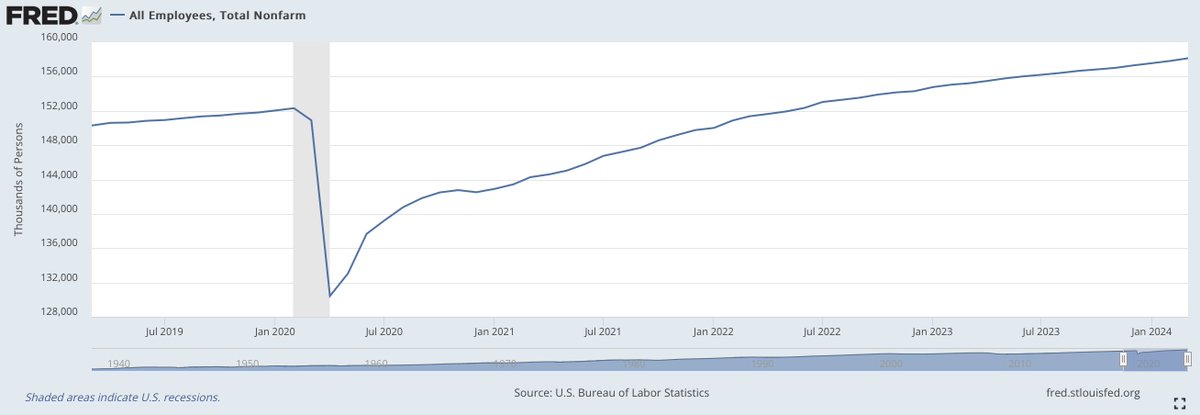

All trade wars have to be government financed. Since governments are broke, they need to rely on the kindness of strangers to lend them money for interest.

Strangers are willing to lend to China at a far lower yield than the US, i.e. the bond market is saying US is a bigger credit risk.

Which makes sense.

Strangers are willing to lend to China at a far lower yield than the US, i.e. the bond market is saying US is a bigger credit risk.

Which makes sense.

Everyone thinks the US dominates in banking, but in reality 4 of the top 5 banks are Chinese. ICBC has 60% more assets than JP Morgan.

The CCP has more influence on Chinese institutions than Trump has on Jamie Dimon.

The CCP has more influence on Chinese institutions than Trump has on Jamie Dimon.

In terms of financing, China has yet another geopolitical ace up its sleeve. They can borrow at a lower rate in US dollars than the US Treasury itself. They demonstrated this when Trump was elected - a warning that the incoming administration completely ignored.

https://x.com/kashyap286/status/1862938115310031272

What happens if the US and China announce a trade embargo? China can easily replace its imports from the US and benefit other trading partners. The US cannot replace China. Period.

Chinese exporters will be hurt temporarily, but those factories are going nowhere. The government can always borrow cheap and support the industries that get hurt.

US consumers will find Wal-Mart's shelves 40% empty. No more solar panels. No more electronics since China controls the critical minerals used to produce them.

If there's no more trade with the US, the PBoC doesn't need to hold as many US Treasuries.

If Norinchukin selling Treasuries and going broke can cause so much turmoil that Trump capitulated on tariffs, imagine what will happen when China starts dumping treasuries.

Chinese exporters will be hurt temporarily, but those factories are going nowhere. The government can always borrow cheap and support the industries that get hurt.

US consumers will find Wal-Mart's shelves 40% empty. No more solar panels. No more electronics since China controls the critical minerals used to produce them.

If there's no more trade with the US, the PBoC doesn't need to hold as many US Treasuries.

If Norinchukin selling Treasuries and going broke can cause so much turmoil that Trump capitulated on tariffs, imagine what will happen when China starts dumping treasuries.

As always, FinTwit influencers have completely inverted the picture and think China will have to devalue their currency or give Trump a call.

Nope. China holds all the aces and the other guy playing the game doesn't even know the rules.

TLDR: long China, short US.

Nope. China holds all the aces and the other guy playing the game doesn't even know the rules.

TLDR: long China, short US.

• • •

Missing some Tweet in this thread? You can try to

force a refresh