Indian expat living the good life in Dubai | 9+ years in capital markets | Gold Bug | Energy Bull | Macro Expert | MBA - IIT Madras

8 subscribers

How to get URL link on X (Twitter) App

Let's address this chart crime. The dollar milkshake theory, which forecasts a strong and forever rising dollar, claims the theory is valid because the DXY rose 30% from its 2008 lows.

Let's address this chart crime. The dollar milkshake theory, which forecasts a strong and forever rising dollar, claims the theory is valid because the DXY rose 30% from its 2008 lows.

Not at all. Brazilian soybeans will replace US soybeans. It's a commodity after all. Airbus will replace Boeing.

Not at all. Brazilian soybeans will replace US soybeans. It's a commodity after all. Airbus will replace Boeing.

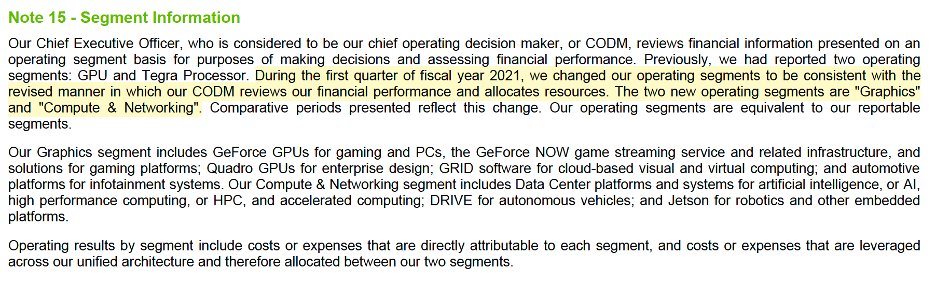

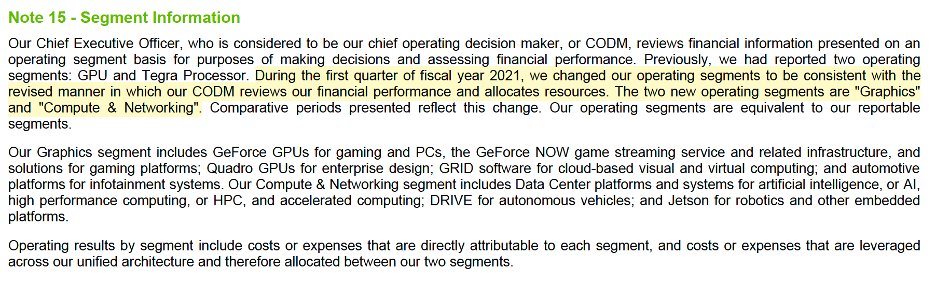

The first, subtle way, is by offering something similar to a sales rebate but booking it separately so it doesn't impact net revenue.

The first, subtle way, is by offering something similar to a sales rebate but booking it separately so it doesn't impact net revenue.

The Bank of Japan implemented QE and zero interest rate policy in the 1990s, in response to the implosion of a mega bubble. Since then, Japan has had a deflationary economy, i.e. the opposite of the post-Covid US economy.

The Bank of Japan implemented QE and zero interest rate policy in the 1990s, in response to the implosion of a mega bubble. Since then, Japan has had a deflationary economy, i.e. the opposite of the post-Covid US economy.

https://twitter.com/kashyap286/status/1731677900716257499First off, banks are lending again. Note how borrowing started to take off just after the Nov FOMC, when the Fed hinted at changes to the SEP.

https://twitter.com/kashyap286/status/1592948126406803456

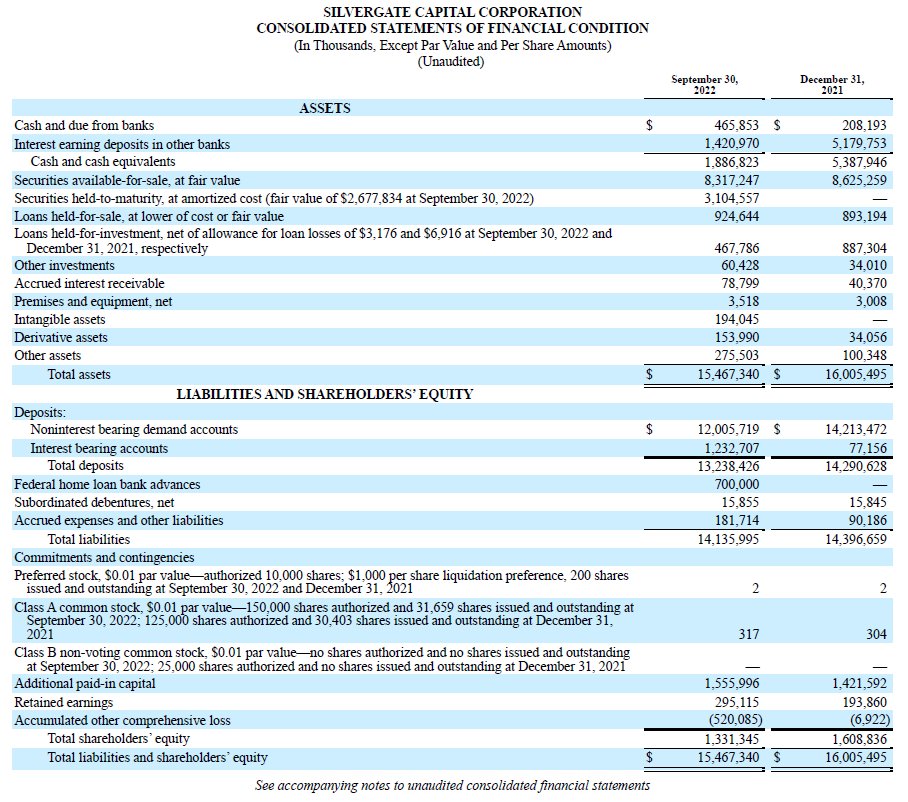

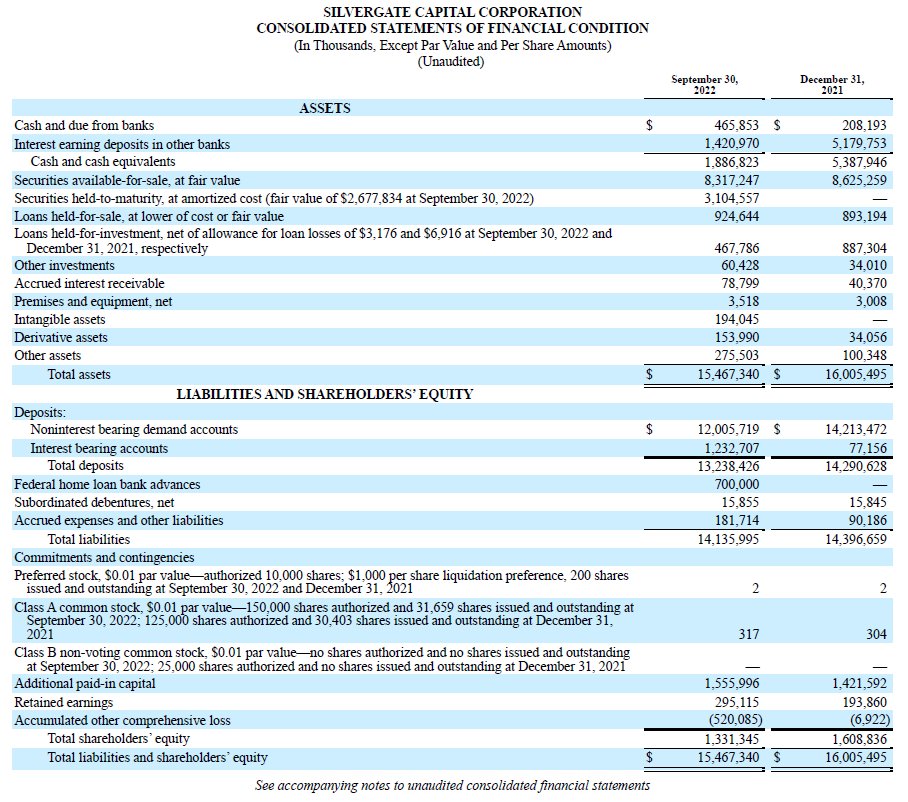

$SI Why will their short-and-distort campaign against @silvergatebank fail, you ask? Because short interest as of Nov 30 is a frigging 11,110,000 shares, up from 5.64 million shares on Nov 14. Total share count is 31.66 mn. Institutions (77.81%) and insiders (2.06%) collectively

$SI Why will their short-and-distort campaign against @silvergatebank fail, you ask? Because short interest as of Nov 30 is a frigging 11,110,000 shares, up from 5.64 million shares on Nov 14. Total share count is 31.66 mn. Institutions (77.81%) and insiders (2.06%) collectively

https://twitter.com/kashyap286/status/1593658514148593664Falling rig counts at the beginning of the month was an obvious red flag, even if you had chosen to ignore all other data...

https://twitter.com/kashyap286/status/1598871295466536960

of which $302.2 million consists of SEN leveraged loans, classified as Commercial & Industrial loans below. This forms part of loans held for investment in their balance sheet (above). These are loans collateralized with bitcoin or USD. What about default risk? See 10-Q page 51.

of which $302.2 million consists of SEN leveraged loans, classified as Commercial & Industrial loans below. This forms part of loans held for investment in their balance sheet (above). These are loans collateralized with bitcoin or USD. What about default risk? See 10-Q page 51.