Trump just triggered a global shockwave:

➤ 125% tariffs on China

➤ 90-day pause for 75+ countries

Markets panicked. China retaliated.

But beneath the noise is a masterplan of chaos and control that most miss.

Here’s the real play 🧵👇

➤ 125% tariffs on China

➤ 90-day pause for 75+ countries

Markets panicked. China retaliated.

But beneath the noise is a masterplan of chaos and control that most miss.

Here’s the real play 🧵👇

1) April 2: The Opening Shock – Chaos by Design

➤ Trump slaps 10% base tariff on $2.7T of U.S. imports

➤ Adds 11–50% “reciprocal tariffs” on 90+ nations

💥 In 6 days:

• Global market cap loses $5.1T (Reuters)

• SPY: –12.7%a

• VIX: 24.4 (CBOE)

• Dollar Index (DXY): –1.8%

• 10-yr yields: spike to 4.82%

This wasn’t panic. It was provocation.

📌Logic:

1. Trump weaponized volatility to force global attention

2. Created a "fear premium" to gain negotiation leverage

3. Exposed which economies cracked the fastest

4. Collected real-time pressure data to guide the next moves

➤ Trump slaps 10% base tariff on $2.7T of U.S. imports

➤ Adds 11–50% “reciprocal tariffs” on 90+ nations

💥 In 6 days:

• Global market cap loses $5.1T (Reuters)

• SPY: –12.7%a

• VIX: 24.4 (CBOE)

• Dollar Index (DXY): –1.8%

• 10-yr yields: spike to 4.82%

This wasn’t panic. It was provocation.

📌Logic:

1. Trump weaponized volatility to force global attention

2. Created a "fear premium" to gain negotiation leverage

3. Exposed which economies cracked the fastest

4. Collected real-time pressure data to guide the next moves

2) 🇨🇳China’s Response: Precision Retaliation

Between April 4–9:

➤ 84% tariffs on $162B U.S. goods

➤ Rare earth export ban (semis, EVs, defense hit)

➤ Yuan falls to 7.28/USD (–2.1%)

➤ Q1 U.S. exports to China: –12.4% (China Customs)

📌Logic:

1. China targeted Trump’s voter base: agri, autos, tech

2. Rare earth ban = economic pressure + nationalist messaging

3. Devaluation = FX shield against tariffs

4. Xi is playing for the long game absorb the pain now, and wait for Trump to overplay

Between April 4–9:

➤ 84% tariffs on $162B U.S. goods

➤ Rare earth export ban (semis, EVs, defense hit)

➤ Yuan falls to 7.28/USD (–2.1%)

➤ Q1 U.S. exports to China: –12.4% (China Customs)

📌Logic:

1. China targeted Trump’s voter base: agri, autos, tech

2. Rare earth ban = economic pressure + nationalist messaging

3. Devaluation = FX shield against tariffs

4. Xi is playing for the long game absorb the pain now, and wait for Trump to overplay

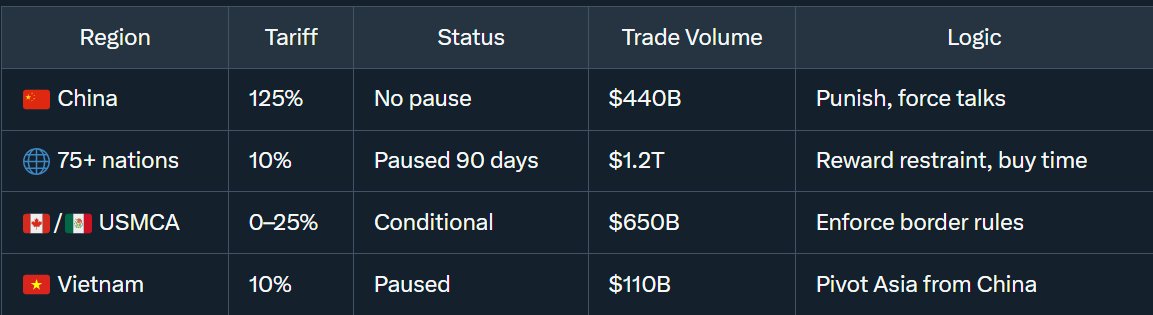

3) April 9: The Pivot - Not a Pause, a Power Move

➤ Trump pauses higher tariffs for 75+ countries (10% flat)

➤ China alone gets hit harder — 125%

➤ USMCA partners: 0–25% (rule-based)

📈 Market reaction:

• S&P 500: +9.5%

• SPY: +11.8%

• Nasdaq: +10.1%

📌Logic:

1. Split the world: reward friends, punish foes

2. Created negotiating space while isolating China

3. Gave allies incentive to stay neutral

4. Showed markets: “Trump can reverse damage fast”

➤ Trump pauses higher tariffs for 75+ countries (10% flat)

➤ China alone gets hit harder — 125%

➤ USMCA partners: 0–25% (rule-based)

📈 Market reaction:

• S&P 500: +9.5%

• SPY: +11.8%

• Nasdaq: +10.1%

📌Logic:

1. Split the world: reward friends, punish foes

2. Created negotiating space while isolating China

3. Gave allies incentive to stay neutral

4. Showed markets: “Trump can reverse damage fast”

What was this pivot?

4) Trump’s Team Confirms: “This Was All Planned”

Scott Bessent (U.S. Treasury Sec):

“Trump baited China. The pause rewards cooperation.”

📌Logic:

1. Chaos = leverage

2. Pause = control

3. Public statement = psychological play

4. Bessent’s quote = signal to markets: “We’re steering this ship”

Scott Bessent (U.S. Treasury Sec):

“Trump baited China. The pause rewards cooperation.”

📌Logic:

1. Chaos = leverage

2. Pause = control

3. Public statement = psychological play

4. Bessent’s quote = signal to markets: “We’re steering this ship”

5) 🕵️Leaked USTR Memo: The Mineral Exemption Trap

📄 April 8 draft (USTR):

➤ Lithium, graphite, and cobalt exempted from new tariffs

🔋 China supplies:

• Lithium: 68%

• Graphite: 82%

• Cobalt: 61%

📌Logic:

1. Pre-empted China’s rare earth ban neutralized their biggest card

2. Protected U.S. EV, defense & tech sectors

3. Secured Tesla, Apple, Raytheon supply chains

4. Shows the real war isn’t over goods it’s over resources

📄 April 8 draft (USTR):

➤ Lithium, graphite, and cobalt exempted from new tariffs

🔋 China supplies:

• Lithium: 68%

• Graphite: 82%

• Cobalt: 61%

📌Logic:

1. Pre-empted China’s rare earth ban neutralized their biggest card

2. Protected U.S. EV, defense & tech sectors

3. Secured Tesla, Apple, Raytheon supply chains

4. Shows the real war isn’t over goods it’s over resources

6) Tariff Map - Not Random, But Calculated

📌Logic:

1. Different tariffs = different messages

2. Vietnam’s pause = bait to pull ASEAN away from China

3. USMCA differentiation = pressure for compliance

4. Signals to WTO: “We’re strategic, not erratic”

📌Logic:

1. Different tariffs = different messages

2. Vietnam’s pause = bait to pull ASEAN away from China

3. USMCA differentiation = pressure for compliance

4. Signals to WTO: “We’re strategic, not erratic”

7) Markets Bounced - But Smart Money Stayed Wary

• Wayfair: +20.3%

• Levi’s: +18.7%

• Tesla: +7.8%

• Raytheon: +5.4%

• Gold: +3.2%

• Oil: +4.2%

• VIX: 24+

📌Logic:

1. Markets cheered relief

2. But VIX stayed high → fear of Round 2

3. Bond yields stayed sticky → inflation risk priced in

4. Hedge funds buying downside protection = not over yet

• Wayfair: +20.3%

• Levi’s: +18.7%

• Tesla: +7.8%

• Raytheon: +5.4%

• Gold: +3.2%

• Oil: +4.2%

• VIX: 24+

📌Logic:

1. Markets cheered relief

2. But VIX stayed high → fear of Round 2

3. Bond yields stayed sticky → inflation risk priced in

4. Hedge funds buying downside protection = not over yet

8) 🇨🇳China’s Game: Absorb, Rewire, Delay

➤ $25B agri hit

➤ $15B auto exports blocked

➤ $8B rare earth disruption

➤ EU exports: +9% (Eurostat)

📌Logic:

1. Rewiring trade to Europe = soft landing

2. Buying time as domestic growth slows

3. Rare earth play wins propaganda + political time

4. Strategy: “Let Trump peak too early”

➤ $25B agri hit

➤ $15B auto exports blocked

➤ $8B rare earth disruption

➤ EU exports: +9% (Eurostat)

📌Logic:

1. Rewiring trade to Europe = soft landing

2. Buying time as domestic growth slows

3. Rare earth play wins propaganda + political time

4. Strategy: “Let Trump peak too early”

9)📚Smoot-Hawley Flashback? Yes… and No.

1930:

• Avg. tariff: 59%

• Global trade: –66%

• U.S. GDP: –30%

2025:

• U.S. → China: 125%

• China → U.S.: 84%

📌Logic:

1. Same tools, different intent

2. Trump = using tariffs for negotiation, not protection

3. But history shows: this can still spiral

4. One wrong move → 2008 + 1930 combo

1930:

• Avg. tariff: 59%

• Global trade: –66%

• U.S. GDP: –30%

2025:

• U.S. → China: 125%

• China → U.S.: 84%

📌Logic:

1. Same tools, different intent

2. Trump = using tariffs for negotiation, not protection

3. But history shows: this can still spiral

4. One wrong move → 2008 + 1930 combo

10) Allies: Grateful... but Cautious

• 🇯🇵 Japan: “Relief, but concern”

• 🇪🇺 EU: $40B retaliation fund on standby

• 🇨🇦 Canada: $13B duties prepared

• 🇻🇳 Vietnam: +15% exports post-pause

📌Logic:

1. Allies are hedging

2. U.S. unpredictability = risk

3. Some will talk with both U.S. + China

4. They love the pause - not the policy

• 🇯🇵 Japan: “Relief, but concern”

• 🇪🇺 EU: $40B retaliation fund on standby

• 🇨🇦 Canada: $13B duties prepared

• 🇻🇳 Vietnam: +15% exports post-pause

📌Logic:

1. Allies are hedging

2. U.S. unpredictability = risk

3. Some will talk with both U.S. + China

4. They love the pause - not the policy

11) U.S. Pain: Consumers Already Feeling It

• 75% expect inflation

• iPhone projected: $2,300

• Manufacturing PMI: 48.2

• Confidence: 3-year low

• Jobless claims: +8K

📌Logic:

1. Tariffs = hidden tax

2. Consumer slowdown coming

3. Trump is forcing CEOs to reshore, not rely

4. Political gamble: “Short-term pain, long-term sovereignty”

• 75% expect inflation

• iPhone projected: $2,300

• Manufacturing PMI: 48.2

• Confidence: 3-year low

• Jobless claims: +8K

📌Logic:

1. Tariffs = hidden tax

2. Consumer slowdown coming

3. Trump is forcing CEOs to reshore, not rely

4. Political gamble: “Short-term pain, long-term sovereignty”

Will this backfire domestically?

12) The Endgame: Not Trade. Control.

➤ Fix $1.23T deficit

➤ Secure EV, defense, pharma supply

➤ Pressure China in isolation

➤ Create new trade blocs with leverage

📌Logic:

1. This is economic statecraft

2. Goal: independence from China

3. Create asymmetric pressure - U.S. can absorb more pain

4. Trade = leverage, not cooperation anymore

➤ Fix $1.23T deficit

➤ Secure EV, defense, pharma supply

➤ Pressure China in isolation

➤ Create new trade blocs with leverage

📌Logic:

1. This is economic statecraft

2. Goal: independence from China

3. Create asymmetric pressure - U.S. can absorb more pain

4. Trade = leverage, not cooperation anymore

13) The Big Split: Experts Can’t Agree

• Krugman: “Economic suicide”

• Summers: “Govt. by chaos”

• Navarro: “China’s trapped”

• Musk: “Zero tariffs is the goal, this is the path”

📌Logic:

1. There’s no consensus

2. That is the strategy

3. Confusion = power

4. Trump wins when nobody knows the next move

• Krugman: “Economic suicide”

• Summers: “Govt. by chaos”

• Navarro: “China’s trapped”

• Musk: “Zero tariffs is the goal, this is the path”

📌Logic:

1. There’s no consensus

2. That is the strategy

3. Confusion = power

4. Trump wins when nobody knows the next move

14) Was this chaos a plan? Or panic?

✅ Plan:

• Exemptions dated before reversal

• Allies pre-briefed for pause

• Market bounce suggests confidence

⚠️ Panic:

• 13-hr reversal

• No WTO coordination

• Ally distrust rising

📌 Truth?

It was a high-speed tactical pivot - calculated improvisation.

✅ Plan:

• Exemptions dated before reversal

• Allies pre-briefed for pause

• Market bounce suggests confidence

⚠️ Panic:

• 13-hr reversal

• No WTO coordination

• Ally distrust rising

📌 Truth?

It was a high-speed tactical pivot - calculated improvisation.

What do you think?

15) The 90-Day Clock Is Ticking

Scenarios by July:

A) China cuts a deal = Trump wins

B) China retaliates again = trade war 2.0

C) Allies drift away = U.S. isolated

D) U.S. slides into recession -1.5% GDP (Oxford)

📌Logic:

1. Leverage is peaking - so is risk

2. Trump wants a win before election season

3. Xi wants to delay without losing face

4. Markets are bracing - not celebrating

Scenarios by July:

A) China cuts a deal = Trump wins

B) China retaliates again = trade war 2.0

C) Allies drift away = U.S. isolated

D) U.S. slides into recession -1.5% GDP (Oxford)

📌Logic:

1. Leverage is peaking - so is risk

2. Trump wants a win before election season

3. Xi wants to delay without losing face

4. Markets are bracing - not celebrating

16) Real-Time Trade Shifts Have Already Begun

• 🇻🇳 Vietnam ➝ U.S.: +15%

• 🇨🇳 China ➝ EU: +9%

• 🇲🇽 Mexico ➝ U.S.: +4%

• Rare earths: +18% in 48 hrs

📌 The future is being redrawn right now.

Every tariff has reshaped global flows overnight.

• 🇻🇳 Vietnam ➝ U.S.: +15%

• 🇨🇳 China ➝ EU: +9%

• 🇲🇽 Mexico ➝ U.S.: +4%

• Rare earths: +18% in 48 hrs

📌 The future is being redrawn right now.

Every tariff has reshaped global flows overnight.

17) Exclusive: Trump’s Taiwan Chip Pact?

📌Insider sources:

Trump’s team is close to finalizing a semiconductor co-production deal with Taiwan — announcement expected by June 2025

📌Logic:

1. Cuts China’s tech influence

2. Secures chip supply

3. Reinforces Taiwan-US alliance

4. Psychological escalation

📌Insider sources:

Trump’s team is close to finalizing a semiconductor co-production deal with Taiwan — announcement expected by June 2025

📌Logic:

1. Cuts China’s tech influence

2. Secures chip supply

3. Reinforces Taiwan-US alliance

4. Psychological escalation

18) Final Takeaway

Trump’s 2025 tariff war is:

✅ Bold

✅ Strategic

✅ Risky

❓ Still unfolding

He’s not trying to “fix trade.”

He’s trying to remake the system.

Trump’s 2025 tariff war is:

✅ Bold

✅ Strategic

✅ Risky

❓ Still unfolding

He’s not trying to “fix trade.”

He’s trying to remake the system.

What’s the most likely 90-day outcome?

🔁 If this opened your eyes to what’s really happening behind Trump’s tariffs, RT it.

📩 Bookmark it — you’ll want to revisit this when the 90-day clock hits zero.

📲 Follow @CaVivekkhatri for elite macro insights, trade war intelligence, and geopolitical power plays — decoded daily.

🧠 Don’t just scroll headlines.

Understand the game.

This wasn’t just a thread - it was your intel brief.

Welcome to economic warfare.

#End 🧵

📩 Bookmark it — you’ll want to revisit this when the 90-day clock hits zero.

📲 Follow @CaVivekkhatri for elite macro insights, trade war intelligence, and geopolitical power plays — decoded daily.

🧠 Don’t just scroll headlines.

Understand the game.

This wasn’t just a thread - it was your intel brief.

Welcome to economic warfare.

#End 🧵

📲 Join Our Free Telegram Channel for Daily Market Insights & Learning

🔹 Charts, OI Data, Sector Views

🔹 Research-Based Trade Observations

🔹 No Tips. No Hype. Pure Learning.

👉 t.me/Stockizenoffic…

📌 SEBI Registered RA – INH000017675 | Educational Only

📎 stockizenresearch.com/disclaimer

🔹 Charts, OI Data, Sector Views

🔹 Research-Based Trade Observations

🔹 No Tips. No Hype. Pure Learning.

👉 t.me/Stockizenoffic…

📌 SEBI Registered RA – INH000017675 | Educational Only

📎 stockizenresearch.com/disclaimer

• • •

Missing some Tweet in this thread? You can try to

force a refresh