Algo Trader | Macro Strategist | Spiritual Thinker ll

Partner at @Stocki_zen -SEBI Reg. RA Firm-INH000017675 ll

Join - https://t.co/oOm6SRALUY

12 subscribers

How to get URL link on X (Twitter) App

𝟭/ 𝗧𝗵𝗲 𝗝𝗼𝘂𝗿𝗻𝗲𝘆 𝗼𝗳 𝗪𝗶𝗹𝗹𝗶𝗮𝗺 𝗢’𝗡𝗲𝗶𝗹

𝟭/ 𝗧𝗵𝗲 𝗝𝗼𝘂𝗿𝗻𝗲𝘆 𝗼𝗳 𝗪𝗶𝗹𝗹𝗶𝗮𝗺 𝗢’𝗡𝗲𝗶𝗹

𝟭. 𝗦𝘁𝗮𝗿𝘁 𝗦𝗺𝗮𝗹𝗹, 𝗗𝗿𝗲𝗮𝗺 𝗕𝗶𝗴

𝟭. 𝗦𝘁𝗮𝗿𝘁 𝗦𝗺𝗮𝗹𝗹, 𝗗𝗿𝗲𝗮𝗺 𝗕𝗶𝗴

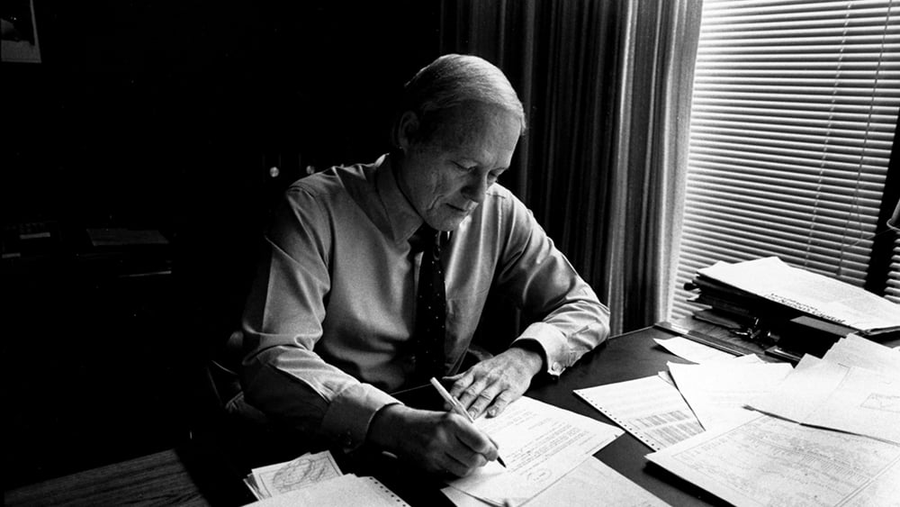

🗺️ THE BLUEPRINT

🗺️ THE BLUEPRINT

𝟭. 𝗧𝗛𝗘 𝗕𝗟𝗨𝗘𝗣𝗥𝗜𝗡𝗧

𝟭. 𝗧𝗛𝗘 𝗕𝗟𝗨𝗘𝗣𝗥𝗜𝗡𝗧

1️⃣ Déjà Vu: Silver at $49 - Again.

1️⃣ Déjà Vu: Silver at $49 - Again.