Algo Trader | Macro Strategist | Spiritual Thinker ll

Partner at @Stocki_zen -SEBI Reg. RA Firm-INH000017675 ll

Join - https://t.co/oOm6SRALUY

12 subscribers

How to get URL link on X (Twitter) App

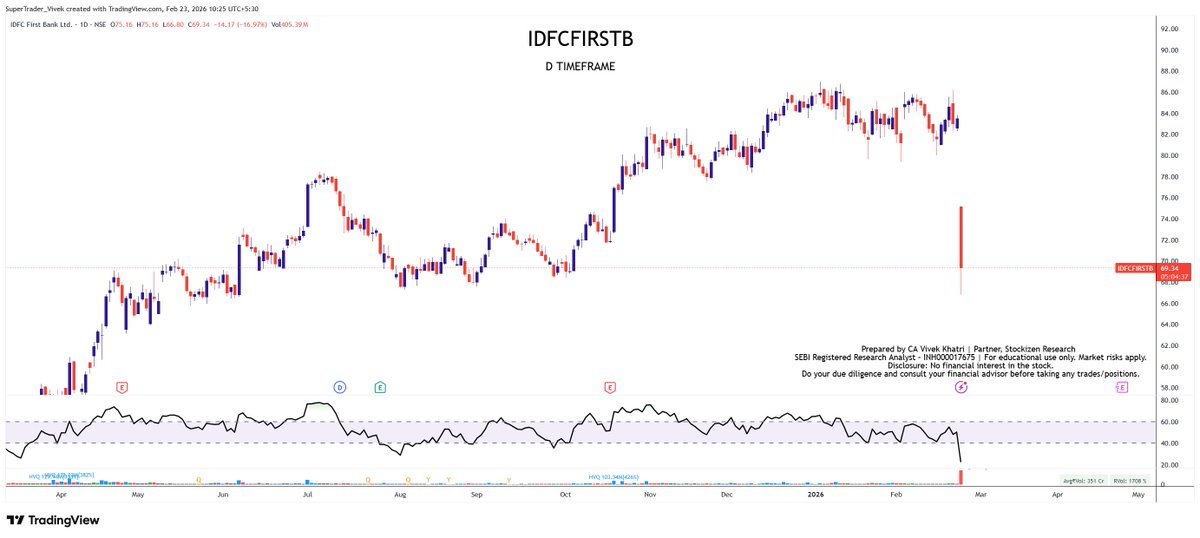

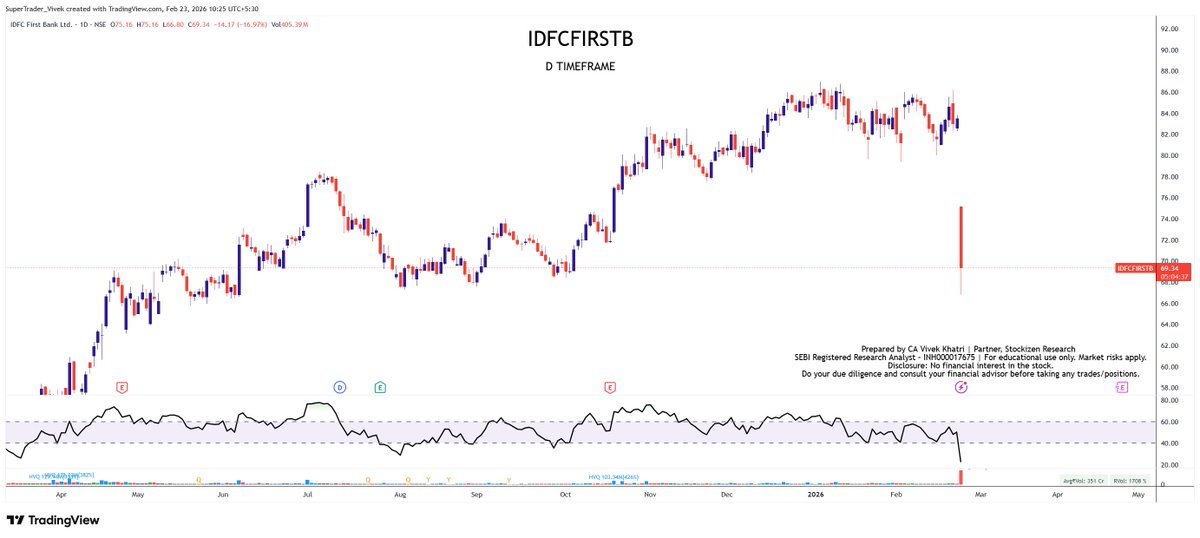

First, understand who IDFC First Bank is.

First, understand who IDFC First Bank is.

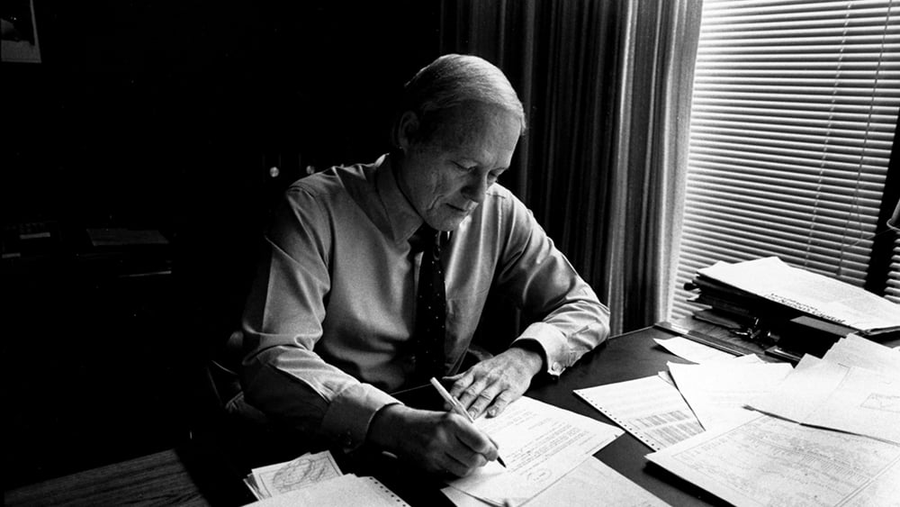

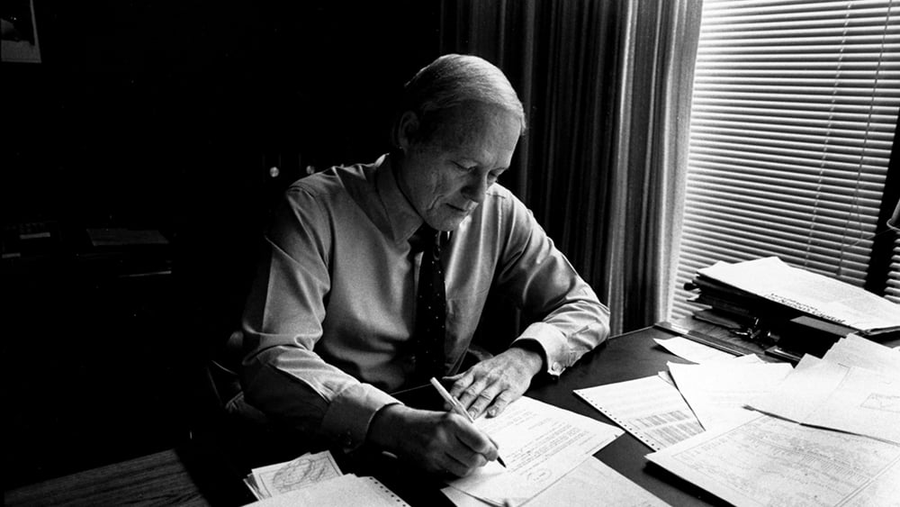

𝟭/ 𝗧𝗵𝗲 𝗝𝗼𝘂𝗿𝗻𝗲𝘆 𝗼𝗳 𝗪𝗶𝗹𝗹𝗶𝗮𝗺 𝗢’𝗡𝗲𝗶𝗹

𝟭/ 𝗧𝗵𝗲 𝗝𝗼𝘂𝗿𝗻𝗲𝘆 𝗼𝗳 𝗪𝗶𝗹𝗹𝗶𝗮𝗺 𝗢’𝗡𝗲𝗶𝗹

𝟭. 𝗦𝘁𝗮𝗿𝘁 𝗦𝗺𝗮𝗹𝗹, 𝗗𝗿𝗲𝗮𝗺 𝗕𝗶𝗴

𝟭. 𝗦𝘁𝗮𝗿𝘁 𝗦𝗺𝗮𝗹𝗹, 𝗗𝗿𝗲𝗮𝗺 𝗕𝗶𝗴

🗺️ THE BLUEPRINT

🗺️ THE BLUEPRINT