🚨 It's official: UK millionaires are fleeing in record numbers.

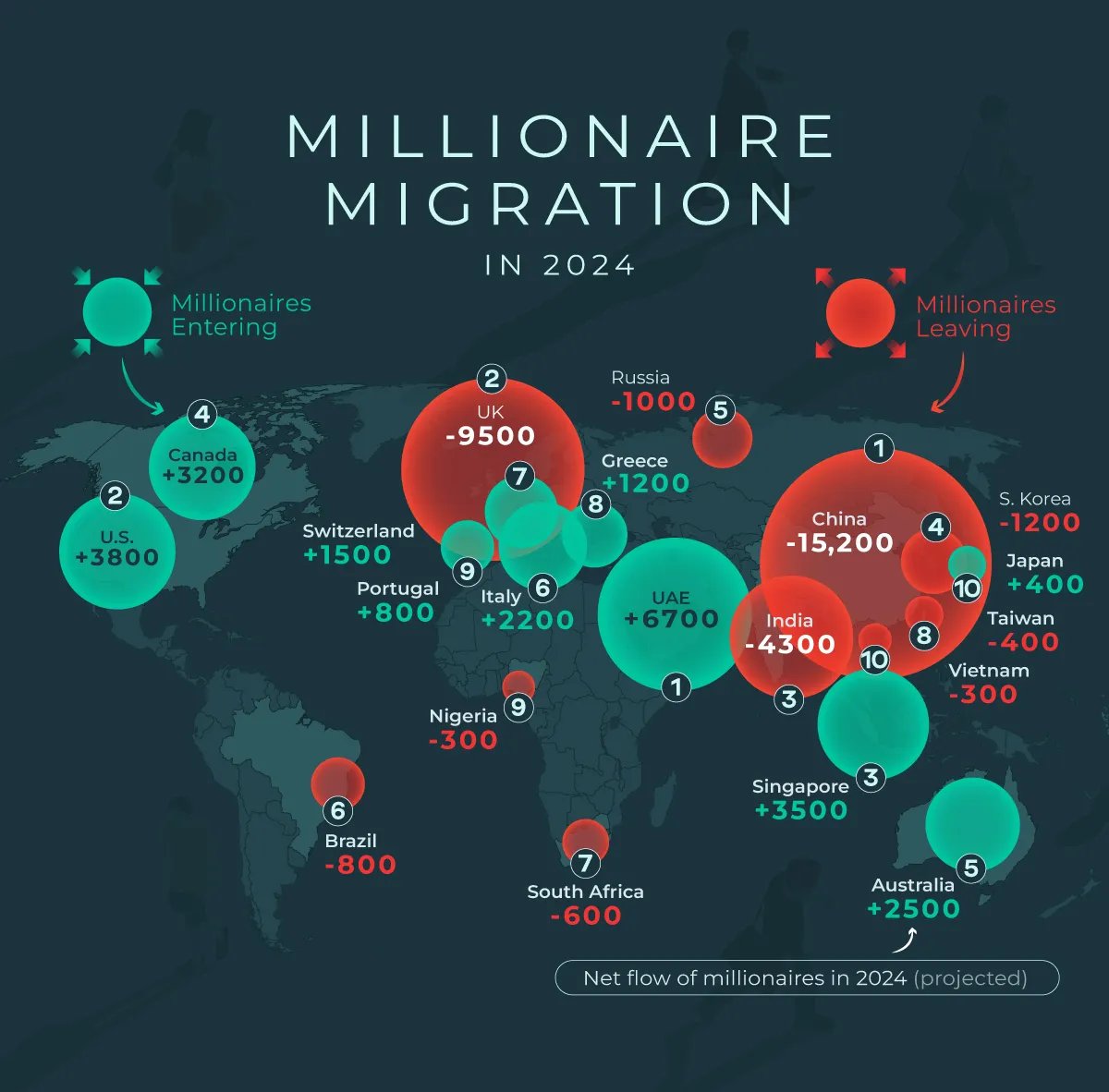

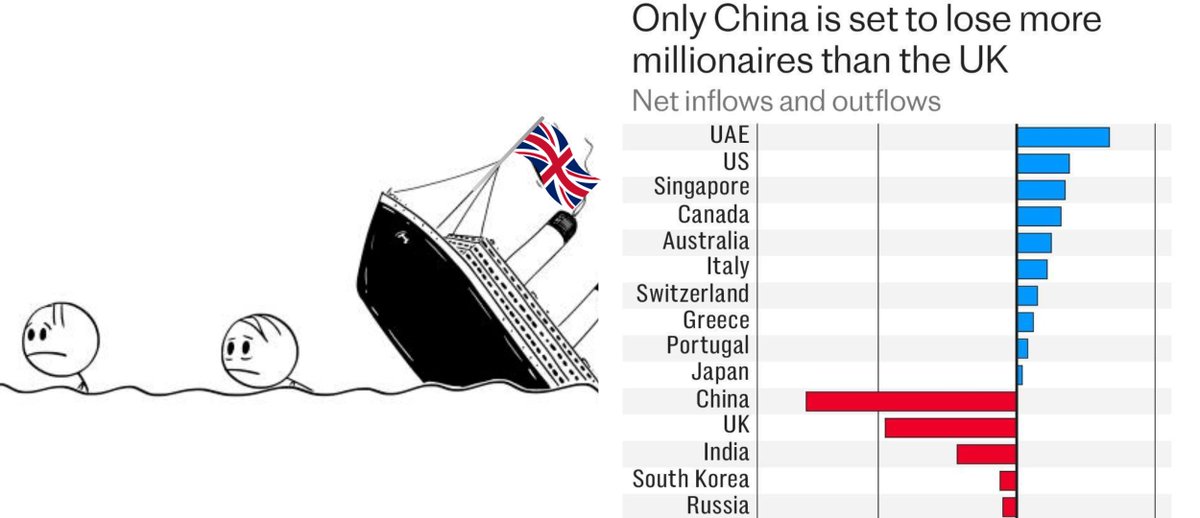

In 2024, the UK ranked second only to China in wealth exodus – ahead of even India.

But where exactly are these millionaires going and why?

Here's what the data shows (and what it means for the future of global wealth):🧵

In 2024, the UK ranked second only to China in wealth exodus – ahead of even India.

But where exactly are these millionaires going and why?

Here's what the data shows (and what it means for the future of global wealth):🧵

The Henley Private Wealth Migration Report confirms it:

UK is hemorrhaging high-net-worth individuals at an accelerating rate – one of the largest outflows of high-net-worth individuals in the world.

And 2025 projections? Even worse.

This isn't slowing down anytime soon.

UK is hemorrhaging high-net-worth individuals at an accelerating rate – one of the largest outflows of high-net-worth individuals in the world.

And 2025 projections? Even worse.

This isn't slowing down anytime soon.

"I'm never going back to the UK."

That's what a Web3 founder told me in Lisbon last month.

The reason?

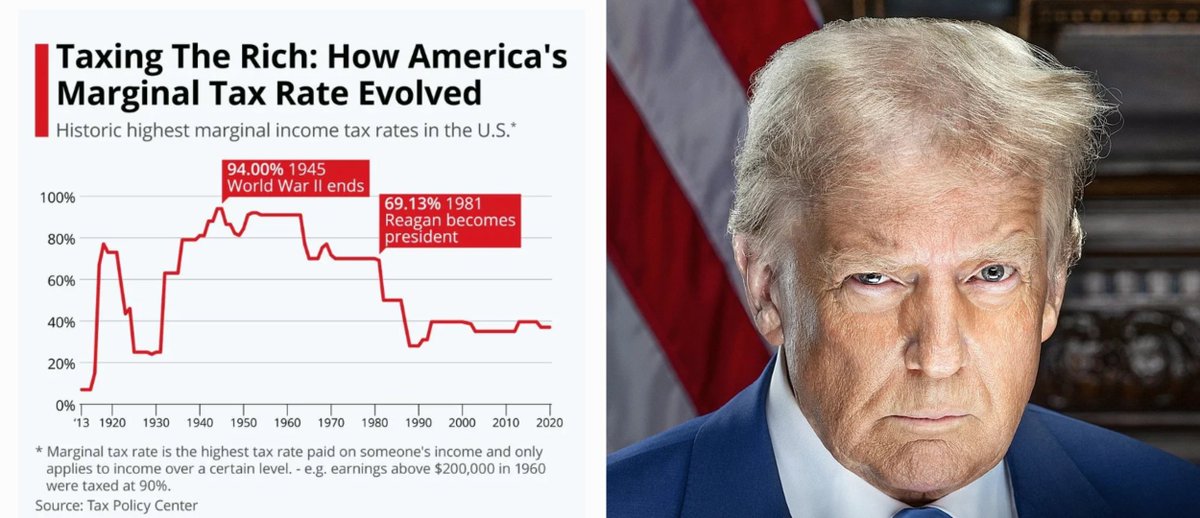

- Sky-high taxes

- Runaway living costs

- Growing safety concerns

- Collapsing public services

I hear this everywhere now. It's the new normal...

That's what a Web3 founder told me in Lisbon last month.

The reason?

- Sky-high taxes

- Runaway living costs

- Growing safety concerns

- Collapsing public services

I hear this everywhere now. It's the new normal...

So where is all this wealth flowing?

Here are the top 5 destinations attracting millionaires in 2024:

1. 🇦🇪 UAE: 6,700

2. 🇺🇸 USA: 3,800

3. 🇸🇬 Singapore: 3,500

4. 🇨🇦 Canada: 3,200

5. 🇦🇺 Australia: 2,500

Each offers something unique. Let's break them down:

Here are the top 5 destinations attracting millionaires in 2024:

1. 🇦🇪 UAE: 6,700

2. 🇺🇸 USA: 3,800

3. 🇸🇬 Singapore: 3,500

4. 🇨🇦 Canada: 3,200

5. 🇦🇺 Australia: 2,500

Each offers something unique. Let's break them down:

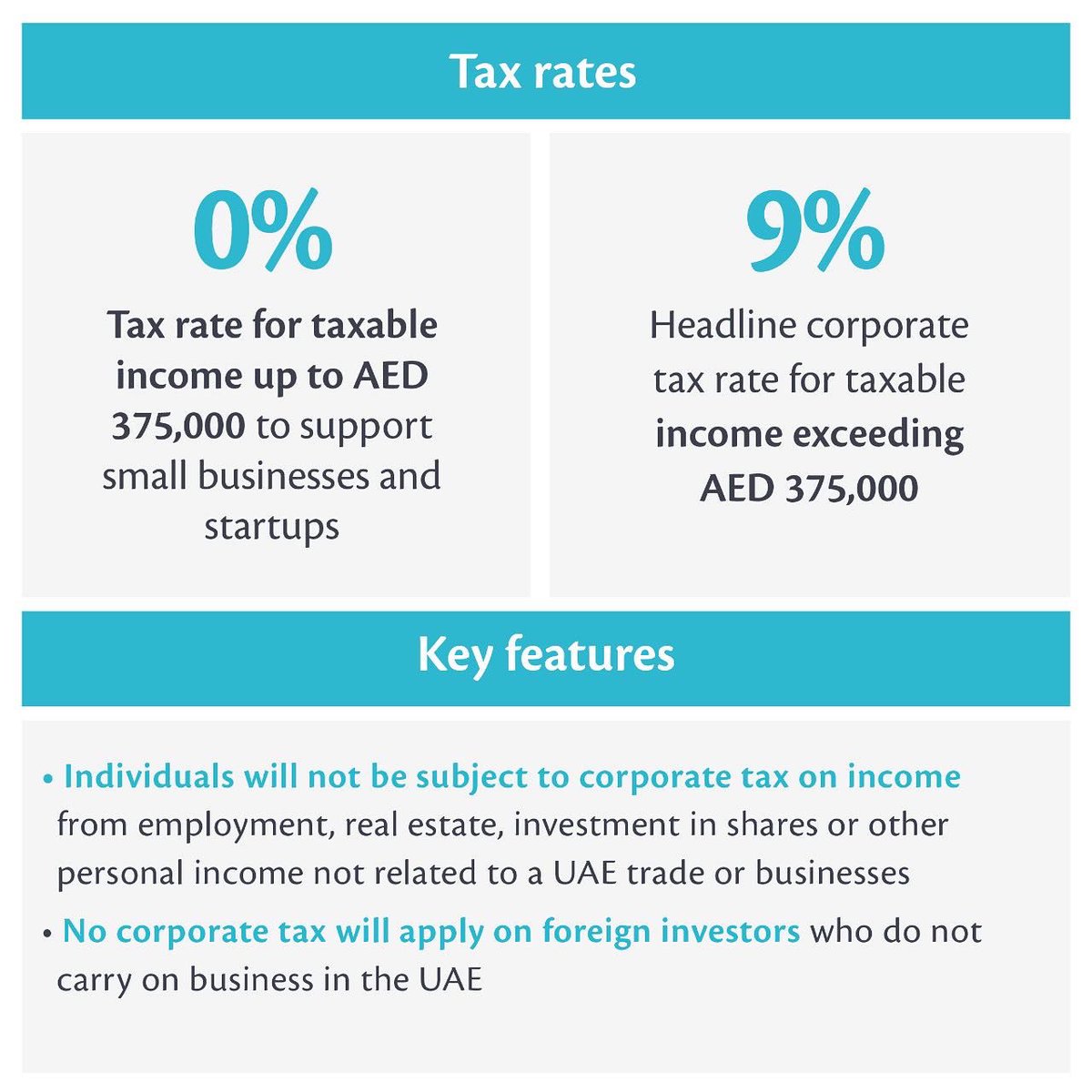

1. 🇦🇪 UAE: The Zero-Tax Haven

The clear winner with 6,700 millionaires expected to relocate there in 2024.

- Zero income tax (the big one)

- Golden Visa program

- Luxury lifestyle

- Strategic global location

- Sophisticated wealth management

Tax efficiency at its finest.

The clear winner with 6,700 millionaires expected to relocate there in 2024.

- Zero income tax (the big one)

- Golden Visa program

- Luxury lifestyle

- Strategic global location

- Sophisticated wealth management

Tax efficiency at its finest.

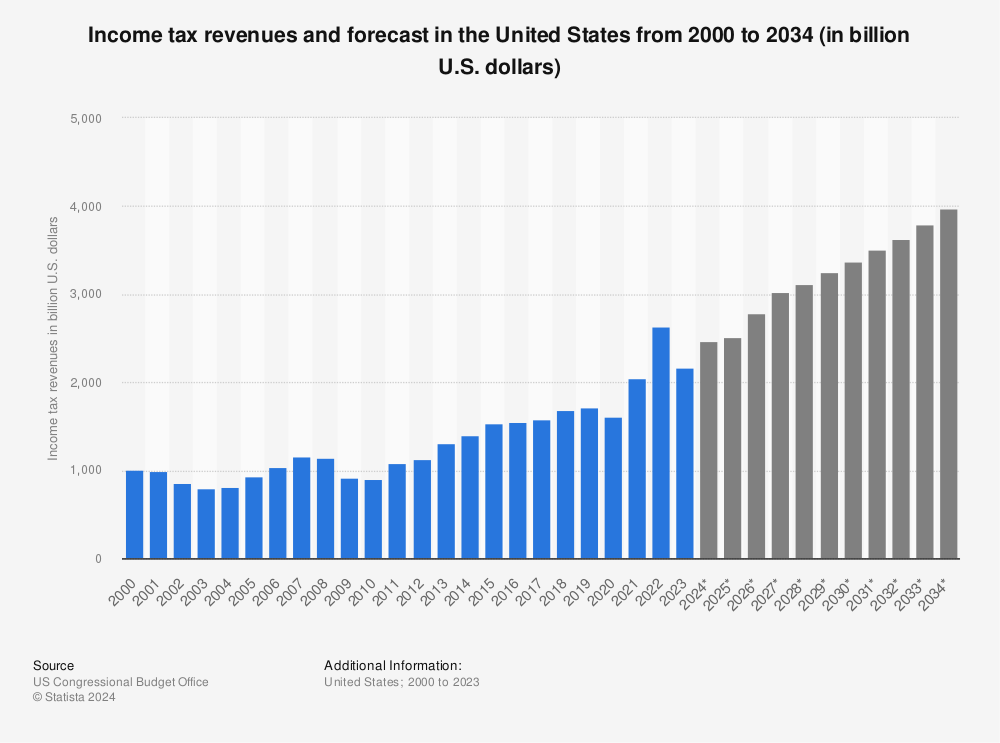

2. 🇺🇸 USA: Still the Land of Opportunity

Despite higher taxes, America draws 3,800 millionaires, due to:

- HNWI population growth: +62% over 10 years

- Unmatched economic scale

- Industry hubs (tech, finance, entertainment)

- Network effects of wealth concentration

Opportunity trumps tax efficiency here (for now...).

Despite higher taxes, America draws 3,800 millionaires, due to:

- HNWI population growth: +62% over 10 years

- Unmatched economic scale

- Industry hubs (tech, finance, entertainment)

- Network effects of wealth concentration

Opportunity trumps tax efficiency here (for now...).

3. 🇸🇬 Singapore: Asia's Wealth Hub

Singapore has masterfully positioned itself as the financial center of Asia, attracting 3,500 millionaires with:

- Rock-solid financial stability

- Low personal income tax

- No capital gains tax

- Gateway to Asian markets

The Switzerland of Asia.

Singapore has masterfully positioned itself as the financial center of Asia, attracting 3,500 millionaires with:

- Rock-solid financial stability

- Low personal income tax

- No capital gains tax

- Gateway to Asian markets

The Switzerland of Asia.

4. 🇨🇦 Canada: The Safety Play

Canada draws 3,200 millionaires seeking:

- Exceptional safety and security

- World-class healthcare and education

- Banking system stability

- HNWI growth: +29% over 10 years

Quality of life seems to compensate for higher taxes.

Canada draws 3,200 millionaires seeking:

- Exceptional safety and security

- World-class healthcare and education

- Banking system stability

- HNWI growth: +29% over 10 years

Quality of life seems to compensate for higher taxes.

5. 🇦🇺 Australia: Lifestyle + Security

Australia rounds out the top five with 2,500 millionaires, attracted by:

- Climate and lifestyle benefits

- Safety and low crime

- Strong economy

- HNWI growth: +35% over 10 years

The ultimate lifestyle upgrade with a stable base.

Australia rounds out the top five with 2,500 millionaires, attracted by:

- Climate and lifestyle benefits

- Safety and low crime

- Strong economy

- HNWI growth: +35% over 10 years

The ultimate lifestyle upgrade with a stable base.

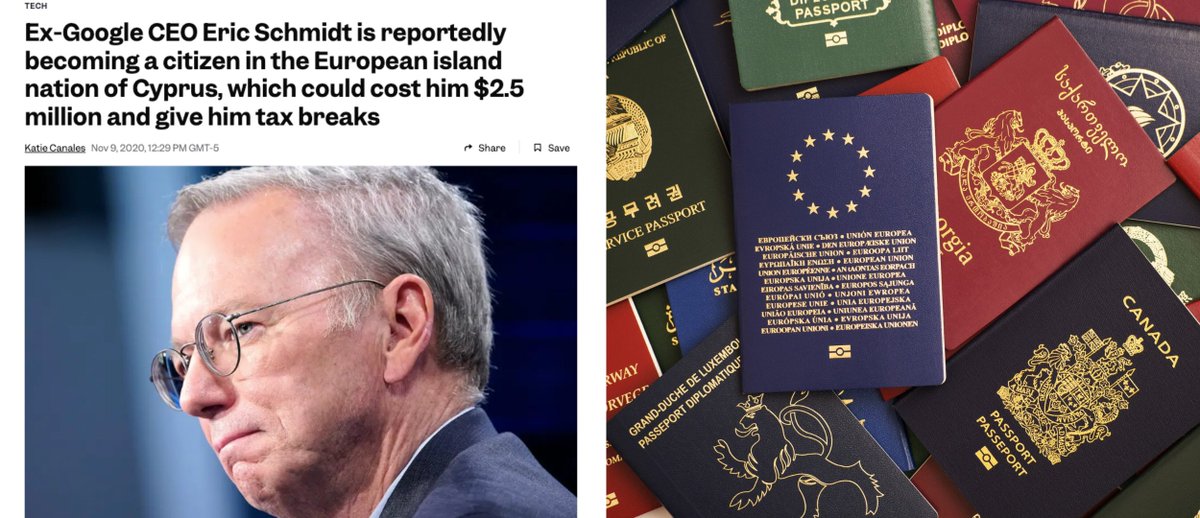

Europe still offers compelling alternatives for those not wanting extreme relocations:

🇵🇹 Portugal: Golden Visa + IFICI (NHR2.0) tax regime, European access

🇪🇸 Spain: Beckham Law tax incentives, Mediterranean lifestyle

🇪🇸 Canary Islands: Spanish jurisdiction with better climate and lower costs

🇵🇹 Portugal: Golden Visa + IFICI (NHR2.0) tax regime, European access

🇪🇸 Spain: Beckham Law tax incentives, Mediterranean lifestyle

🇪🇸 Canary Islands: Spanish jurisdiction with better climate and lower costs

"The UK is in a death spiral."

Not my words. A recent UK relocator I spoke to gave this blunt assessment.

Why?

- Taxes up, services down

- Political chaos, policy U-turns

- Investor-hostile tax changes

- Family quality of life crashing

Why endure this when alternatives exist?

Not my words. A recent UK relocator I spoke to gave this blunt assessment.

Why?

- Taxes up, services down

- Political chaos, policy U-turns

- Investor-hostile tax changes

- Family quality of life crashing

Why endure this when alternatives exist?

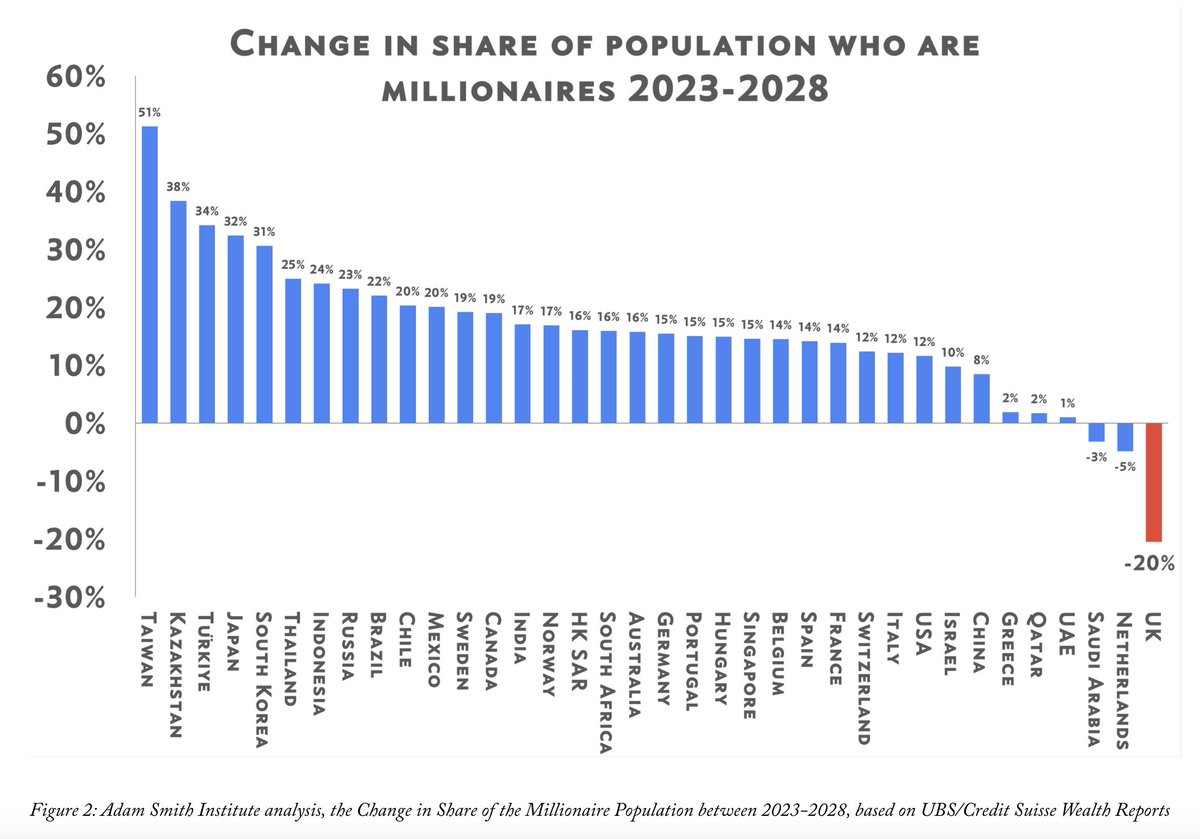

This isn't just about individual choices – it's about structural economic consequences:

When wealth leaves:

- Investment capital vanish

- Job creators leave

- Startup founders flee

- Global competitiveness erode

This has become an existential issue for the UK and Europe more broadly.

When wealth leaves:

- Investment capital vanish

- Job creators leave

- Startup founders flee

- Global competitiveness erode

This has become an existential issue for the UK and Europe more broadly.

All indicators suggest this isn't a temporary blip but a structural shift.

HNWIs have new priorities:

- Tax matters, but isn't everything

- Quality of life now dominates decisions

- Political stability is non-negotiable

- Family prospects drive location choices

The game is changing drastically and the UK is already behind.

HNWIs have new priorities:

- Tax matters, but isn't everything

- Quality of life now dominates decisions

- Political stability is non-negotiable

- Family prospects drive location choices

The game is changing drastically and the UK is already behind.

What does this mean for you?

Whether you're considering a move or just interested in where opportunity is flowing:

1. Options are expanding globally

2. The calculation goes beyond just tax now

3. Network effects matter – wealth attracts more wealth

The question isn't just where they're going, but why.

Whether you're considering a move or just interested in where opportunity is flowing:

1. Options are expanding globally

2. The calculation goes beyond just tax now

3. Network effects matter – wealth attracts more wealth

The question isn't just where they're going, but why.

I'd love to hear your thoughts on this wealth migration trend.

Are you considering relocating? Have you already made the move?

What factors would be most important in your decision?

Let me know in the comments 👇

Are you considering relocating? Have you already made the move?

What factors would be most important in your decision?

Let me know in the comments 👇

P.S. For weekly actionable tips on how to unlock financial freedom for you and your family, join my newsletter!

Join here:

palombo.substack.com

Join here:

palombo.substack.com

Thank you for reading!

For more posts and insights on the future of global citizenship, follow @thealepalombo

And repost this to share with your audience:

For more posts and insights on the future of global citizenship, follow @thealepalombo

And repost this to share with your audience:

https://twitter.com/953352286255886338/status/1910327100286115952

P.S. For weekly actionable tips on how to unlock financial freedom for you and your family, join my newsletter!

Join here:

alepalombo.com

Join here:

alepalombo.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh