1/6

Bonds are getting crushed again today. Now it looks like selling is coming from foreigners, especially Europe.

China is believed to hold several hundred billion of US Treasuries in legal entities in Belgium and Luxembourg.

🧵

Bonds are getting crushed again today. Now it looks like selling is coming from foreigners, especially Europe.

China is believed to hold several hundred billion of US Treasuries in legal entities in Belgium and Luxembourg.

🧵

2/6

The 10-year continues to get crushed today ... just traded 4.57%.

Higher than Tuesday's peak of 4.51%

*US 10-YEAR YIELD HITS HIGHEST SINCE FEBRUARY AS SELLOFF RESUMES

The 10-year continues to get crushed today ... just traded 4.57%.

Higher than Tuesday's peak of 4.51%

*US 10-YEAR YIELD HITS HIGHEST SINCE FEBRUARY AS SELLOFF RESUMES

3/6

Where is the selling coming from?

Answer: Europe

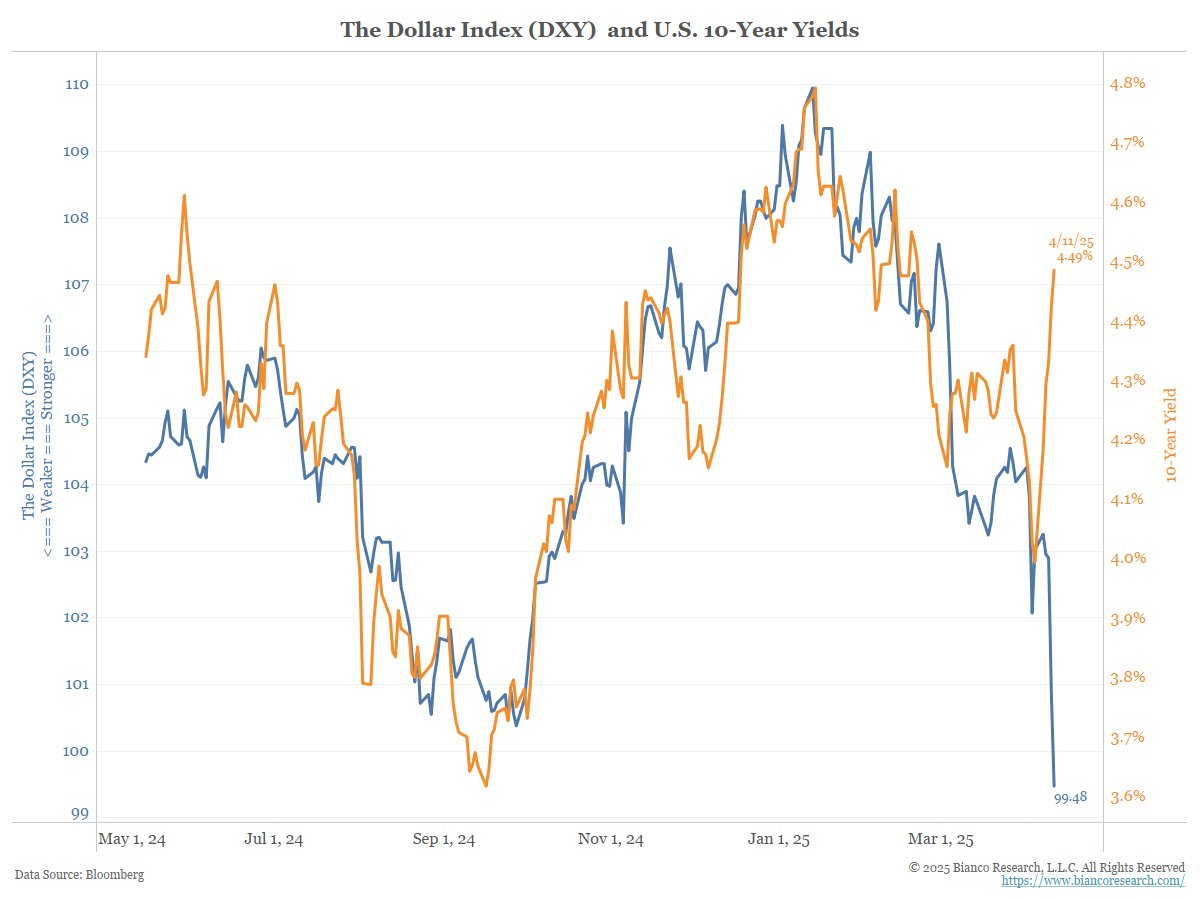

The dollar is going straight down, and US yields are going straight up as this chart shows.

This relationship has broken this week.

Where is the selling coming from?

Answer: Europe

The dollar is going straight down, and US yields are going straight up as this chart shows.

This relationship has broken this week.

5/6

Over the last 3 days, US yields are going straight up and European yields are going straight down.

Sell US bonds and buying European bonds.

Over the last 3 days, US yields are going straight up and European yields are going straight down.

Sell US bonds and buying European bonds.

6/6

Which Europeans are selling UST?

Unknown but, China is thought to holds hundreds of billions of UST in Belgium (orange) and Luxembourg (blue).

Note not all these holdings are Chinese. But they are way outsized relative to the size of the economies.

Which Europeans are selling UST?

Unknown but, China is thought to holds hundreds of billions of UST in Belgium (orange) and Luxembourg (blue).

Note not all these holdings are Chinese. But they are way outsized relative to the size of the economies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh