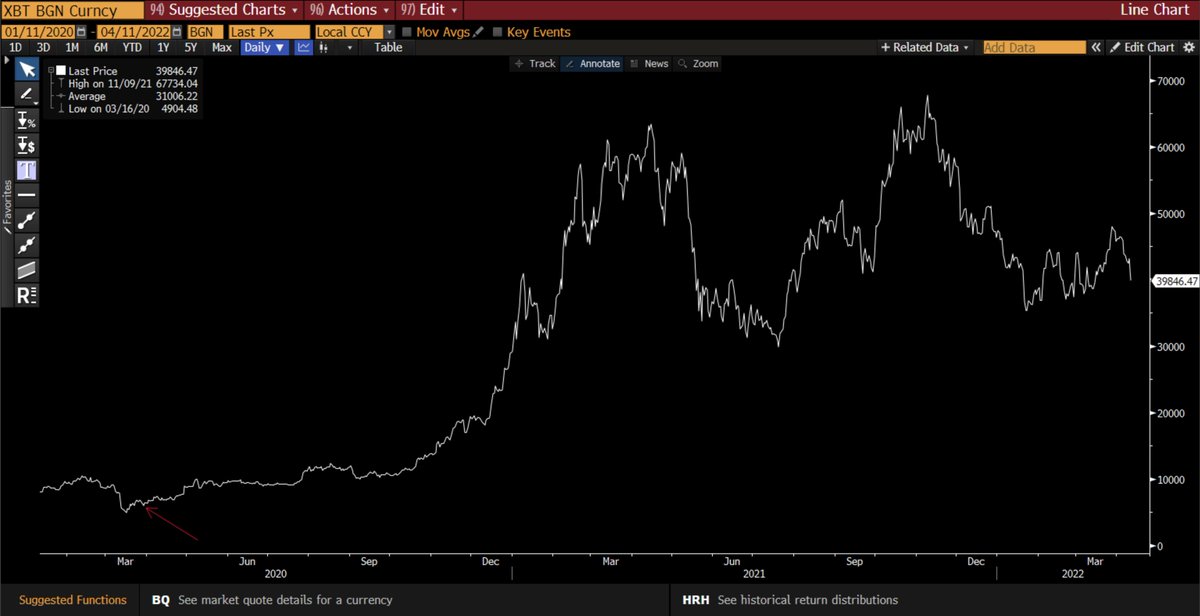

1/ Time for a quick BTC thread to close out a week where we have historic macro moves helping start the next leg despite all the bearish rhetoric.

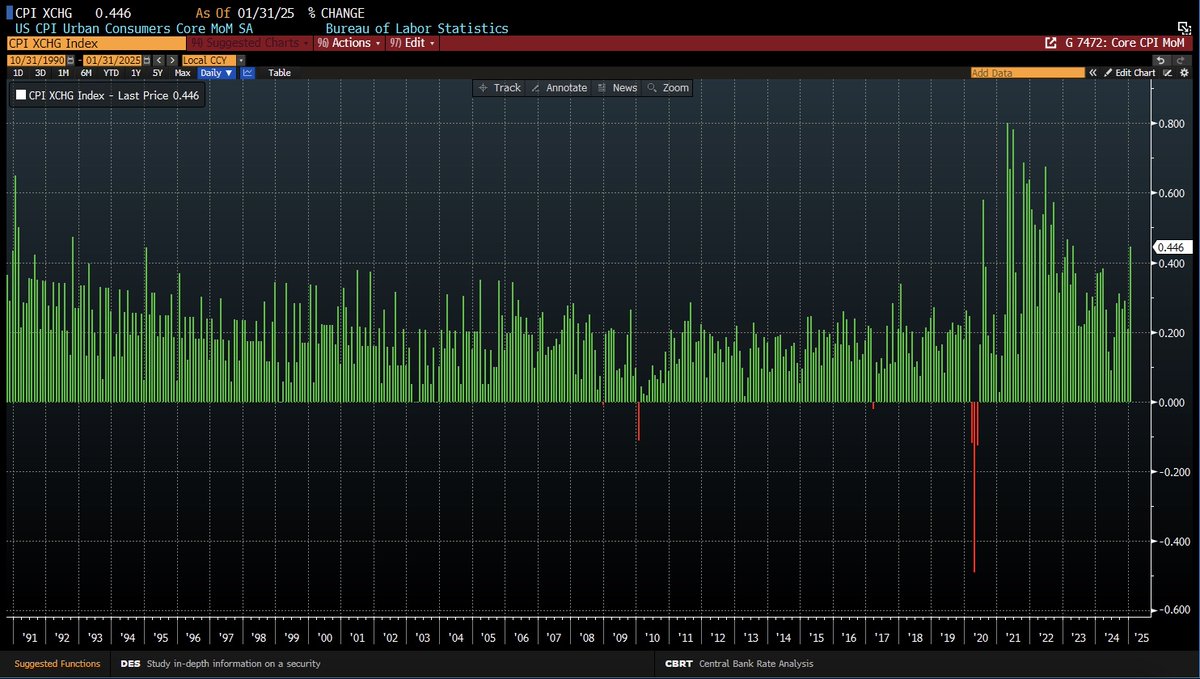

5/ then the basis trade blew up and we had this in 30 yr yields for the largest weekly rise since 1987

6/ while US 10 yr rates went up, German rates were unchanged leading to largest weekly divergence in history

13/ the global fiat system is breaking into national capitalism which will lead to more debt around the globe as countries focus on their economies in this trade reshuffling. the new global system of exchange will be driven by AI, stablecoins and BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh