22V Research

Watch my videos at https://t.co/ccIwXF66jy

Read my papers at https://t.co/iblvrOpf7E

2 subscribers

How to get URL link on X (Twitter) App

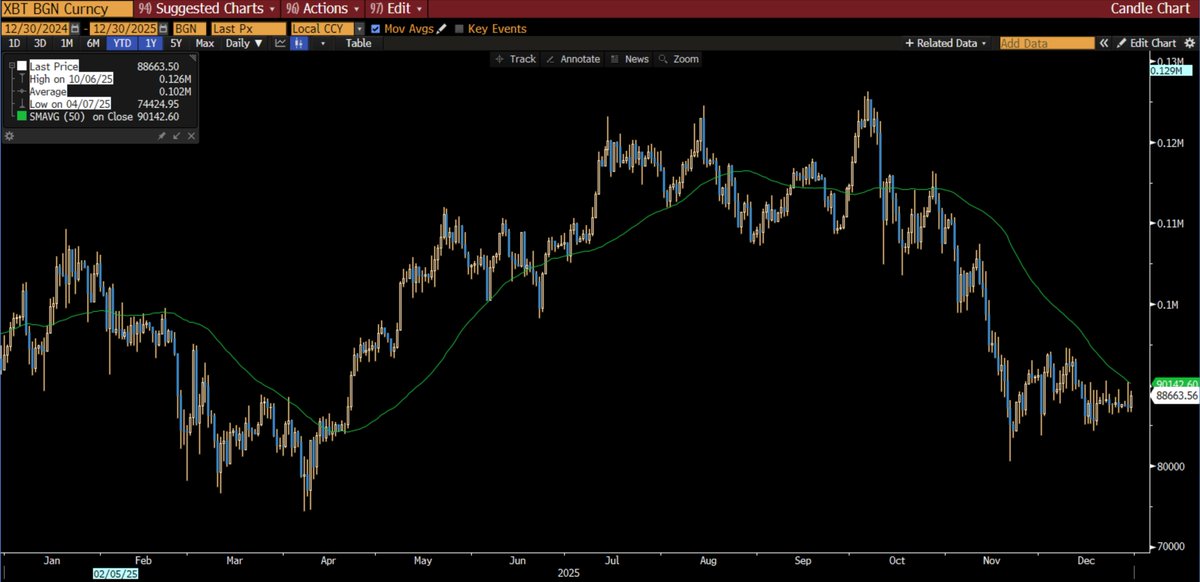

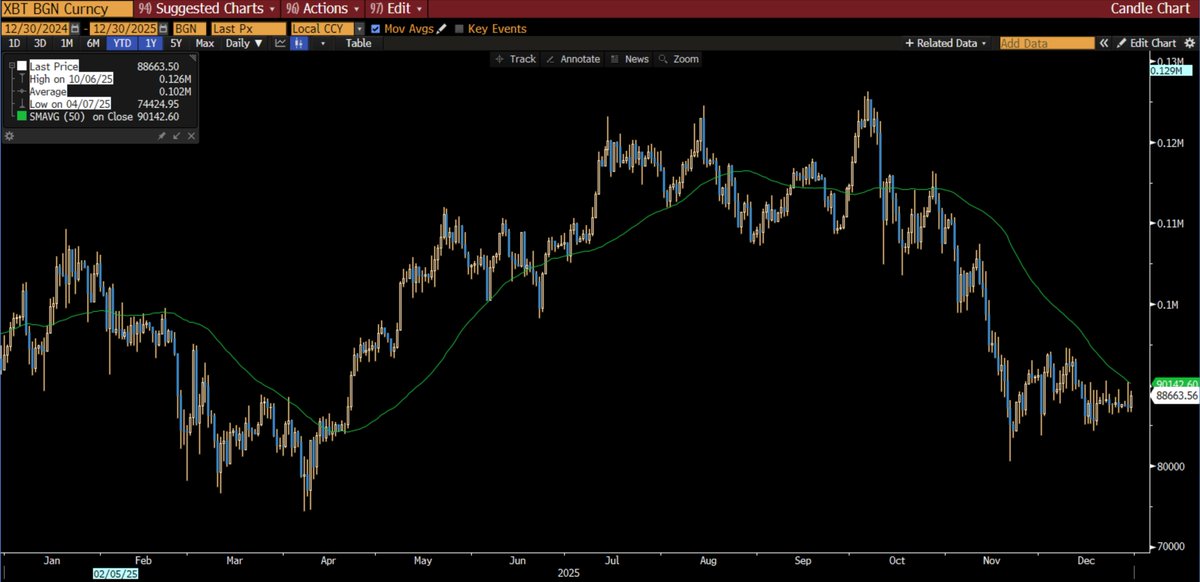

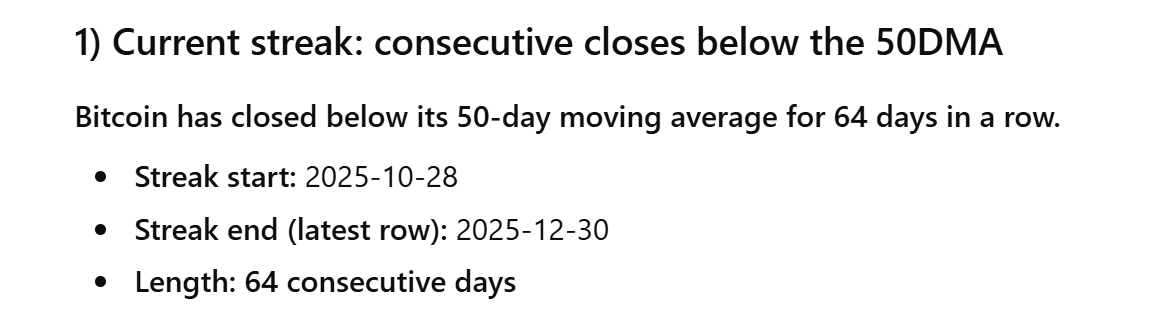

2/ This matters because Bitcoin has now closed below the 50DMA for 64 consecutive days.

2/ This matters because Bitcoin has now closed below the 50DMA for 64 consecutive days.

https://x.com/Geiger_Capital/status/1897995482300891580

1/ First of all if we use the internet bubble as an example of a bubble to compare the Bitcoin chart, the NDX from 12/90-3/00 compounded at 40% a year and did not have a down year with 1999 being up more than 100%. The Bitcoin chart over the last three years is not a bubble.

1/ First of all if we use the internet bubble as an example of a bubble to compare the Bitcoin chart, the NDX from 12/90-3/00 compounded at 40% a year and did not have a down year with 1999 being up more than 100%. The Bitcoin chart over the last three years is not a bubble.