We are in 3rd economic period since China opened up.

1st period 1980-2005

Advanced economies invested in China, taught China how to make stuff to lower cost

2nd 2006-2020

China became world's factory, US moved from mfg to design.

3rd 2021-

China competes on top end in design.

See graph for foreign export vs private/others

1st period 1980-2005

Advanced economies invested in China, taught China how to make stuff to lower cost

2nd 2006-2020

China became world's factory, US moved from mfg to design.

3rd 2021-

China competes on top end in design.

See graph for foreign export vs private/others

Use shipbuilding as an example:

Until 2006, China was still learning how to build ships.

It was competing mostly on low cost for simpler ships like container ships.

It used mostly foreign supply chain like engines, propellers & more.

Other heavy industries also like this.

Until 2006, China was still learning how to build ships.

It was competing mostly on low cost for simpler ships like container ships.

It used mostly foreign supply chain like engines, propellers & more.

Other heavy industries also like this.

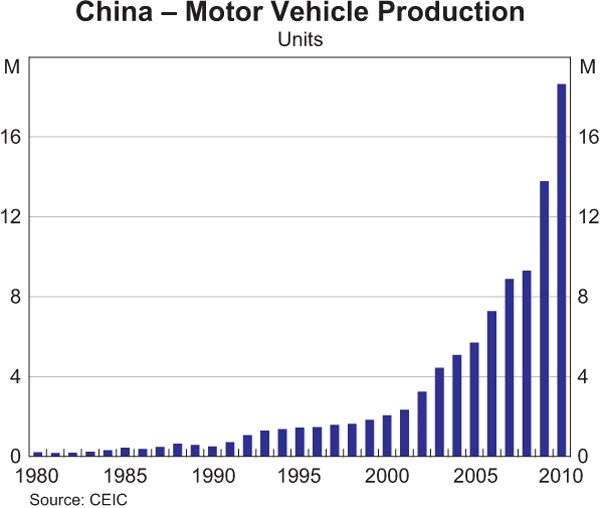

By mid 2000s, China was making stuff like cars, TVs, PCs & phones locally

Focusing on auto industry, Chinese production was mostly foreign JVs. Local automakers made cheaper cars.

But China Inc kept improving, building local supply chain & growing in size.

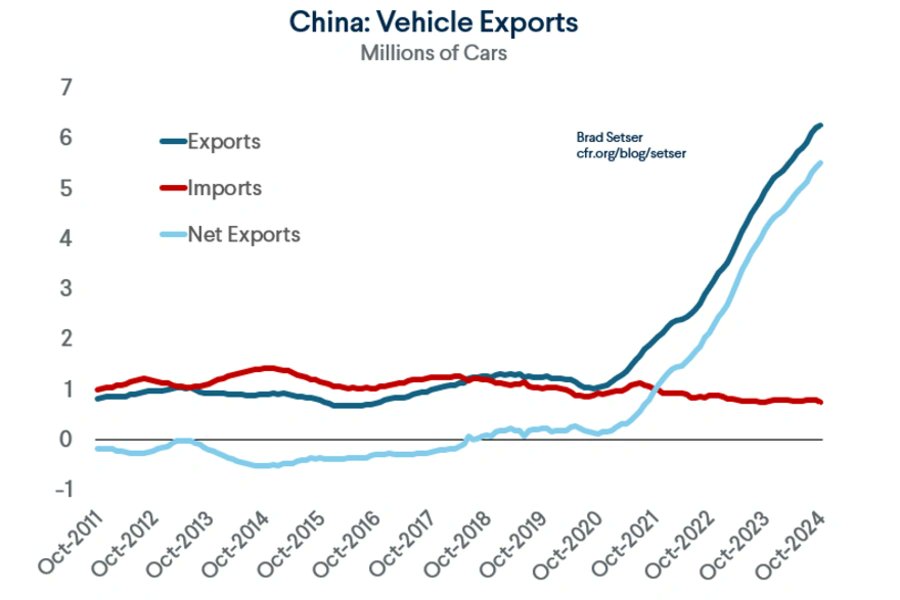

Still, export was flat

Focusing on auto industry, Chinese production was mostly foreign JVs. Local automakers made cheaper cars.

But China Inc kept improving, building local supply chain & growing in size.

Still, export was flat

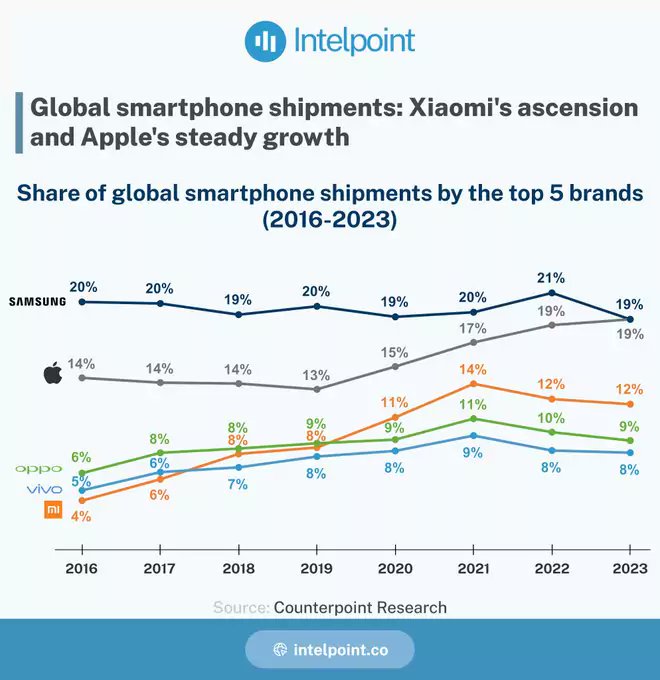

During this period, China started to dominate production of smart phones, pads, PCs & more.

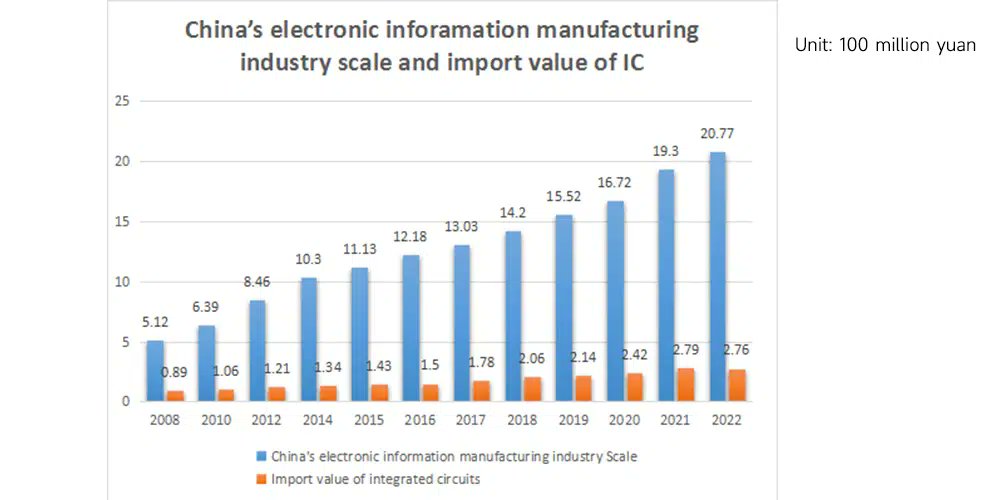

See its steady growth in electronics mfg (need ICs to produce more electronics)

China built up its electronics supply chain dominance

You design something?

well, you need China to make it

See its steady growth in electronics mfg (need ICs to produce more electronics)

China built up its electronics supply chain dominance

You design something?

well, you need China to make it

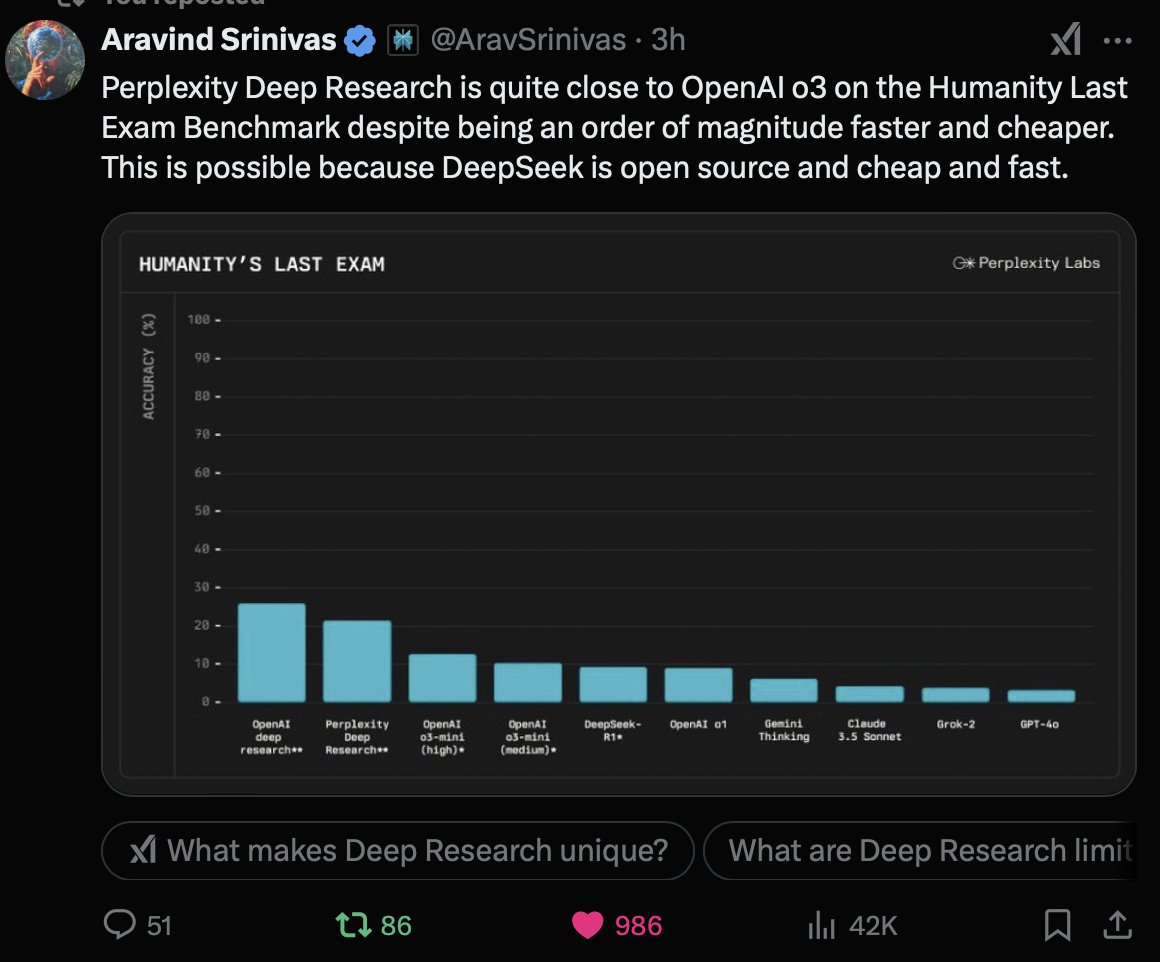

As we get to 3rd stage, AI products are the future.

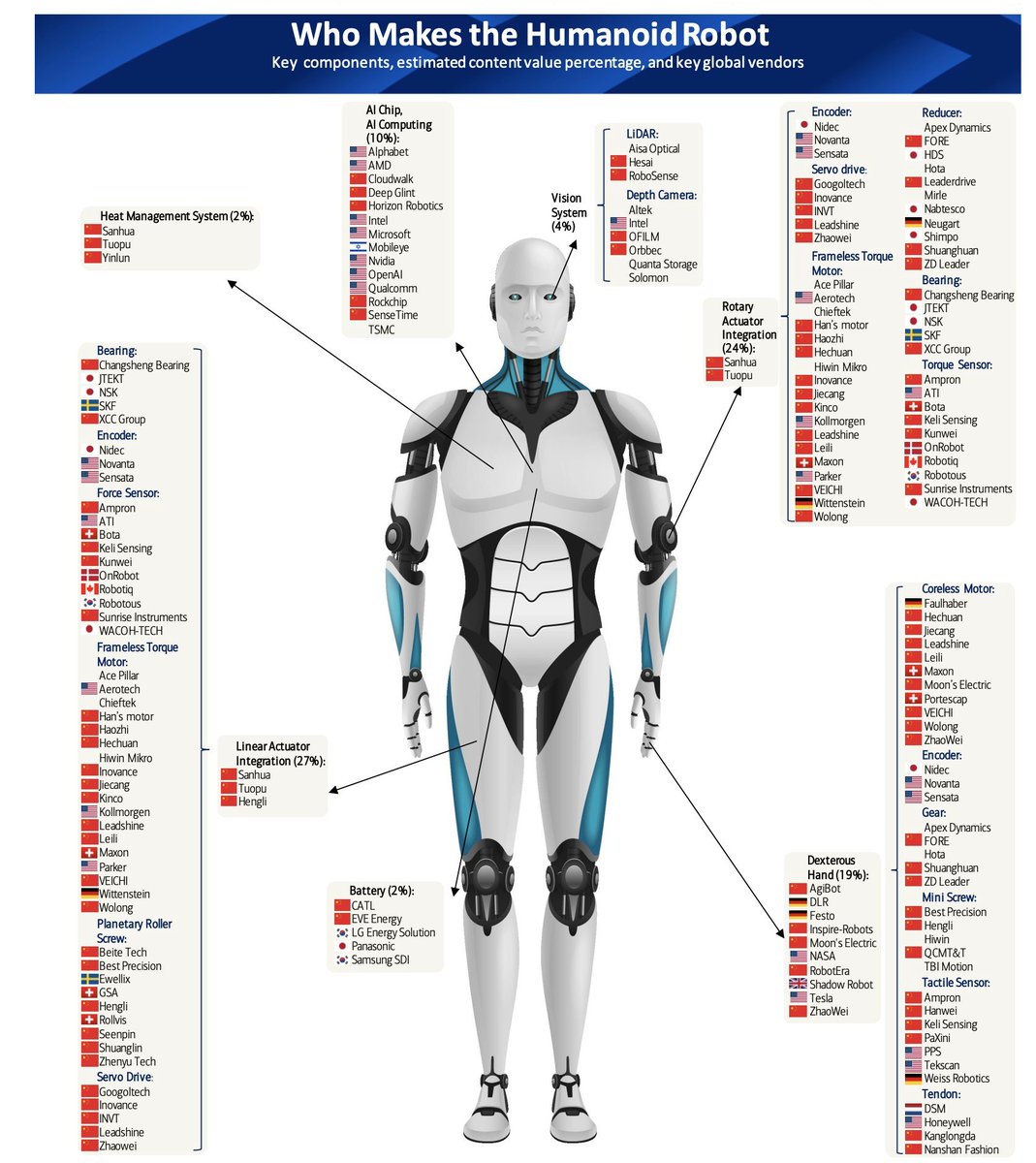

See below for suppliers of humanoid robot.

China dominates supply chain for AI robots.

That allows faster product iteration for local companies that put everything together.

Notice how many AI robot companies are in China?

See below for suppliers of humanoid robot.

China dominates supply chain for AI robots.

That allows faster product iteration for local companies that put everything together.

Notice how many AI robot companies are in China?

I'm continuously surprised by the wide range of Edge AI chips, AIoT products, smaller AI models (Qwen) & multi-modal models coming out of China.

See below for SpacemiT RISC-V AI chip used in wide range of scenario.

Accessing this supply chain is huge

See below for SpacemiT RISC-V AI chip used in wide range of scenario.

Accessing this supply chain is huge

https://x.com/tphuang/status/1899235801738694699

Product iteration time for a company in Shenzhen or Hangzhou is so fast.

They have full access to ppl that design boards, understands mfg process, can buy all the ICs/parts & that do multi-modal small models.

There is no language or timezone barrier.

How to compete w/ this?

They have full access to ppl that design boards, understands mfg process, can buy all the ICs/parts & that do multi-modal small models.

There is no language or timezone barrier.

How to compete w/ this?

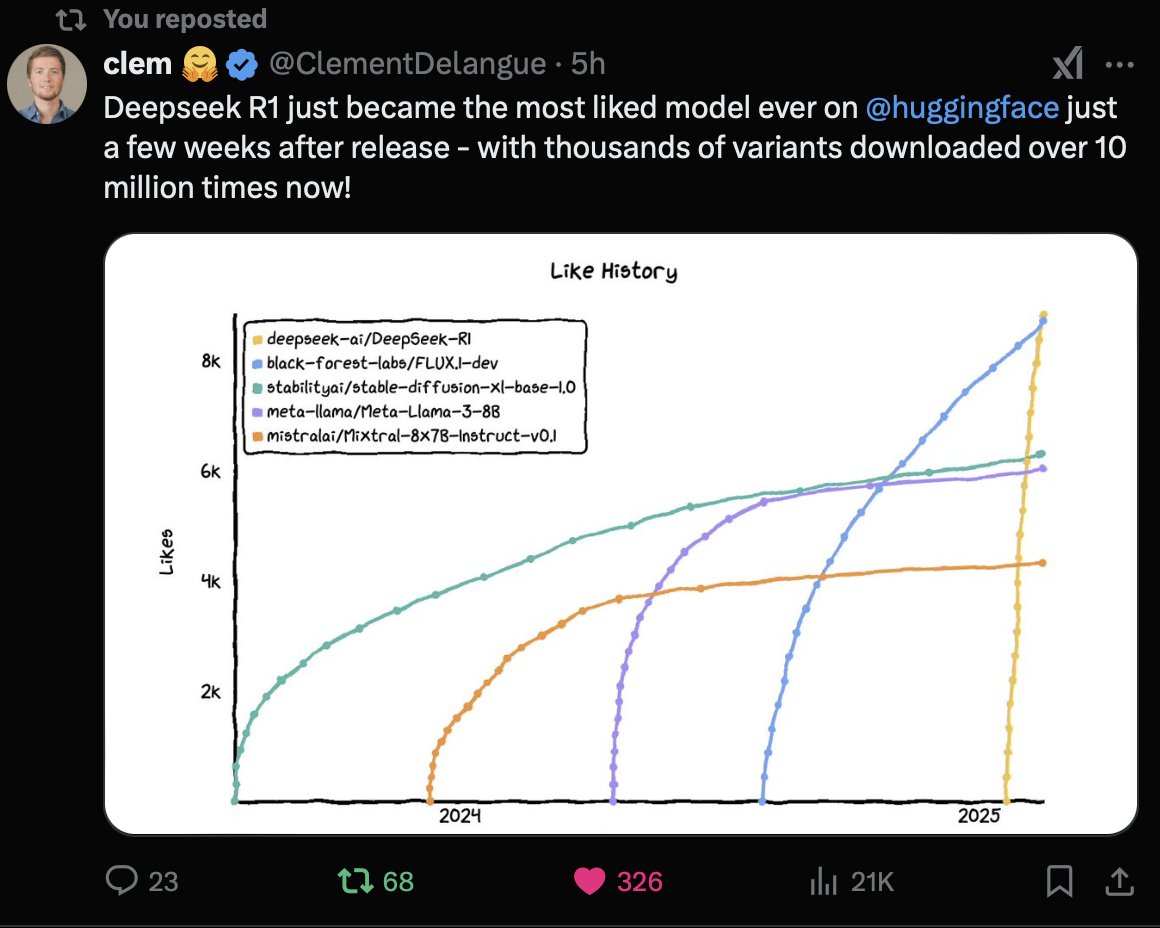

You may think I'm joking, but go look up GitHub & Huggingface and check out just how many of these multi-modal models w/ smallish # of params come out of China.

And then, look up how many AIoT chips are designed in China/Taiwan.

Nvidia makes AI chips, but they are not affordable!

And then, look up how many AIoT chips are designed in China/Taiwan.

Nvidia makes AI chips, but they are not affordable!

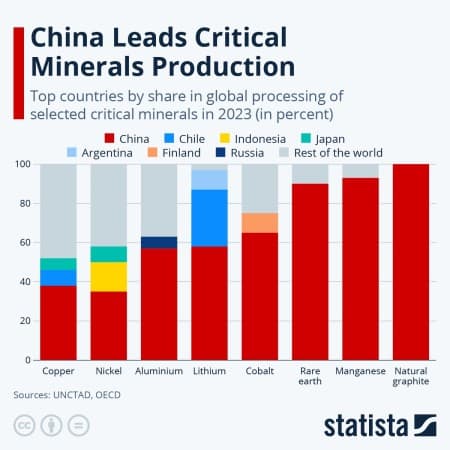

This supply advantage go way beyond AI. It goes into the most basic materials.

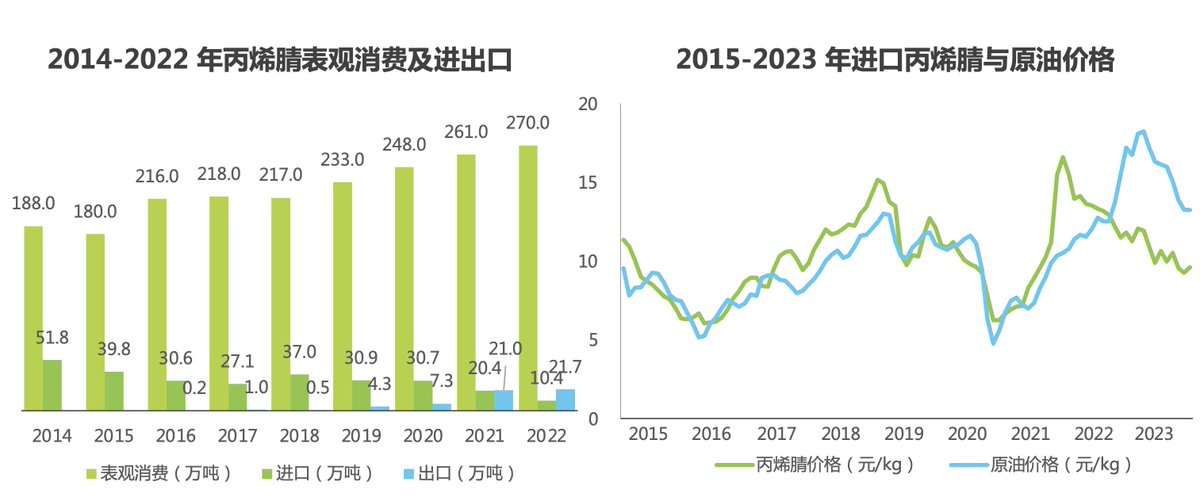

Acrylonitrile is used to make plastics, rubber & acrylic fibers.

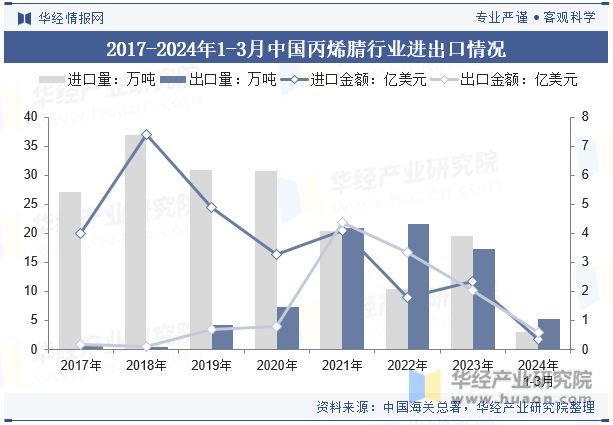

See how quickly China went from being a huge importer of Acrylonitrile to a net exporter.

This is quite common across supply chain.

Acrylonitrile is used to make plastics, rubber & acrylic fibers.

See how quickly China went from being a huge importer of Acrylonitrile to a net exporter.

This is quite common across supply chain.

See demand of Acrylonitrile went up 50% from 2015 to 2022 & domestic petrochem production went through the roof during this time while China's import of crude sky rocketed.

Hence why all the relocated toy/apparel production in ASEAN countries rely on Chinese supply chain input.

Hence why all the relocated toy/apparel production in ASEAN countries rely on Chinese supply chain input.

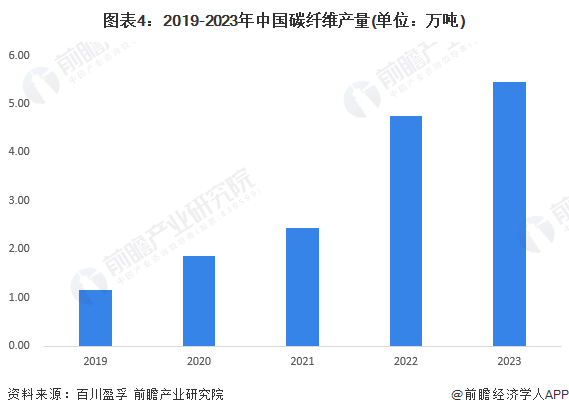

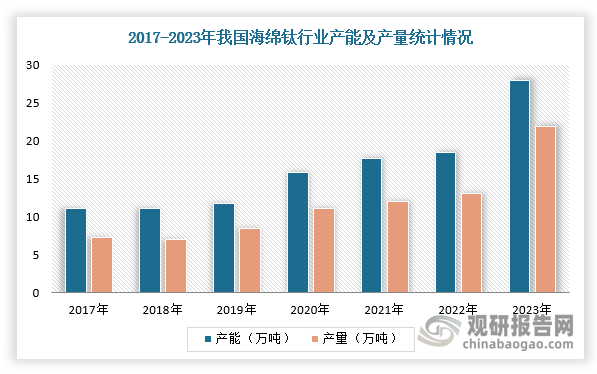

Supply chain growth of basic material

Carbon fiber production 5x in 4 yr

Titanium sponge production 3x in 4 yr

Complete dominance of Acrylic production capacity

Jilin will have more capacity than ROW combined

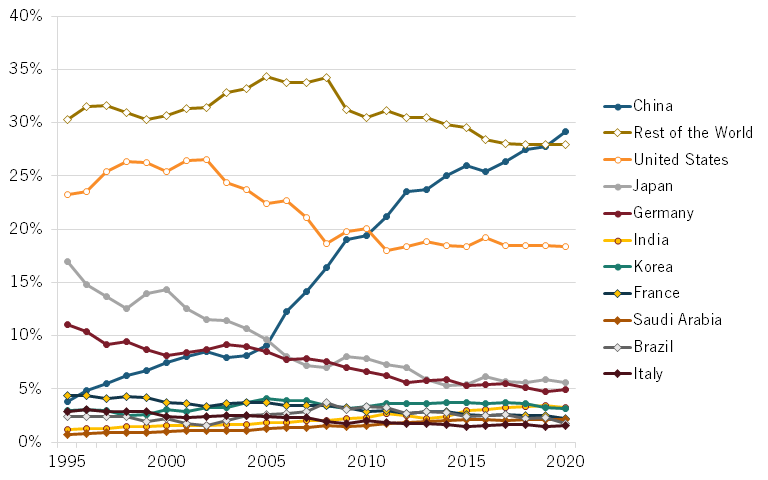

China's chemical value added increased from 8% in 2005 to 29% in 2020.

Carbon fiber production 5x in 4 yr

Titanium sponge production 3x in 4 yr

Complete dominance of Acrylic production capacity

Jilin will have more capacity than ROW combined

China's chemical value added increased from 8% in 2005 to 29% in 2020.

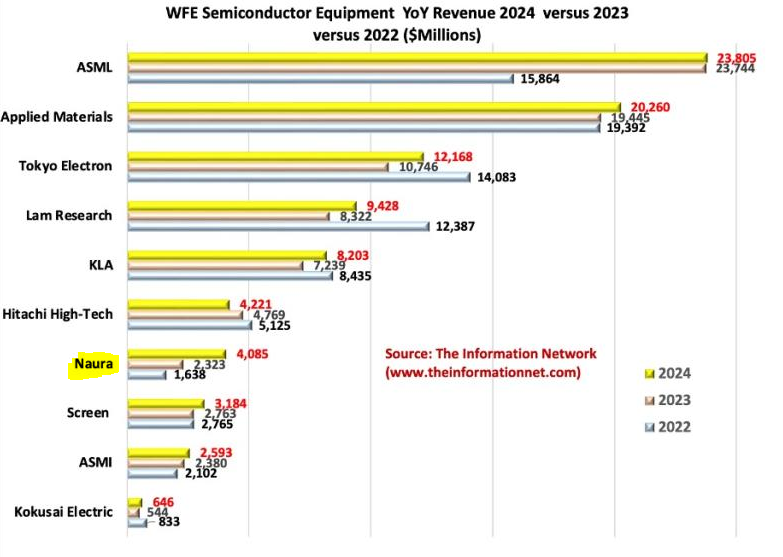

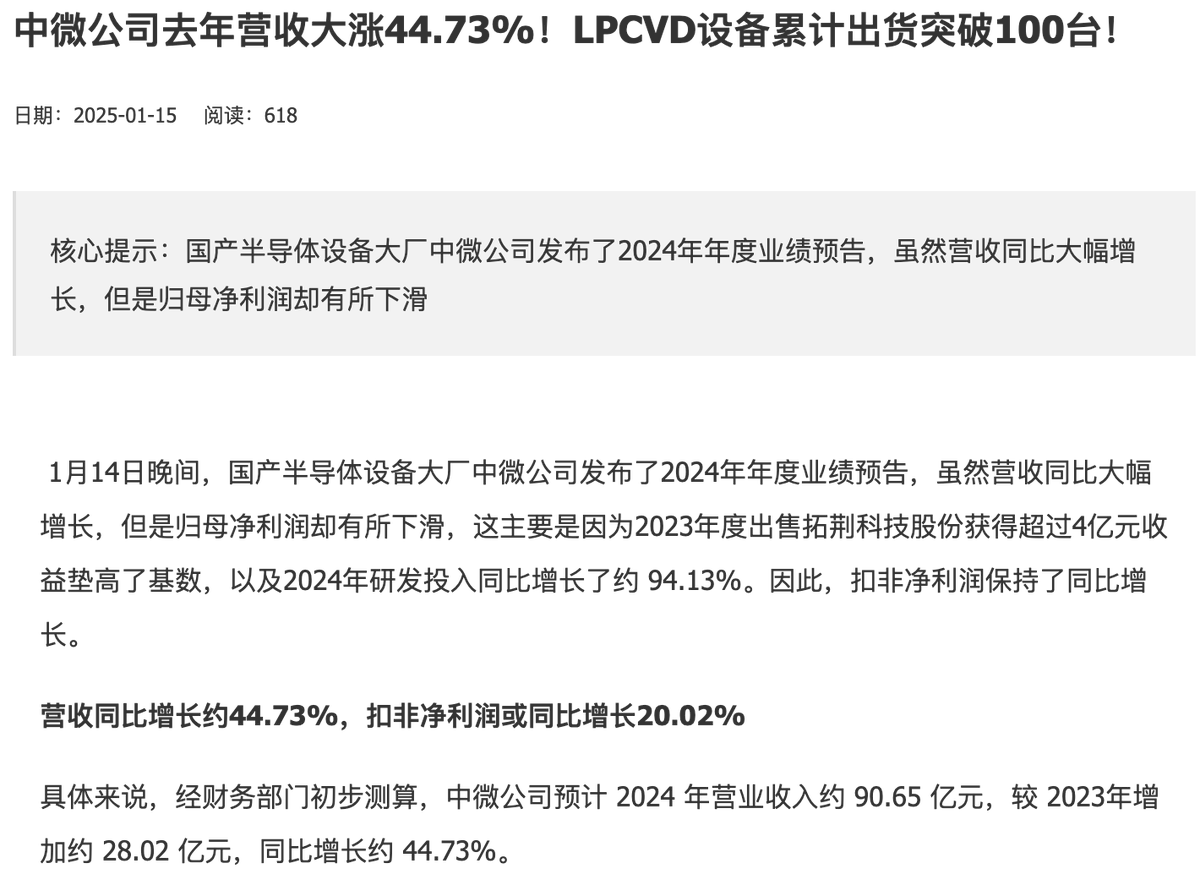

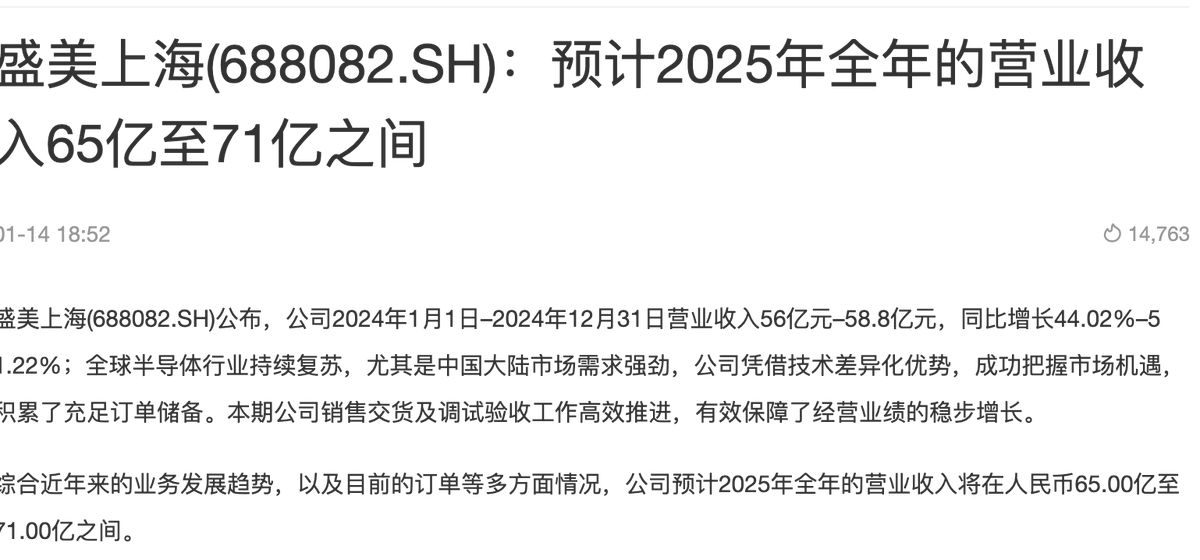

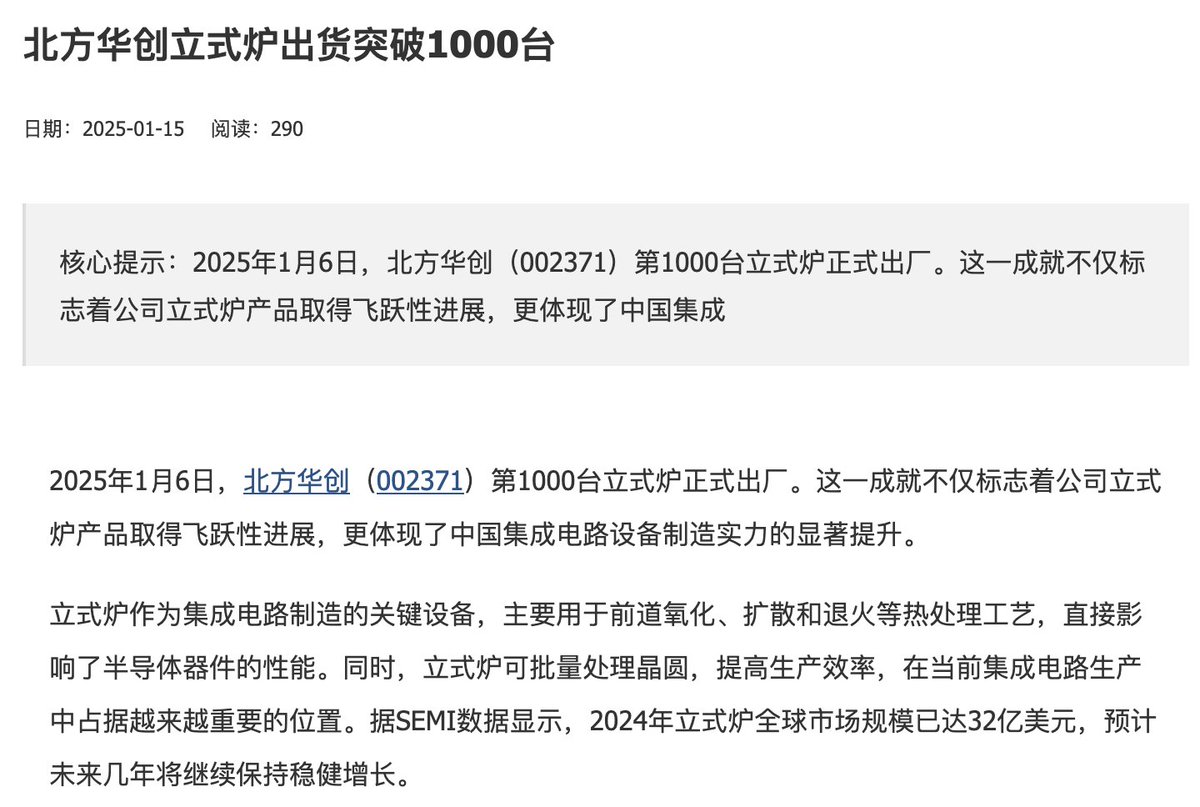

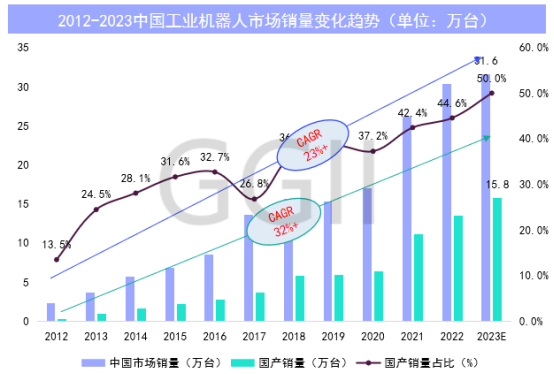

Growth in supply chain extend way beyond basic material like chemical products, RE & other metals.

Industrial robots, Cutting/casting equipment & all other factory equipment saw huge shift from import to domestic.

Same w/ establishment of domestic supply chain for this.

Industrial robots, Cutting/casting equipment & all other factory equipment saw huge shift from import to domestic.

Same w/ establishment of domestic supply chain for this.

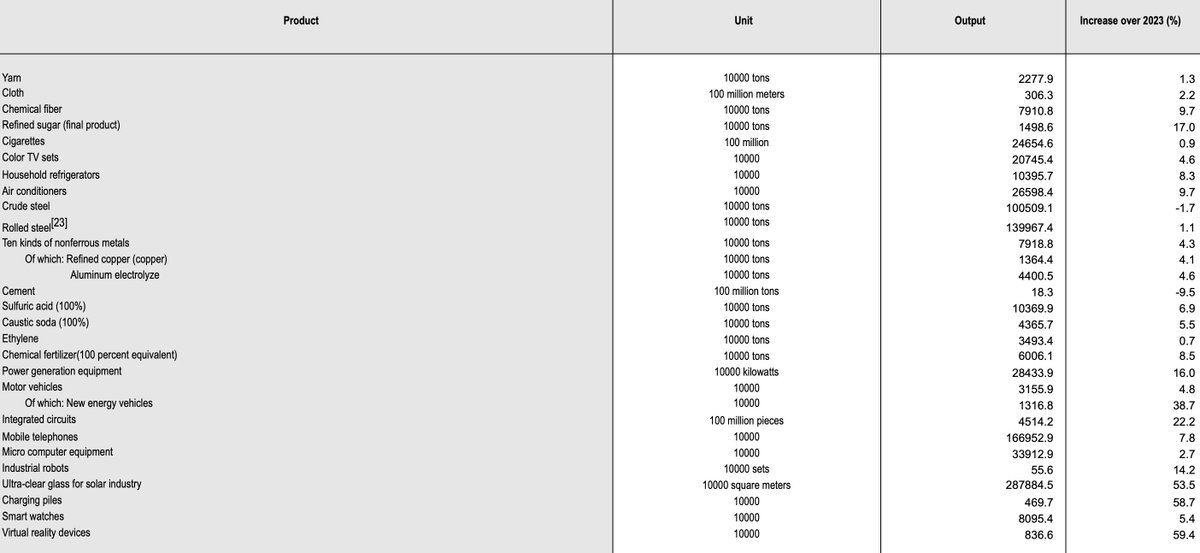

After dominating the raw materials, the move toward higher end materials like chemical fiber, Ti & ultra clear glass as well as ICs, batteries, robots, eMotor, power generation & NEVs is quite clear based on China's 2024 industrial production report.

A lot of this is driven by intense competition in NEVs, smart phones & drones.

But make no mistake, their supply chain can be re-used in AI robots, VR glasses, eVTOL & other cutting edge AI products.

Ever wondered why Chinese OEMs are all beating Apple in AI feature deployment?

But make no mistake, their supply chain can be re-used in AI robots, VR glasses, eVTOL & other cutting edge AI products.

Ever wondered why Chinese OEMs are all beating Apple in AI feature deployment?

All of this happened while China is rapidly losing jobs in many labor intensive mfg sectors.

They are either getting automated or off-shored

Final assembly is low value added & easily tariffed.

China continues to maintain its place in supply chain while moving up value chain.

They are either getting automated or off-shored

Final assembly is low value added & easily tariffed.

China continues to maintain its place in supply chain while moving up value chain.

Started in 90s w/ goal of dominating dirty, energy intensive minerals.

Moved up supply chain & did final assembly all the way through to 2010s.

Once China got good w/ that, it's rapidly growing in product design also while maintaining supply chain.

Moved up supply chain & did final assembly all the way through to 2010s.

Once China got good w/ that, it's rapidly growing in product design also while maintaining supply chain.

We get to today where it's hard to compete w/ Chinese firms that have supply chain advantage.

If you are developing product in US/EU, your main advantages are knowledge of local mkt, service & brand (+ tariffs?)

But what if your Chinese competitors get there a yr earlier than u?

If you are developing product in US/EU, your main advantages are knowledge of local mkt, service & brand (+ tariffs?)

But what if your Chinese competitors get there a yr earlier than u?

• • •

Missing some Tweet in this thread? You can try to

force a refresh