I trade 1 hour per day using trendlines.

My simple strategy was the #1 reason I became a 6-figure trader.

I don’t use indicators, and I don’t stare at charts all day.

Here’s the exact trendline strategy I use to trade only 1 hour per day:🧵

My simple strategy was the #1 reason I became a 6-figure trader.

I don’t use indicators, and I don’t stare at charts all day.

Here’s the exact trendline strategy I use to trade only 1 hour per day:🧵

Trendlines are the foundation of technical analysis.

There are two types of Trendlines:

- Upward Trendline

- Downward Trendline

This will be a top-down analysis on both trendlines.

There are two types of Trendlines:

- Upward Trendline

- Downward Trendline

This will be a top-down analysis on both trendlines.

Let’s start on the monthly timeframe.

We start on higher timeframes to get a good understanding of where the overall trend is heading.

Each trendline should have a point A and B, and should precisely hold price without breaking.

We start on higher timeframes to get a good understanding of where the overall trend is heading.

Each trendline should have a point A and B, and should precisely hold price without breaking.

Weekly timeframe:

Each time we drop timeframes, we want the trendline to get cleaner.

We’re stacking trendlines, and each new point A should start at the previous point B.

This is how I trade with precision using a simple strategy.

Each time we drop timeframes, we want the trendline to get cleaner.

We’re stacking trendlines, and each new point A should start at the previous point B.

This is how I trade with precision using a simple strategy.

Daily Timeframe:

The previous point B turns into the new point A, and we connect to the next most recent low.

4-Hour Timeframe:

Once we’ve maxed out our upward trendlines, we start looking for downward trendlines.

The previous point B turns into the new point A, and we connect to the next most recent low.

4-Hour Timeframe:

Once we’ve maxed out our upward trendlines, we start looking for downward trendlines.

Downward Trendlines:

Everything is the same (but opposite), so instead, point A will be the highest point of the chart.

Point B is the next lower high.

In this example, we’ve identified another trendline before moving to the 1H.

Everything is the same (but opposite), so instead, point A will be the highest point of the chart.

Point B is the next lower high.

In this example, we’ve identified another trendline before moving to the 1H.

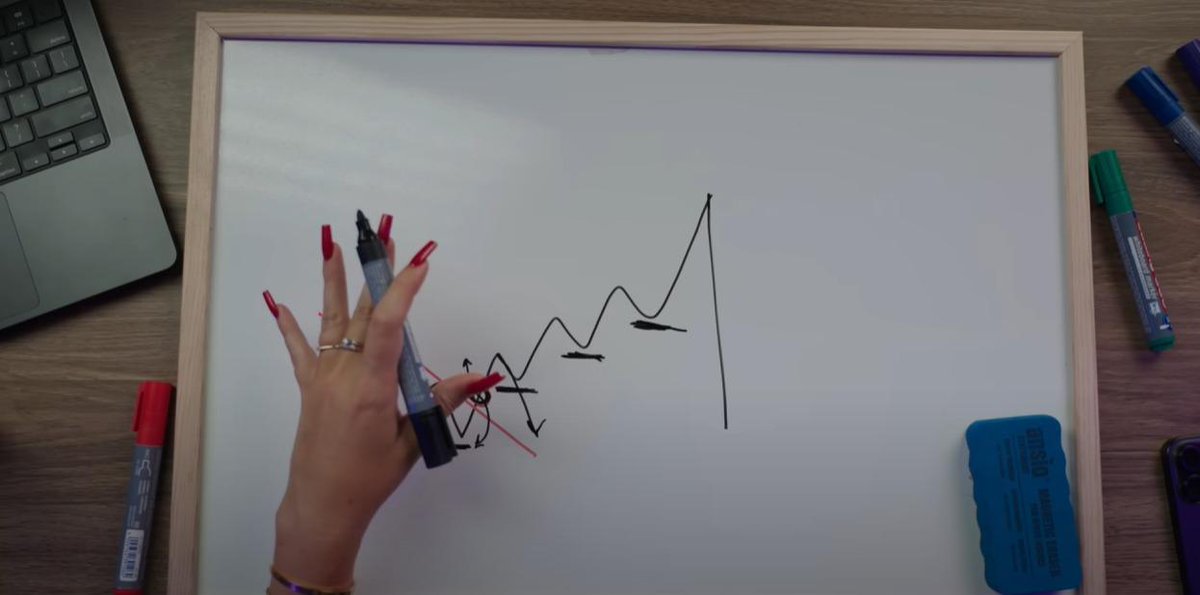

There are two different strategies within trendline trading:

1. Bounce Strategy

- Anticipating that price will bounce off of the trendline (continuation)

2. Breakout Strategy

- Price breaks through a trendline (reversal)

1. Bounce Strategy

- Anticipating that price will bounce off of the trendline (continuation)

2. Breakout Strategy

- Price breaks through a trendline (reversal)

Bounce Strategy:

As price continues in the trend, we anticipate that the trendline will hold, and price will continue to bounce.

Risk: 1-2% of your capital.

As price continues in the trend, we anticipate that the trendline will hold, and price will continue to bounce.

Risk: 1-2% of your capital.

Exits:

Our stop-loss goes on the other side of the downward trendline.

If price doesn’t bounce, it’s time to exit, but if it bounces in our favor, we let it run.

Allow the trend to play out, or take profits at an area of support/resistance where price is likely to reverse.

Our stop-loss goes on the other side of the downward trendline.

If price doesn’t bounce, it’s time to exit, but if it bounces in our favor, we let it run.

Allow the trend to play out, or take profits at an area of support/resistance where price is likely to reverse.

Breakout Strategy:

We’re anticipating a reversal, and we enter when price breaks the trendline (instead of bouncing).

As price breaks the trendline, we start following the opposite trendline, and we follow the same exit criteria as the bounce strategy.

We’re anticipating a reversal, and we enter when price breaks the trendline (instead of bouncing).

As price breaks the trendline, we start following the opposite trendline, and we follow the same exit criteria as the bounce strategy.

Live Account Trade:

Here’s an example of a live trade I took using the breakout strategy.

Price broke the upward trendline, and I stayed in the trade until price reached a strong area of support.

RR: 3.11

Risk: $8,900

Profit: $27,683

Here’s an example of a live trade I took using the breakout strategy.

Price broke the upward trendline, and I stayed in the trade until price reached a strong area of support.

RR: 3.11

Risk: $8,900

Profit: $27,683

Advanced Tips:

1. Constantly adjust and find new trendlines

2. Incorporate multiple timeframes - top-down analysis

3. Utilize areas of support/resistance for exits

1. Constantly adjust and find new trendlines

2. Incorporate multiple timeframes - top-down analysis

3. Utilize areas of support/resistance for exits

Most traders are constantly switching strategies.

One day it’s order blocks, the next day it’s indicators.

Everything changed when I committed to just one visual tool: trendlines.

One day it’s order blocks, the next day it’s indicators.

Everything changed when I committed to just one visual tool: trendlines.

Thank you for reading!

I’m curious, what strategy do you use?

And what are your thoughts on trendline trading?

I’m curious, what strategy do you use?

And what are your thoughts on trendline trading?

• • •

Missing some Tweet in this thread? You can try to

force a refresh