How to get URL link on X (Twitter) App

Before we get started…

Before we get started…

When I first started trading, I was glued to the charts.

When I first started trading, I was glued to the charts.

Shift #1: I narrowed my watchlist.

Shift #1: I narrowed my watchlist.

Everyone teaches entries.

Everyone teaches entries.

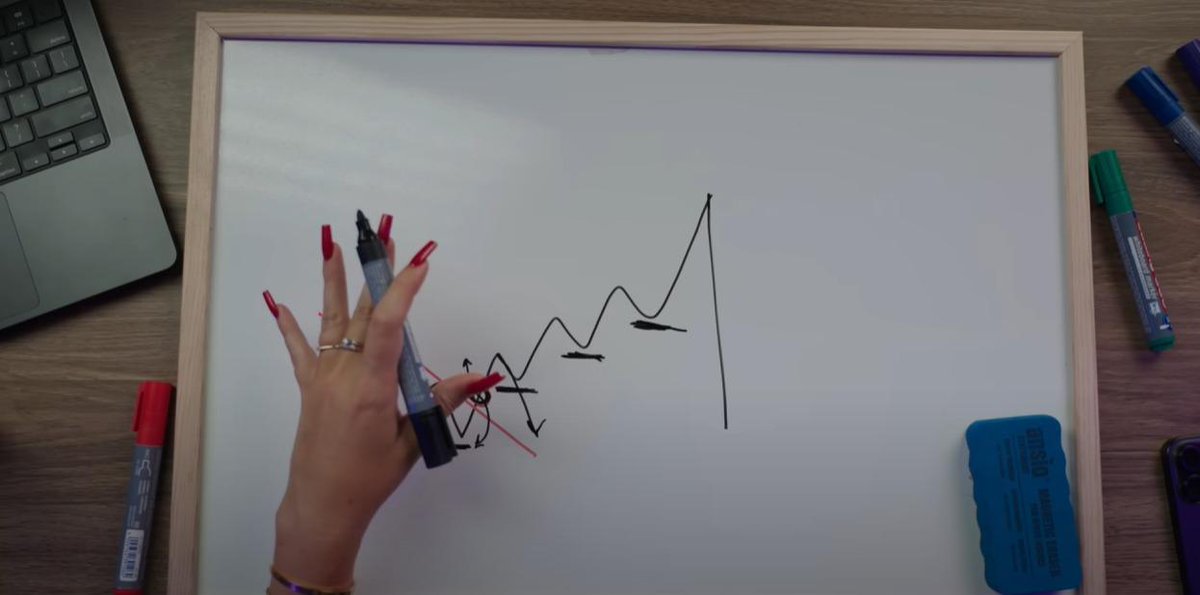

Most traders draw trendlines randomly.

Most traders draw trendlines randomly.

I only use manually drawn trendlines, that’s it.

I only use manually drawn trendlines, that’s it.

Most traders treat fakeouts like mistakes.

Most traders treat fakeouts like mistakes.

Lesson #1: Less is more.

Lesson #1: Less is more.

I’ve seen this cycle firsthand.

I’ve seen this cycle firsthand.

I’ve been trading for 9 years.

I’ve been trading for 9 years.

Most new swing traders fail because they close trades too early.

Most new swing traders fail because they close trades too early.

Most beginners think they need fancy tools.

Most beginners think they need fancy tools.

1) Finding My Trades

1) Finding My Trades

My trading journal showed exactly where I was going wrong.

My trading journal showed exactly where I was going wrong.

Trendlines are the foundation of technical analysis.

Trendlines are the foundation of technical analysis.