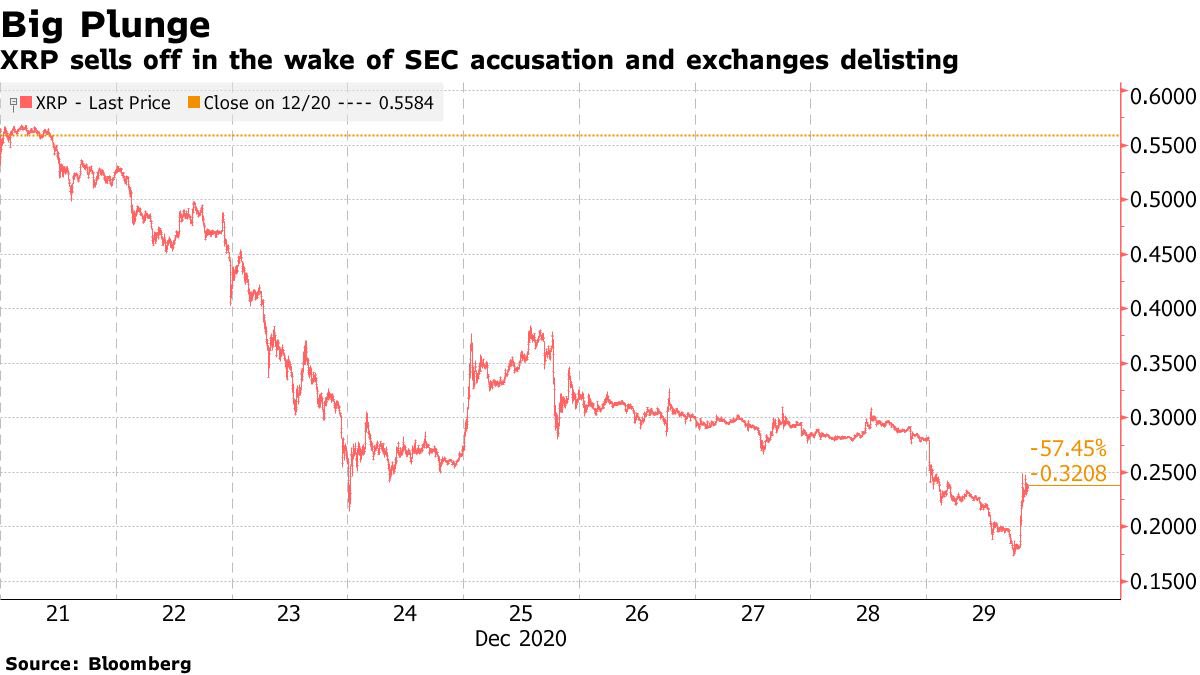

(1/🧵) Most people are waking up to XRP’s potential…

but they’re still sleeping on Stellar (XLM).

Stellar has quietly built real-world infrastructure across 180+ countries.

Remittances. Aid. Banking. Stablecoins.

Here’s what they’ve been building — and who’s using it:

🧵

but they’re still sleeping on Stellar (XLM).

Stellar has quietly built real-world infrastructure across 180+ countries.

Remittances. Aid. Banking. Stablecoins.

Here’s what they’ve been building — and who’s using it:

🧵

(2/🧵) MoneyGram + Stellar

In 2022, Stellar teamed up with MoneyGram to bridge crypto and cash.

Result?

People in 180+ countries can now convert USDC on Stellar into physical cash — and vice versa — with no bank account needed.

A global cash-to-crypto on/off ramp is live.

In 2022, Stellar teamed up with MoneyGram to bridge crypto and cash.

Result?

People in 180+ countries can now convert USDC on Stellar into physical cash — and vice versa — with no bank account needed.

A global cash-to-crypto on/off ramp is live.

(3/🧵) United Nations (UNHCR) + Stellar Aid Assist

During the Ukraine conflict, the UN used Stellar to distribute USDC-based aid to refugees.

Funds could be received on a phone, held in a self-custody wallet, and cashed out instantly via MoneyGram.

No bank. No borders. Full control.

During the Ukraine conflict, the UN used Stellar to distribute USDC-based aid to refugees.

Funds could be received on a phone, held in a self-custody wallet, and cashed out instantly via MoneyGram.

No bank. No borders. Full control.

(4/🧵) Franklin Templeton + Stellar

One of the world’s largest asset managers ($1.5T AUM) tokenized its money market fund on Stellar.

Why?

Low fees, compliance-ready rails, and real-time asset visibility.

Traditional finance has already started building on Stellar.

One of the world’s largest asset managers ($1.5T AUM) tokenized its money market fund on Stellar.

Why?

Low fees, compliance-ready rails, and real-time asset visibility.

Traditional finance has already started building on Stellar.

(5/🧵) VELO Labs

@veloprotocol uses Stellar for real-time, cross-border settlement across Asia.

It offers a blockchain-based alternative to SWIFT — powering payments between banks, fintechs, and businesses.

In 2023, VELO processed millions in transactions monthly.

@veloprotocol uses Stellar for real-time, cross-border settlement across Asia.

It offers a blockchain-based alternative to SWIFT — powering payments between banks, fintechs, and businesses.

In 2023, VELO processed millions in transactions monthly.

(6/🧵) Stronghold (SHX)

@strongholdpay is Stellar’s infrastructure powerhouse in the U.S.

Used for:

• Instant merchant settlements

• Payroll

• Fiat on/off ramps

• Access to banking APIs

Stronghold bridges the gap between regulated finance and blockchain — and it runs on Stellar.

@strongholdpay is Stellar’s infrastructure powerhouse in the U.S.

Used for:

• Instant merchant settlements

• Payroll

• Fiat on/off ramps

• Access to banking APIs

Stronghold bridges the gap between regulated finance and blockchain — and it runs on Stellar.

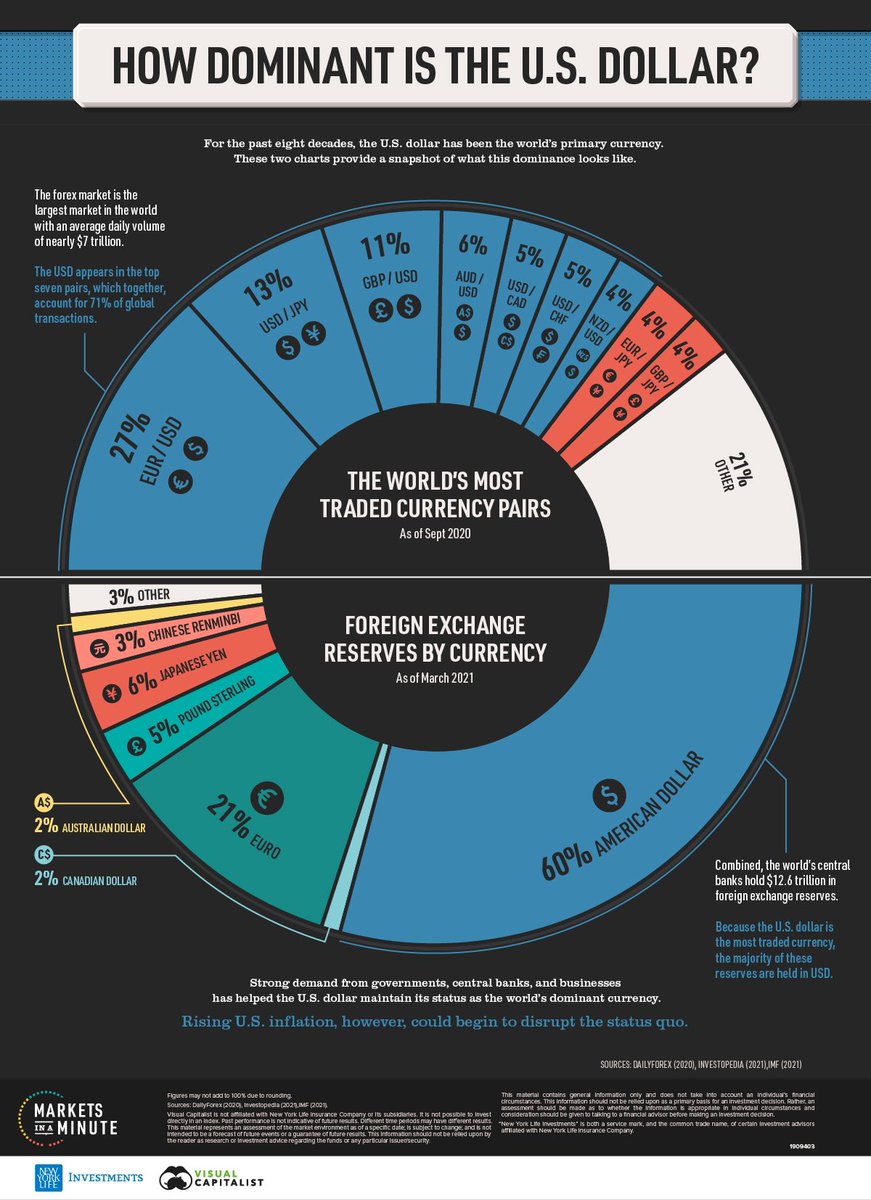

(7/🧵) USDC on Stellar

Stellar supports full native USDC, offering fast, low-cost, and scalable stablecoin transfers.

Used in:

• Fintech apps

• Humanitarian aid

• Global remittances

Stellar is building tools that quietly work everywhere.

Stellar supports full native USDC, offering fast, low-cost, and scalable stablecoin transfers.

Used in:

• Fintech apps

• Humanitarian aid

• Global remittances

Stellar is building tools that quietly work everywhere.

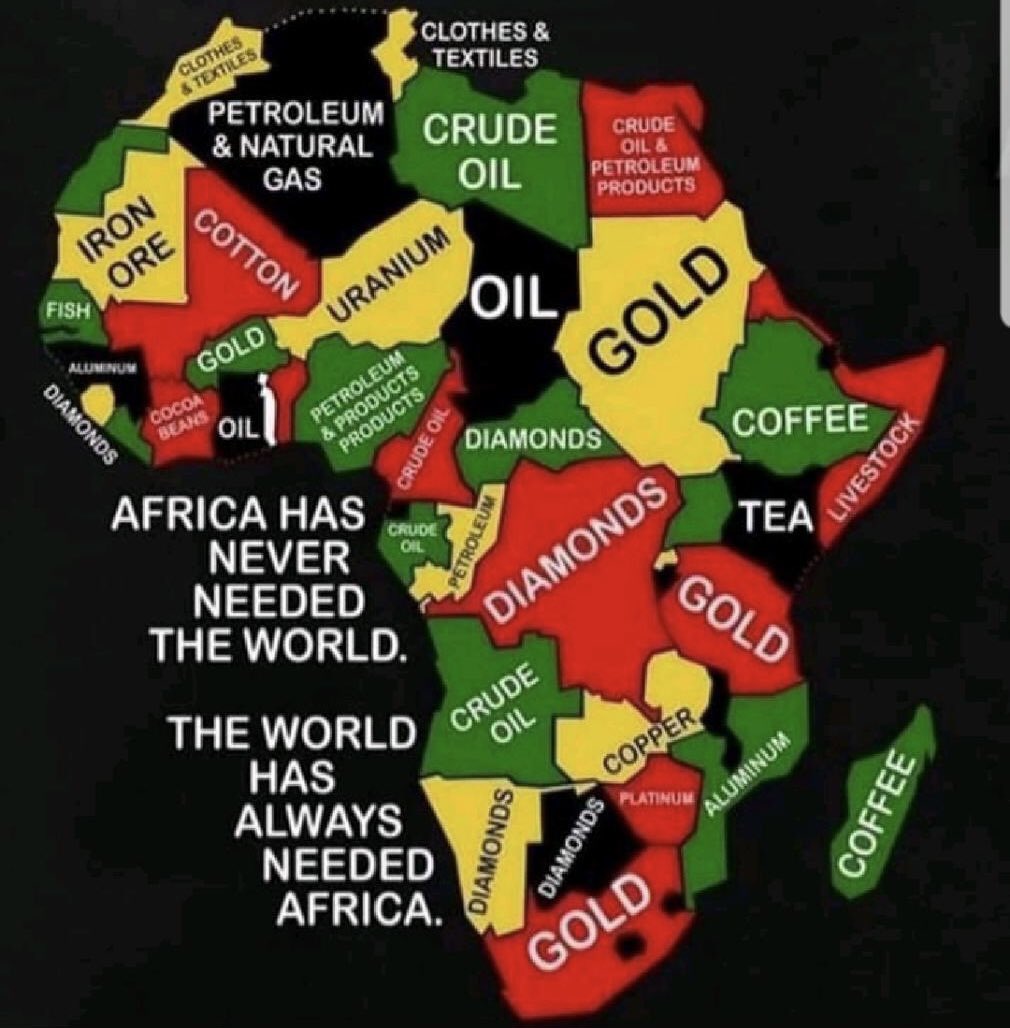

(8/🧵) Cowrie Exchange (Nigeria)

In Africa, @sdfwestafrica powers local fintechs like Cowrie to deliver low-cost remittances, payments, and mobile money services — especially in unbanked regions.

In Africa, @sdfwestafrica powers local fintechs like Cowrie to deliver low-cost remittances, payments, and mobile money services — especially in unbanked regions.

(9/🧵) Don’t sleep on Stellar.

It was never meant to go viral.

It was meant to become invisible infrastructure.

Stellar - This ecosystem isn’t waiting for the future.

It’s already plugged in.

It was never meant to go viral.

It was meant to become invisible infrastructure.

Stellar - This ecosystem isn’t waiting for the future.

It’s already plugged in.

(10/10) On Telegram, I will dive into Ripple & Stellar’s global takeover — and the unknown tokens on these chains that are quietly changing the world.

Join the insiders👇

t.me/ripplercult

Join the insiders👇

t.me/ripplercult

• • •

Missing some Tweet in this thread? You can try to

force a refresh