How do you monopolize any industry?

According to Mukesh Ambani, Asia's richest man, you give away $25 billion.

His competitors laughed... Until he bankrupted 11 companies, created $100 billion & disrupted India's economy.

This is history's most ruthless takeover: 🧵

According to Mukesh Ambani, Asia's richest man, you give away $25 billion.

His competitors laughed... Until he bankrupted 11 companies, created $100 billion & disrupted India's economy.

This is history's most ruthless takeover: 🧵

In 2016, India's telecom was controlled by Airtel, Vodafone, and Idea with 70% market share.

Data prices were among the world's highest at $3-5 per GB.

Millions of Indians couldn't afford internet access. But everything was about to change...

Data prices were among the world's highest at $3-5 per GB.

Millions of Indians couldn't afford internet access. But everything was about to change...

Enter Mukesh Ambani, worth $92 billion and head of Reliance Industries—a conglomerate controlling 10% of India's GDP.

He'd already conquered oil, retail, and petrochemicals.

Telecom would be his most brilliant move yet. And his plan was already in motion.

He'd already conquered oil, retail, and petrochemicals.

Telecom would be his most brilliant move yet. And his plan was already in motion.

Ambani quietly built Jio, India's first 4G-only network, investing $35 billion.

While rivals struggled with 3G, Jio covered 18,000 cities and 200,000 villages.

But great infrastructure wasn't enough—he needed mass adoption.

That's when he made his shocking move...

While rivals struggled with 3G, Jio covered 18,000 cities and 200,000 villages.

But great infrastructure wasn't enough—he needed mass adoption.

That's when he made his shocking move...

His unprecedented strategy:

ALL Jio services FREE for 6 months.

• FREE calls

• FREE texts

• FREE unlimited 4G data

"He's committing financial suicide," competitors said. They had no idea what was coming.

ALL Jio services FREE for 6 months.

• FREE calls

• FREE texts

• FREE unlimited 4G data

"He's committing financial suicide," competitors said. They had no idea what was coming.

The results were explosive:

• 16M users in month one

• 50M by month three

• 100M+ by month six

This wasn't customer acquisition—it was invasion. And the competitors could only watch in horror.

• 16M users in month one

• 50M by month three

• 100M+ by month six

This wasn't customer acquisition—it was invasion. And the competitors could only watch in horror.

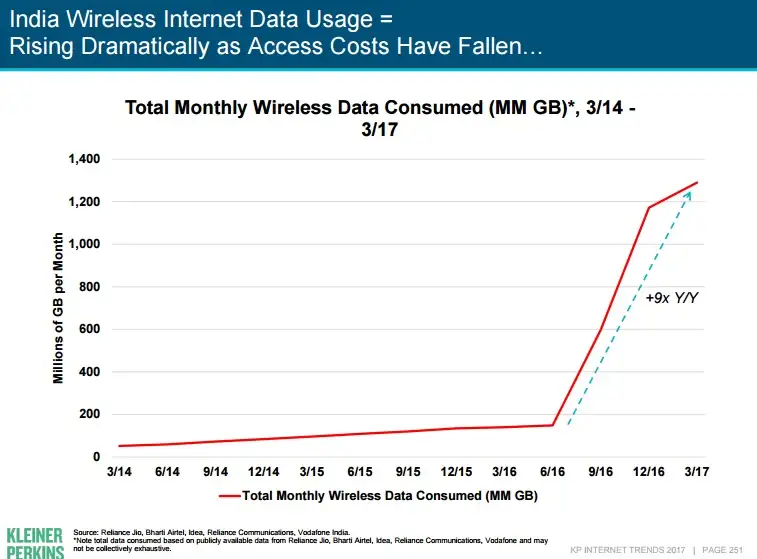

Ambani wasn't just giving away services—he was changing behavior.

Millions who never used data before were streaming videos and making video calls.

Once they got a taste, they couldn't go back. And that's exactly what he was counting on.

Millions who never used data before were streaming videos and making video calls.

Once they got a taste, they couldn't go back. And that's exactly what he was counting on.

Established telecoms panicked, slashing prices by 80%.

But it was too late. Ambani had bled them of $25B in market value.

Smaller carriers began collapsing.

The massacre had only just begun...

But it was too late. Ambani had bled them of $25B in market value.

Smaller carriers began collapsing.

The massacre had only just begun...

After six months, Jio started charging—but at just $0.15/GB, 95% cheaper than before.

Even at rock-bottom prices, Jio was profitable thanks to its superior infrastructure.

The competition was trapped in a game they couldn't possibly win.

Even at rock-bottom prices, Jio was profitable thanks to its superior infrastructure.

The competition was trapped in a game they couldn't possibly win.

The brutal aftermath:

• Vodafone-Idea forced to merge

• Airtel's first loss in 15 years

• 11 operators reduced to 4

• 150,000 industry jobs lost

Not just disruption. Decimation. But for consumers? The story was very different.

• Vodafone-Idea forced to merge

• Airtel's first loss in 15 years

• 11 operators reduced to 4

• 150,000 industry jobs lost

Not just disruption. Decimation. But for consumers? The story was very different.

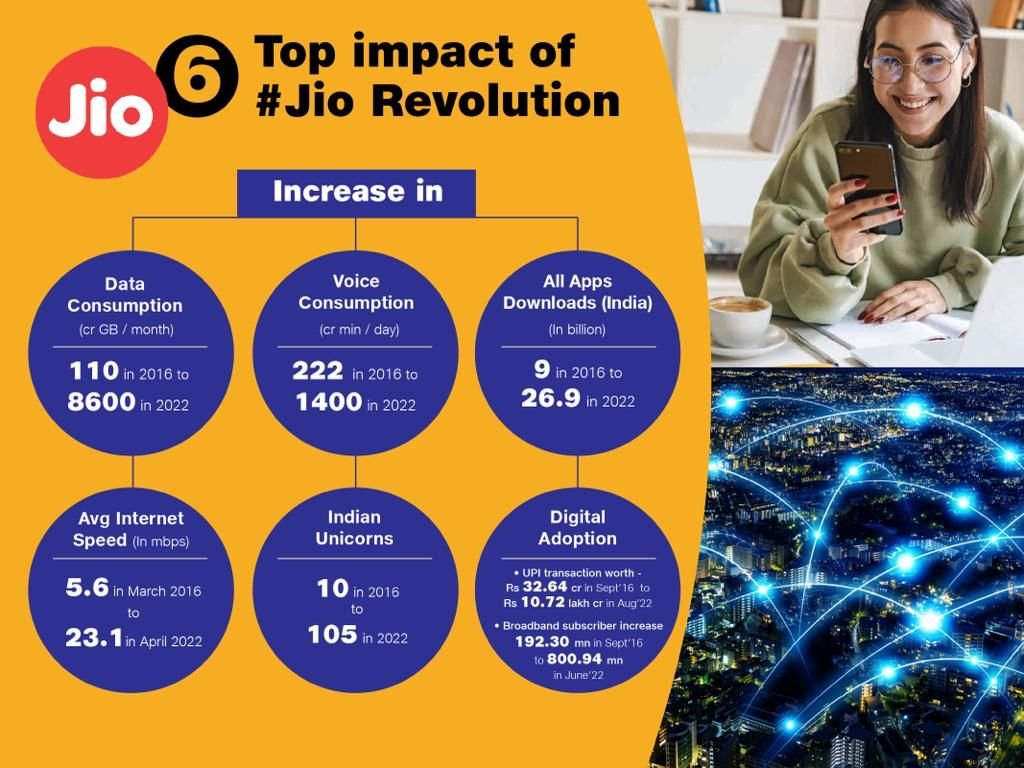

For India's people, it sparked revolution:

• Data use jumped 50x to 10GB/month

• Internet penetration leaped from 27% to 47%

• India went from most expensive to cheapest data globally

Yet Ambani's master plan was only half complete...

• Data use jumped 50x to 10GB/month

• Internet penetration leaped from 27% to 47%

• India went from most expensive to cheapest data globally

Yet Ambani's master plan was only half complete...

Ambani's genius wasn't just market share—it was creating a digital ecosystem.

With 400M+ subscribers, Jio expanded to:

• E-commerce

• Broadband

• Fintech

• Video conferencing

The $25B "giveaway" was just the opening move in a much larger game.

With 400M+ subscribers, Jio expanded to:

• E-commerce

• Broadband

• Fintech

• Video conferencing

The $25B "giveaway" was just the opening move in a much larger game.

The $25B gamble created a $70B telecom giant.

In 2020, tech giants invested:

• Google: $4.5B

• Facebook: $5.7B

• Intel and Qualcomm followed

What looked like madness to his rivals had become the deal of the century.

In 2020, tech giants invested:

• Google: $4.5B

• Facebook: $5.7B

• Intel and Qualcomm followed

What looked like madness to his rivals had become the deal of the century.

Today, Jio is worth $100B+ with 40% market share.

What looked like "financial suicide" became history's most brilliant market takeover.

India's digital economy exploded to $200B.

Millions of businesses went online, digital payments soared to 8.3B transactions monthly.

What looked like "financial suicide" became history's most brilliant market takeover.

India's digital economy exploded to $200B.

Millions of businesses went online, digital payments soared to 8.3B transactions monthly.

Ambani saw what others missed:

In the digital age, telecommunications isn't just a service—it's the foundation of EVERYTHING.

By making it nearly free, he put his company at the center of India's digital future.

The question is: what industry will be transformed next?

In the digital age, telecommunications isn't just a service—it's the foundation of EVERYTHING.

By making it nearly free, he put his company at the center of India's digital future.

The question is: what industry will be transformed next?

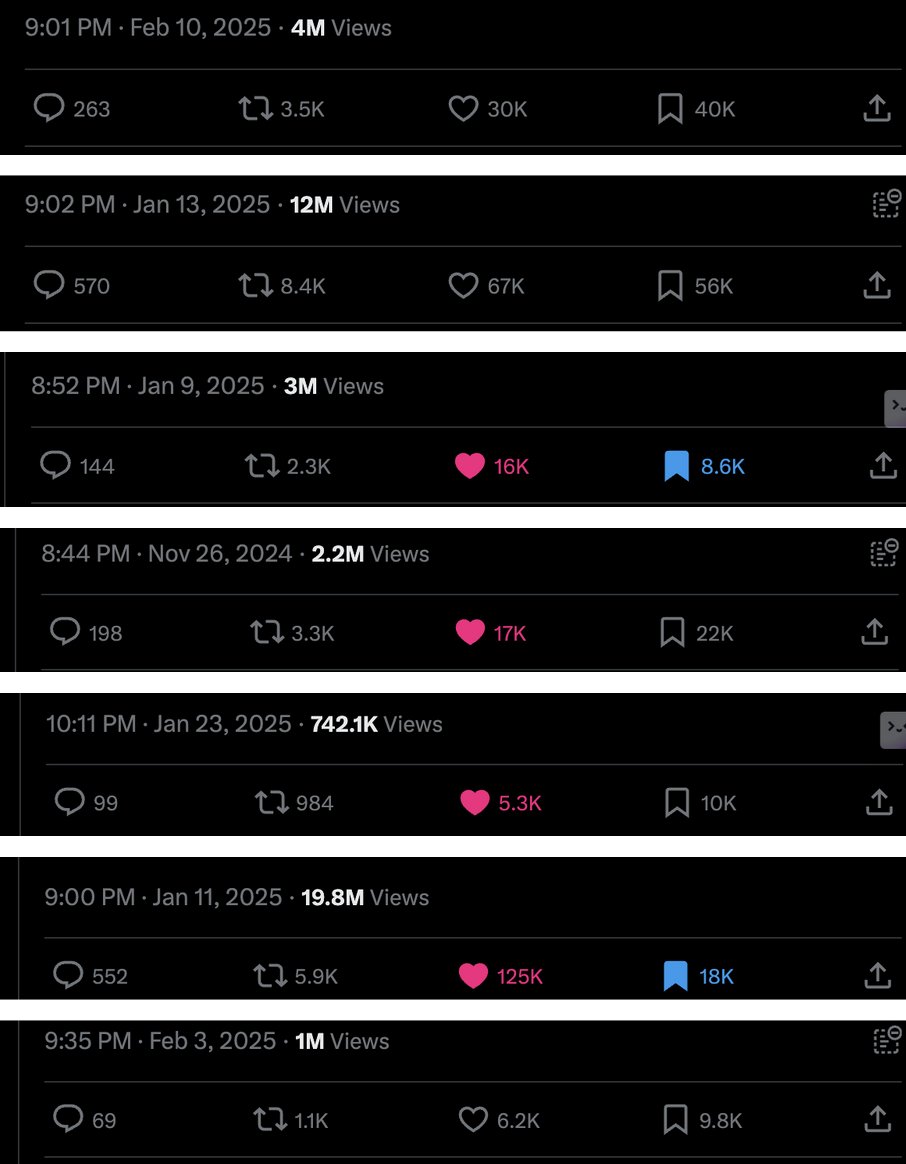

If you liked this thread, join my mission:

"School never taught you how to build wealth.

I uncover hidden wisdom in psychology and game theory for those building wealth and freedom.

Follow @GeniusBusiness_

"School never taught you how to build wealth.

I uncover hidden wisdom in psychology and game theory for those building wealth and freedom.

Follow @GeniusBusiness_

If you're a business owner or creator looking for promotion or ghostwriting partnership with a premium network of accounts, DM me "partner" to learn more.

Ok since we didn't go as deep into Mukesh Ambani's actual strategy, here's a short TLDR on other factors playing into his domination:

The Jio disruption was backed by a perfect storm of advantages:

- Government relationships: Ambani's close ties with PM Modi's administration created a favorable regulatory environment. The timing coincided with Modi's Digital India initiative, which helped Jio secure spectrum and approvals at unprecedented speed.

- Banking support: As part of Reliance Industries (which represented ~7% of BSE market cap), Jio had access to enormous financing from India's banking sector at preferential rates - something competitors couldn't match.

- Cross-subsidization: Reliance's oil and retail businesses generated massive cash flows that subsidized Jio's initial losses - allowing it to sustain the "free" strategy while competitors had to remain profitable.

- Demonetization timing: India's 2016 demonetization (when 86% of currency was suddenly invalidated) pushed millions toward digital payments precisely when Jio was offering free internet - creating a perfect user acquisition environment.

- Vertical integration: Reliance built its own fiber network, data centers, and app ecosystem rather than leasing infrastructure like competitors - giving it a sustainable cost advantage.

These advantages created an uneven playing field that competitors couldn't hope to match, regardless of their strategies.

The Jio disruption was backed by a perfect storm of advantages:

- Government relationships: Ambani's close ties with PM Modi's administration created a favorable regulatory environment. The timing coincided with Modi's Digital India initiative, which helped Jio secure spectrum and approvals at unprecedented speed.

- Banking support: As part of Reliance Industries (which represented ~7% of BSE market cap), Jio had access to enormous financing from India's banking sector at preferential rates - something competitors couldn't match.

- Cross-subsidization: Reliance's oil and retail businesses generated massive cash flows that subsidized Jio's initial losses - allowing it to sustain the "free" strategy while competitors had to remain profitable.

- Demonetization timing: India's 2016 demonetization (when 86% of currency was suddenly invalidated) pushed millions toward digital payments precisely when Jio was offering free internet - creating a perfect user acquisition environment.

- Vertical integration: Reliance built its own fiber network, data centers, and app ecosystem rather than leasing infrastructure like competitors - giving it a sustainable cost advantage.

These advantages created an uneven playing field that competitors couldn't hope to match, regardless of their strategies.

• • •

Missing some Tweet in this thread? You can try to

force a refresh