Smitty's Bitcoin Retirement Guide: e-Book Edition 📙

*Only here on X*

The wait is finally over - you're going to want to bookmark this.

- - -

🧵Thread👇

Without detailing the exact instructions on how to use the guide, this time around, I will explain the important changes - and from there, please engage, share, and enjoy!

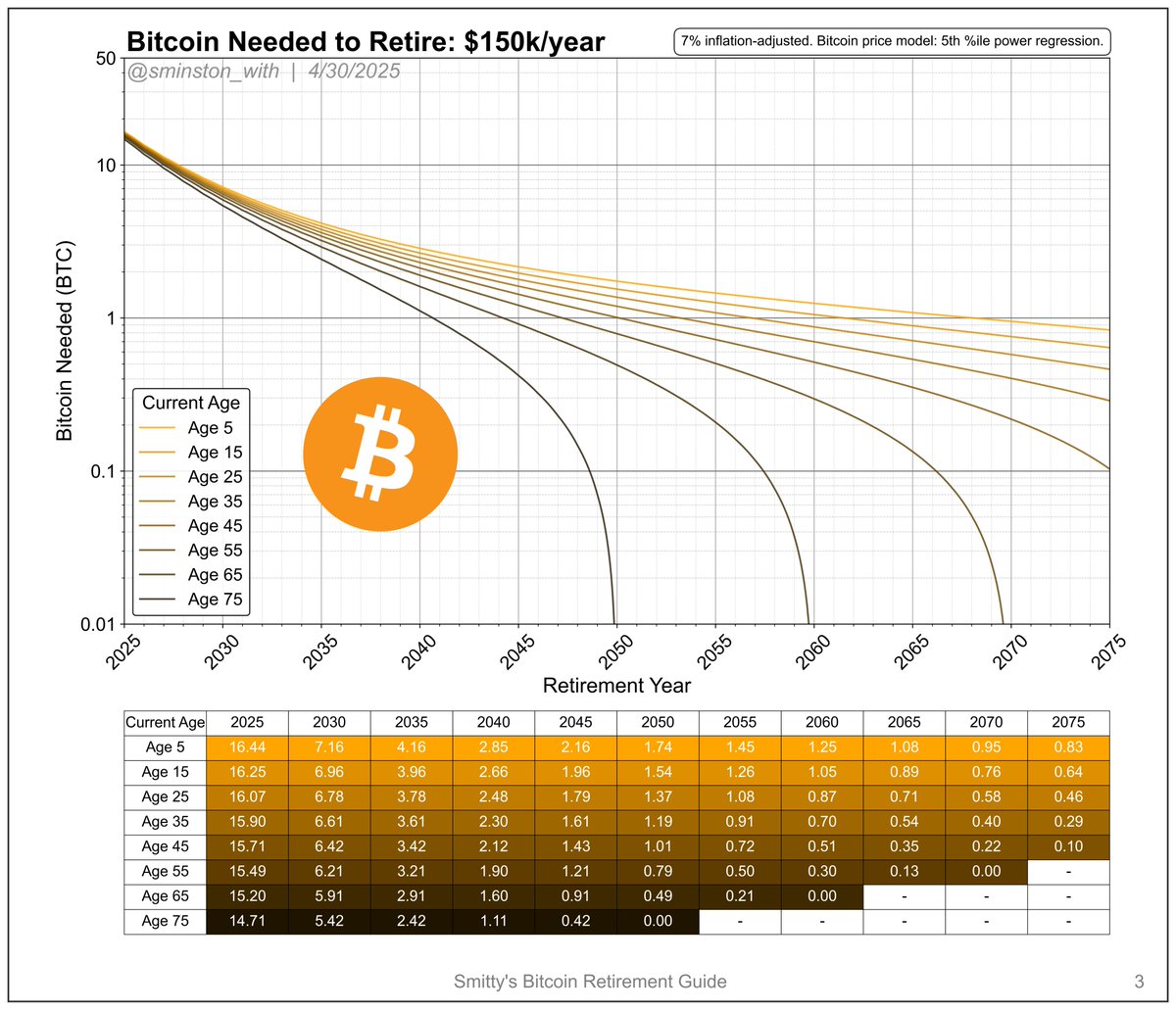

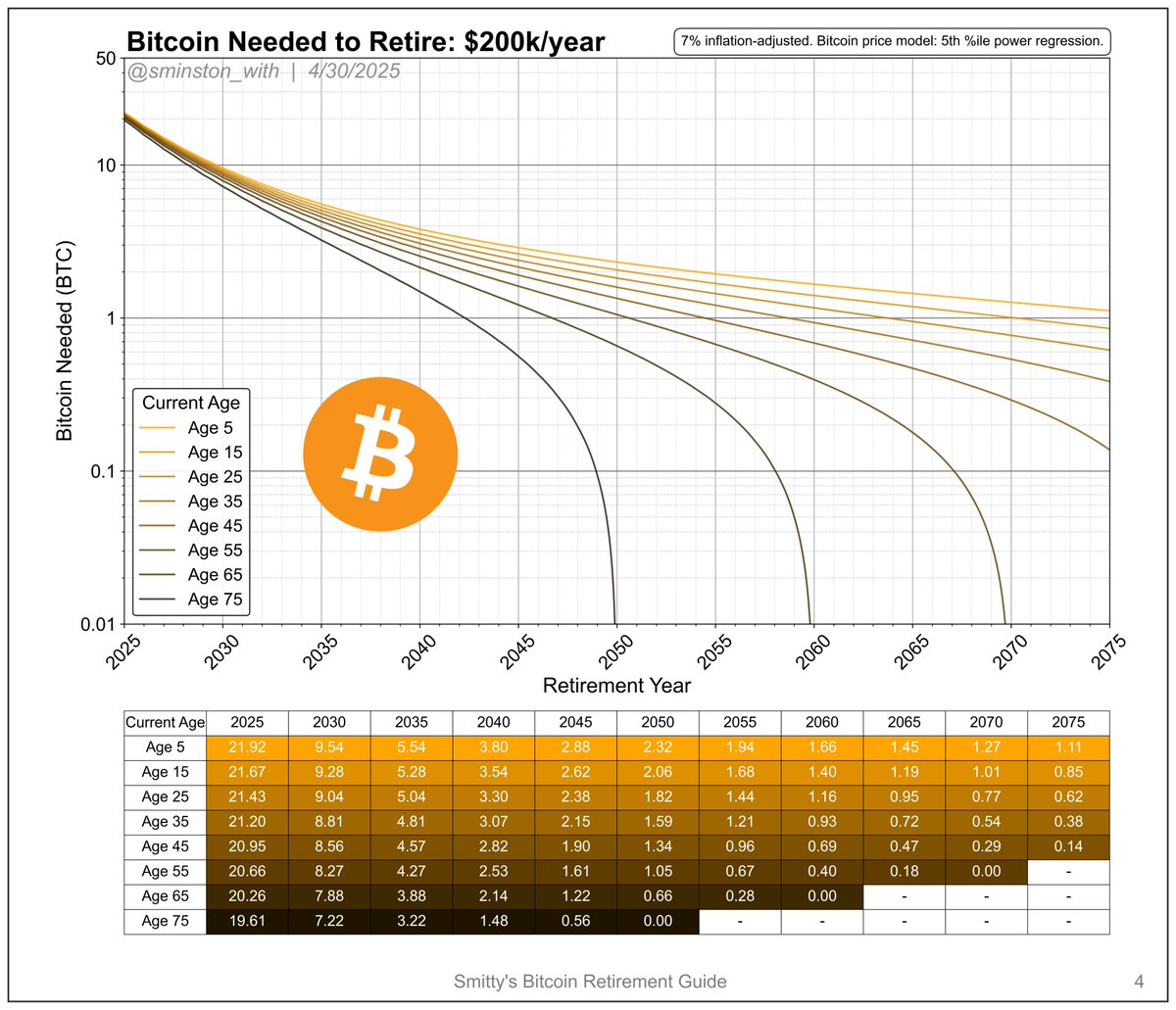

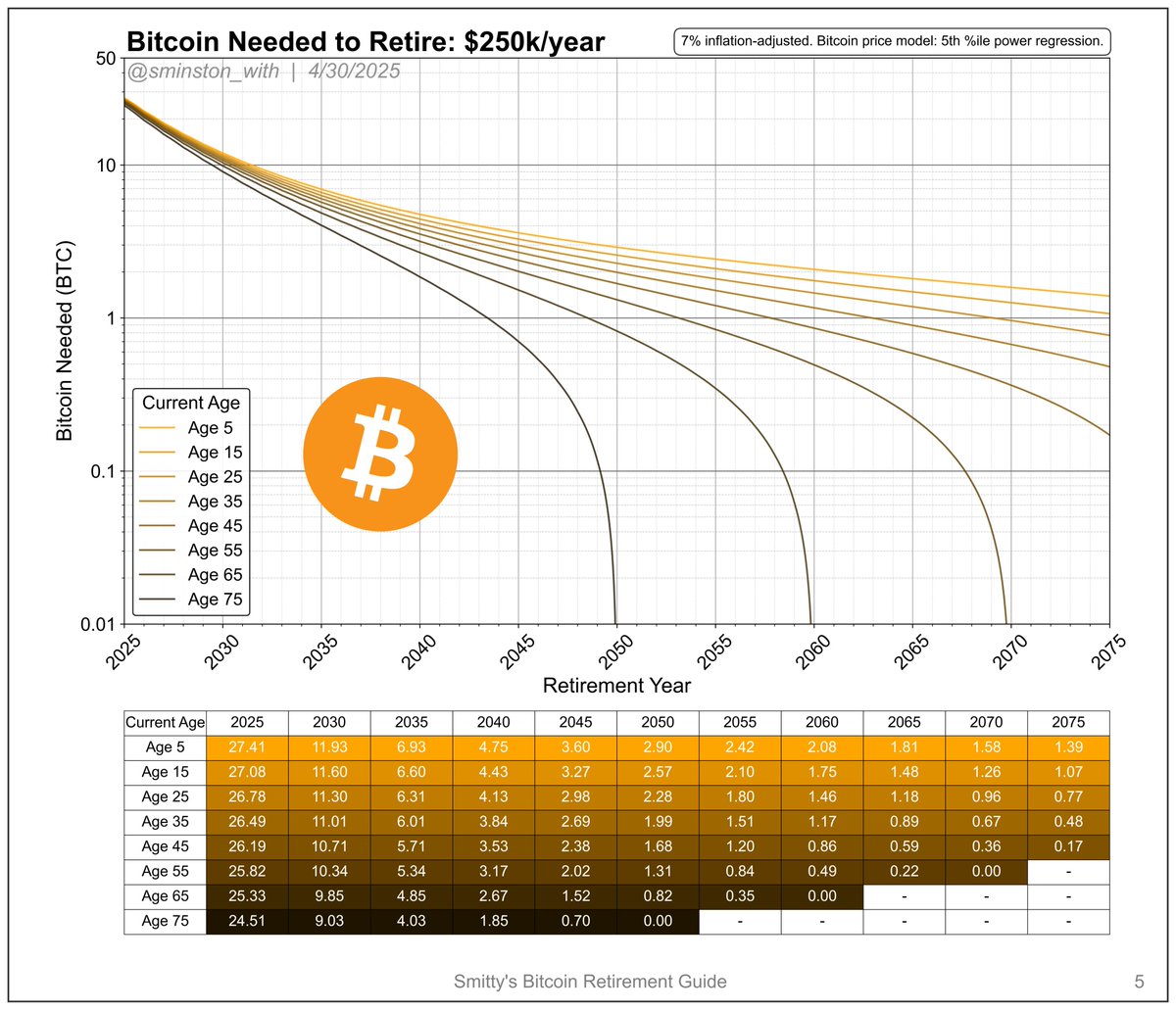

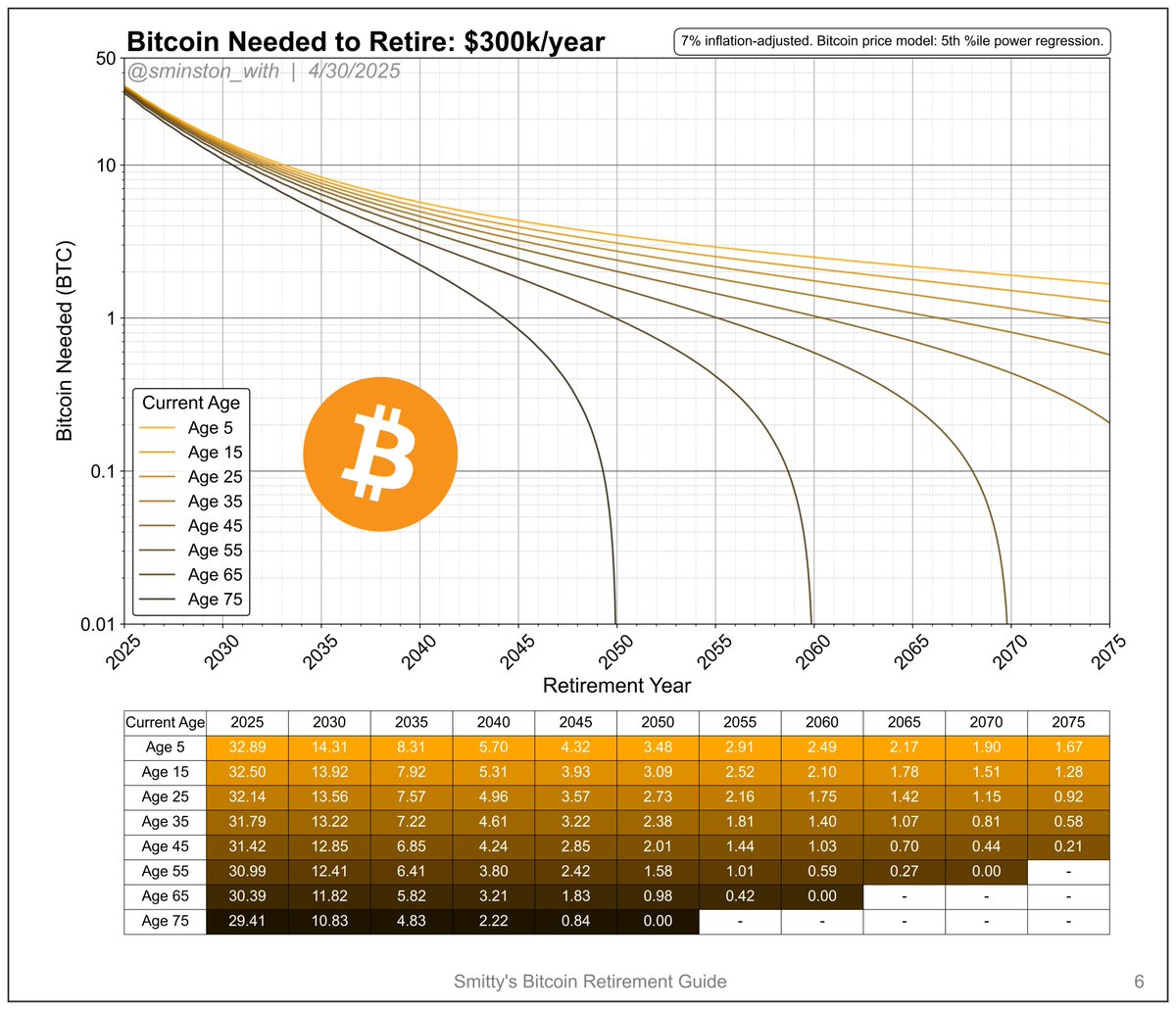

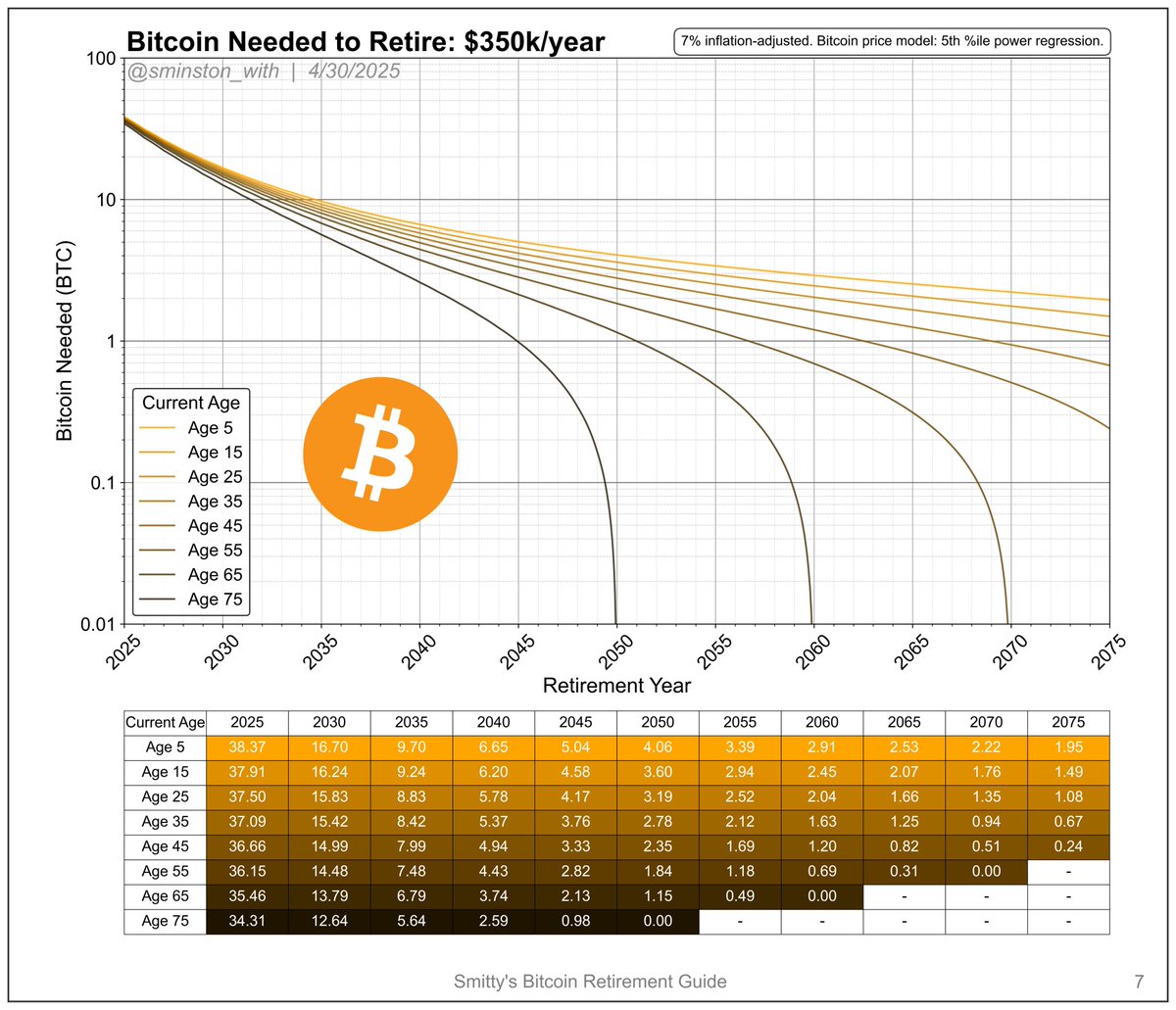

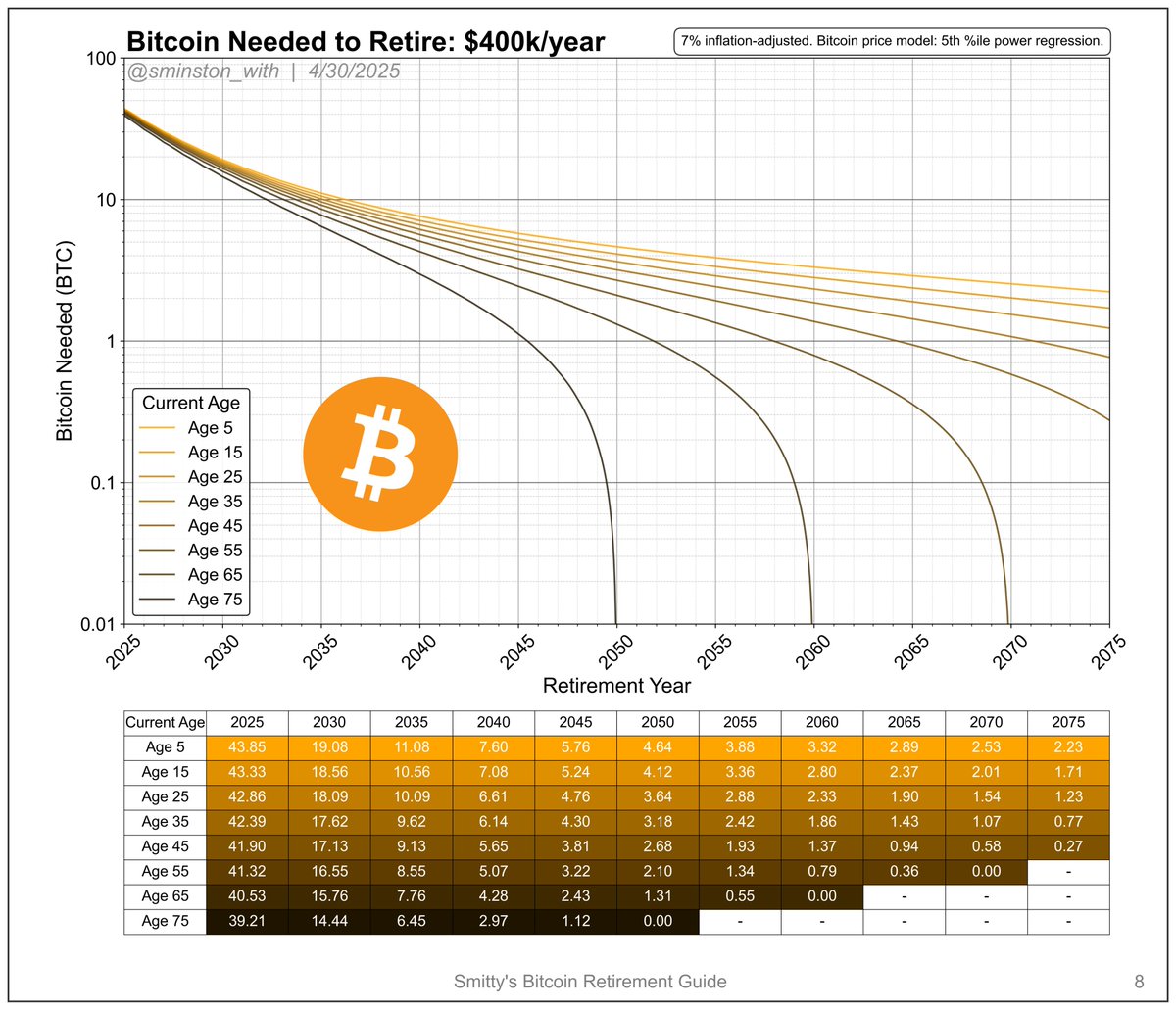

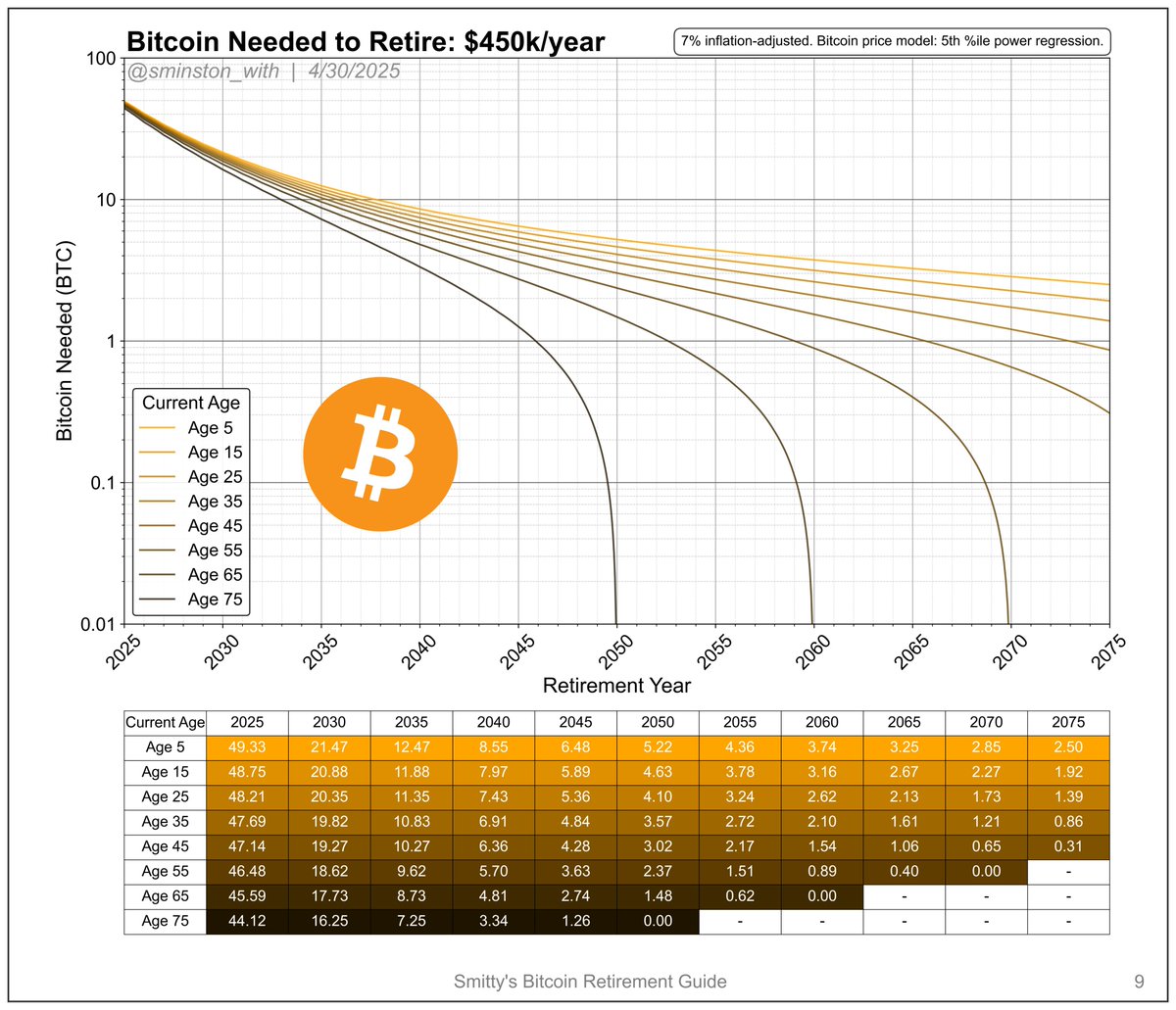

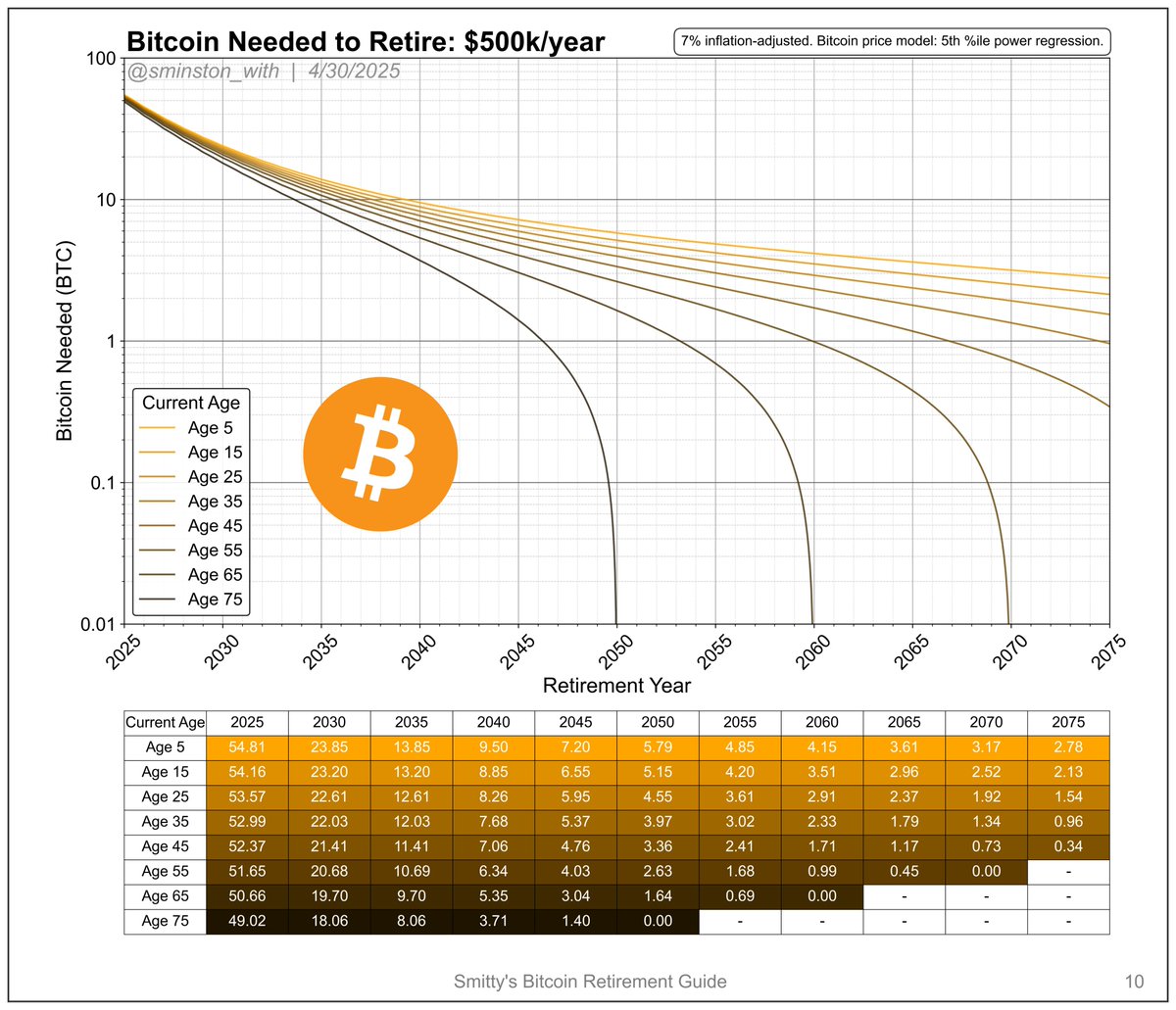

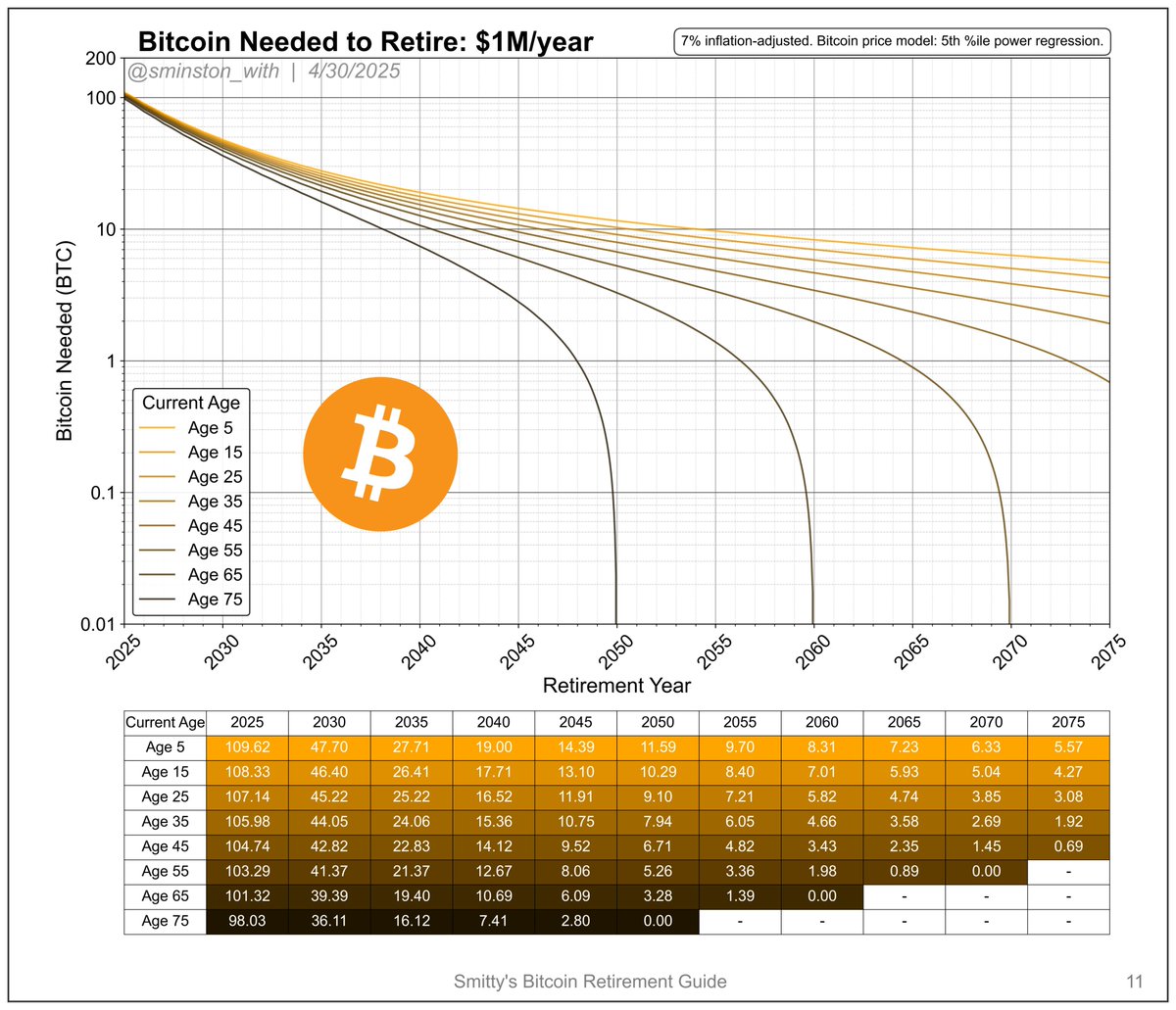

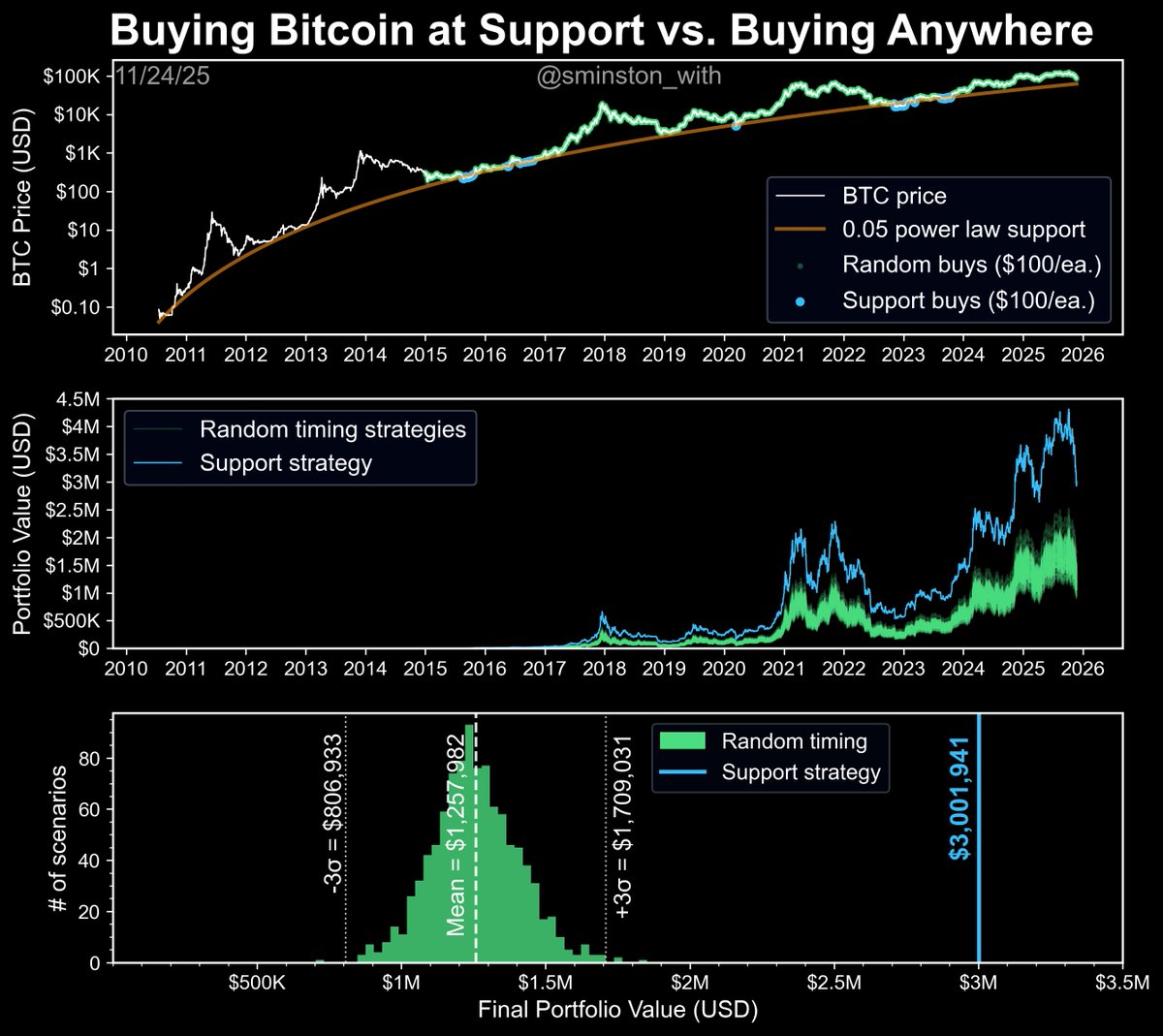

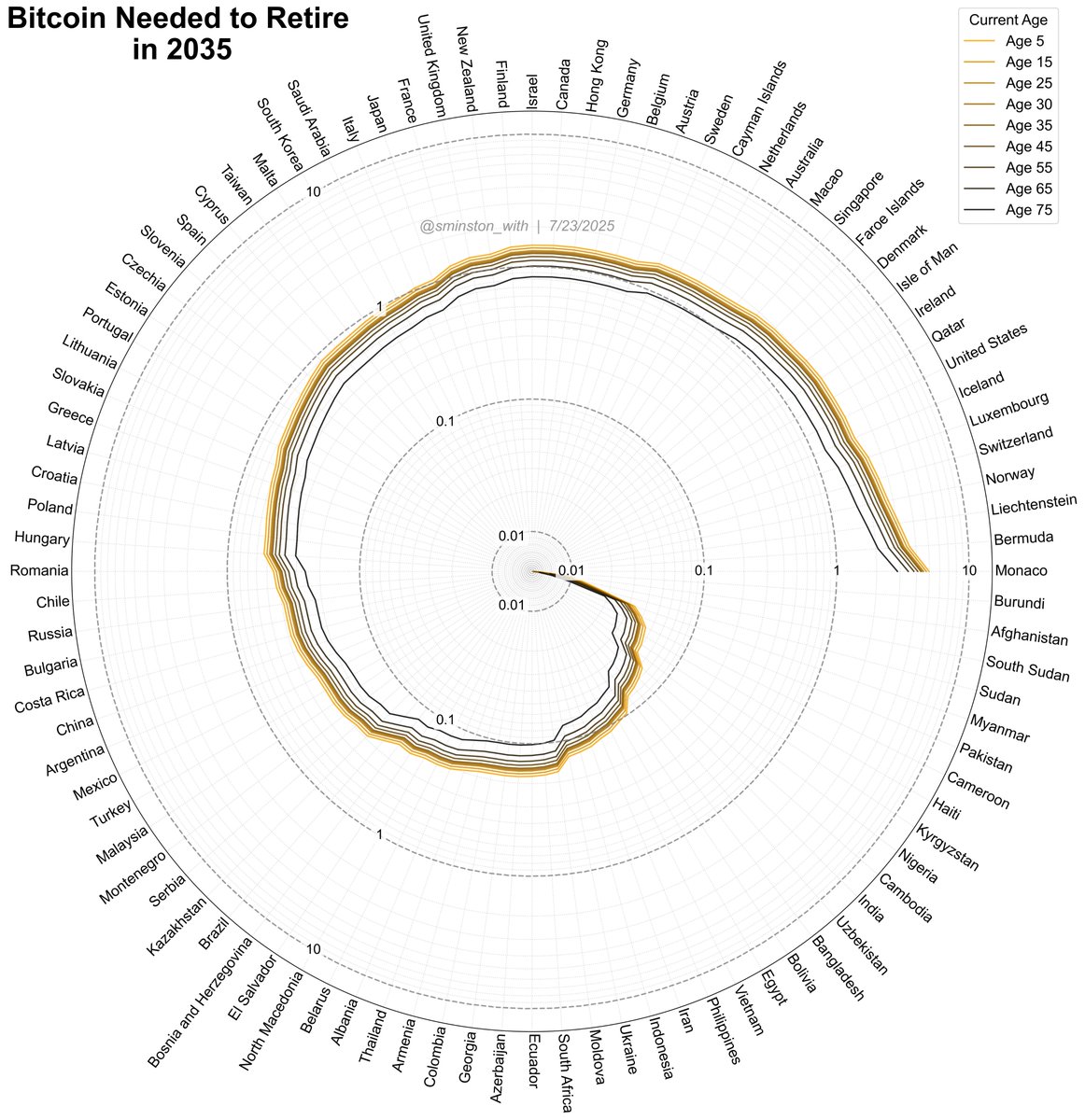

1) Updated Model: This is a critical solution, and I'll explain why. Rather than using the median (50th quantile) power regression model, as was used in previous versions, Smitty's e-Book uses the 5th quantile. Why? Statistically, theoretically, this ensures that 95% of the time the desired annual withdrawal rate (living/spending costs) will not need to be down-adjusted due to volatility - because by definition, only 5% of the price falls below this 'support' line (see my other models). Therefore, you should only expect to need to down-adjust roughly once in 20 years. This makes this e-Book version more conservative, while maintaining realism and (clearly) attainability of stacking targets (see the various pages).

2) e-Book Format: I'm only posting these to X for now; but since in the past there has been so much positive engagement, I wanted to keep the overall 'brand' while enhancing the stylings so that it feels like an easy mini reader for folks comparing spending/stacking scenarios for retirement. It is also high DPI, now with nice borders, headers/footers and even page numbers. Feel free to print out and make a physical copy, or choose your favorite scenario, laminate and post on the wall.

3) Table addition: I've been meaning to include this change for a while. Not all of us are graphic/visually inclined, and indeed many of us are table/spreadsheet inclined. Therefore, below the graphs, I added easy-to-read look-up tables which exactly map to the Retirement Years and Current Age from the graphs, along with exact color-matching according to Current Age. No more needing to follow lines and line intersections; should also help for the visually impaired.

- - -

As always, the key assumptions in the guide to remember:

1*Assumed 7% annual inflation rate going forward (not easy to predict but historical expansion has been pretty close to this).

2*Taxes not accounted for - tax policy is too variable and too liable to change in any given year - please do your own homework for your own situation.

3*You're living to 100 (or at least planning your conservative BTC spend-down plan out to that age).

- - -

So, as always, flip through the replies in this thread, and enjoy the new tool!

"Helping you develop a better Bitcoin stacking target for life planning." - Sminston With

#notfinancialadvice

*Only here on X*

The wait is finally over - you're going to want to bookmark this.

- - -

🧵Thread👇

Without detailing the exact instructions on how to use the guide, this time around, I will explain the important changes - and from there, please engage, share, and enjoy!

1) Updated Model: This is a critical solution, and I'll explain why. Rather than using the median (50th quantile) power regression model, as was used in previous versions, Smitty's e-Book uses the 5th quantile. Why? Statistically, theoretically, this ensures that 95% of the time the desired annual withdrawal rate (living/spending costs) will not need to be down-adjusted due to volatility - because by definition, only 5% of the price falls below this 'support' line (see my other models). Therefore, you should only expect to need to down-adjust roughly once in 20 years. This makes this e-Book version more conservative, while maintaining realism and (clearly) attainability of stacking targets (see the various pages).

2) e-Book Format: I'm only posting these to X for now; but since in the past there has been so much positive engagement, I wanted to keep the overall 'brand' while enhancing the stylings so that it feels like an easy mini reader for folks comparing spending/stacking scenarios for retirement. It is also high DPI, now with nice borders, headers/footers and even page numbers. Feel free to print out and make a physical copy, or choose your favorite scenario, laminate and post on the wall.

3) Table addition: I've been meaning to include this change for a while. Not all of us are graphic/visually inclined, and indeed many of us are table/spreadsheet inclined. Therefore, below the graphs, I added easy-to-read look-up tables which exactly map to the Retirement Years and Current Age from the graphs, along with exact color-matching according to Current Age. No more needing to follow lines and line intersections; should also help for the visually impaired.

- - -

As always, the key assumptions in the guide to remember:

1*Assumed 7% annual inflation rate going forward (not easy to predict but historical expansion has been pretty close to this).

2*Taxes not accounted for - tax policy is too variable and too liable to change in any given year - please do your own homework for your own situation.

3*You're living to 100 (or at least planning your conservative BTC spend-down plan out to that age).

- - -

So, as always, flip through the replies in this thread, and enjoy the new tool!

"Helping you develop a better Bitcoin stacking target for life planning." - Sminston With

#notfinancialadvice

• • •

Missing some Tweet in this thread? You can try to

force a refresh