I don't think people understand what's happening in housing market right now.

Florida now has 177,00 listings. Highest level on record.

Entire Northeast U.S. has 79,000 listings. Lowest level on record.

People are leaving Florida. And moving back north. A structural trend that will likely last years, and cause Florida's housing market to decline for an extended period.

Florida now has 177,00 listings. Highest level on record.

Entire Northeast U.S. has 79,000 listings. Lowest level on record.

People are leaving Florida. And moving back north. A structural trend that will likely last years, and cause Florida's housing market to decline for an extended period.

1) The entire housing market got this wrong. Builders, investors, and 2nd/3rd homebuyers flocked to Florida during pandemic thinking it was a stable, safe place to invest.

Where they actually should have been buying and building is the Northeast.

Where they actually should have been buying and building is the Northeast.

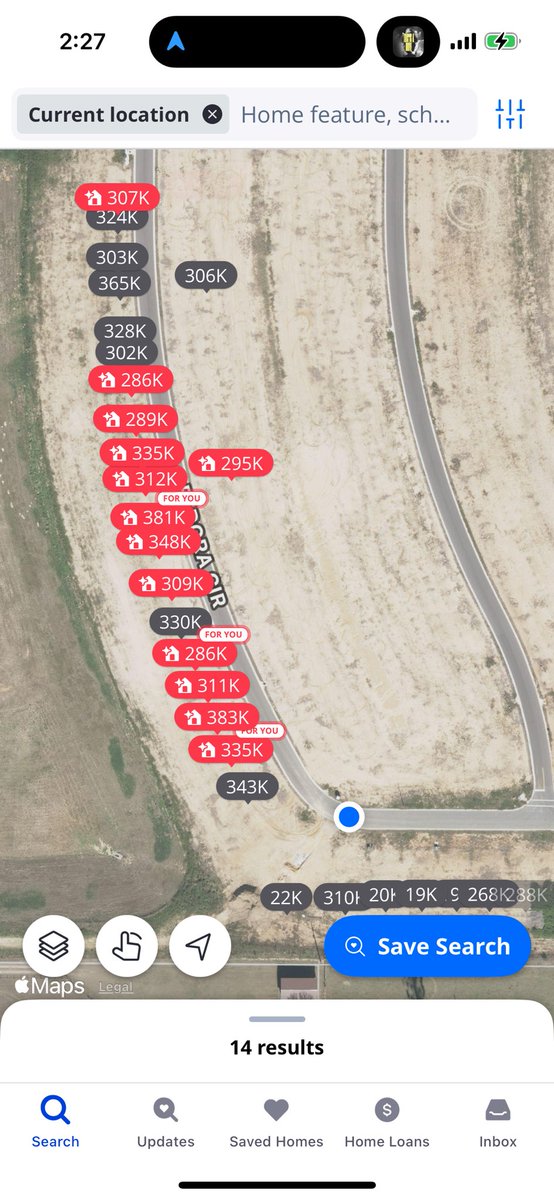

2) Now Florida's housing market is in a housing downturn. Prices are dropping all across the state, and will likely continue to drop for years due to an oversupply of housing combined with record lack of affordability.

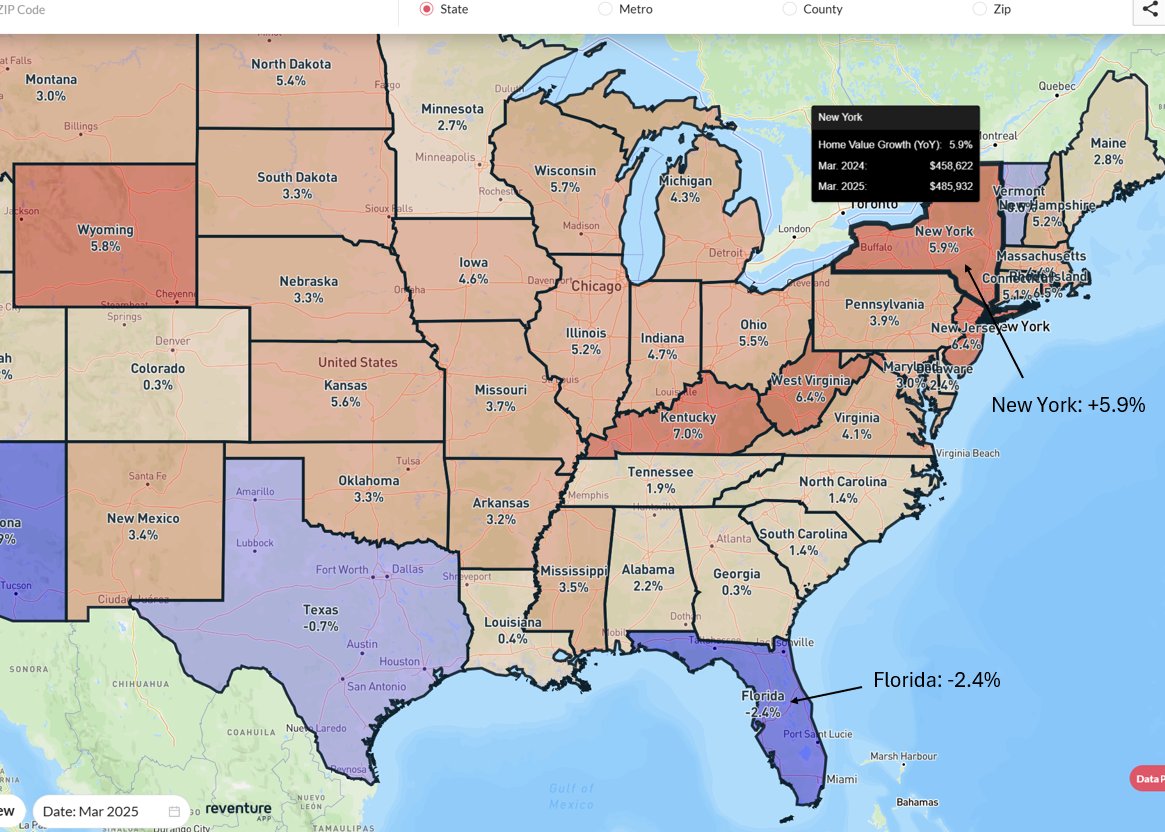

3) Meanwhile - home prices in the Northeast are going up, and will continue to go up, due to a shortage of housing.

For instance, in New York values are up +5.9% over the last year.

Meanwhile, Florida is down -2.4%.

For instance, in New York values are up +5.9% over the last year.

Meanwhile, Florida is down -2.4%.

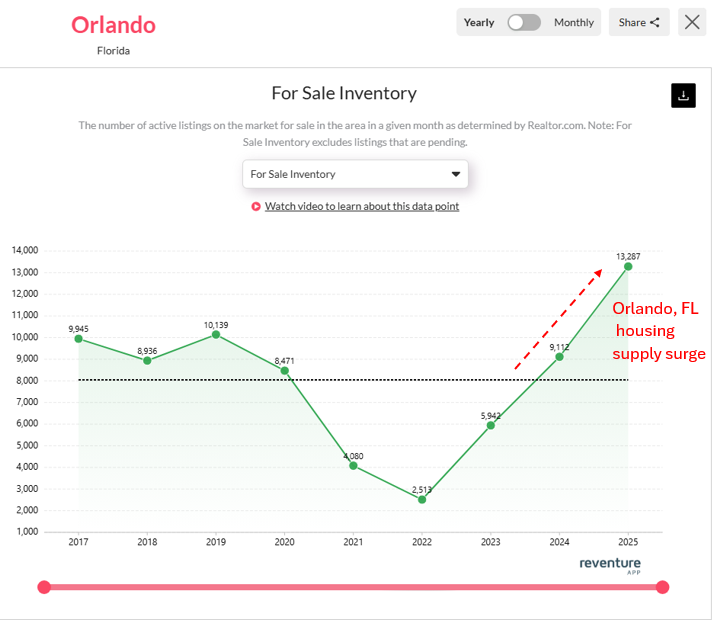

4) But this is just start of declines in Florida.

Inventory growth is showing no signs of slowing, and the structural reversal in migration will take years to normalize.

Inventory growth is showing no signs of slowing, and the structural reversal in migration will take years to normalize.

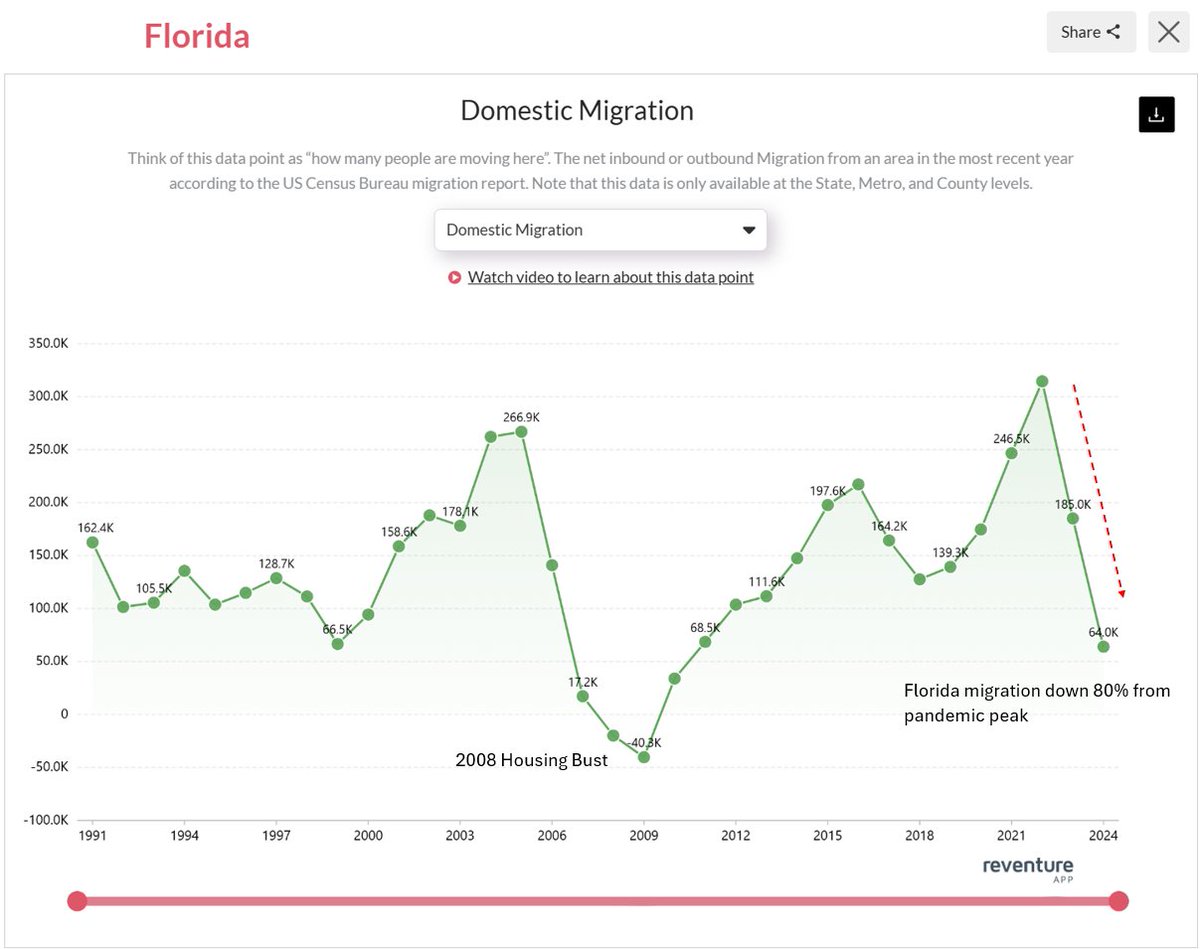

5) For instance, Florida's migration levels are down 80% from their pandemic peak.

In 2024, the state registered 64,000 net domestic migration.

Which was the 5th worst level on record.

In 2024, the state registered 64,000 net domestic migration.

Which was the 5th worst level on record.

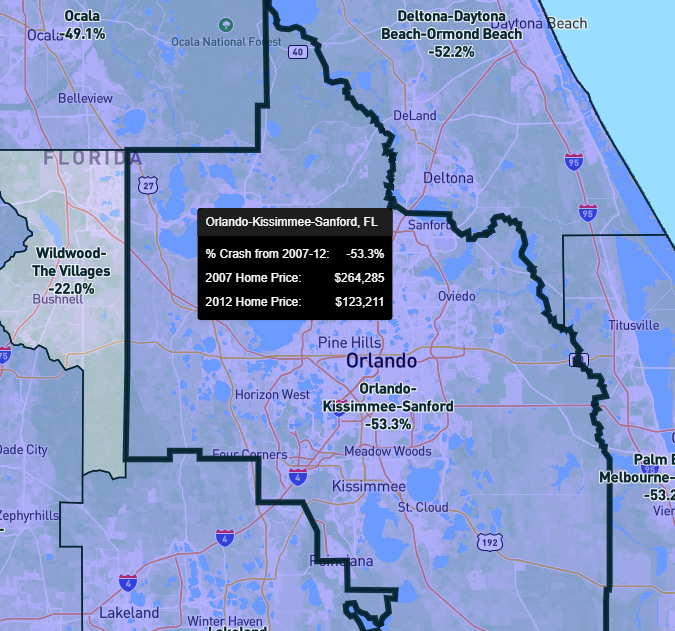

6) The last time something like this happened, it was the 2008 housing bust, and Florida went through a 5 year-period of reduced migration.

And when Florida goes through reduced migration, major problems crop up in the housing market. Because prices went up based on the influx of people previously moving in.

And when Florida goes through reduced migration, major problems crop up in the housing market. Because prices went up based on the influx of people previously moving in.

7) And I just think this is the big piece of the story people don't understand yet about Florida's housing market.

Everyone is blaming HOA fees, hurricanes, and insurance.

And many think this is just a "blip" that will soon subside.

Everyone is blaming HOA fees, hurricanes, and insurance.

And many think this is just a "blip" that will soon subside.

8) The true reality could be that Florida is now entering the downcycle of inbound migration, and that downcycle will last for years.

And the only thing that will fix this downcycle in migration, and entice more people to move back, is significantly cheaper prices.

And the only thing that will fix this downcycle in migration, and entice more people to move back, is significantly cheaper prices.

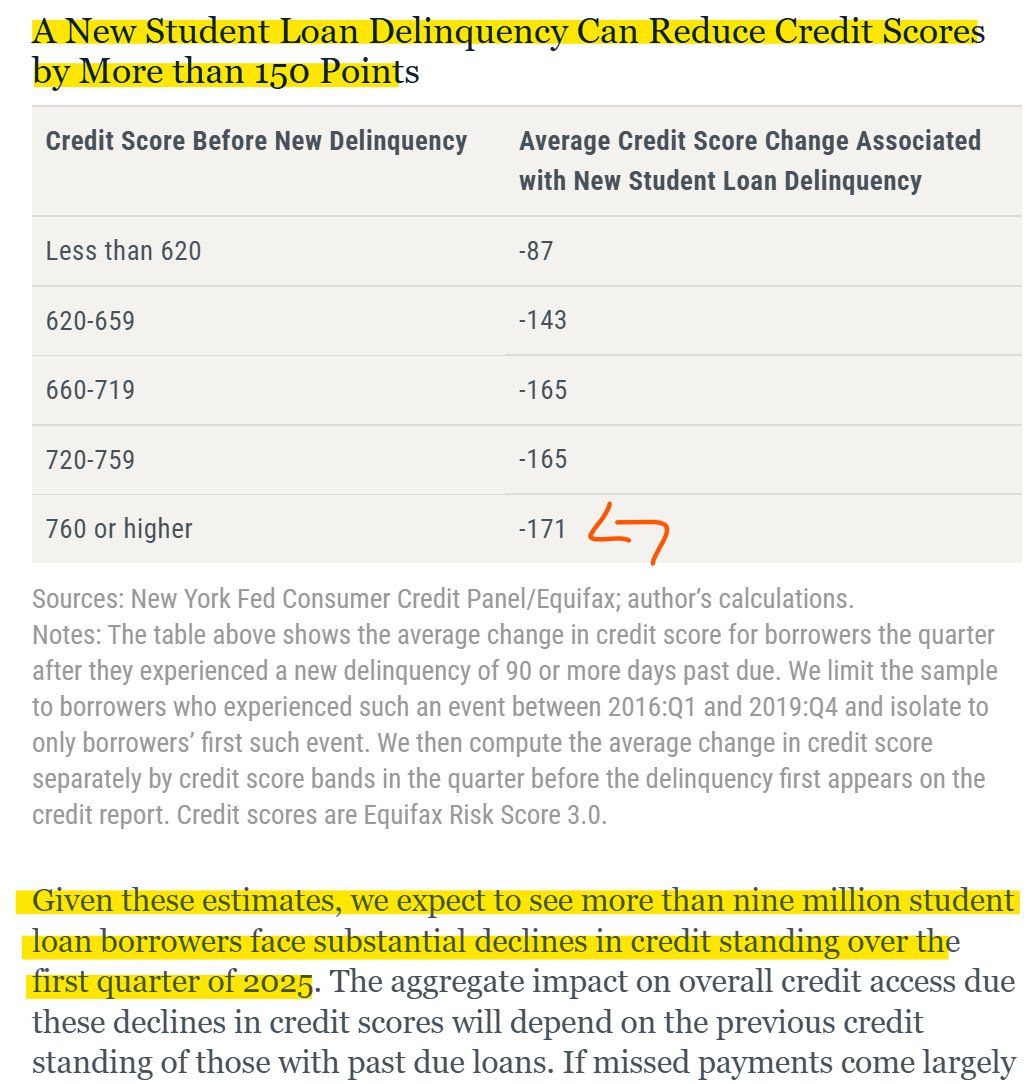

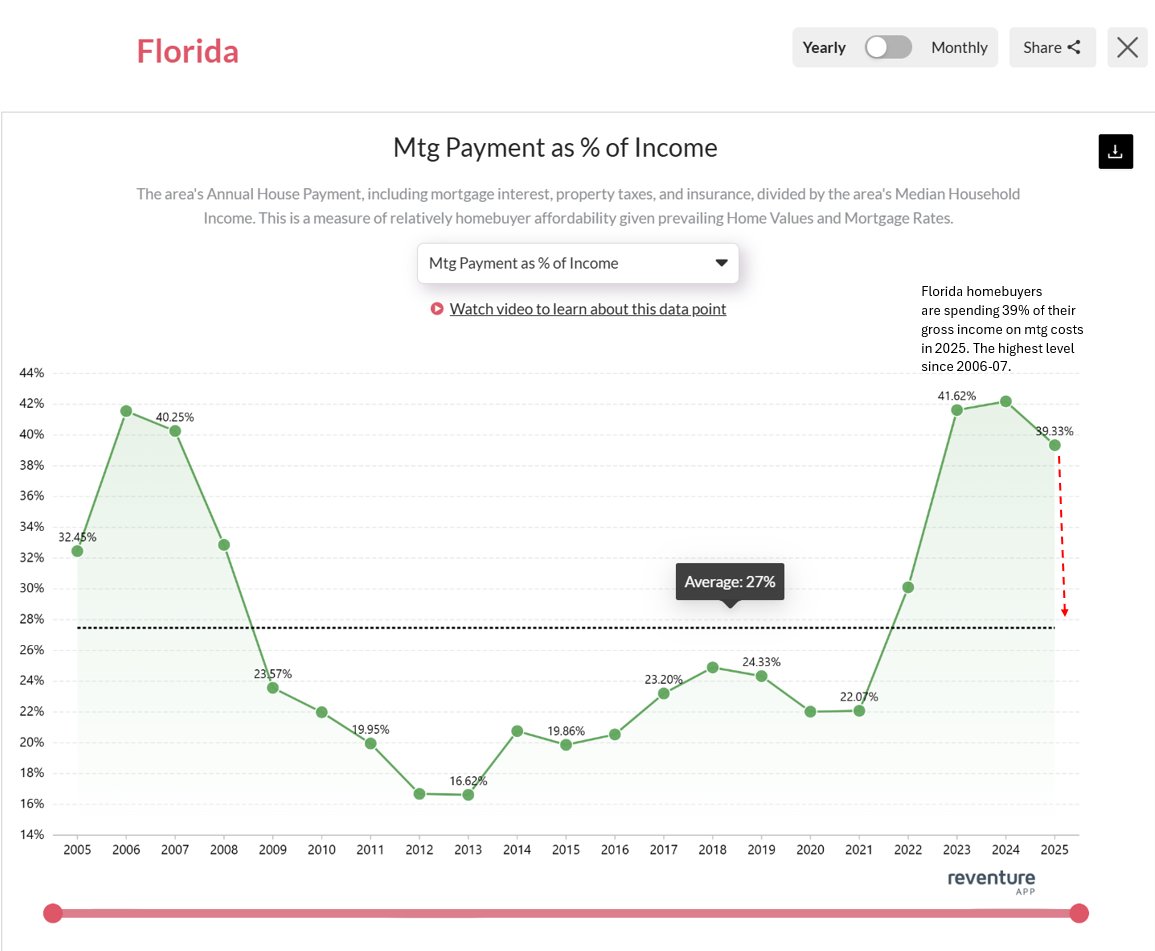

9) Data on Reventure App shows that local homebuyers in Florida now need to pay 39% of their gross income on the mortgage and tax costs for buying a house.

That's the highest level since the 2006-07 bubble.

And way above the long-term average of 27%.

Indicating that local buyers in Florida are priced out, and quite simply can't even qualify for mortgages.

That's the highest level since the 2006-07 bubble.

And way above the long-term average of 27%.

Indicating that local buyers in Florida are priced out, and quite simply can't even qualify for mortgages.

10) So if the local buyers are priced out, and the migration train has slowed, who's going to support the Florida housing market?

The answer - no one.

Which is why inventory is through the roof, and prices are dropping fast.

The answer - no one.

Which is why inventory is through the roof, and prices are dropping fast.

11) Reventure is forecasting prices to drop in Florida by about -5% over the next 12 months.

Our price forecast score for the state is a 35/100.

Meanwhile, we're at 55/100 on New York, which equates to +4.3%.

Our price forecast score for the state is a 35/100.

Meanwhile, we're at 55/100 on New York, which equates to +4.3%.

12) Based on the valuation rates in the market, it's feasible to expect prices in Florida to drop for multiple years. Before affordability is returned and the local buyers can step into the market and support it.

Meanwhile, Northeast housing markets likely have another 12 months of appreciation before the slowdown will begin to hit.

Meanwhile, Northeast housing markets likely have another 12 months of appreciation before the slowdown will begin to hit.

13) Head to to access housing data down to the ZIP code level for your market.

Home value and inventory data is accessible under a free account.

Upgrade to premium to access our price forecast score and valuation rates for your area.reventure.app

Home value and inventory data is accessible under a free account.

Upgrade to premium to access our price forecast score and valuation rates for your area.reventure.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh