Just in time for Prime Minister Carney's meeting with Donald Trump, I have analyzed new U.S. Census Bureau data on bilateral Canada-U.S. trade (now including full-year 2024 results). Full analysis here: . #cdnecon #cdnpoli /2progressive-economics.ca/2025/05/latest…

The U.S. bilateral trade deficit with Canada shrank 12% in 2024, to just $35.7b (U.S.). That's a small fraction of the inflated numbers ("$100 billion, $200 billion, $300 billion") that Trump just makes up. /3

Relative to U.S. GDP, which has been growing quickly in nominal terms, that bilateral deficit has been halved since 2022 (largely due to lower oil prices), falling to 0.12% in 2024. Even the U.S. global deficit is a much smaller share of GDP (3.1% in 2024) than in the 2000s. /4

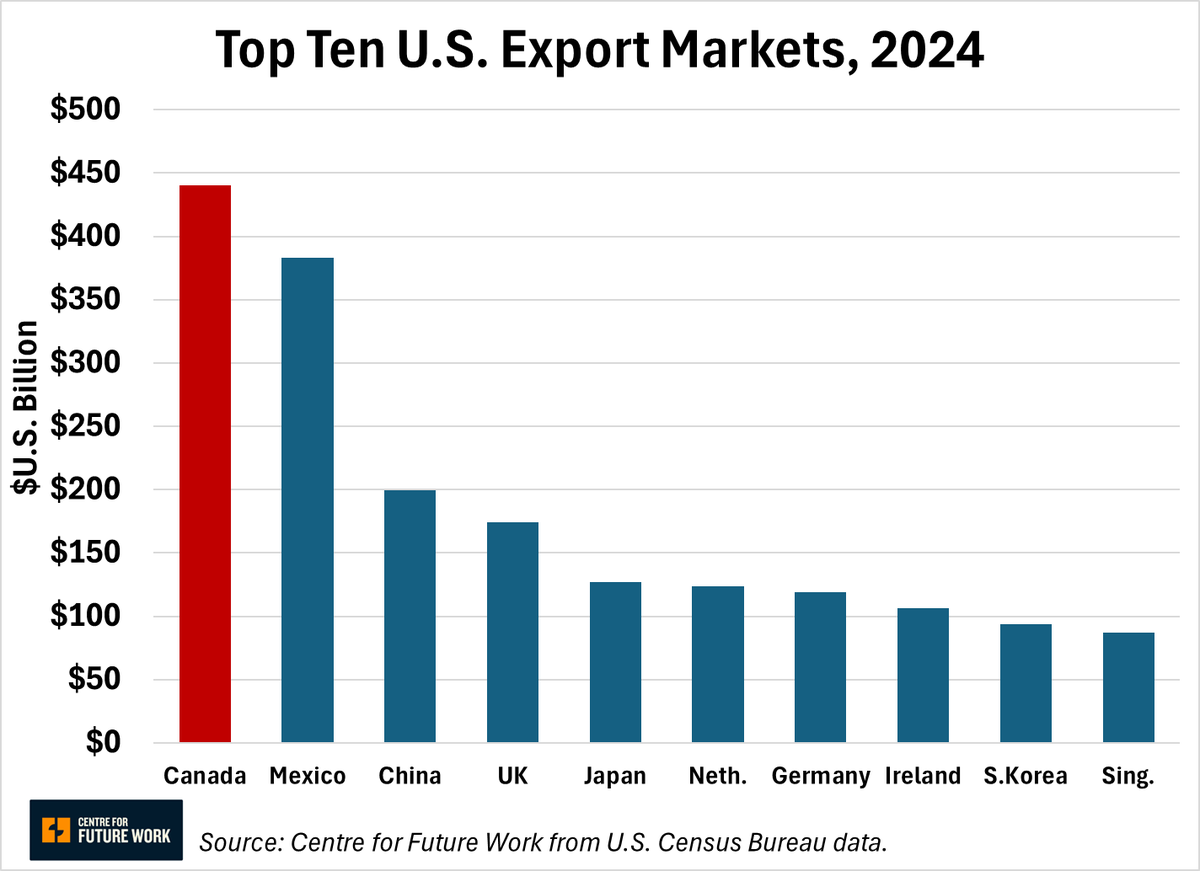

Canada retained its crown last year as the biggest market for U.S. exports. We bought $440b of U.S. goods and services last year, more than twice as much as China. Curtailing bilateral trade, and using "economic force" to extract concessions from us, will hurt U.S firms. /5

Canadian purchases of U.S. services grew significantly last year, and the U.S. bilateral trade surplus in services with Canada is now $35b (U.S.). That offsets half of the bilateral trade deficit in goods. Moreover, many imports of U.S. services are not counted in this total. /6

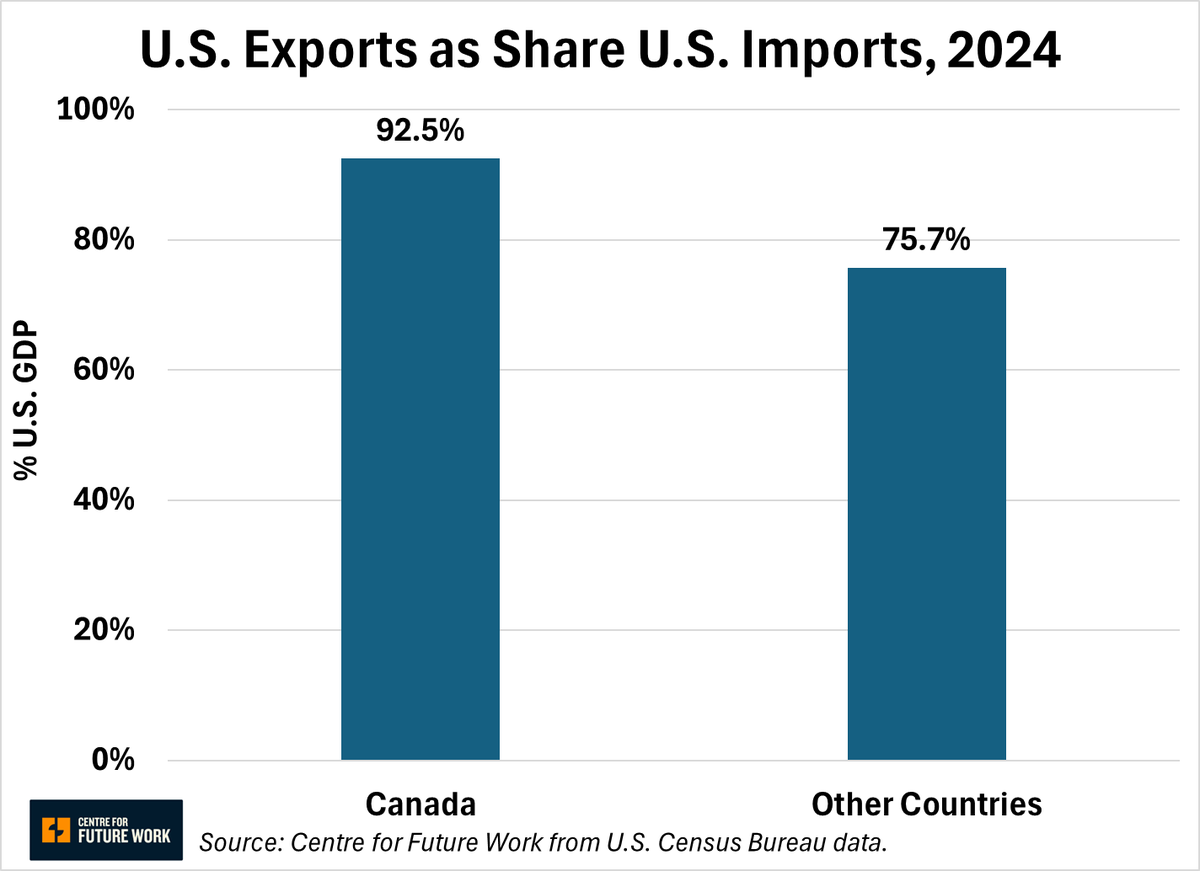

The Canada-U.S. trade flow is both large ($916b two-way in 2024, biggest in the world) & relatively balanced. The U.S. sold 92.5¢ of exports to 🇨🇦, for every $1 they bought from us. That's up from previous years & much better than the 75.7¢ per $ they sell to other countries. /7

In sum Trump's complaints about trade deficits are no more real than phony complaints about fentanyl, defense spending, or supply management. Structural U.S. deficits reflect huge ongoing capital inflows, not "unfair" treatment. And the U.S. benefits hugely from trade with 🇨🇦. /8

For more background on measuring and understanding trade imbalances, and a catalogue of the ways Canada in fact subsidizes the U.S. (through unusually lucrative trade arrangements), please see the @futurework_cda report, "Who's Subsidizing Whom?": .centreforfuturework.ca/2025/01/12/who…

• • •

Missing some Tweet in this thread? You can try to

force a refresh