Economist & Director, Centre for Future Work. He/him. Also Economics Dept. McMaster U.; Hon. Prof. of Political-Economy Sydney U.; author Economics for Everyone

How to get URL link on X (Twitter) App

This thread draws on analysis of oil futures markets from @futurework_cda's recent report, "Counting the Costs": . It computes the costs of the 2022 oil price spike: directly & indirectly it cost the average Canadian household $12,000 over 3 years. /3 falseprofits.ca/reports

This thread draws on analysis of oil futures markets from @futurework_cda's recent report, "Counting the Costs": . It computes the costs of the 2022 oil price spike: directly & indirectly it cost the average Canadian household $12,000 over 3 years. /3 falseprofits.ca/reports

Economists have long shown ELCC's many economic gains, via:

Economists have long shown ELCC's many economic gains, via:

https://twitter.com/PierrePoilievre/status/1825921941242351887

A. You don't calculate change in real wage by subtracting the inflation rate from % wage growth. You must calculate an index (dividing wage by CPI) and measure how that changes.

A. You don't calculate change in real wage by subtracting the inflation rate from % wage growth. You must calculate an index (dividing wage by CPI) and measure how that changes.https://twitter.com/Ryan_r_Williams/status/1805975519227183230Can we thus credit Freeland's tax reform for *lowering* the rate of grocery inflation? Of course not: it's ridiculous to link the two. Blaming taxes, instead of Loblaws, Cargill, PepsiCo, oil companies, and climate change for high food prices, is world-class bait and switch. /3

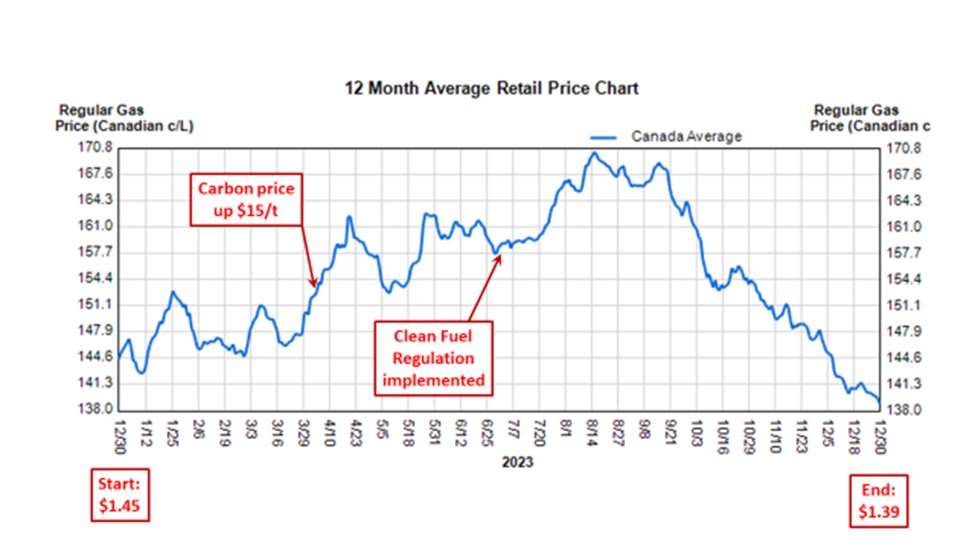

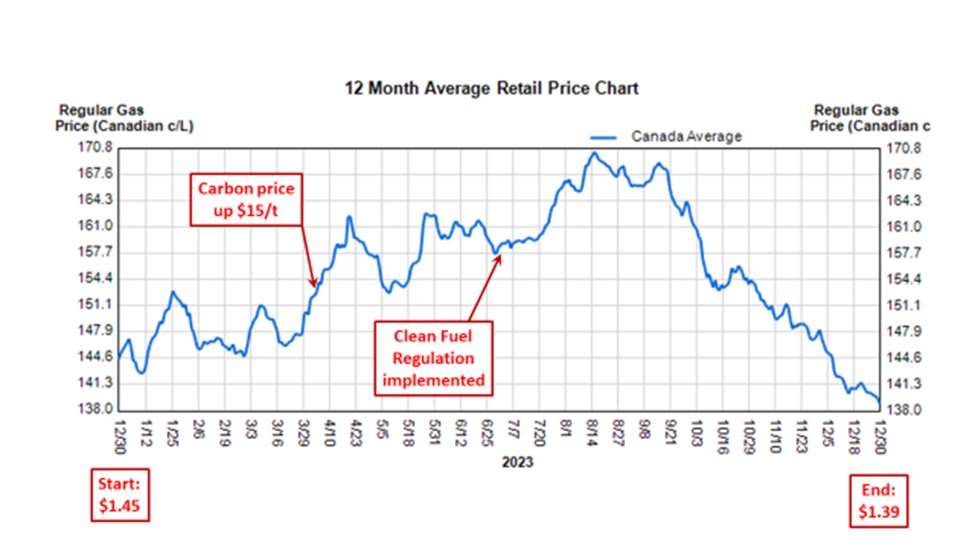

Gasoline ended '23 5₵/litre lower than it began, despite a higher carbon price (worth about 3₵/l, offset by CAIP rebates). The ups & downs of oil prices are dominated by oil companies & futures markets, not carbon prices. The 2022 oil price surge added 40x more to gas prices./3

Gasoline ended '23 5₵/litre lower than it began, despite a higher carbon price (worth about 3₵/l, offset by CAIP rebates). The ups & downs of oil prices are dominated by oil companies & futures markets, not carbon prices. The 2022 oil price surge added 40x more to gas prices./3

Of course, the ups and downs of world oil futures markets are the major reason for this roller-coaster (even for gasoline extracted, refined & consumed here in 🇨🇦). What's striking is the irrelevance of Cdn fiscal & climate policies to the path of gas prices over the year. /3

Of course, the ups and downs of world oil futures markets are the major reason for this roller-coaster (even for gasoline extracted, refined & consumed here in 🇨🇦). What's striking is the irrelevance of Cdn fiscal & climate policies to the path of gas prices over the year. /3

The April uptick in yr/yr CPI was mostly due, StatsCan reported, to higher rents & mortgage debt charges. Both of those are direct effects of *higher* interest rates. Mortgage debt (3% of the CPI bundle) is skyrocketing. Rents are a bigger weight (6.57%), also growing fast. /3

The April uptick in yr/yr CPI was mostly due, StatsCan reported, to higher rents & mortgage debt charges. Both of those are direct effects of *higher* interest rates. Mortgage debt (3% of the CPI bundle) is skyrocketing. Rents are a bigger weight (6.57%), also growing fast. /3