I bought my first stock 21 years ago.

Here are 21 harsh investing truths I learned the hard way:

1: The worst mistake is to sell a mega-winner early

Here are 21 harsh investing truths I learned the hard way:

1: The worst mistake is to sell a mega-winner early

2: Humans are pre-programmed to be bad at investing.

3: Your personal finances are 10x more important than your investments.

4: Handle volatility is 100x easier in theory than in reality.

3: Your personal finances are 10x more important than your investments.

4: Handle volatility is 100x easier in theory than in reality.

5: Confidence in your strategy will rise and fall in lock-step with asset prices.

6: The best stocks put their owners through gut-wrenching volatility. The worst stocks do, too.

7: You're going to be wrong—a lot. Be humble.

6: The best stocks put their owners through gut-wrenching volatility. The worst stocks do, too.

7: You're going to be wrong—a lot. Be humble.

8: It's never as good as it seems or as bad as it seems.

9: Successful investing requires an uncomfortable mix of pessimism and optimism, which is damn hard for our brains to handle.

10: Graduate school taught me a lot of complex calculations that only work in theory.

9: Successful investing requires an uncomfortable mix of pessimism and optimism, which is damn hard for our brains to handle.

10: Graduate school taught me a lot of complex calculations that only work in theory.

11: History + psychology are the most important subjects for investors to study.

12: Consistently avoiding ruin is the most underrated financial skill.

13: Frauds, bad investments, good investments, and how to perfectly time the market are only obvious in hindsight.

12: Consistently avoiding ruin is the most underrated financial skill.

13: Frauds, bad investments, good investments, and how to perfectly time the market are only obvious in hindsight.

14: Interest rates matter. A lot.

15: The stock market will always attract people who are in a rush to build wealth and build wealth for people who are not in a rush.

16: No amount of words can explain what a 50% drop feels like.

15: The stock market will always attract people who are in a rush to build wealth and build wealth for people who are not in a rush.

16: No amount of words can explain what a 50% drop feels like.

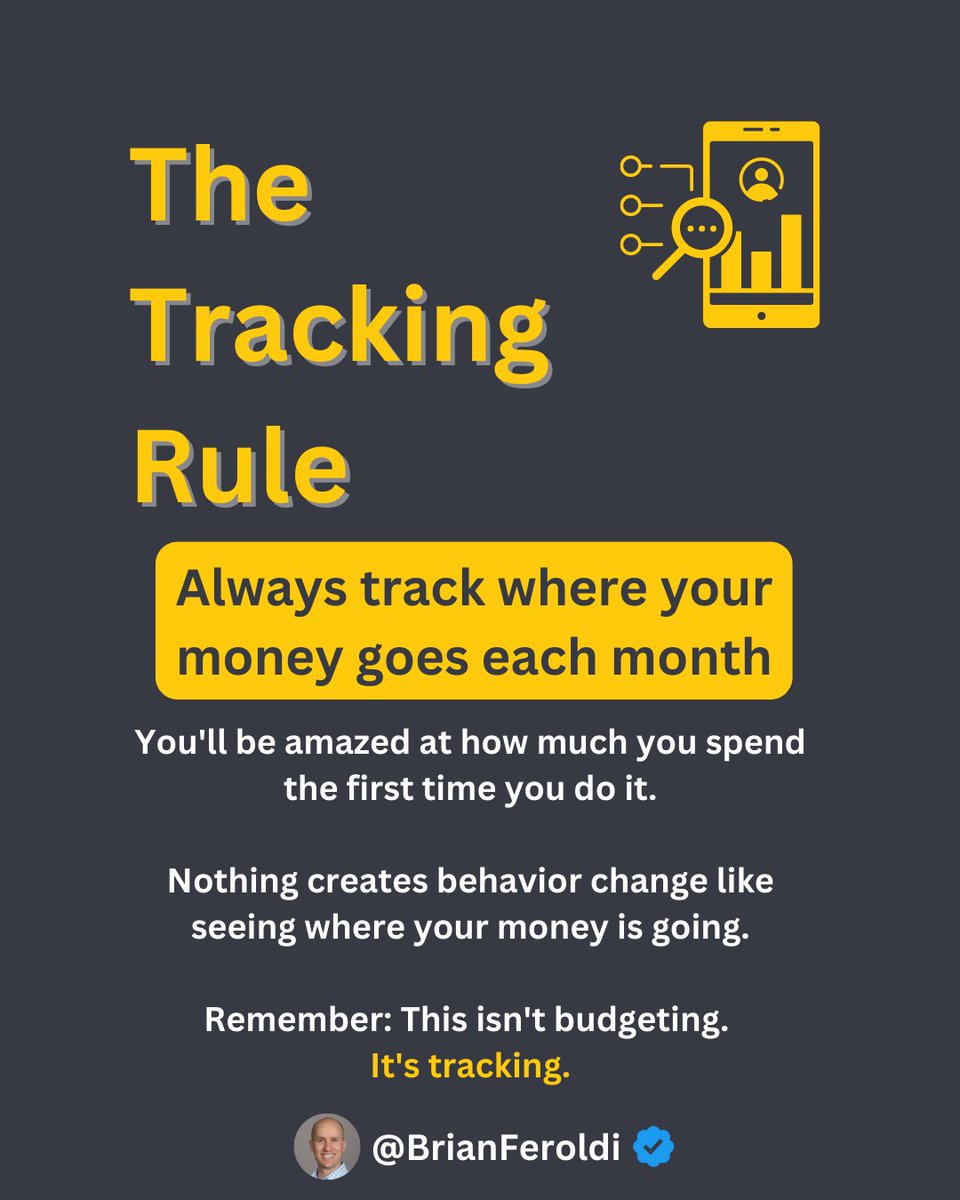

17: "Make more, spend less, invest simply, and wait longer" is the best financial advice.

18: Consistently avoiding ruin is the most underrated financial skill.

19: Activity is not progress.

18: Consistently avoiding ruin is the most underrated financial skill.

19: Activity is not progress.

20: Ignore predictions. They are useless at best, dangerous at worst.

21: 99% of investors should dollar cost average into index funds and call it a day

21: 99% of investors should dollar cost average into index funds and call it a day

If you enjoyed this thread, follow me @brianferoldi

I teach investors how to analyze businesses.

To share with your audience, retweet the first tweet below:

I teach investors how to analyze businesses.

To share with your audience, retweet the first tweet below:

https://twitter.com/61558281/status/1920456290842673306

• • •

Missing some Tweet in this thread? You can try to

force a refresh