#Tether watch!

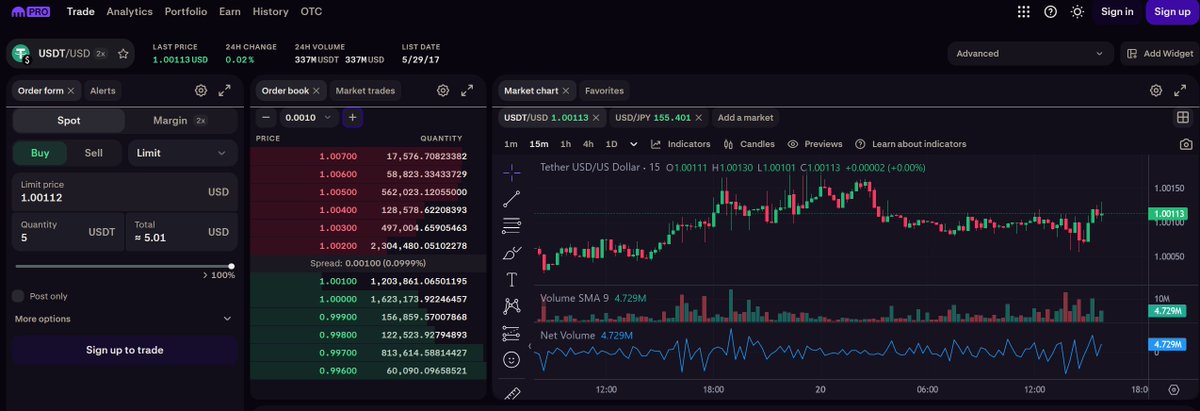

I'ma bout to lose my goddamn mind. I've broken down a monthly+ chart of Bitfinex's USDT:USD peg, compared to BTC:USD on Coinbase and Tether's market cap; everything since the recent BTC bottom.

I mean to me these patterns are obvious. This is such a disaster.🧵

I'ma bout to lose my goddamn mind. I've broken down a monthly+ chart of Bitfinex's USDT:USD peg, compared to BTC:USD on Coinbase and Tether's market cap; everything since the recent BTC bottom.

I mean to me these patterns are obvious. This is such a disaster.🧵

To clarify:

Every ponzi has a dollar (or local currency) limit. That's the real cash pile, which they use to service real dollar obligations; obligations that don't take casino tokens.

The real cash limit here is whatever leverage Abraxas/Cumberland/Wintermute can build up.

Every ponzi has a dollar (or local currency) limit. That's the real cash pile, which they use to service real dollar obligations; obligations that don't take casino tokens.

The real cash limit here is whatever leverage Abraxas/Cumberland/Wintermute can build up.

Meaning Abraxas and Cumberland lend to buy USDT, Wintermute lends to buy crypto, then Abraxas/Cumberland sells USDT to Wintermute for Crypto, they use the dollars to lever down/cycle again, while Wintermute pushes everything into Binance where it cycles until retail buys it.

I mean i can prove parts of it now. Abraxas and Cumberland aren't public, but Wintermute does have to file its finances publicly under UK law.

And it clearly shows their inventory is based on borrowed money while their net assets consists mostly of their PnL account.

And it clearly shows their inventory is based on borrowed money while their net assets consists mostly of their PnL account.

So basically, crypto profits. They still have tokens on the books on which they have a net gain, which is most of their net assets. Stated very clearly: If crypto prices weren't so high, there's a good chance they'd go broke, as their PnL account gets shot in the back of the head

I can't show the same for Abraxas or Cumberland, since Cumberland is part of a large private company whose founder got his start in the Eurodollar options market; eurodollars being "loans made by people in dollars who don't actually have dollars". Which sounds very familiar;

And Abraxas because they're supposedly "managing their funds on behalf of HEKA funds", which is a Malta based hedgefund -

But to the best of my ability i can't find shit about them, and the listed fund size i did come across matches Abraxas' own Elysium global "arbitrage" fund.

But to the best of my ability i can't find shit about them, and the listed fund size i did come across matches Abraxas' own Elysium global "arbitrage" fund.

And it just bothers me to no end since this is all on-chain trackable.

This isn't just any bullshit ponzi where everything is hidden. I mean i can just enter the Tether ETH treasury into Arkham Intelligence, and this is what pops out for the last month of spike activity:

This isn't just any bullshit ponzi where everything is hidden. I mean i can just enter the Tether ETH treasury into Arkham Intelligence, and this is what pops out for the last month of spike activity:

Yes, currently, the ETH treasury is at $4.2B again because Justin Sun's been doing his regular bullshit crime again of cycling USDT from ETH to TRON via Tether; but cycling TRON USDT to ETH back through Binance.

It's 100% part of the ponzi routine, just can't figure out how.

It's 100% part of the ponzi routine, just can't figure out how.

Then their recent attestation basically is as close to an admission of guilt as we can possibly get before the collapse:

IMAGINE A $150 *BILLION* DOLLARS BEING ADMINISTERED AND OVERSEEN BY ONE PERSON!

RATHER THAN A WHOLE FUCKING COMPLIANCE DEPARTMENT!

IMAGINE A $150 *BILLION* DOLLARS BEING ADMINISTERED AND OVERSEEN BY ONE PERSON!

RATHER THAN A WHOLE FUCKING COMPLIANCE DEPARTMENT!

https://x.com/DesoGames/status/1918432417410679177

At this point i'm at a loss. Not on "who dun it" but how to get people to care.

Anybody that does get clicks wanna do a more indepth report on the money behind Tether? @coffeebreak_YT? @zachxbt? @protos's doing their best. Maybe @NewYorkStateAG to take down Trump via Justin.

Anybody that does get clicks wanna do a more indepth report on the money behind Tether? @coffeebreak_YT? @zachxbt? @protos's doing their best. Maybe @NewYorkStateAG to take down Trump via Justin.

I'll tag some friends since i can't make it more condensed than this thread. Took years, but i've got Tether mostly figured out now.

@Bitfinexed @JG_Nuke @freedom_rpt @TheEarlyStage @GoldTelegraph_ @ParrotCapital @Cryptadamist

Ain't up to me anymore to "do something". I'm done

@Bitfinexed @JG_Nuke @freedom_rpt @TheEarlyStage @GoldTelegraph_ @ParrotCapital @Cryptadamist

Ain't up to me anymore to "do something". I'm done

• • •

Missing some Tweet in this thread? You can try to

force a refresh