What should the Fed do with Trump Tariffs?

New paper on 'Monetary Policy in Times of Tariffs' with Guido Lorenzoni & Veronica Guerrieri (link at end)

We show the simplest most intuitive way to approach tariffs is actually correct:

Tariffs = textbook cost-push shock

🧵1/N

New paper on 'Monetary Policy in Times of Tariffs' with Guido Lorenzoni & Veronica Guerrieri (link at end)

We show the simplest most intuitive way to approach tariffs is actually correct:

Tariffs = textbook cost-push shock

🧵1/N

The Fed recently hit the pause button on adjusting rates due to tariffs. A month ago Fed Chair Powell said:

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension.” (Speech at Economic Club of Chicago, April 16)

2/N

“We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension.” (Speech at Economic Club of Chicago, April 16)

2/N

Our main result: In a simple open-economy model with imported intermediates, a tariff acts AS IF it were a labor wedge in a standard New Keynesian closed economy.

The good: standard results & insights on cost-push shocks directly apply!

The bad: cost push shocks are bad!

3/N

The good: standard results & insights on cost-push shocks directly apply!

The bad: cost push shocks are bad!

3/N

Intuitively, as Powell said, tariffs raise costs and lower productivity. They are a negative supply shock that creates a nastier tradeoff for the dual mandate.

Very intuitive... but international macro models are more involved.

Our result formalizes the simple intuition. 4/N

Very intuitive... but international macro models are more involved.

Our result formalizes the simple intuition. 4/N

Translation: Tariffs shift the Phillips curve up.

The central bank faces a tradeoff: control inflation or support output.

It can’t do both.

So what should monetary policy do?... 5/N

The central bank faces a tradeoff: control inflation or support output.

It can’t do both.

So what should monetary policy do?... 5/N

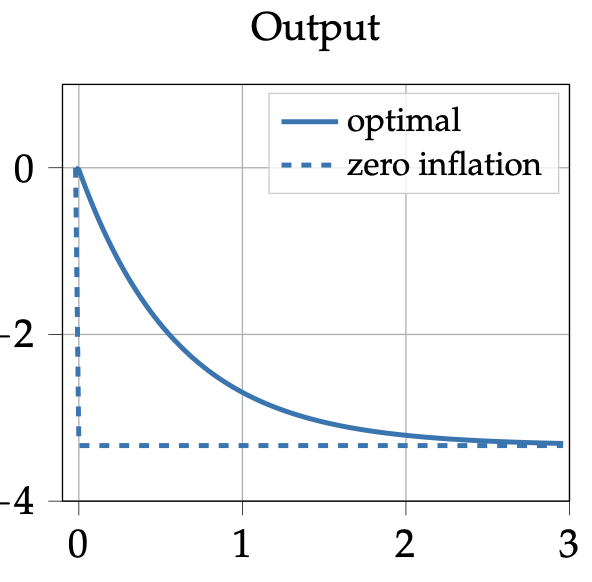

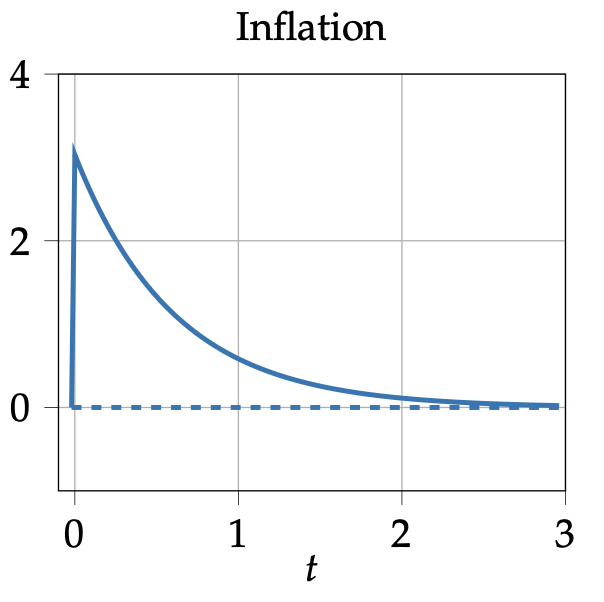

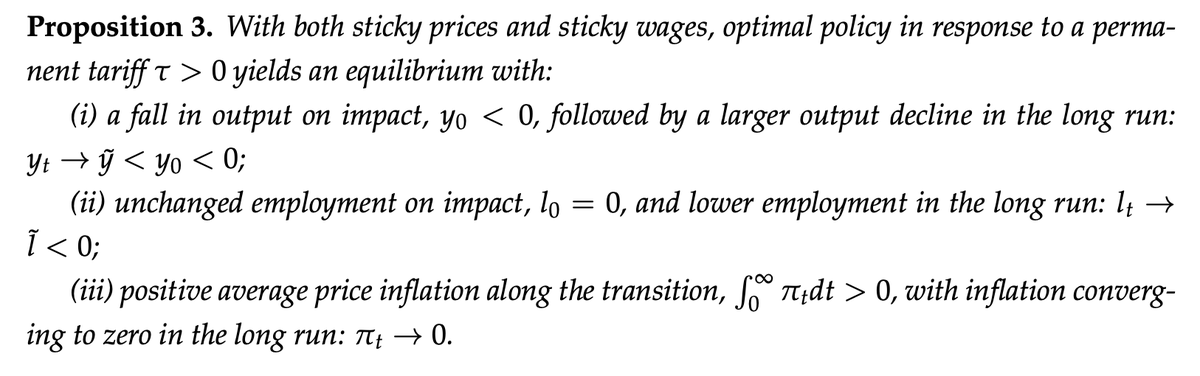

We analytically characterize the optimal response.

Spoiler: it involves tolerating inflation—temporarily.

It involves softening the blow of tariffs on output and labor.

Intuitively ....

Spoiler: it involves tolerating inflation—temporarily.

It involves softening the blow of tariffs on output and labor.

Intuitively ....

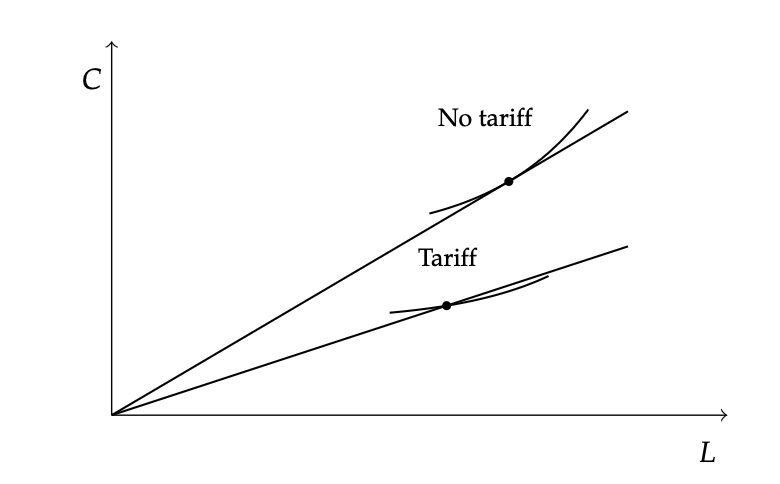

Intuition: tariffs lower the natural real wage (due to lower profitability) more than productivity. This creates a positive labor wedge, which drives the cost-push effect.

In fact, technically: the productivity loss is second-order, but profitability loss is first order.

In fact, technically: the productivity loss is second-order, but profitability loss is first order.

It looks something like this using a basic microeconomic intuition. The economy frontier goes down, but also wages are not equal to actual productivity, they are lower, so labor is distorted down. The second effect is stronger starting from free trade.

So tariffs are bad, can lead to sharp hit. Optimal monetary policy smooths the adjustment...

Inflation rises in the short run

Output stays above the distorted steady state

Gradual convergence to lower level follows

6/N

Inflation rises in the short run

Output stays above the distorted steady state

Gradual convergence to lower level follows

6/N

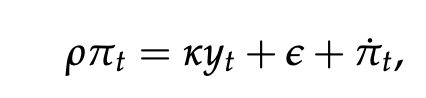

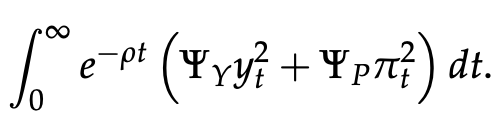

Technically, our AS IF result is as follows.

-an extra "cost push" epsilon term in the Phillips curve, so it is pushes the curve out.

- the welfare objective is unchanged: dual mandate penalizing inflation and output deviations.

7/N

-an extra "cost push" epsilon term in the Phillips curve, so it is pushes the curve out.

- the welfare objective is unchanged: dual mandate penalizing inflation and output deviations.

7/N

Basically, you can do open economy macro with your closed economy model.

Here are some numerical examples run thro the model...

Here are some numerical examples run thro the model...

Here’s what’s NOT optimal...

1. Targeting zero inflation. That would require a sharp contraction in output—too costly.

Letting inflation run a bit helps cushion the blow.

2. "See through principle": hoping inflation rises, but minimally, via direct costs. 9/N

1. Targeting zero inflation. That would require a sharp contraction in output—too costly.

Letting inflation run a bit helps cushion the blow.

2. "See through principle": hoping inflation rises, but minimally, via direct costs. 9/N

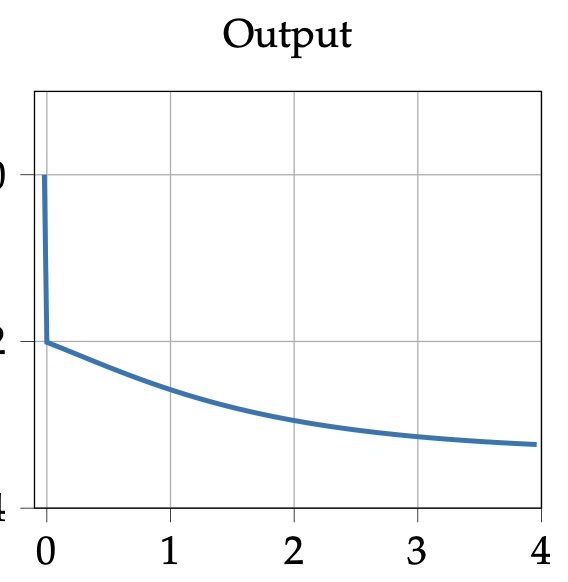

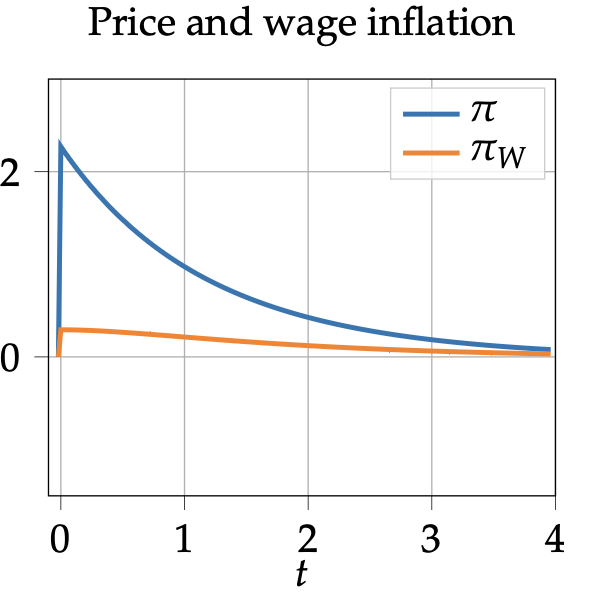

The results hold with sticky wages, but then inflation control is even costlier.

Zero inflation now requires deeper recessions and wage deflation.

The optimal policy is still to accommodate—with some inflation.

Zero inflation now requires deeper recessions and wage deflation.

The optimal policy is still to accommodate—with some inflation.

A common idea in policy circles is the "see through principle" (not really grounded in economic theory).

It makes some sense as a simple communication device or slogan, but our model says...

... optimal inflation typically exceeds the mechanical pass-through from tariffs.

It makes some sense as a simple communication device or slogan, but our model says...

... optimal inflation typically exceeds the mechanical pass-through from tariffs.

The effects show up in the nominal exchange rate too...

In our setup, tariffs raise prices and depreciate the currency.

This echoes recent empirical patterns during trade tensions.

(capital flight is surely another reason, but basic macro+trade can already explain it)

In our setup, tariffs raise prices and depreciate the currency.

This echoes recent empirical patterns during trade tensions.

(capital flight is surely another reason, but basic macro+trade can already explain it)

Lots of policy commentary says “central banks shouldn’t respond to tariffs.”

That’s not what our model says.

A better rule: Don’t overreact, but don’t ignore either.

Bottom line...

Tariffs create inflation-output tradeoffs that monetary policy can’t ignore.

That’s not what our model says.

A better rule: Don’t overreact, but don’t ignore either.

Bottom line...

Tariffs create inflation-output tradeoffs that monetary policy can’t ignore.

• • •

Missing some Tweet in this thread? You can try to

force a refresh