MIT Professor of Economics | Macro, International, Public, Monetary, Taxes, Finance | v = u + β v | Beatles | Boston Argentina

2 subscribers

How to get URL link on X (Twitter) App

This flips the usual narrative.

This flips the usual narrative.

The Fed recently hit the pause button on adjusting rates due to tariffs. A month ago Fed Chair Powell said:

The Fed recently hit the pause button on adjusting rates due to tariffs. A month ago Fed Chair Powell said:

... Tariffs indirectly affect exports in general equilibrium!

... Tariffs indirectly affect exports in general equilibrium!

Abro hilo...

Abro hilo...

Two well-known costs are...

Two well-known costs are...

https://twitter.com/ivanwerning/status/1257268772529995778?s=61&t=gQ3-EPDKIhGNYTDUXcUD2w

https://twitter.com/reason/status/1652282101247406082Arguments like these were well received by most economists, rationally considered and discussed. Many other economists made great contributions, especially as data became available.

(I release it today because I will present this today at 11 ET in a webinar, details down below)

(I release it today because I will present this today at 11 ET in a webinar, details down below)

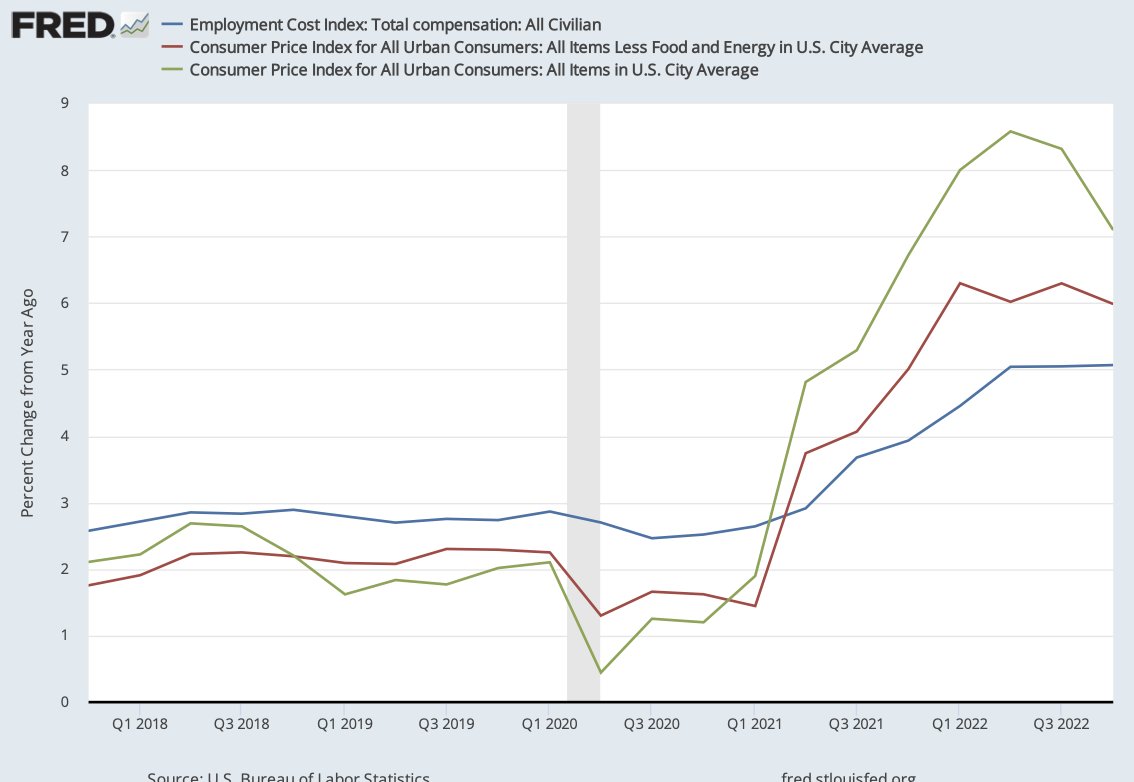

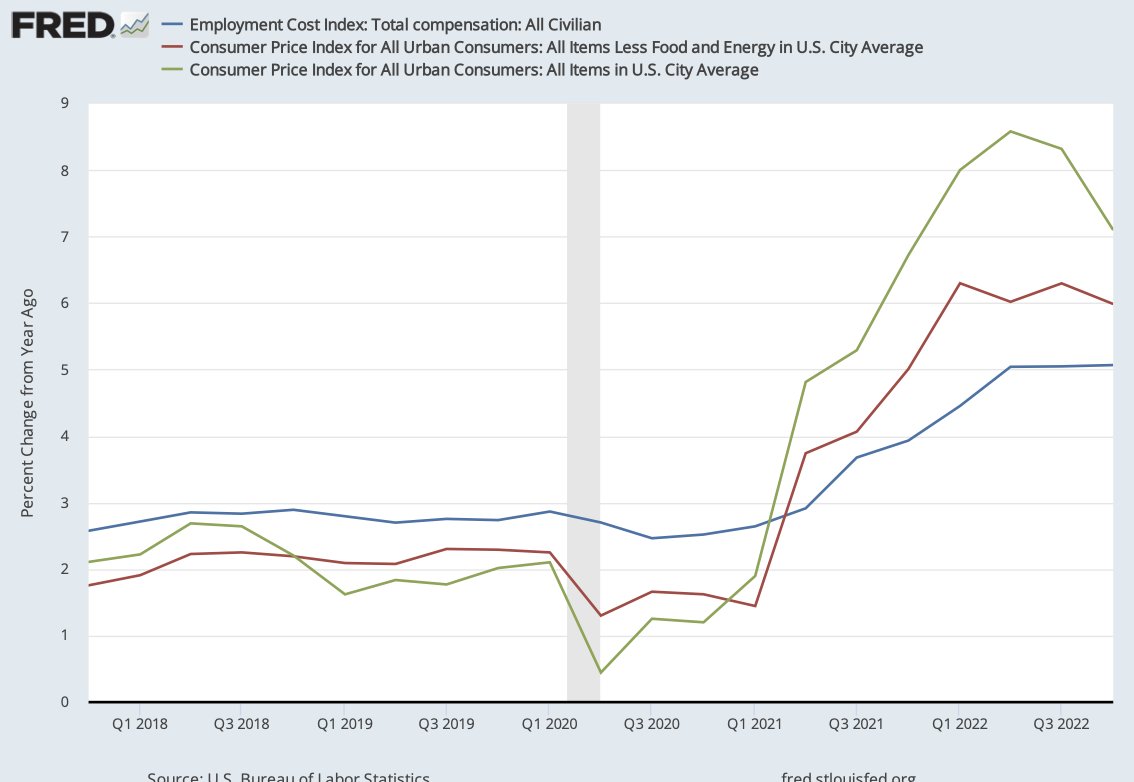

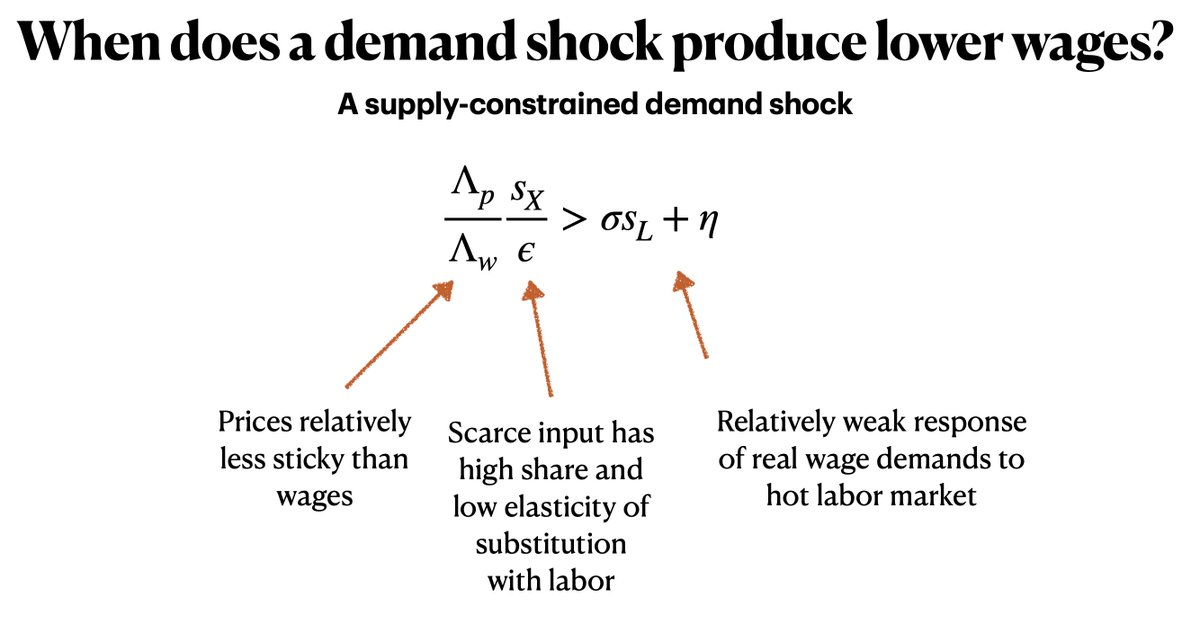

https://twitter.com/R2Rsquared/status/1609880310816153600... that a inflation may first rise, faster than wages, lowering the real wage (and labor share), followed by a fall in price inflation as wages rise and the real wage catch back up. So the opposite can happen. This depends on parameters and shock.

https://twitter.com/IvanWerning/status/1609273266702622721?s=20&t=PVOjk92-qyXrjrNaW0Holg

https://twitter.com/ojblanchard1/status/1608967176232525824The analysis is done with a completely standard component of a macro New Keynesian (Calvo) model, and could be adapted to many other settings.

I hope to have a manuscript in a few months, for now I will put the slides up at the end of this thread.

I hope to have a manuscript in a few months, for now I will put the slides up at the end of this thread.

YouTube Stream, presentation at 12:45 ET:

YouTube Stream, presentation at 12:45 ET: