The COLLAPSE of the US Dollar has begun

This could have major consequences for the markets

A thread 🧵

This could have major consequences for the markets

A thread 🧵

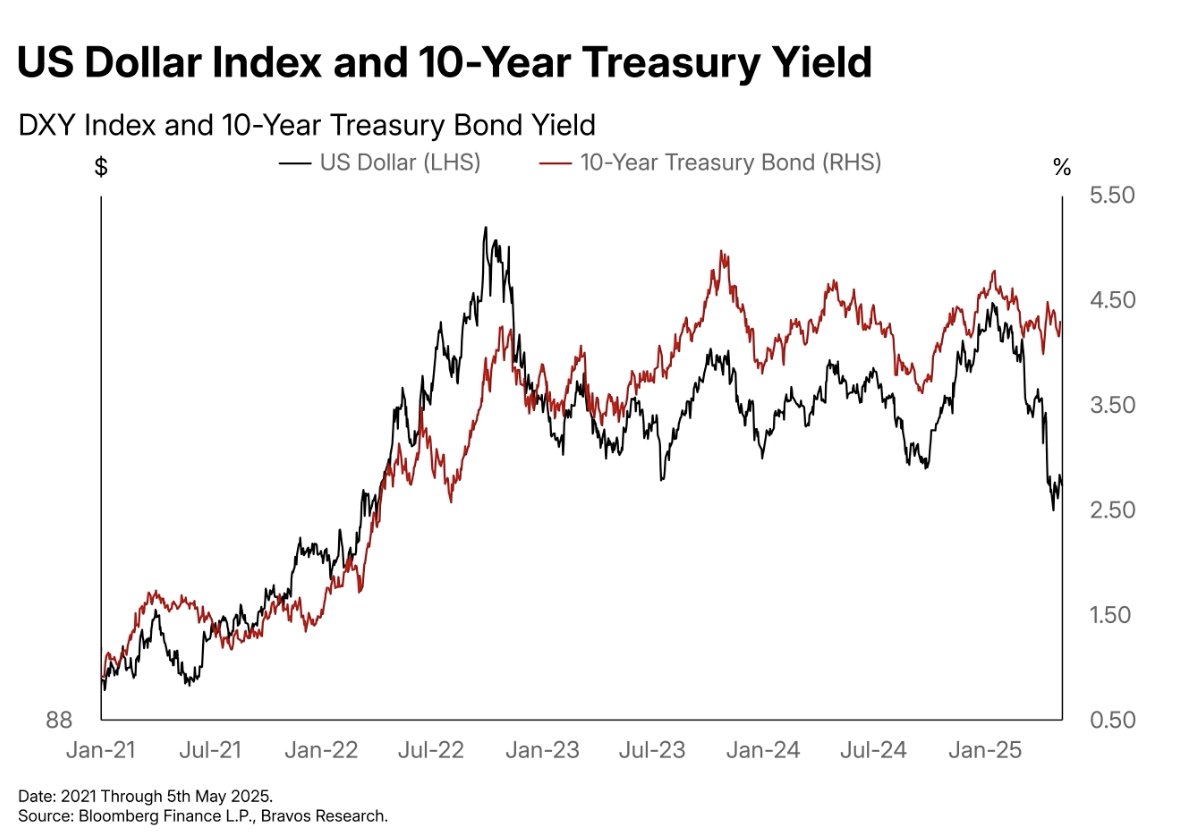

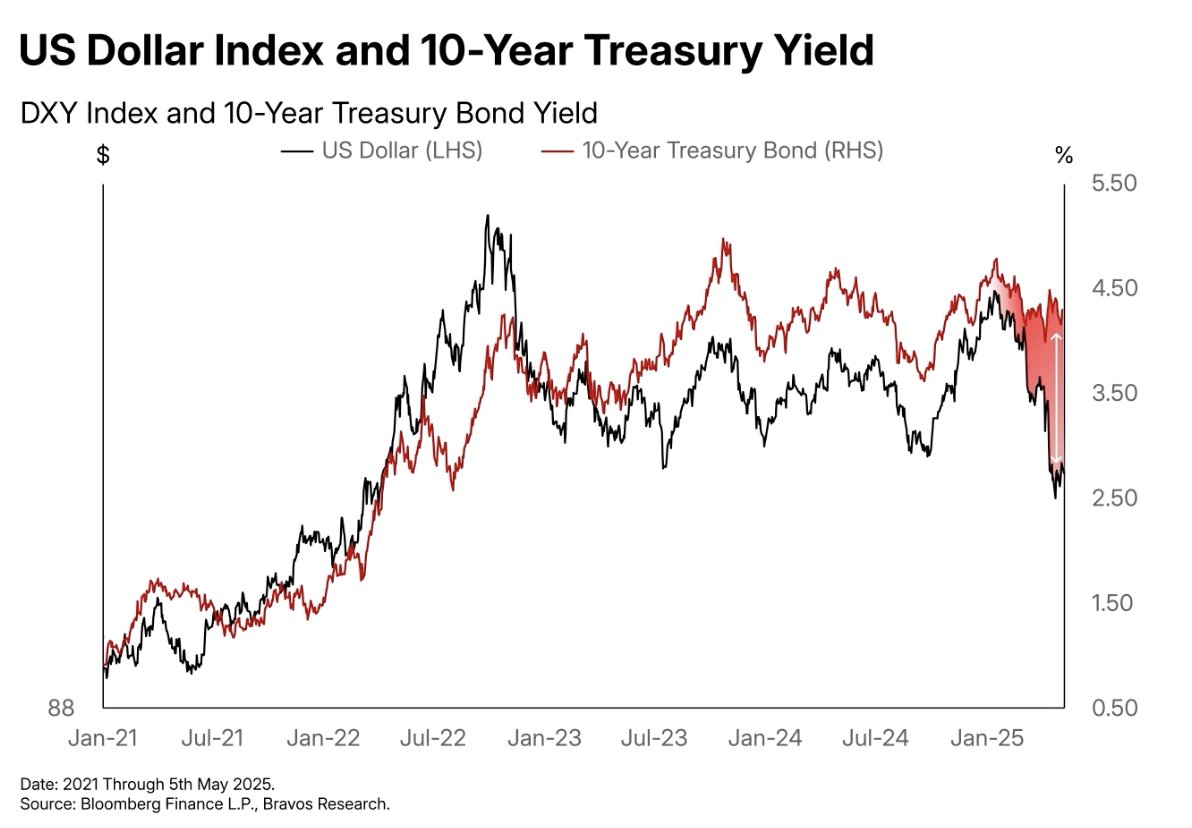

2/ Something has just broken on the US dollar

The DXY just posted its biggest drop since COVID

And it’s now completely disconnected from its fundamentals

The DXY just posted its biggest drop since COVID

And it’s now completely disconnected from its fundamentals

3/ Since the dawn of civilization, every fiat currency has eventually collapsed into irrelevance

And when that collapse comes, those holding the currency usually see their wealth wiped out

History is clear about how this ends

And when that collapse comes, those holding the currency usually see their wealth wiped out

History is clear about how this ends

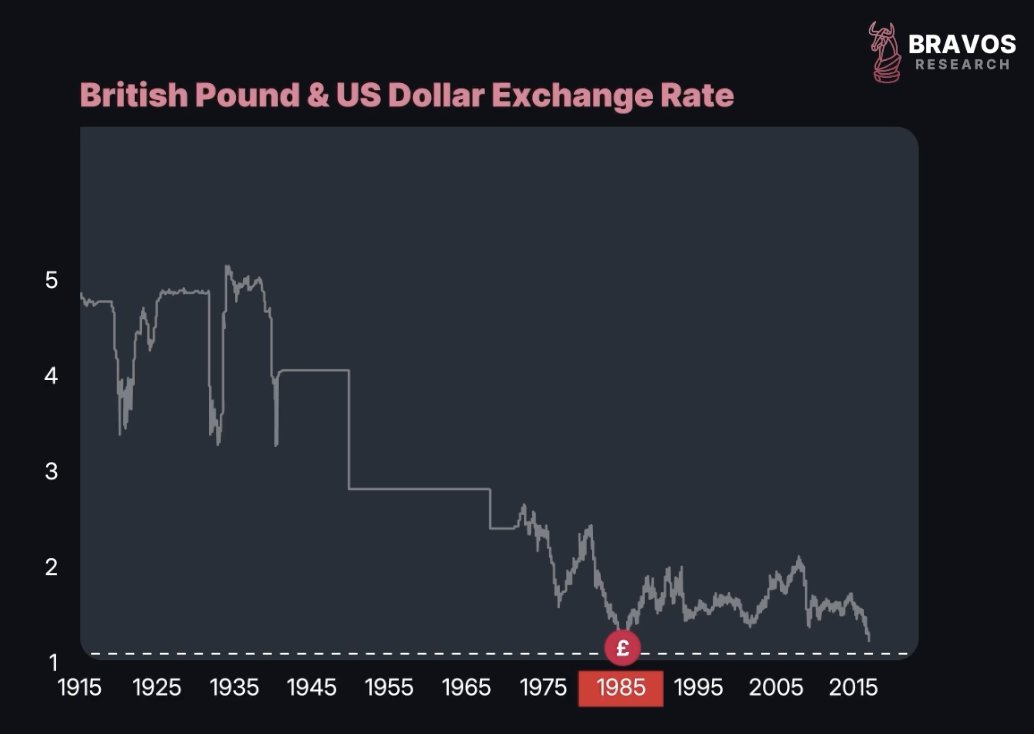

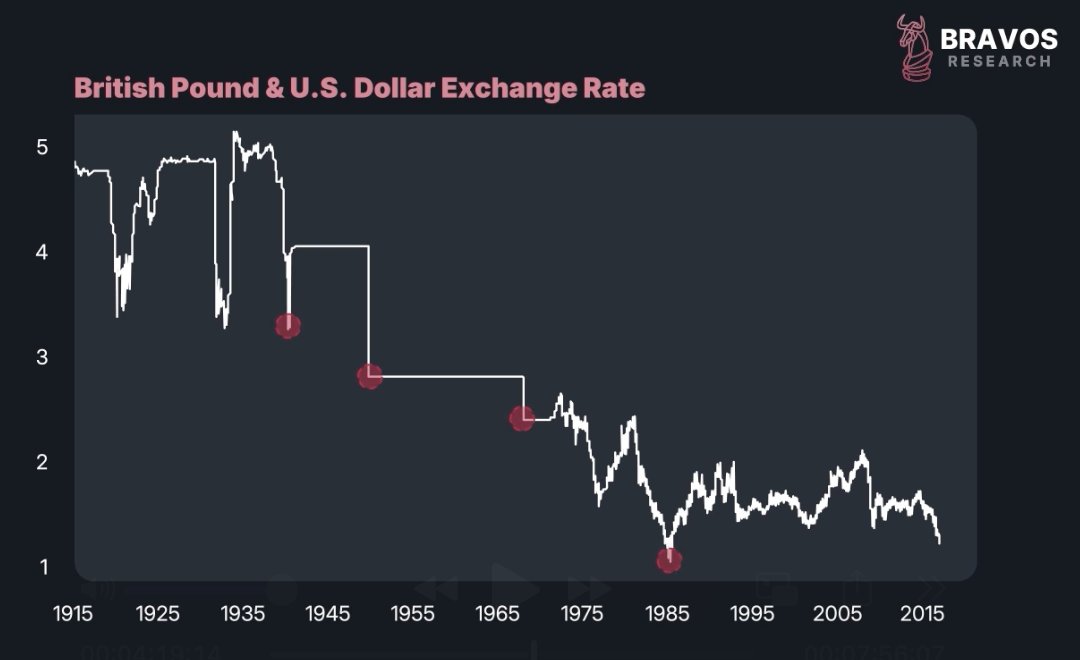

4/ Take the British pound, for example

In the 1940s, £1 was worth $5

It was the world’s dominant currency

By the 1980s, £1 was worth just $1

That collapse destroyed the purchasing power of its holders

And reshaped global trade, economic power, and geopolitics

In the 1940s, £1 was worth $5

It was the world’s dominant currency

By the 1980s, £1 was worth just $1

That collapse destroyed the purchasing power of its holders

And reshaped global trade, economic power, and geopolitics

5/ Today, it’s not the British pound under pressure, it’s the US dollar

Still the world’s dominant currency, but now some are projecting a similar decline ahead

And Donald Trump’s proposed government policies could be the spark that lights the fuse

Find out our exact trading strategy for these conditions at:

go.bravosresearch.com/X

Still the world’s dominant currency, but now some are projecting a similar decline ahead

And Donald Trump’s proposed government policies could be the spark that lights the fuse

Find out our exact trading strategy for these conditions at:

go.bravosresearch.com/X

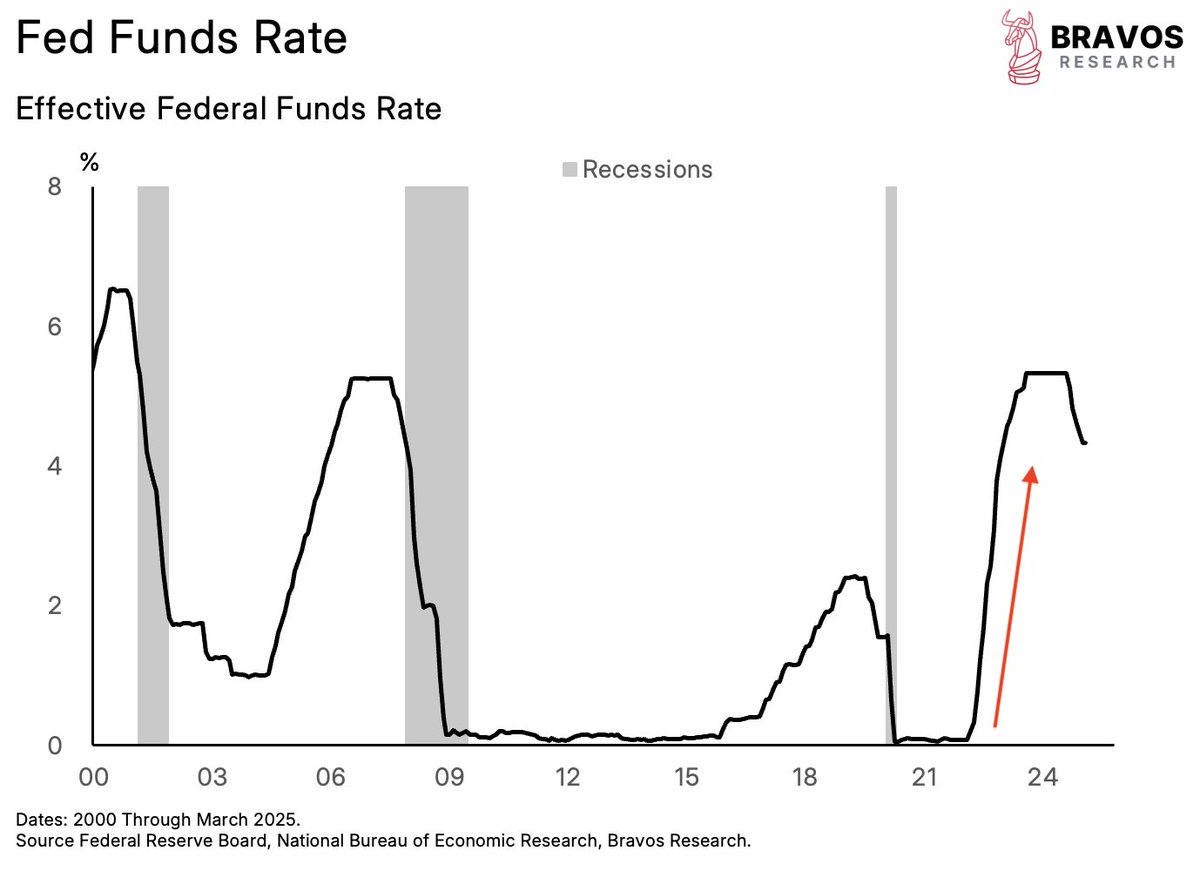

6/ The US dollar index (DXY) has faced heavy selling pressure since April 2nd (Liberation Day) when Trump announced new tariffs

Now, it's not been an outright collapse, but something has happened that is suggesting this decline in the US dollar could be a lot more dangerous than it looks

Now, it's not been an outright collapse, but something has happened that is suggesting this decline in the US dollar could be a lot more dangerous than it looks

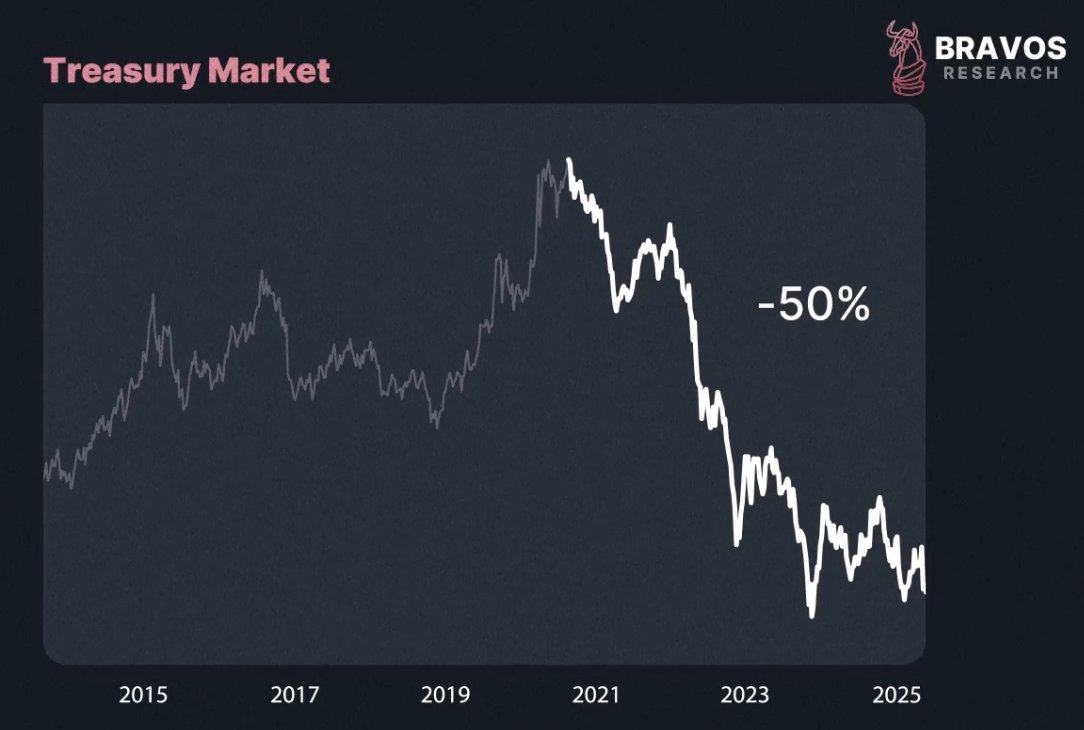

7/ You see, DXY usually moves in sync with US bond yields

Which reflect the return on holding US dollars

That relationship makes sense:

As yields rise, the dollar should strengthen

But for the first time in years, that connection is starting to break

Which reflect the return on holding US dollars

That relationship makes sense:

As yields rise, the dollar should strengthen

But for the first time in years, that connection is starting to break

8/ The chart now shows the dollar weakening despite high yields

That’s a serious warning sign

It suggests 1 of 2 things:

Either interest rates must rise even more to stabilize the dollar

Or the dollar is at real risk of a steeper collapse

That’s a serious warning sign

It suggests 1 of 2 things:

Either interest rates must rise even more to stabilize the dollar

Or the dollar is at real risk of a steeper collapse

9/ So what’s behind this growing gap?

First, remember tariffs are taxes and taxes slow down the economy

And since forex markets price in growth, a weaker economy means a weaker dollar

That’s the most basic explanation for this dislocation

First, remember tariffs are taxes and taxes slow down the economy

And since forex markets price in growth, a weaker economy means a weaker dollar

That’s the most basic explanation for this dislocation

10/ That explanation might prove temporary though

The US economy is still strong and leads in many future-facing industries

But the 2nd reason behind the DXY-yield gap is more worrying

The US economy is still strong and leads in many future-facing industries

But the 2nd reason behind the DXY-yield gap is more worrying

11/ Trump’s tariff policy could shrink global trade volumes

And since most global trade is conducted in dollars, falling trade activity directly reduces demand for dollars

If this happens, the US dollar’s downtrend could become a long-term theme

And since most global trade is conducted in dollars, falling trade activity directly reduces demand for dollars

If this happens, the US dollar’s downtrend could become a long-term theme

12/ But the biggest factor could be this:

The administration may actually want a weaker dollar

Trump has often said he prefers a weaker dollar to support US industry

A lower dollar boosts exports and helps revive domestic manufacturing

The administration may actually want a weaker dollar

Trump has often said he prefers a weaker dollar to support US industry

A lower dollar boosts exports and helps revive domestic manufacturing

13/ If Trump is actively pushing for a weaker dollar, we could see policies aimed at keeping it suppressed

That’s exactly what happened with the British pound in the 1940s

All of these currency devaluations of the British pound relative to the dollar that we highlighted earlier were driven by 2 root causes

That’s exactly what happened with the British pound in the 1940s

All of these currency devaluations of the British pound relative to the dollar that we highlighted earlier were driven by 2 root causes

14/ First, Britain had a large trade deficit

It wasn’t producing enough domestically

A weaker pound made its goods cheaper and more competitive globally

Which helped stimulate the local economy

It wasn’t producing enough domestically

A weaker pound made its goods cheaper and more competitive globally

Which helped stimulate the local economy

15/ Second, Britain was drowning in debt after WWII

Devaluing the pound made it easier to repay that debt

Since it had been accumulated when the currency was much stronger

Devaluing the pound made it easier to repay that debt

Since it had been accumulated when the currency was much stronger

16/ In short, the UK willingly sacrificed the strength of its currency to fix domestic problems: Debt and trade deficits

And that comparison to today’s US situation might not be as far-fetched as it sounds

And that comparison to today’s US situation might not be as far-fetched as it sounds

17/ We’ve been guiding our clients through this market environment with multiple successful Trades

Achieving 85 winning positions (out of 129) in 2024

With an avg profit of 16.65% and avg loss of just 3.67%

Try our service at:

go.bravosresearch.com/X

Achieving 85 winning positions (out of 129) in 2024

With an avg profit of 16.65% and avg loss of just 3.67%

Try our service at:

go.bravosresearch.com/X

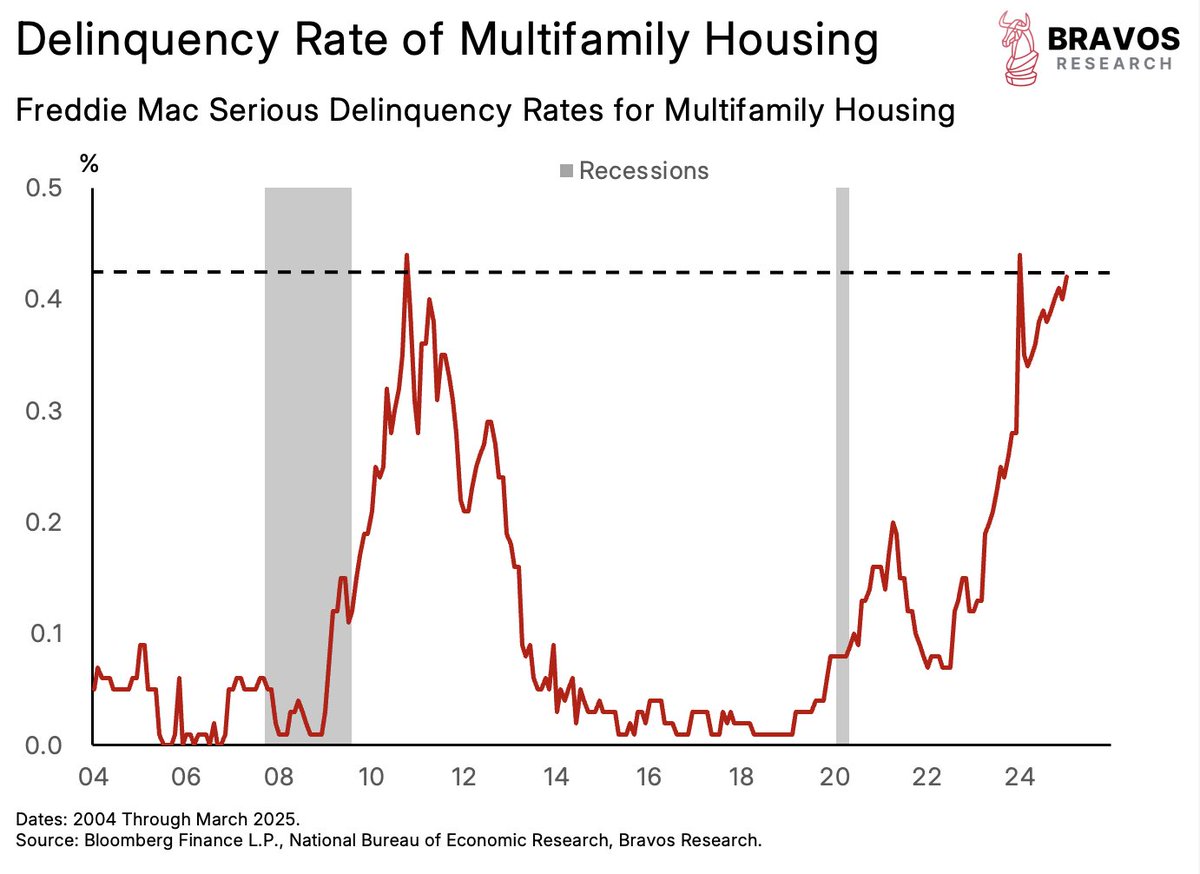

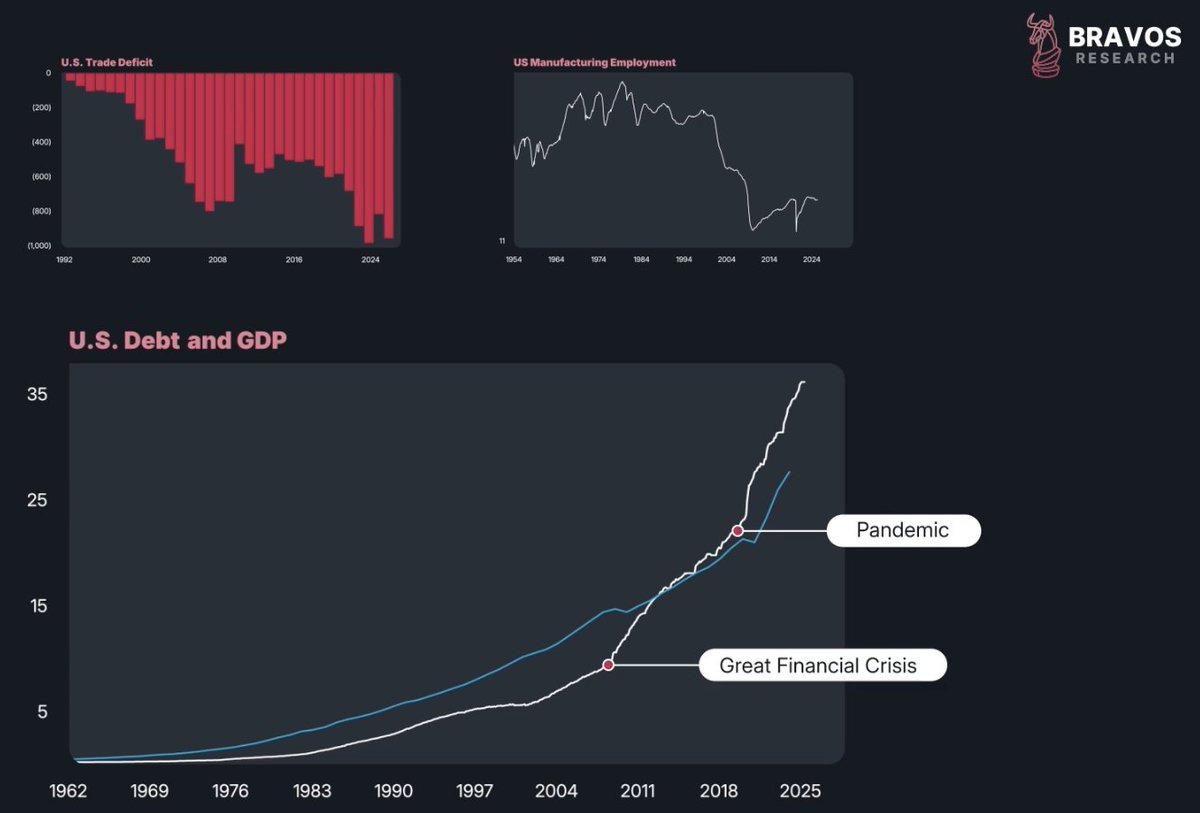

18/ The US trade deficit has ballooned over the past 30 years

Fewer goods are produced at home, and entire sectors, like manufacturing, have been hollowed out

This can be seen by the employment trends in the US manufacturing industry

Fewer goods are produced at home, and entire sectors, like manufacturing, have been hollowed out

This can be seen by the employment trends in the US manufacturing industry

19/ At the same time, US government debt has exploded

America is now one of the most indebted countries in the world

With government liabilities exceeding GDP, and COVID only made it worse

America is now one of the most indebted countries in the world

With government liabilities exceeding GDP, and COVID only made it worse

20/ Ideally, the US should cut spending and raise taxes to fix the deficit

But both are politically painful

The easier path is to let the dollar fall

Which would stimulate growth and make debt cheaper to repay

But both are politically painful

The easier path is to let the dollar fall

Which would stimulate growth and make debt cheaper to repay

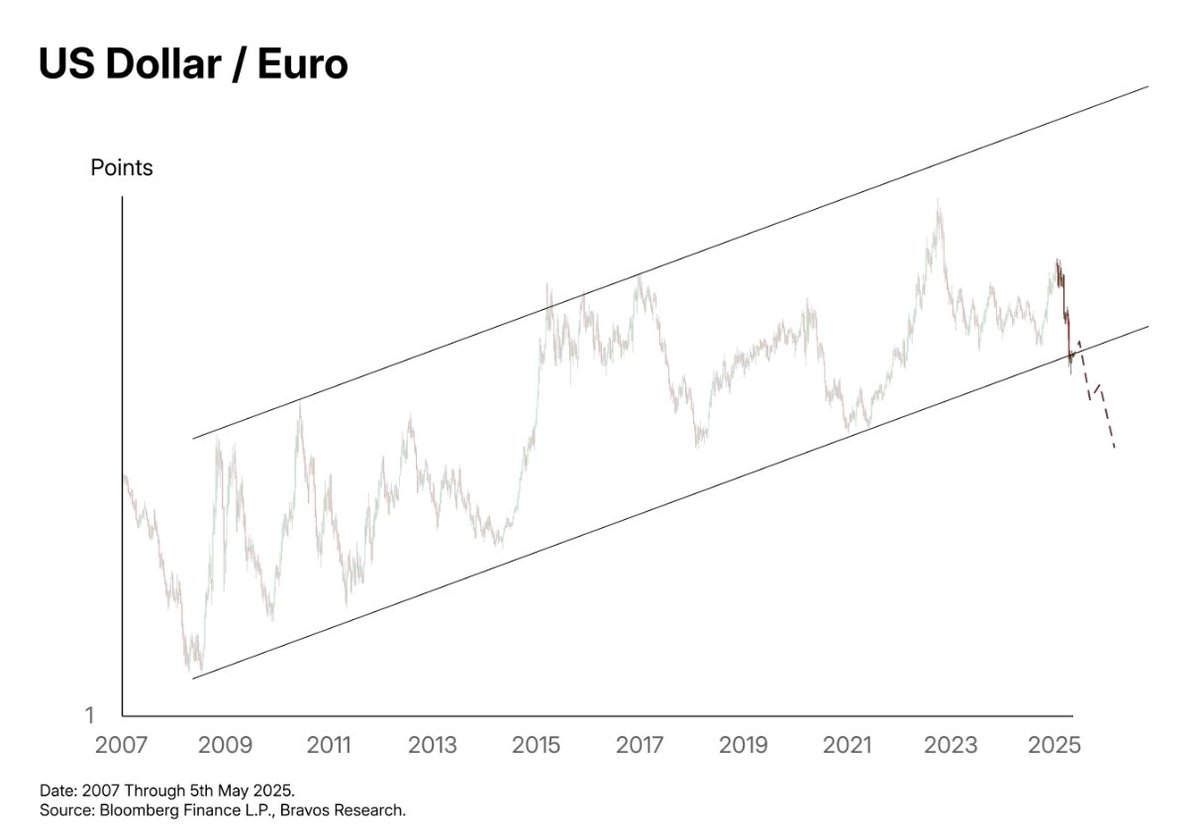

21/ Technically, the dollar is also showing cracks

Its exchange rate against the euro, one of the key components of DXY, has broken below a long-term uptrend that started in 2008

That’s a serious breakdown

Its exchange rate against the euro, one of the key components of DXY, has broken below a long-term uptrend that started in 2008

That’s a serious breakdown

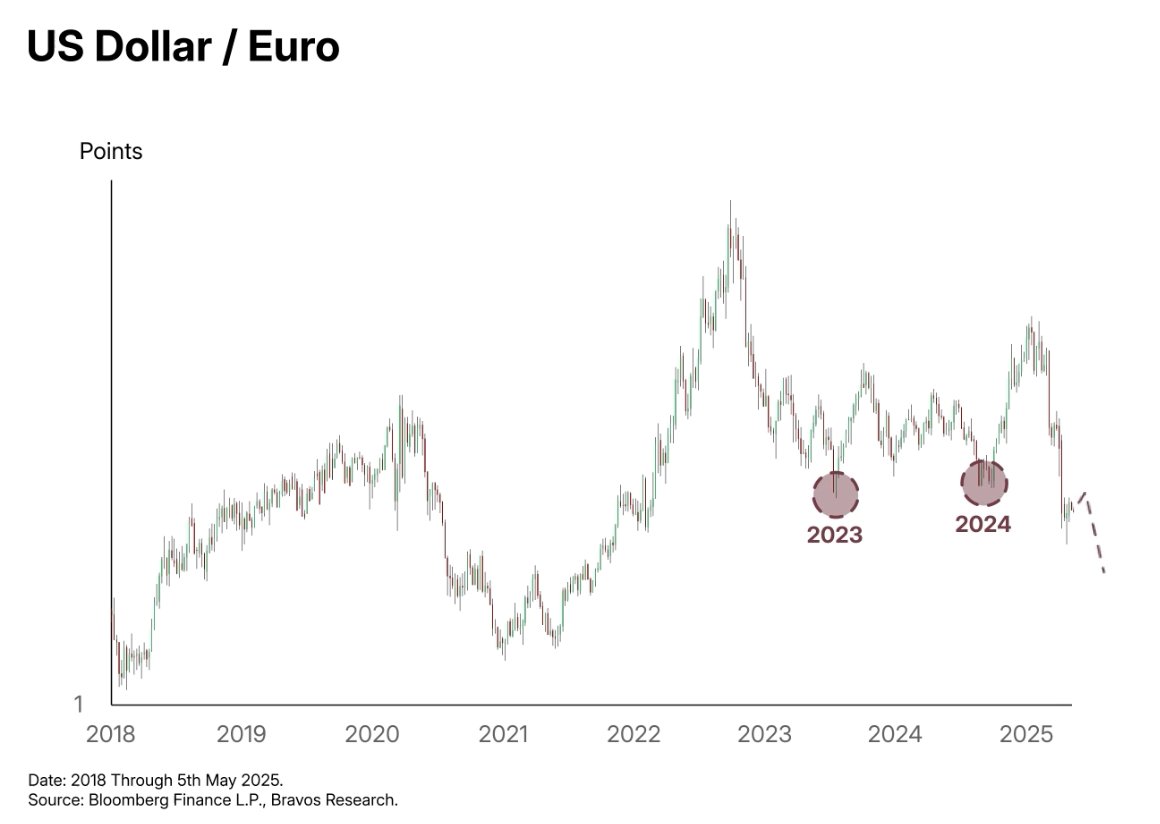

22/ We weren’t bullish on the dollar during the dips in ‘23 and ‘24

Today, we’re not convinced it can recover like before though

That said, nothing is guaranteed

If you’re trading the dollar, manage your risk carefully

Today, we’re not convinced it can recover like before though

That said, nothing is guaranteed

If you’re trading the dollar, manage your risk carefully

23/ If you’re sitting on a lot of US dollars and concerned about a decline, there are steps you can take

This isn’t financial advice, just educational

First, diversify your currency exposure

You don’t need to keep all your cash in USD

This isn’t financial advice, just educational

First, diversify your currency exposure

You don’t need to keep all your cash in USD

24/ One option is the Swiss franc

It doesn’t offer much yield

But it has a strong history of holding value vs. the dollar

Switzerland has very low government debt

Which supports long-term currency strength and investor confidence

It doesn’t offer much yield

But it has a strong history of holding value vs. the dollar

Switzerland has very low government debt

Which supports long-term currency strength and investor confidence

25/ The second option: Own assets

If the dollar weakens, things like housing, stocks, oil, gold, and Bitcoin should benefit

In fact, we just released a video on how Bitcoin fits into the current macro setup:

If the dollar weakens, things like housing, stocks, oil, gold, and Bitcoin should benefit

In fact, we just released a video on how Bitcoin fits into the current macro setup:

26/ Our members have seen solid returns in the past year

With an avg. win of 16.65% and an avg. loss of just 3.67%

View our track record for FREE at:

go.bravosresearch.com/X

With an avg. win of 16.65% and an avg. loss of just 3.67%

View our track record for FREE at:

go.bravosresearch.com/X

27/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

https://x.com/bravosresearch/status/1921960892293374085

• • •

Missing some Tweet in this thread? You can try to

force a refresh