BEST BITCOIN OPPORTUNITIES ISSUE #2

BTC is at $102K and there's so much to do with it.

Let's make your orange coin grow🧵👇

BTC is at $102K and there's so much to do with it.

Let's make your orange coin grow🧵👇

2) @OG_RogerTennis 🤝 @protocol_fx

This was a strategy thought up by my strategist friend, Roger, and it's quite clever.

TL;DR: 9.6% APR on BTC

The idea is simple:

Have the notional value of your long be exactly 1 principal's worth more than the notional value of your short.

The math, however, gets sticky, but I built a tool for it.

Example: $10,000 Starting Capital

► Long Leverage: 3x

► Short Leverage: 2x

Using these starting conditions, you get

► Long Margin: $6,000

► Short Margin: $4,000

► Your Long Notional Exposure is $18,000

► Your Short Notional Exposure is $8,000

So your NET LONG exposure is $10,000

I.E., you keep 100% of your long exposure, but now you're farming the funding on the short.

AND, you don't pay interest on the long because you're using @protocol_fx

Do mind your entries and exits.

Someone should build a vault for this.

This was a strategy thought up by my strategist friend, Roger, and it's quite clever.

TL;DR: 9.6% APR on BTC

The idea is simple:

Have the notional value of your long be exactly 1 principal's worth more than the notional value of your short.

The math, however, gets sticky, but I built a tool for it.

Example: $10,000 Starting Capital

► Long Leverage: 3x

► Short Leverage: 2x

Using these starting conditions, you get

► Long Margin: $6,000

► Short Margin: $4,000

► Your Long Notional Exposure is $18,000

► Your Short Notional Exposure is $8,000

So your NET LONG exposure is $10,000

I.E., you keep 100% of your long exposure, but now you're farming the funding on the short.

AND, you don't pay interest on the long because you're using @protocol_fx

Do mind your entries and exits.

Someone should build a vault for this.

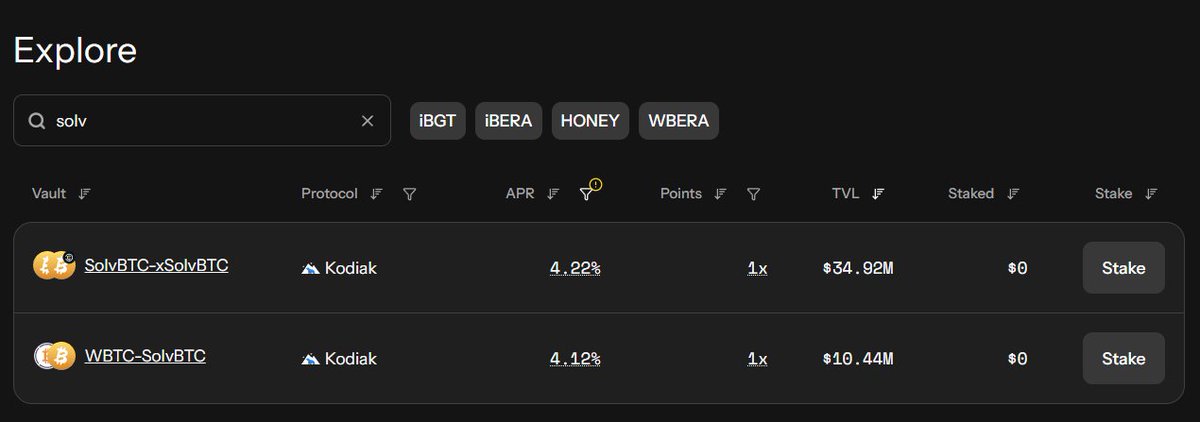

3) @SolvProtocol 🤝 @VelodromeFi

This is on @soneium, but the APR is nice.

Granted, 15% does imply a +/- 0.01% tick range, which is TIGHT.

But even at +/- 0.03%, you're still squeezing out 6%, which is good for a BTC yield.

This is on @soneium, but the APR is nice.

Granted, 15% does imply a +/- 0.01% tick range, which is TIGHT.

But even at +/- 0.03%, you're still squeezing out 6%, which is good for a BTC yield.

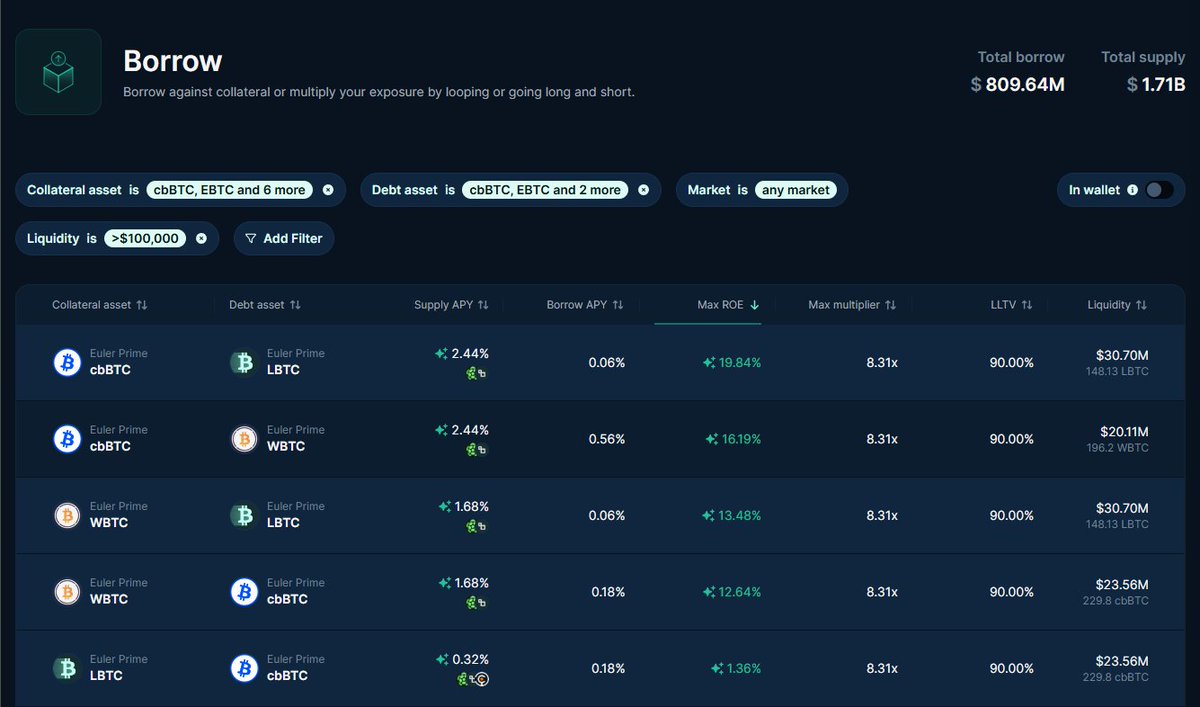

4) @eulerfinance has LOOPS

Here, you can farm rEUL up to 20% APR for looping cbBTC against LBTC.

And, there's $30M in liquidity to do so.

AS A REMINDER, you do need to vest rEUL (or take a haircut) to realize those emissions entirely, but EUL has held up VERY strongly this cycle.

Here, you can farm rEUL up to 20% APR for looping cbBTC against LBTC.

And, there's $30M in liquidity to do so.

AS A REMINDER, you do need to vest rEUL (or take a haircut) to realize those emissions entirely, but EUL has held up VERY strongly this cycle.

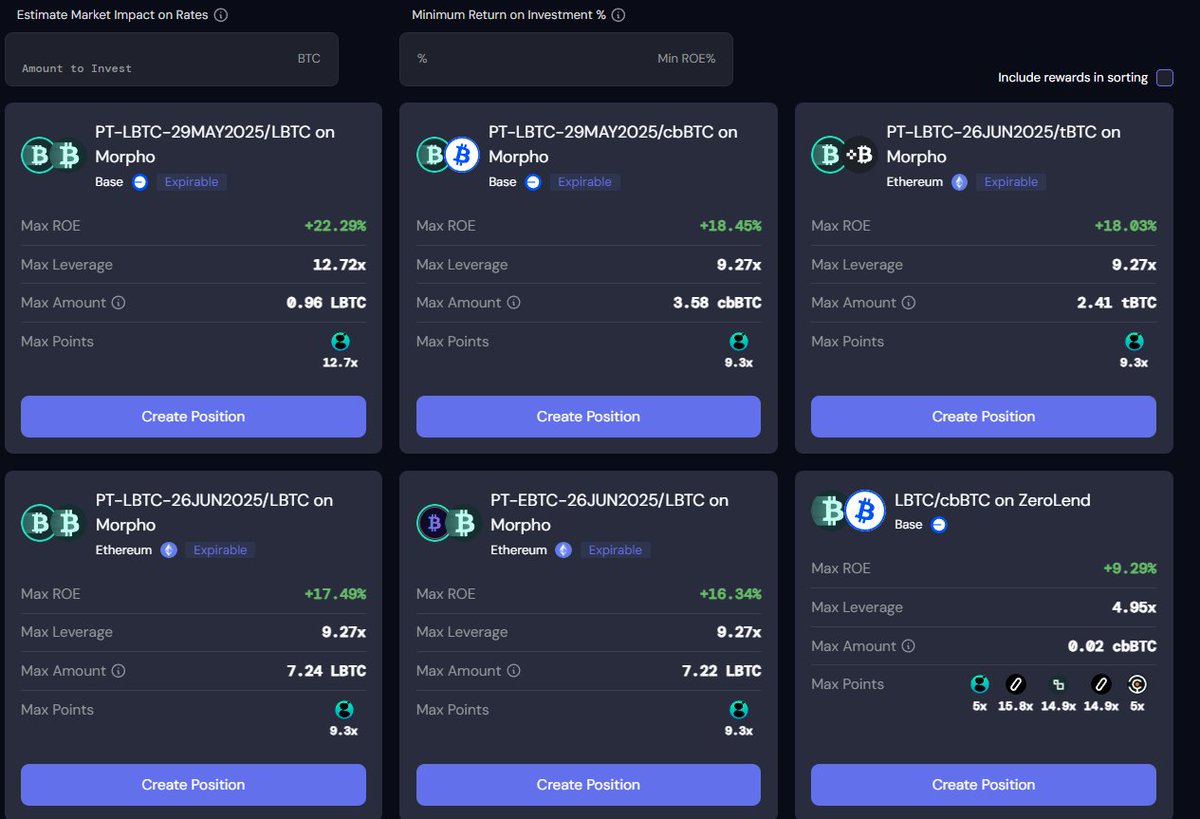

5) @MorphoLabs has @pendle_fi Loops

PT-eBTC: 2% Fixed / 0.23% Borrow Cost

PT-LBTC: 2% Fixed / 0.17% Borrow Cost

At 10X Leverage:

PT-eBTC: 17.93% APR

PT-LBTC: 18.47% APR

And, there $5.4M to borrow from each market.

PT-eBTC: 2% Fixed / 0.23% Borrow Cost

PT-LBTC: 2% Fixed / 0.17% Borrow Cost

At 10X Leverage:

PT-eBTC: 17.93% APR

PT-LBTC: 18.47% APR

And, there $5.4M to borrow from each market.

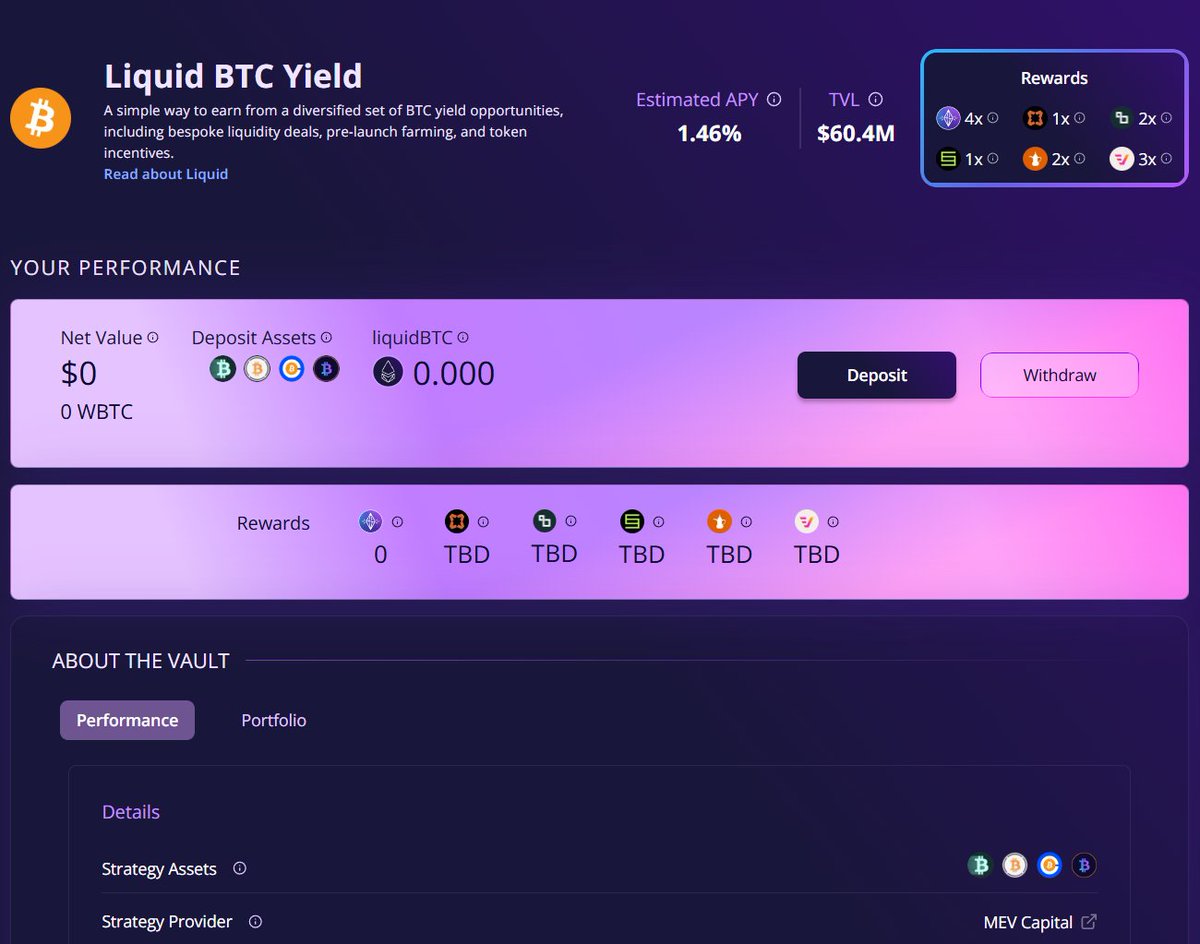

6) @ether_fi lets you spend money against yieldy BTC.

You can use EtherFi's Cash Card to spend dollars (currently interest free) against your LiquidBTC holdings.

► 1.46% APR on the BTC

► 3% Cashback on the spend

It's a neat way to go perma-long BTC while being able to pay your bills.

Use this reflink to get $50 back after the first $1K spent: ether.fi/refer/defidojo

You can use EtherFi's Cash Card to spend dollars (currently interest free) against your LiquidBTC holdings.

► 1.46% APR on the BTC

► 3% Cashback on the spend

It's a neat way to go perma-long BTC while being able to pay your bills.

Use this reflink to get $50 back after the first $1K spent: ether.fi/refer/defidojo

7) @0xfluid

Fluid has had some incredible BTC smart collateral looping opportunities recently.

Here's another one:

cbBTC/LBTC Smart Collateral: 3.43% APR

WBTC Debt: 1.63% APR

Leverage: 10x

Math:

3.43%*10 - 1.63%*9

= 19.63% APR

Fluid has had some incredible BTC smart collateral looping opportunities recently.

Here's another one:

cbBTC/LBTC Smart Collateral: 3.43% APR

WBTC Debt: 1.63% APR

Leverage: 10x

Math:

3.43%*10 - 1.63%*9

= 19.63% APR

8) If you're ever unsure what to do @Contango_xyz has your back

TL;DR: 10%-23% APRs on BTC with one-click leverage.

Great place for people who love capital efficiency and easy entrants / exits.

TL;DR: 10%-23% APRs on BTC with one-click leverage.

Great place for people who love capital efficiency and easy entrants / exits.

Bitcoin yields are still somewhat hard to find.

BUT, they do exist. Let's hope BTCfi makes another resurgence soon.

Ambassadors mentioned:

- Pendle

- Euler

- f(x)

- Solv

- EtherFi

- Contango

BUT, they do exist. Let's hope BTCfi makes another resurgence soon.

Ambassadors mentioned:

- Pendle

- Euler

- f(x)

- Solv

- EtherFi

- Contango

• • •

Missing some Tweet in this thread? You can try to

force a refresh