Republicans ran on a pledge to "terminate" the trillion-dollar Inflation Reduction Act subsidies, aka "the Green New Scam."

But their proposed budget keeps almost all the subsidies, while falsely claiming to save money through easily-reversed “phaseouts” starting in 4 years!

🧵

But their proposed budget keeps almost all the subsidies, while falsely claiming to save money through easily-reversed “phaseouts” starting in 4 years!

🧵

If you’re just joining the conversation about the IRA subsidies, here’s what you need to know: they are subsidies for inferior forms of energy that cost a fortune, raise energy costs, and make our grid unreliable—especially the solar/wind subsidies.

https://twitter.com/32913997/status/1915816725062341102

The IRA subsidies should all be fully repealed.

It is possible that some sort of compromise is absolutely necessary to repeal most of the IRA.

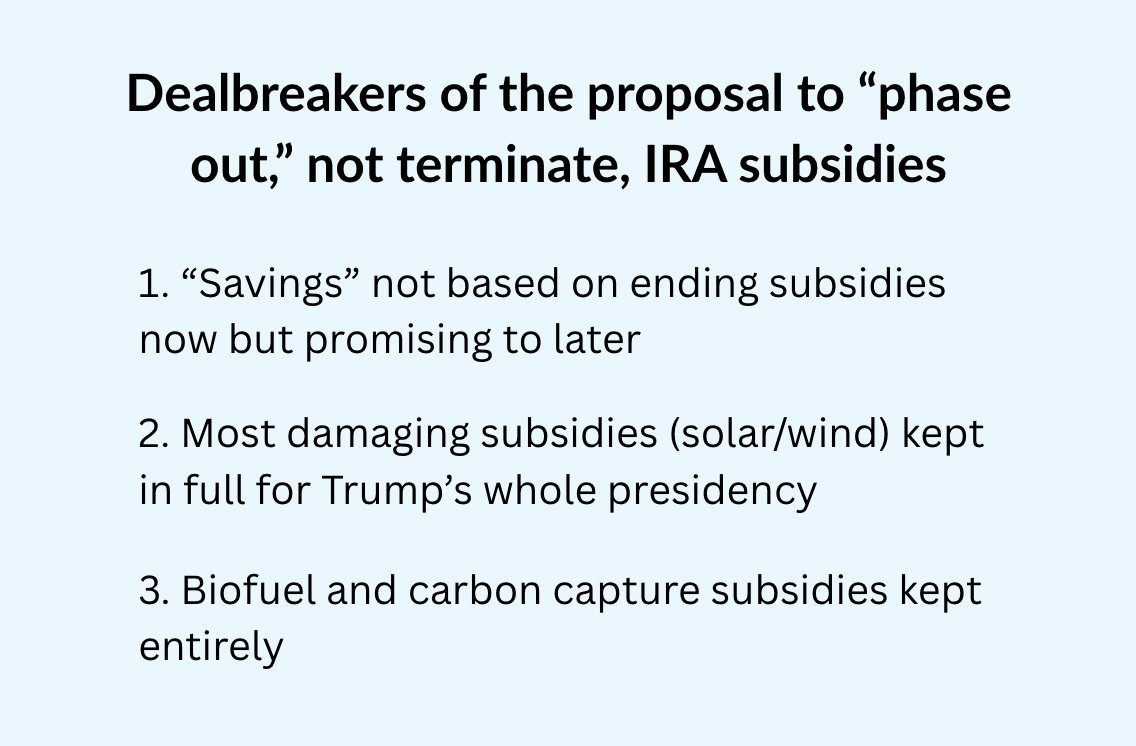

However, the current proposal from House Ways and Means does not repeal the IRA subsidies in any meaningful way due to 3 fatal flaws.

It is possible that some sort of compromise is absolutely necessary to repeal most of the IRA.

However, the current proposal from House Ways and Means does not repeal the IRA subsidies in any meaningful way due to 3 fatal flaws.

Dealbreaker 1: The overwhelming majority of the bill's "savings" are based not on truly ending subsidies now, but on empty promises of "phaseouts" that start 4 years in the future and can easily be reversed by future Congresses.

Multiple tax credits, including the most expensive and destructive solar/wind ITC and PTC, aren’t being eliminated—only "phased out" starting 4 or more years from now.

Hence the overwhelming majority of the bill's "savings" have no chance of happening in the near-term.

Hence the overwhelming majority of the bill's "savings" have no chance of happening in the near-term.

Only 3% of PTC’s savings, 26% of ITC’s planned savings, 20% of 45Q’s savings, and 7% of 45U’s 10-year savings are projected to come between 2025-2029—the rest will come starting 2030, three Congresses from now and when Trump will be out of office!

The most important thing to know about a “phaseout” of subsidies is that, unlike the promised “termination” of subsidies, a “phaseout” is easily reversed by future Congresses under pressure by lobbyists.

The vast majority of the current bill’s “savings” are wishful thinking.

The vast majority of the current bill’s “savings” are wishful thinking.

After the phony "phaseout" period is complete, subsidies don't even truly end—it's only subsidies for *new projects* that end.

Projects that come online by 2031 are grandfathered in and can keep collecting "production" subsidies for up to 10 more years!

Projects that come online by 2031 are grandfathered in and can keep collecting "production" subsidies for up to 10 more years!

Myth: A lot of the solar and wind subsidies won’t happen because of strict anti-China provisions.

Truth: The same solar/wind lobbyists who successfully lobbied for a subsidy bonanza under this bill have accepted these provisions because they know they’re gameable.

Truth: The same solar/wind lobbyists who successfully lobbied for a subsidy bonanza under this bill have accepted these provisions because they know they’re gameable.

Anti-China requirements

1. Can be easily reversed

2. Can be flexibly interpreted by agencies pressured by lobbyists

3. Can be avoided by rerouting/relabeling supply chains or investments—as anti-China provisions under the IRA already were

1. Can be easily reversed

2. Can be flexibly interpreted by agencies pressured by lobbyists

3. Can be avoided by rerouting/relabeling supply chains or investments—as anti-China provisions under the IRA already were

Dealbreaker 2: There isn't even a promise to start phasing out the most damaging IRA subsidies, those for solar and wind, until after Trump is President!

For the next 4 years government will keep giving grid-destroying 10-year subsidies for new solar and wind projects!

For the next 4 years government will keep giving grid-destroying 10-year subsidies for new solar and wind projects!

The most important responsibility for Republicans regarding the IRA is to cut all existing and future subsidies for solar and wind, as these subsidies flood our grid with unreliable electricity.

The current proposal cuts no existing subsidies and keeps almost all futures ones.

The current proposal cuts no existing subsidies and keeps almost all futures ones.

https://twitter.com/32913997/status/1915816891563794566

The one solar and wind subsidy cut is for home solar buyers, but this is phony—because it will just cause people to (even more inefficiently) lease systems that will still get subsidies under the ITC (whose "phaseout" starts in 2029 when Trump is gone!).

Dealbreaker 3: Two huge subsidies are kept, “clean fuels” (including biofuels, which is actually extended!) and carbon capture.

Both of these are huge giveaways for expensive CO2 reduction activities that can’t meaningfully scale.

Both of these are huge giveaways for expensive CO2 reduction activities that can’t meaningfully scale.

The solution:

If full IRA repeal is politically impossible, and compromise is necessary to help those with existing projects depending on IRA: end all subsidies now but grandfather existing projects (for as few subsidies as possible, don't do for grid-killing wind subsidies).

If full IRA repeal is politically impossible, and compromise is necessary to help those with existing projects depending on IRA: end all subsidies now but grandfather existing projects (for as few subsidies as possible, don't do for grid-killing wind subsidies).

In a grandfathering scenario, only the following projects should be included:

- Projects with construction completed or significant construction started

- Projects that already made >10% of the project expenditures

- Projects that entered into legally binding agreements with suppliers or clients, where the termination of such agreements would result in them having to pay >10% of the project expenditures in penalties.

Projects at the permitting stage shouldn’t be accepted.

Grandfathering for projects should also only cover the elements of the projects that are currently in the process of being substantively worked upon, not all the elements announced as part of the projects.

If only existing projects are grandfathered in, it would reduce the cost of the IRA by 60% from the currently projected $1.09 trillion (Cato) to $620.6 billion.

And unlike phony future “phaseout” savings that will easily be reversed, this proposal’s immediate subsidy termination (with grandfathering) gives us a real chance of being done with the IRA “Green New Scam” for good.

- Projects with construction completed or significant construction started

- Projects that already made >10% of the project expenditures

- Projects that entered into legally binding agreements with suppliers or clients, where the termination of such agreements would result in them having to pay >10% of the project expenditures in penalties.

Projects at the permitting stage shouldn’t be accepted.

Grandfathering for projects should also only cover the elements of the projects that are currently in the process of being substantively worked upon, not all the elements announced as part of the projects.

If only existing projects are grandfathered in, it would reduce the cost of the IRA by 60% from the currently projected $1.09 trillion (Cato) to $620.6 billion.

And unlike phony future “phaseout” savings that will easily be reversed, this proposal’s immediate subsidy termination (with grandfathering) gives us a real chance of being done with the IRA “Green New Scam” for good.

Myth: “The Ways and Means Republican tax bill ends special interest giveaways”

Truth: It either keeps the giveaways totally (carbon capture subsidies, biofuel subsidies) or makes a easily-reversible promise to phase them out in 4+ years.

Truth: It either keeps the giveaways totally (carbon capture subsidies, biofuel subsidies) or makes a easily-reversible promise to phase them out in 4+ years.

Myth: "Repeals and phases out every green corporate welfare subsidy in the Democrats’ Inflation Act"

Truth: Carbon capture and “clean fuel” subsidies (e.g., biofuels) are not repealed or phased out—and the "phased out" subsidies will be easily be reversed by a future Congress.

Truth: Carbon capture and “clean fuel” subsidies (e.g., biofuels) are not repealed or phased out—and the "phased out" subsidies will be easily be reversed by a future Congress.

• • •

Missing some Tweet in this thread? You can try to

force a refresh