Investing is an art.

But it’s also a craft and a science at the same time.

In this thread, I’ll teach you how to value a stock.

But it’s also a craft and a science at the same time.

In this thread, I’ll teach you how to value a stock.

1. Keep It Simple

Great investors use common sense.

If you need an Excel sheet to decide if a stock is interesting, it probably isn’t.

Simplicity and patience win in investing.

Great investors use common sense.

If you need an Excel sheet to decide if a stock is interesting, it probably isn’t.

Simplicity and patience win in investing.

2. The Rule of 72

Want to know how long it takes to double your money?

Divide 72 by your yearly return.

9% return = 8 years to double

15% return = 4.8 years

Doubling every 5 years? That’s a solid goal.

Want to know how long it takes to double your money?

Divide 72 by your yearly return.

9% return = 8 years to double

15% return = 4.8 years

Doubling every 5 years? That’s a solid goal.

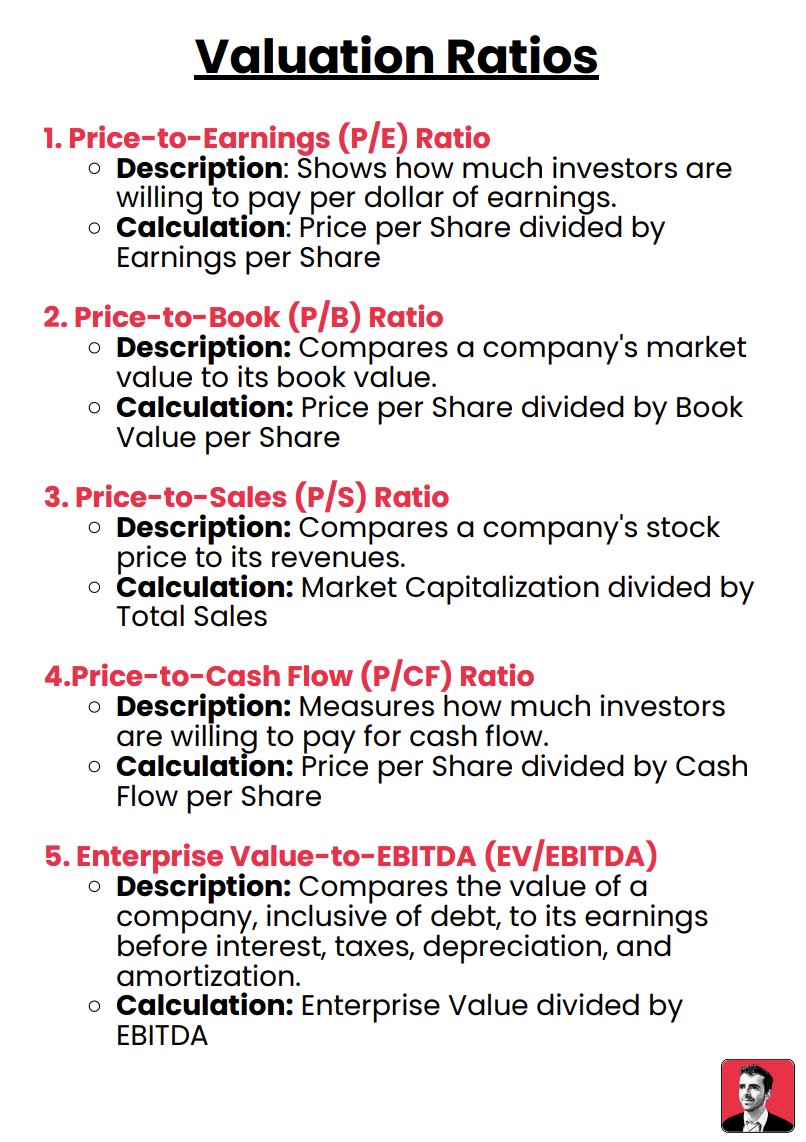

3. Stock Price Formula

Stock Price = Earnings Per Share (EPS) × P/E Ratio

Two key questions to ask:

How much will the company earn in 5 years?

What P/E ratio should it trade at?

Stock Price = Earnings Per Share (EPS) × P/E Ratio

Two key questions to ask:

How much will the company earn in 5 years?

What P/E ratio should it trade at?

4. A Simple Example

Company X earns $1 per share and trades at 20x earnings.

Today’s stock price: $1 × 20 = $20

If earnings grow to $2.5 per share and the P/E contracts to 16x in 5 years:

Future stock price: $2.5 × 16 = $40

Your money just doubled.

Company X earns $1 per share and trades at 20x earnings.

Today’s stock price: $1 × 20 = $20

If earnings grow to $2.5 per share and the P/E contracts to 16x in 5 years:

Future stock price: $2.5 × 16 = $40

Your money just doubled.

5. The Earnings Growth Model

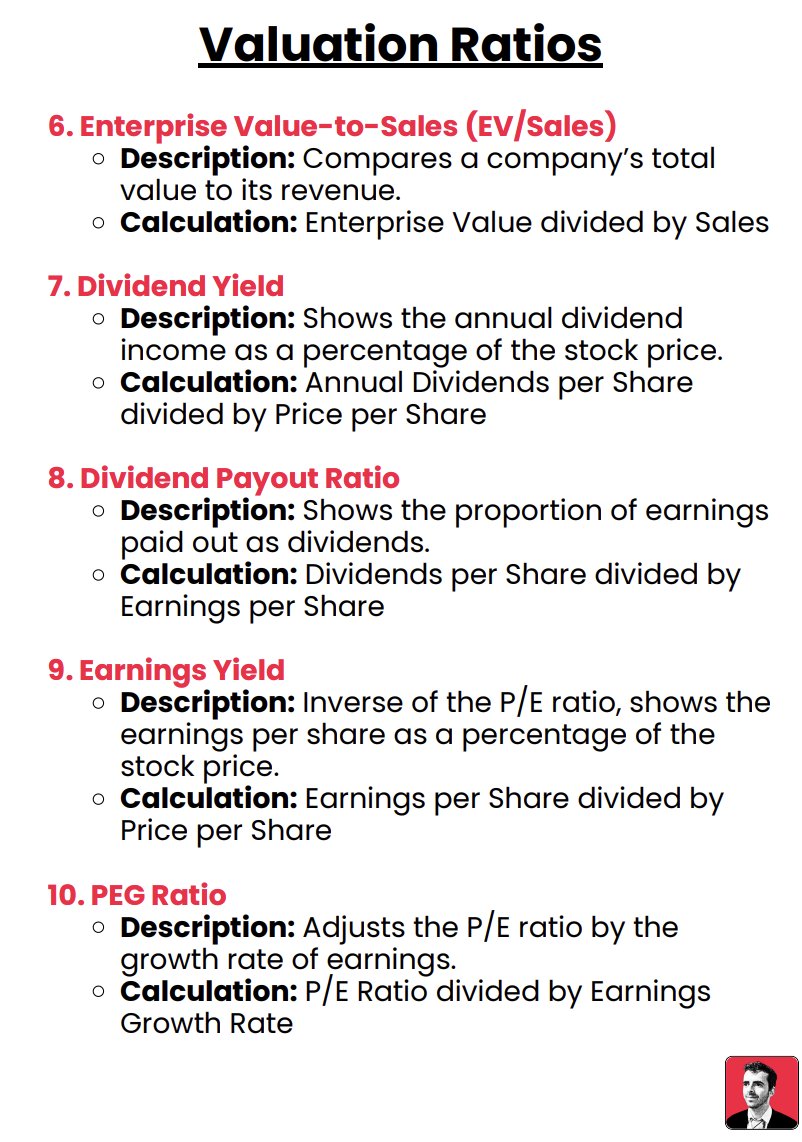

This model estimates your return based on:

1️⃣ Expected EPS growth

2️⃣ Dividend yield

3️⃣ Change in valuation

This model estimates your return based on:

1️⃣ Expected EPS growth

2️⃣ Dividend yield

3️⃣ Change in valuation

6. How to Estimate EPS Growth

Look at:

📈 Past earnings growth

📊 Analyst projections

📢 Management guidance

Adjust for a margin of safety: analysts are often too optimistic.

Look at:

📈 Past earnings growth

📊 Analyst projections

📢 Management guidance

Adjust for a margin of safety: analysts are often too optimistic.

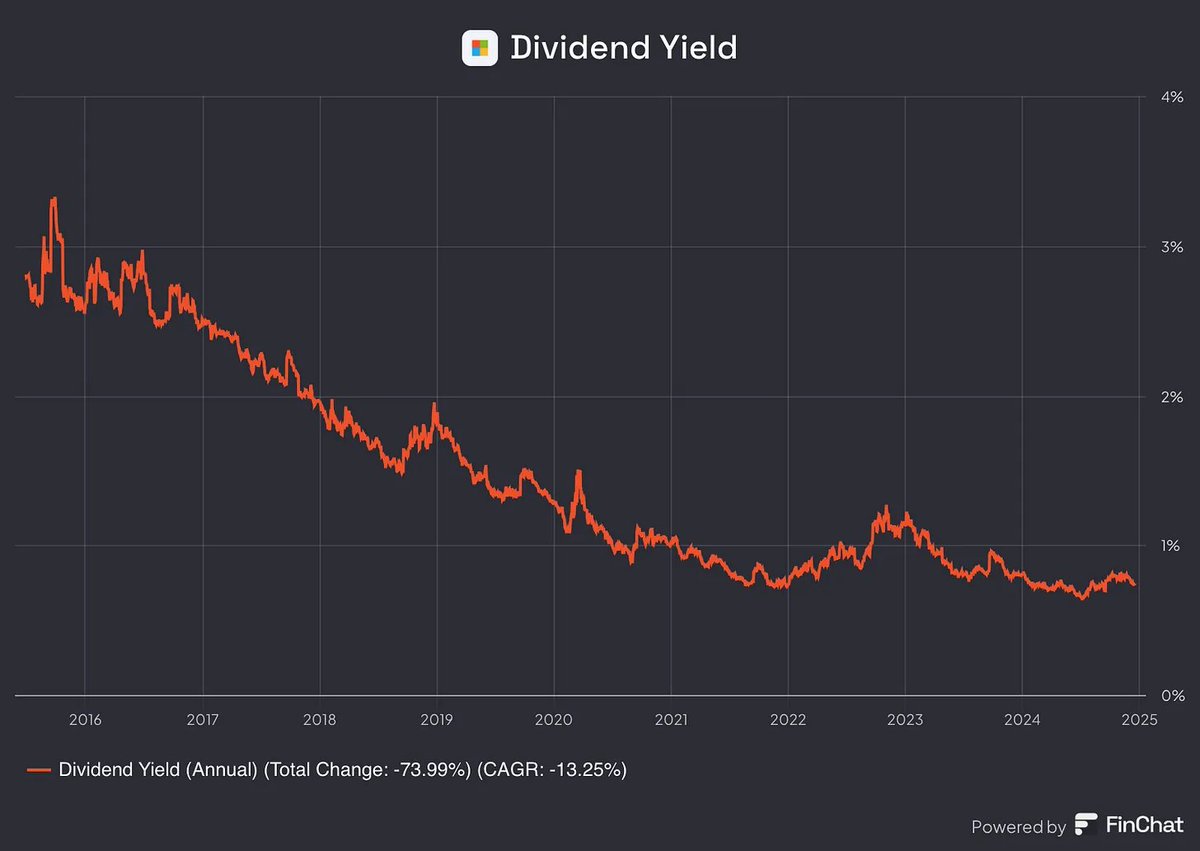

7. The Role of Dividend Yield

Dividend Yield = Dividend per Share ÷ Stock Price

Even a small dividend adds up over time.

Dividend Yield = Dividend per Share ÷ Stock Price

Even a small dividend adds up over time.

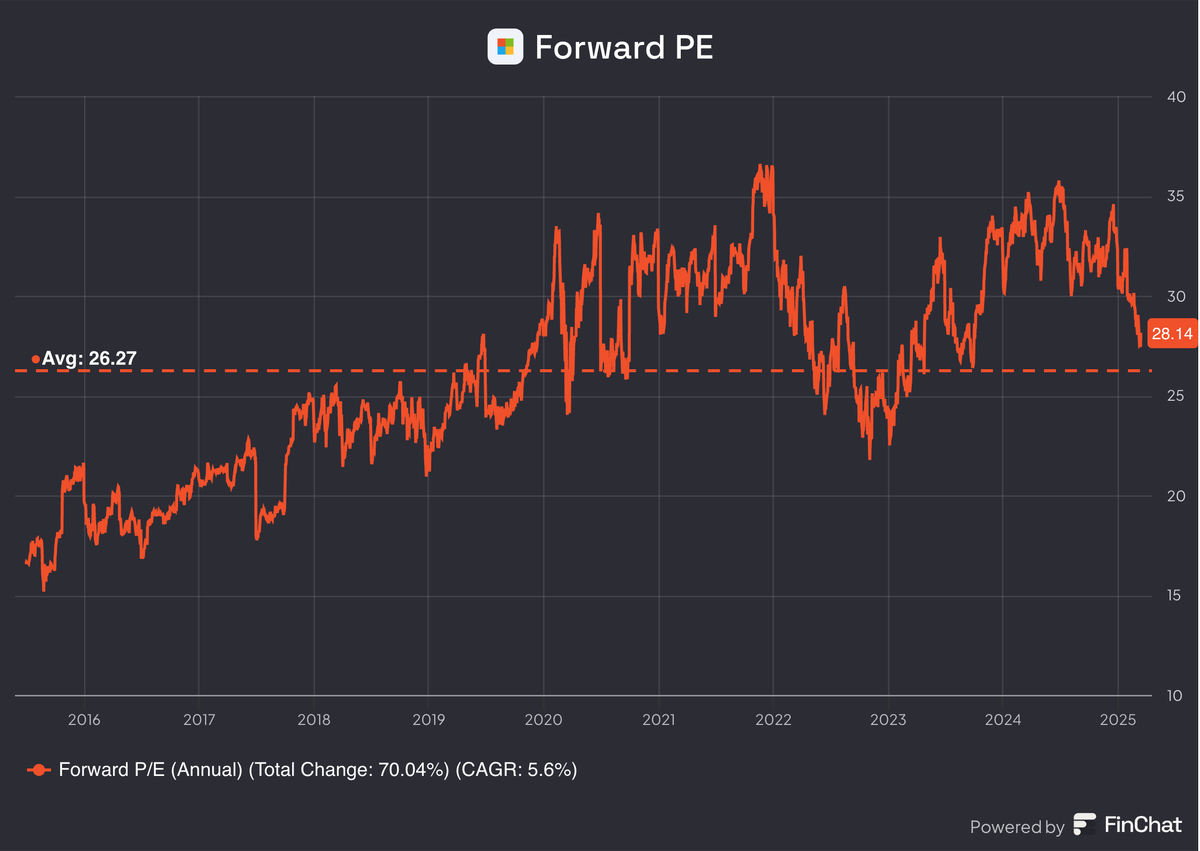

8. Valuation Changes Matter

If a stock’s P/E rises, your return increases.

If it contracts, it drags your return down.

Example: Microsoft’s P/E is 28.1x today, but its 10-year average is 26.3x.

A lower future P/E means a lower return.

If a stock’s P/E rises, your return increases.

If it contracts, it drags your return down.

Example: Microsoft’s P/E is 28.1x today, but its 10-year average is 26.3x.

A lower future P/E means a lower return.

9. Calculating Your Expected Return

Expected Return = 10% + 0.8% + 0.1 * ((26.3x- 28.1x)/ 28.1x)

Using this model, Microsoft is expected to return 10.2% per year.

That means your money doubles every ~7 years.

Expected Return = 10% + 0.8% + 0.1 * ((26.3x- 28.1x)/ 28.1x)

Using this model, Microsoft is expected to return 10.2% per year.

That means your money doubles every ~7 years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh