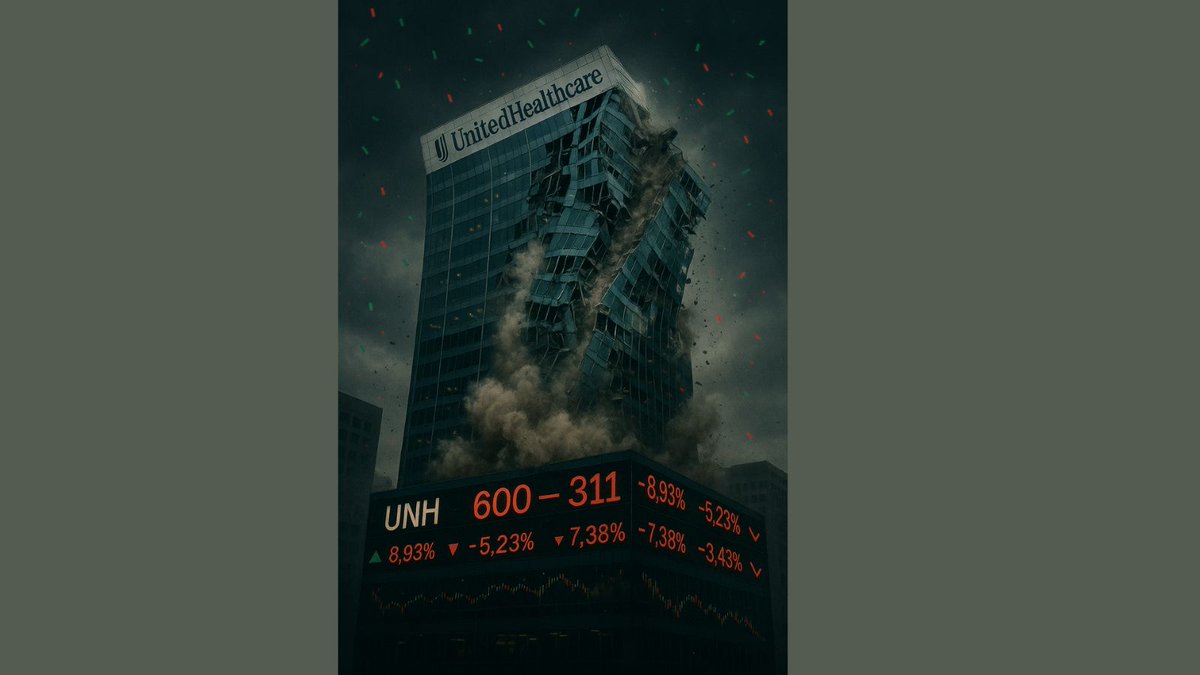

UnitedHealth just lost $288 billion.

The CEO vanished.

The DOJ is circling.

But sure, tell me again how “essential” they are.

A thread 🧵on the implosion of America’s biggest health insurer @UHC —and what it says about our system:

[1/]

The CEO vanished.

The DOJ is circling.

But sure, tell me again how “essential” they are.

A thread 🧵on the implosion of America’s biggest health insurer @UHC —and what it says about our system:

[1/]

UnitedHealth ($UNH), the largest health insurer in the U.S., is under federal criminal investigation for possible Medicare fraud.

Stock is down 50%.

CEO Andrew Witty “resigned” for personal reasons.

Investors are stunned.

Patients?

Just trying to get someone to approve their MRI.

[2/]

Stock is down 50%.

CEO Andrew Witty “resigned” for personal reasons.

Investors are stunned.

Patients?

Just trying to get someone to approve their MRI.

[2/]

This isn’t just a company collapsing;

it’s the entire healthcare industry revealing its true nature.

If you’re saving this, you must definitely follow @DutchRojas.

He has been highlighting these issues for years.

Healthcare isn’t failing;

it’s operating exactly as it was intended to.

[3/]

it’s the entire healthcare industry revealing its true nature.

If you’re saving this, you must definitely follow @DutchRojas.

He has been highlighting these issues for years.

Healthcare isn’t failing;

it’s operating exactly as it was intended to.

[3/]

@UHC The DOJ’s healthcare fraud unit is reportedly leading the probe.

UnitedHealth responded like every well-lawyered corporation under fire:

“We haven’t been notified, but we deny it anyway.”

[4/]

UnitedHealth responded like every well-lawyered corporation under fire:

“We haven’t been notified, but we deny it anyway.”

[4/]

@UHC Meanwhile, UnitedHealth quietly dragged its CEO offstage and brought back their former CEO from 2006–2017.

Because nothing screams “accountability” like asking the guy who built the Death Star to come fix the Death Star.

[5/]

Because nothing screams “accountability” like asking the guy who built the Death Star to come fix the Death Star.

[5/]

Let’s rewind:

• They “pay bills” on behalf of 51 million people

• Run one of the largest PBMs in the world

• Control the care and the coverage

• Called a “nonprofit partner” in some states

• Now under investigation for defrauding Medicare

This isn’t healthcare. It’s a casino.

[6/]

• They “pay bills” on behalf of 51 million people

• Run one of the largest PBMs in the world

• Control the care and the coverage

• Called a “nonprofit partner” in some states

• Now under investigation for defrauding Medicare

This isn’t healthcare. It’s a casino.

[6/]

@UHC This is what happens when the US government writes laws that help large corporations more than citizens.

Profits go up

Patient care stagnates

Accountability disappears

And the government becomes a silent business partner.

Everyone eats—except the sick.

[7/]

Profits go up

Patient care stagnates

Accountability disappears

And the government becomes a silent business partner.

Everyone eats—except the sick.

[7/]

@UHC And yet people were on CNBC this week saying UnitedHealth was “essential.”

If United Healthcare is essential, then fraud is just billing innovation.

[8/]

If United Healthcare is essential, then fraud is just billing innovation.

[8/]

@UHC Here’s the full story UnitedHealth probably doesn’t want you to read:

Healthcare in America isn’t broken.

It’s doing exactly what it’s supposed to—

for shareholders.

[9/] wsj.com/us-news/united…

Healthcare in America isn’t broken.

It’s doing exactly what it’s supposed to—

for shareholders.

[9/] wsj.com/us-news/united…

@UHC If you’re defending UnitedHealth right now,

I hope you’re getting paid in Humira coupons

and rejected prior authorizations.

[10/]

I hope you’re getting paid in Humira coupons

and rejected prior authorizations.

[10/]

• • •

Missing some Tweet in this thread? You can try to

force a refresh