Healthcare. Power. Incentives. Exposing how the system actually works. Physician autonomy. Price transparency. No middlemen. No brakes ⚡️ USMC Forever!

How to get URL link on X (Twitter) App

In much of the South, competition isn’t weak.

In much of the South, competition isn’t weak.

🏎️ Telemetry → Remote Patient Monitoring

🏎️ Telemetry → Remote Patient Monitoring

2/

2/

1/ What is UPL?

1/ What is UPL?

Health systems say they “pay taxes to fund Medicaid.”

Health systems say they “pay taxes to fund Medicaid.”

You’d think RFK—Mr. “Medical Freedom”—would clean house.

You’d think RFK—Mr. “Medical Freedom”—would clean house.

2/ Start with a game:

2/ Start with a game:

The Myth of the Free Market Champion

The Myth of the Free Market Champion

@UCLAHealth 𝗨𝗖𝗟𝗔 𝗛𝗲𝗮𝗹𝘁𝗵 𝗶𝘀 𝗮 “𝗻𝗼𝗻𝗽𝗿𝗼𝗳𝗶𝘁.”

@UCLAHealth 𝗨𝗖𝗟𝗔 𝗛𝗲𝗮𝗹𝘁𝗵 𝗶𝘀 𝗮 “𝗻𝗼𝗻𝗽𝗿𝗼𝗳𝗶𝘁.”

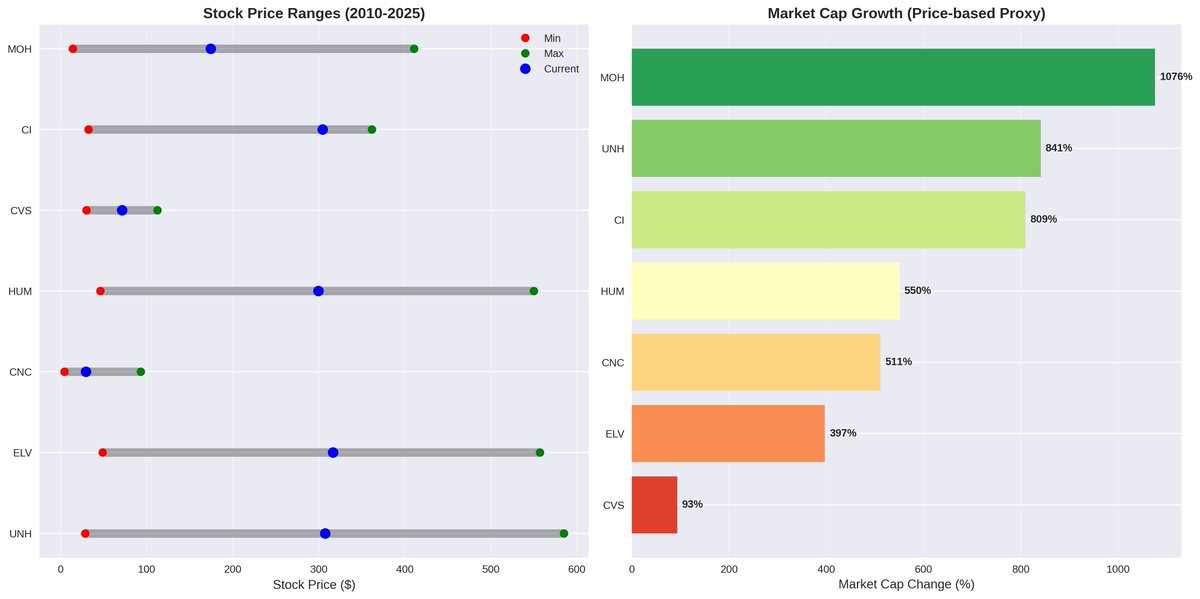

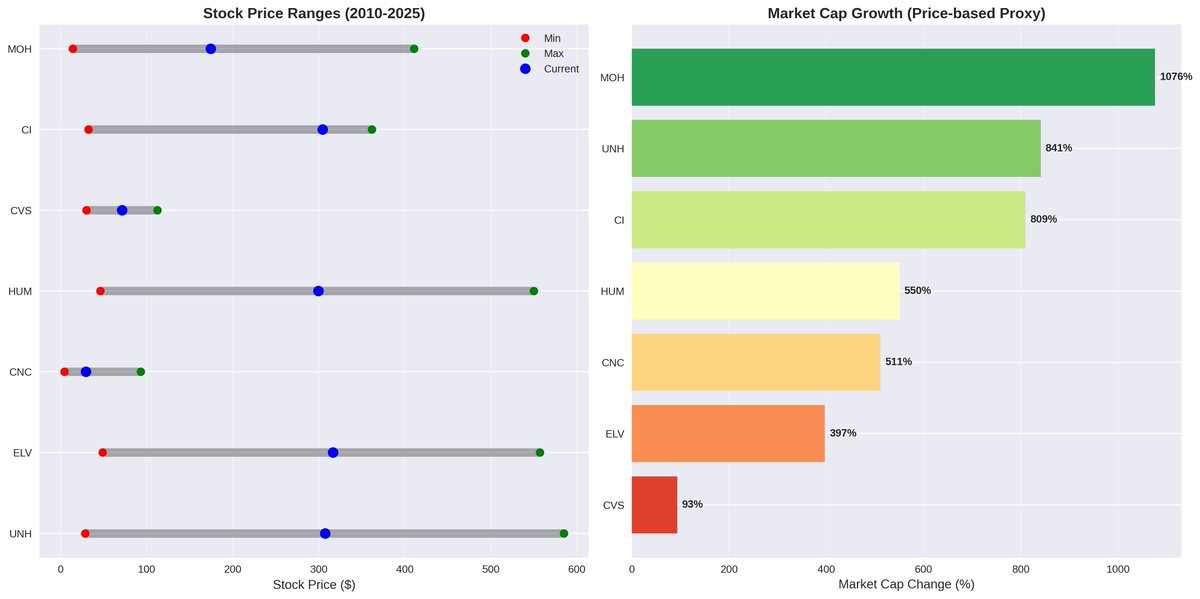

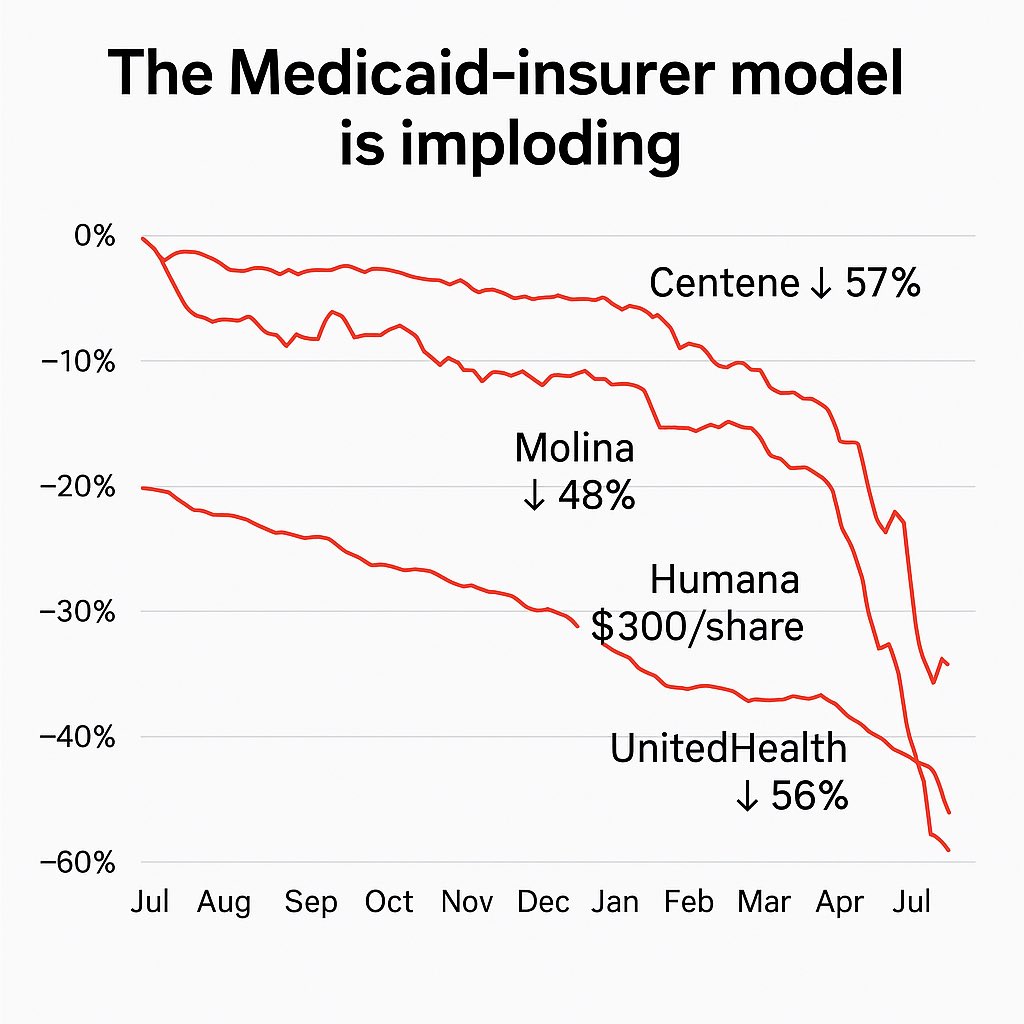

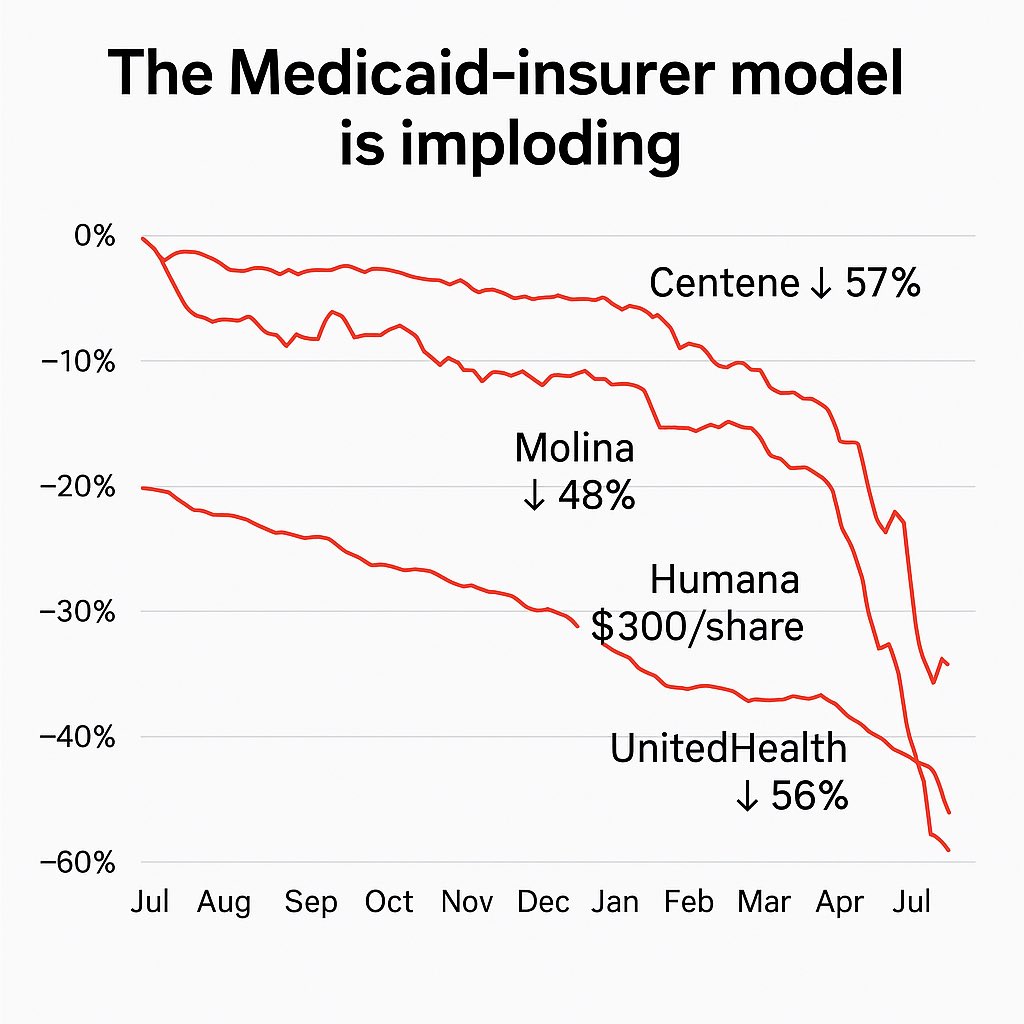

UnitedHealth ($UNH), the largest health insurer in the U.S., is under federal criminal investigation for possible Medicare fraud.

UnitedHealth ($UNH), the largest health insurer in the U.S., is under federal criminal investigation for possible Medicare fraud.