There is no "Maturity Wall" 101.

Though this is a myth you may not be relieved by this thread.

Have you seen the doomer charts about the maturity wall of US Debt. It is a clear signal that you should unfollow those who post it. It usually starts with 9TN of debt comes due.

Though this is a myth you may not be relieved by this thread.

Have you seen the doomer charts about the maturity wall of US Debt. It is a clear signal that you should unfollow those who post it. It usually starts with 9TN of debt comes due.

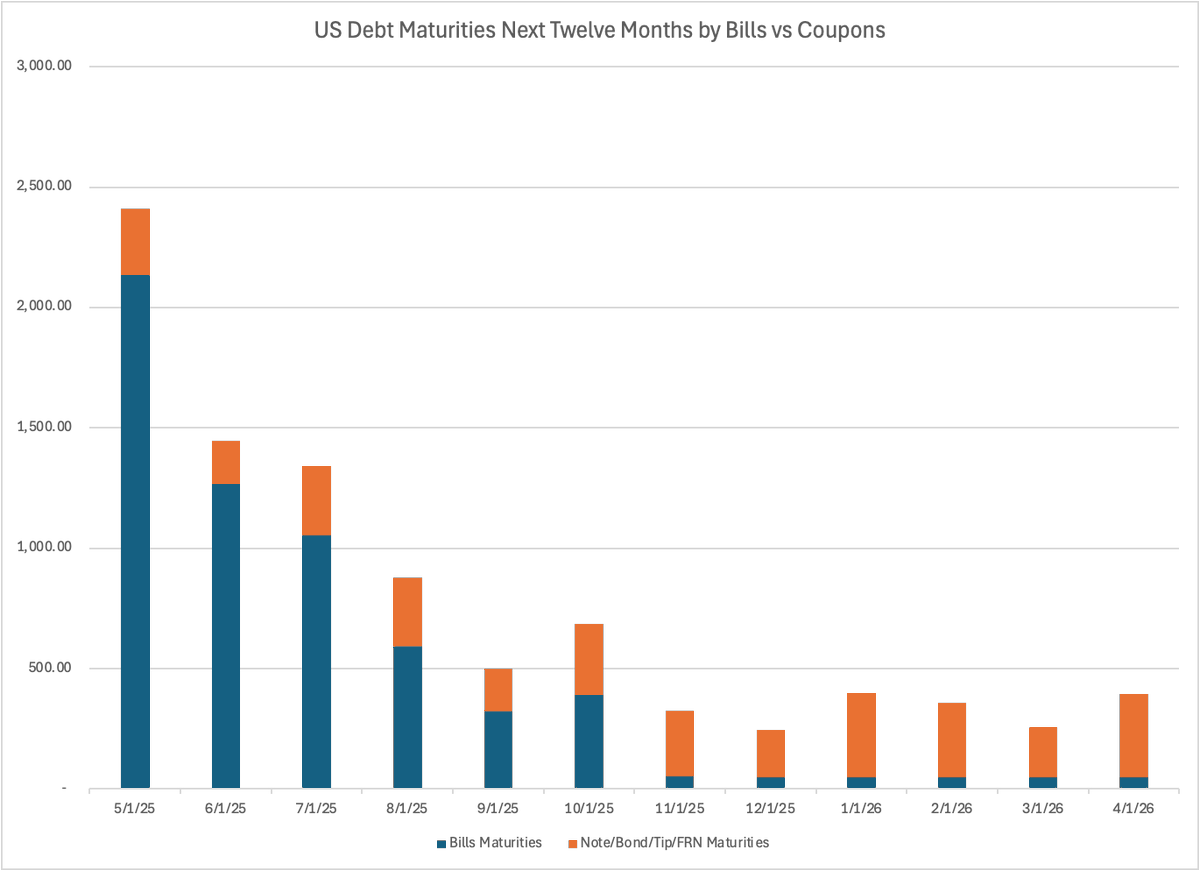

Notice the huge wall of debt maturities in the last chart. Sometimes the FURU posting the chart will do it monthly. Particularly when trying to suggest the Fed should cut rates to save the FURU's precious bags. Close to 6TN coming due in the next 3 months. OMIGOD PANIC!

Whats going on here? Well to put it simply the US has outstanding as of 4/30 6TN T bills. The distribution of these tbills looks like this. Notice while the graph above does not include it every month 4 week tbills mature and refinance and should be added to the next month.

In fact the Debt wall is all about tbills and has hardly anything to do with coupon maturities. Notice how the orange columns are small and about the same size.

When corrected for the Tbills maturing and rolling each month there is no debt wall. Its a constant mountain of debt rolling which are mostly bills.

So there is no imminent debt wall. Not this year nor any future year. But are you reassured? Looking at that last chart between 2 and 2.5TN of US obligations are auctioned every month (AGAIN MOSTLY BILLS). Is that something to panic about? Almost certainly not.

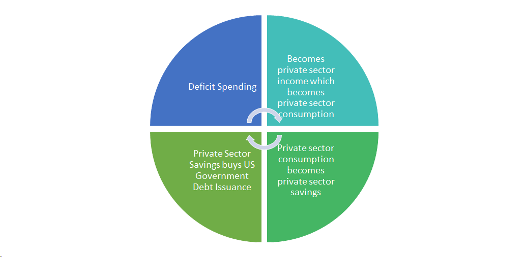

The holder of the maturing bills, notes, bonds, TIPS, and FRN WANTS to roll. Even if on the margin the holder doesnt want to roll they have to buy something with their maturity proceeds. The seller of that something has to buy something and ultimately the seller buys the

auctioned treasuries. Its a circle of life. The debt gets refinaced because there is no place for the money to go.

The price can change but the circle of life is highly unlikely to break

The price can change but the circle of life is highly unlikely to break

That brings us to another topic not covered. Besides the maturing debt that needs to be rolled an additional pile of new debt is auctioned. That grows the pile by roughly 2TN this year and that adds 166BN per month to the auction pile. Again the circle of life will almost

certainly result in no problems getting the financing. But the price that the Treasury can finance its debt can change. Thats for a different thread. There is no debt wall approaching. For over 3 years the 2-2.5TN of auctions per month have gone mostly fine. They will

likely continue to go fine. Its okay to think that 2-2.5TN is alot but thinking that something new and dangerous is about to happen is simply not true

• • •

Missing some Tweet in this thread? You can try to

force a refresh