🚨 A Leveraged Nation with a sub-standard living for Consumers.

- The prime auto loan ABS is deteriorating rapidly - a downgrade is imminent.

- A considerable chunk of consumers feel that homeownership is out of reach.

- a thread🧵

- The prime auto loan ABS is deteriorating rapidly - a downgrade is imminent.

- A considerable chunk of consumers feel that homeownership is out of reach.

- a thread🧵

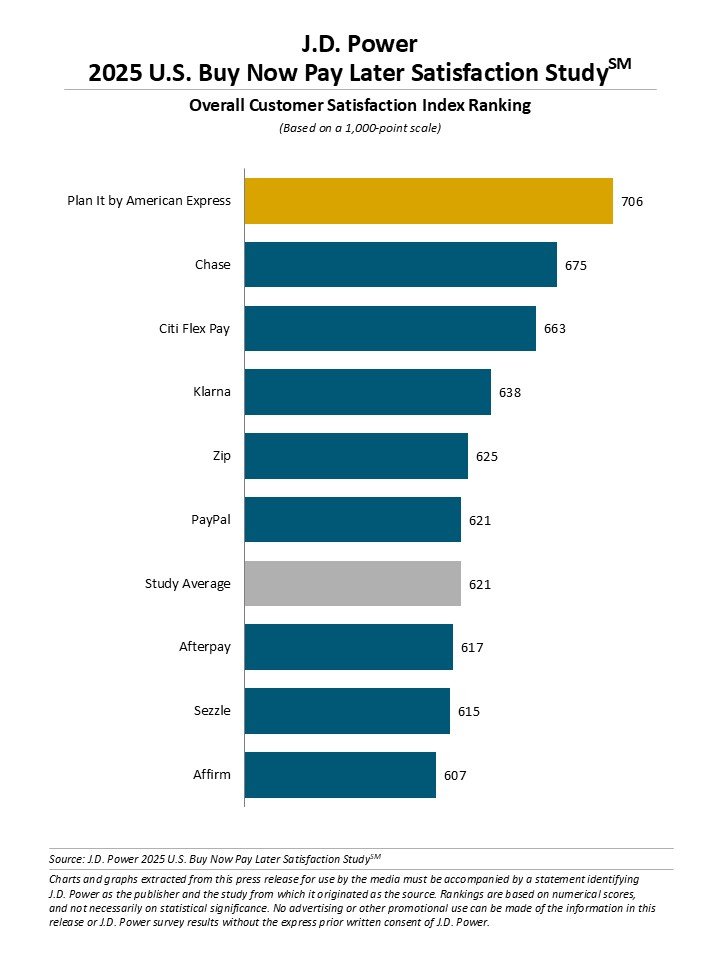

1. For a moment, let us forget politics and the stock market. Let us purely focus on the welfare of the people and that of our country as a whole. We are in deep economic trouble. The United States is facing an economic identity crisis.

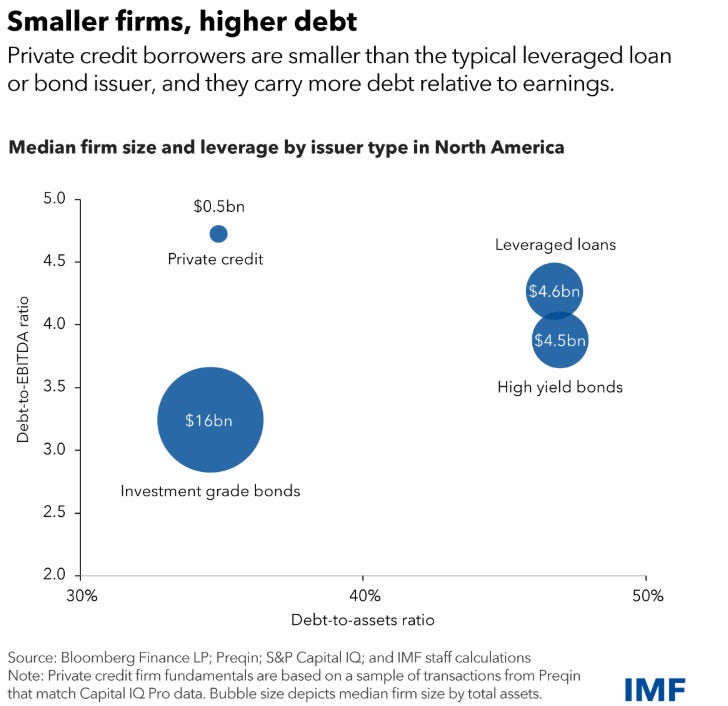

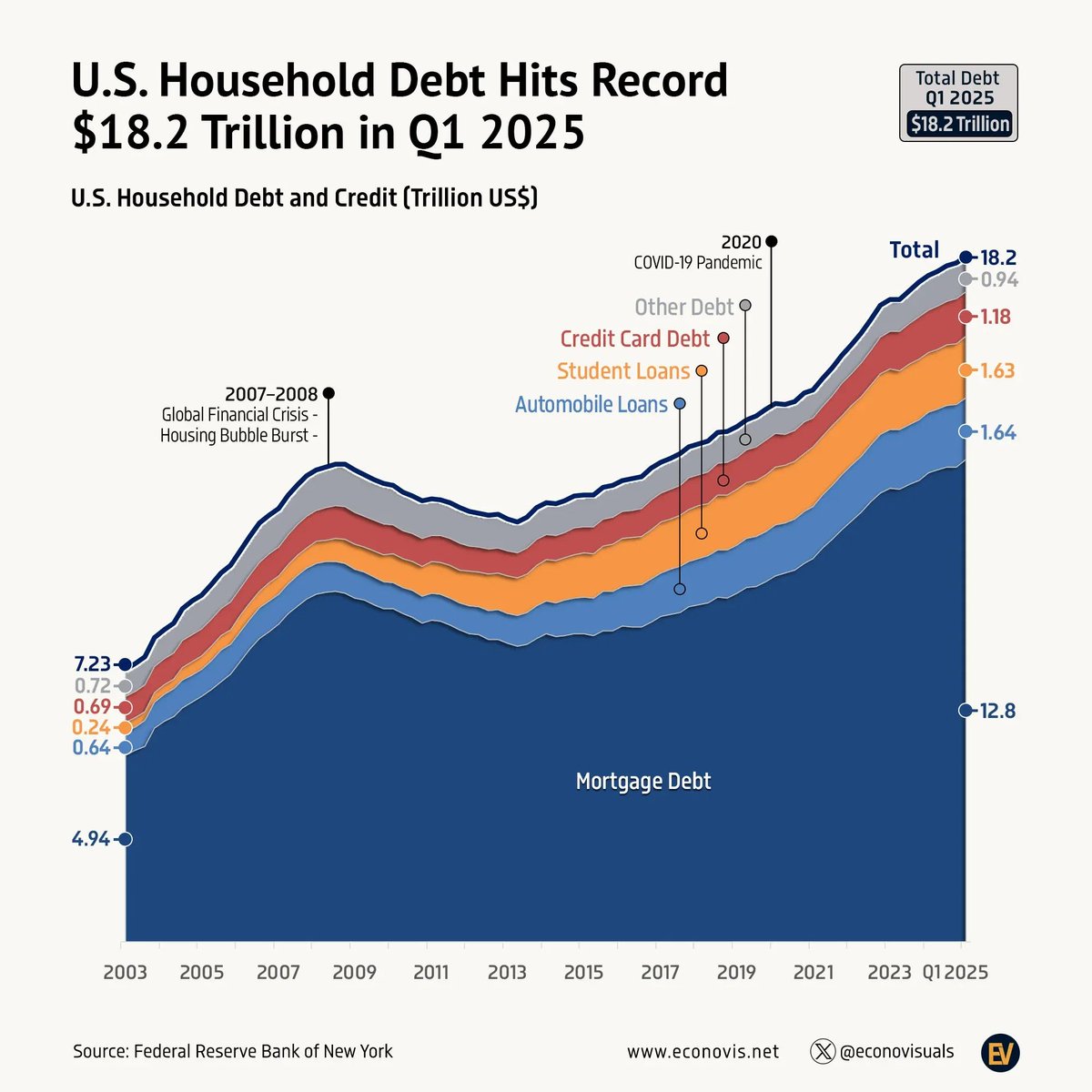

We want to state the obvious yet overlooked fact: The United States and its citizens are heavily in debt.

We want to state the obvious yet overlooked fact: The United States and its citizens are heavily in debt.

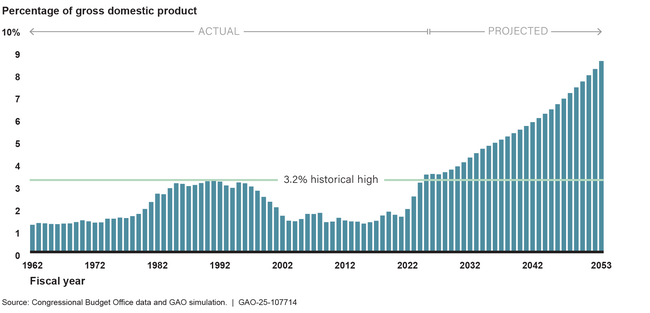

2. As of yesterday, Moody's, the last standing credit rating agency with an AAA rating, has downgraded the United States to Aa1, citing concerns about the nation's growing $36 trillion debt pile and higher interest payments.

Moody's first gave the United States its pristine "Aaa" rating in 1919 and is the last of the three major credit agencies to downgrade it.

Moody's first gave the United States its pristine "Aaa" rating in 1919 and is the last of the three major credit agencies to downgrade it.

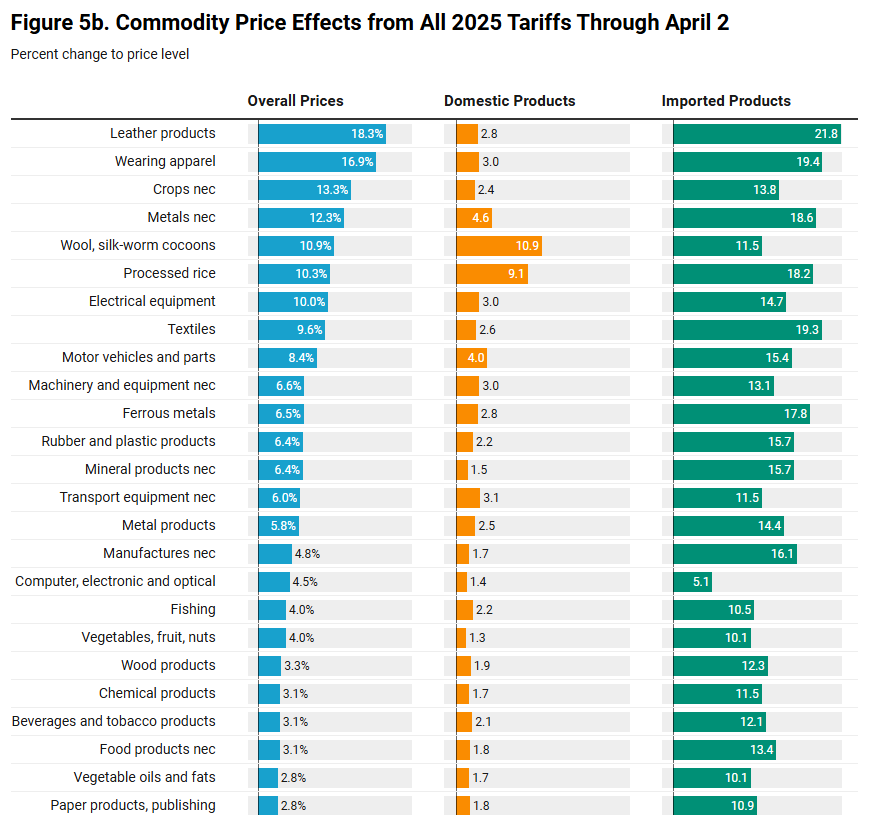

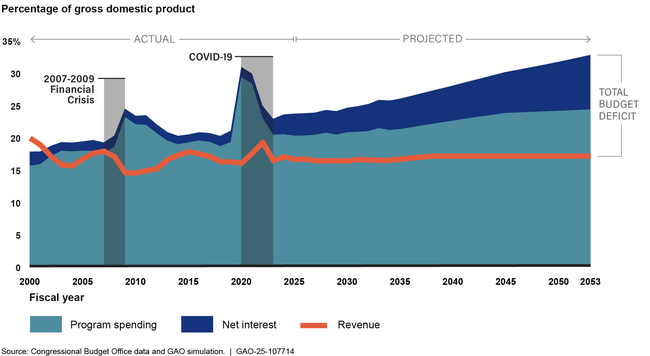

3. Perpetually rising debt as a share of GDP is unsustainable. It has many direct and indirect implications for the economy, American households, and individuals. Risks include slower economic growth and increased chances of a fiscal crisis.

The year 2025 would be regarded as the year where America and its citizens are forced to take a look at the respective debt levels.

The year 2025 would be regarded as the year where America and its citizens are forced to take a look at the respective debt levels.

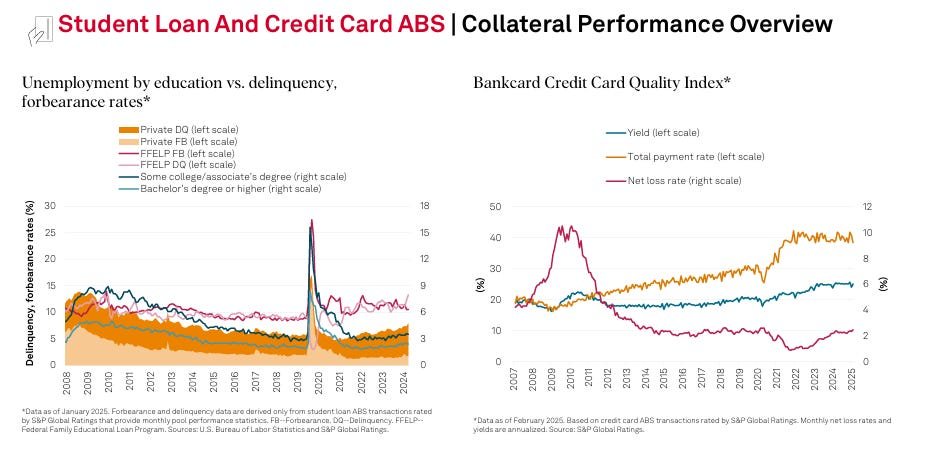

4. Student debt default, garnishments, stagflation and prime auto deterioration in ABS market is of concern.

We are drafting a detailed report on student loan and its impact. Regardless of political allegiance, as a nation and an economy, we are organically screwed.

An economic reset, whether we like it or not, is here.

Pragmatic question is whether individual portfolios and families are prepared for it.

Happy weekend reading: contrarianunicus.substack.com/p/a-leveraged-…

We are drafting a detailed report on student loan and its impact. Regardless of political allegiance, as a nation and an economy, we are organically screwed.

An economic reset, whether we like it or not, is here.

Pragmatic question is whether individual portfolios and families are prepared for it.

Happy weekend reading: contrarianunicus.substack.com/p/a-leveraged-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh