An independent short-only invst. research firm. X is Not Fin Advise. Short: https://t.co/ofRJpAEMjI Macro Credit: https://t.co/zJJixDTTDn

How to get URL link on X (Twitter) App

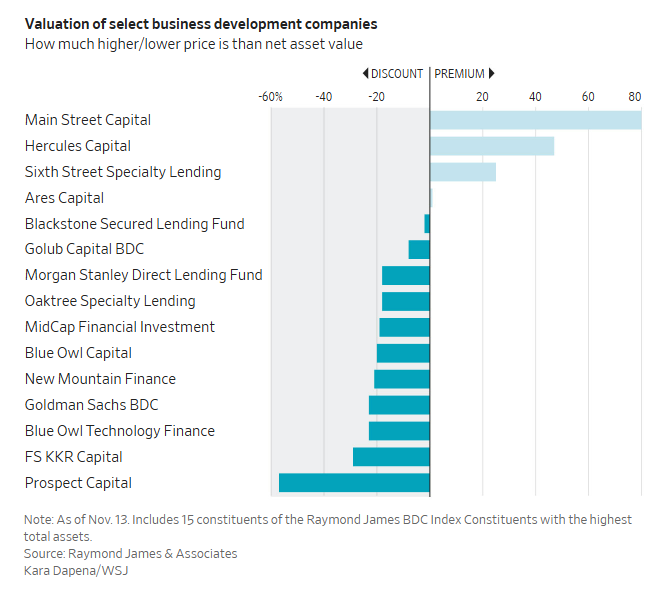

1. Culprits: KKR and Blackrock the worst performers in the publicly traded private-credit funds called BDCs.

1. Culprits: KKR and Blackrock the worst performers in the publicly traded private-credit funds called BDCs.

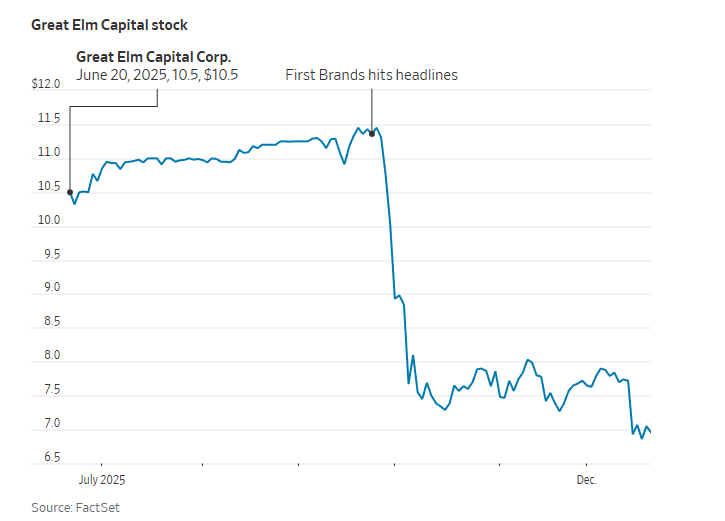

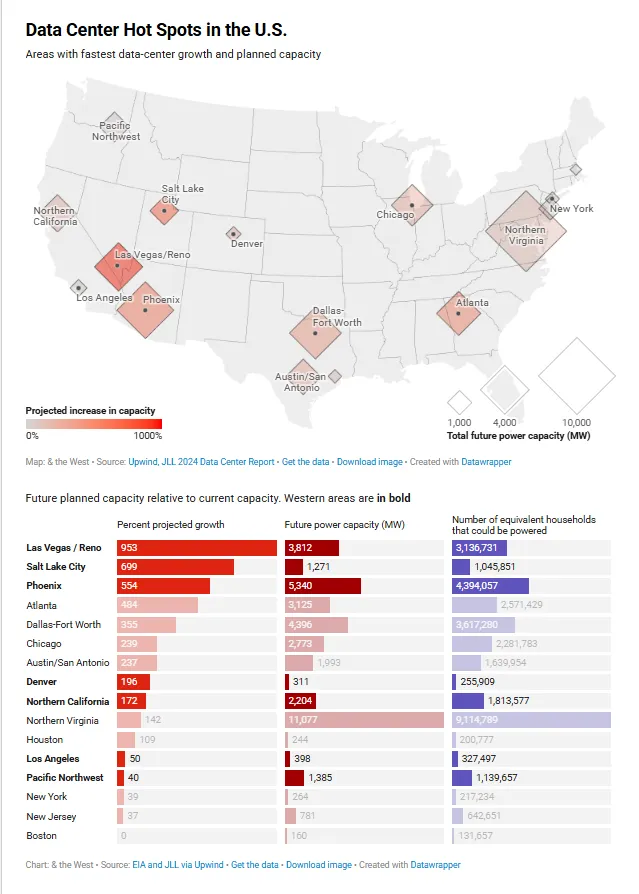

1. In Santa Clara, two data centers have become symbols of AI’s new constraint: electricity, not chips.

1. In Santa Clara, two data centers have become symbols of AI’s new constraint: electricity, not chips.

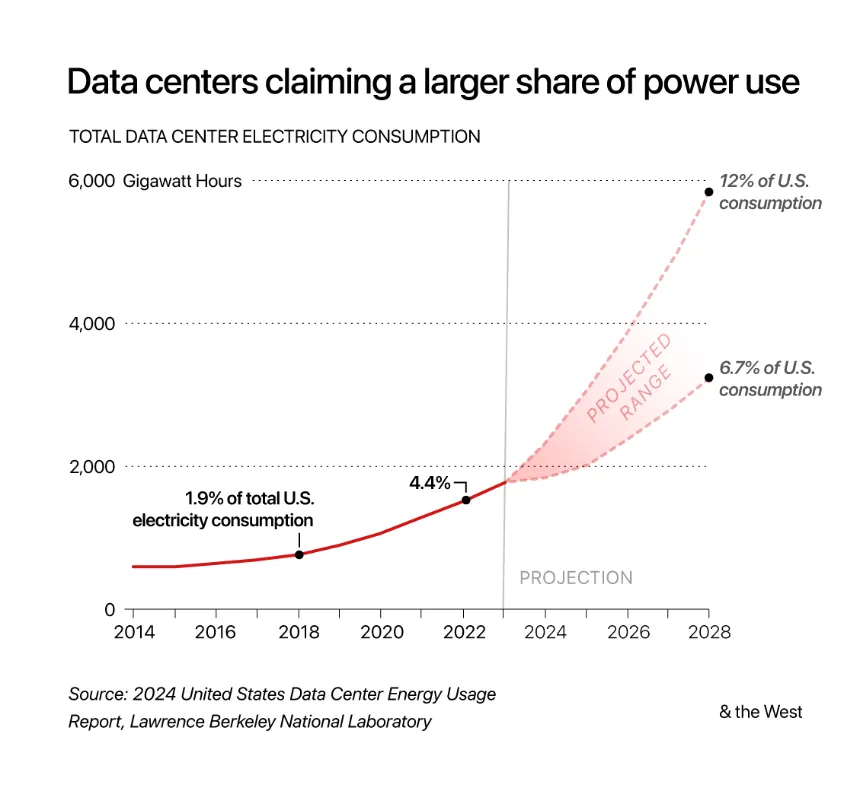

1. In 2023, data centers accounted for nearly 4.5% of total U.S. electricity consumption. That percentage is expected to jump to 10% over the next four years.

1. In 2023, data centers accounted for nearly 4.5% of total U.S. electricity consumption. That percentage is expected to jump to 10% over the next four years.

https://x.com/UnicusResearch/status/1986199066238460129

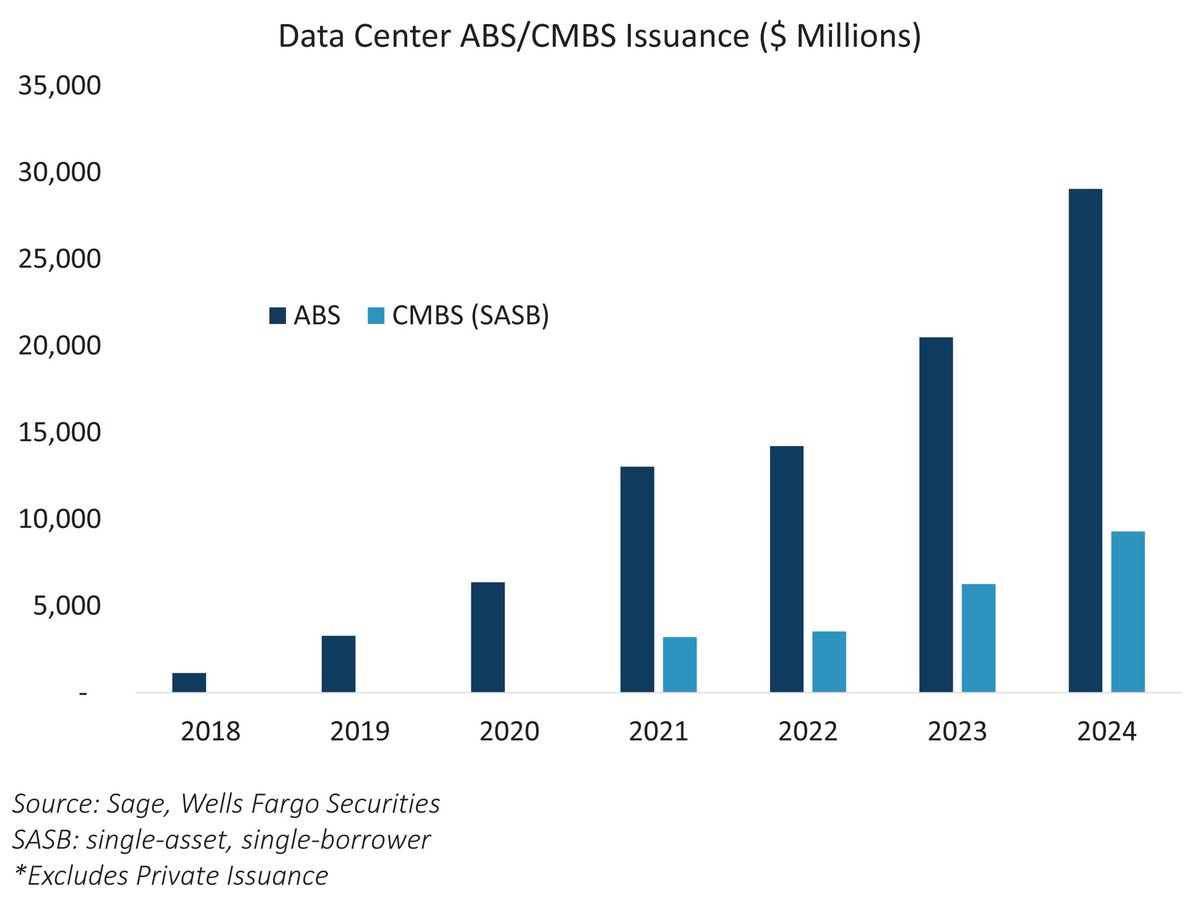

1. Data center securitization issuance reached $17.4 billion year-to-date in 2025, a 50% increase from the full-year total in 2024 ($11.6 billion).

1. Data center securitization issuance reached $17.4 billion year-to-date in 2025, a 50% increase from the full-year total in 2024 ($11.6 billion).

1. What just happened?

1. What just happened?

1. It is certainly not unheard of for a Treasury Secretary to raise the topic of default. For example, in 2023, Janet Yellen said that the U.S. should never default on its debt. The consequence of such an event, she warned, would be “an economic and financial catastrophe.”

1. It is certainly not unheard of for a Treasury Secretary to raise the topic of default. For example, in 2023, Janet Yellen said that the U.S. should never default on its debt. The consequence of such an event, she warned, would be “an economic and financial catastrophe.”

1. The net rating bias (positive minus negative outlooks) was below zero in nearly every sector.

1. The net rating bias (positive minus negative outlooks) was below zero in nearly every sector.

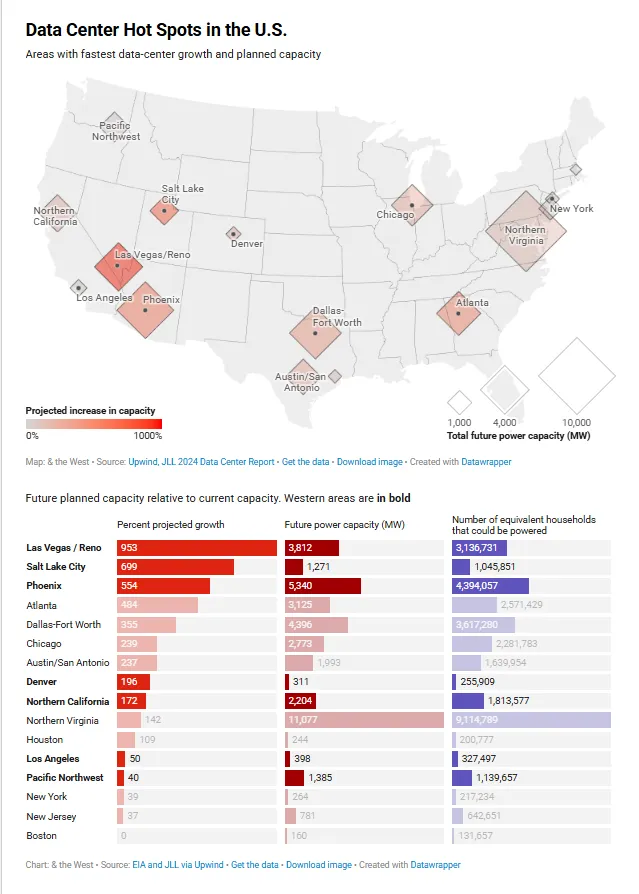

1. We have been tracking the corporate defaults, downgrades and bankruptcies.

1. We have been tracking the corporate defaults, downgrades and bankruptcies.

1. Major changes are introduced to SNAP in H.R.1 – and we have analyzed the companies that will be impacted the most and the consumers who will be pushed below the poverty line.

1. Major changes are introduced to SNAP in H.R.1 – and we have analyzed the companies that will be impacted the most and the consumers who will be pushed below the poverty line.

1. Older borrowers have become the fastest-growing group in the student loan portfolio, which has led to a rising share of defaulters being Social Security beneficiaries. From 2017 to 2023, the number of student loan borrowers aged 62 and older ballooned by 59% (from 1.7 million to 2.7 million), even as the number of borrowers under 62 slightly declined.

1. Older borrowers have become the fastest-growing group in the student loan portfolio, which has led to a rising share of defaulters being Social Security beneficiaries. From 2017 to 2023, the number of student loan borrowers aged 62 and older ballooned by 59% (from 1.7 million to 2.7 million), even as the number of borrowers under 62 slightly declined.

1. For a moment, let us forget politics and the stock market. Let us purely focus on the welfare of the people and that of our country as a whole. We are in deep economic trouble. The United States is facing an economic identity crisis.

1. For a moment, let us forget politics and the stock market. Let us purely focus on the welfare of the people and that of our country as a whole. We are in deep economic trouble. The United States is facing an economic identity crisis.

1. Frothy stock markets occur when investors become overly excited about companies (such as SPACs and AI-driven tech valuations) and are overly focused on the potential upside. Frothy credit markets are when people stop worrying about the downside (think of ‘extend and pretend’ in CREs*, auto loan, BNPL, etc).

1. Frothy stock markets occur when investors become overly excited about companies (such as SPACs and AI-driven tech valuations) and are overly focused on the potential upside. Frothy credit markets are when people stop worrying about the downside (think of ‘extend and pretend’ in CREs*, auto loan, BNPL, etc).

1. You can review some of our work on shadow banks here: substack.com/home/post/p-10…

1. You can review some of our work on shadow banks here: substack.com/home/post/p-10…

https://x.com/UnicusResearch/status/1915127920642699646

1. Student loan garnishments for defaulted federal loans begin on May 5th.

1. Student loan garnishments for defaulted federal loans begin on May 5th.

1 (a)🚩BNPL firms have begun reporting consumers' real-time usage to credit agencies.

1 (a)🚩BNPL firms have begun reporting consumers' real-time usage to credit agencies.

1. A combination of higher interest rates, higher debt levels, inflation/affordability issues, and the resumption of student loan payments - a perfect storm for American consumers.

1. A combination of higher interest rates, higher debt levels, inflation/affordability issues, and the resumption of student loan payments - a perfect storm for American consumers.

1. According to the new report by the Yale Budget Lab, the hit to the regular American families’ pocketbook will be significant - as much as $3,800 annually.

1. According to the new report by the Yale Budget Lab, the hit to the regular American families’ pocketbook will be significant - as much as $3,800 annually.

1. In the event of $AFRM's earnings beat, we thought of sharing this.

1. In the event of $AFRM's earnings beat, we thought of sharing this.

1. According to Wells Fargo, Mexico and Canada are two of the United States’ top trading partners. Aside from the European Union, comprised of 27 sovereign nations, Mexico is the largest source of all U.S. imports.

1. According to Wells Fargo, Mexico and Canada are two of the United States’ top trading partners. Aside from the European Union, comprised of 27 sovereign nations, Mexico is the largest source of all U.S. imports.

1. We have been researching auto sector over the past year. Speaking with dealers across the United States revealed that dealers are quietly shutting their dealerships. Only a few incidents are reported in the main stream media.

1. We have been researching auto sector over the past year. Speaking with dealers across the United States revealed that dealers are quietly shutting their dealerships. Only a few incidents are reported in the main stream media.