SPY can easily crash 5-10% this week because its debt got downgraded by Moody's.

But, this is a once in a lifetime opportunity to 10x your trading account.

Here's 4 critical levels to focus on for SPY 🧵

But, this is a once in a lifetime opportunity to 10x your trading account.

Here's 4 critical levels to focus on for SPY 🧵

Make sure to go to end 🧵where I share my favorite 4 trades with you and what I'll be watching for a swing trade for strong companies like GOOG META AMZN MSFT AAPL TSLA NVDA

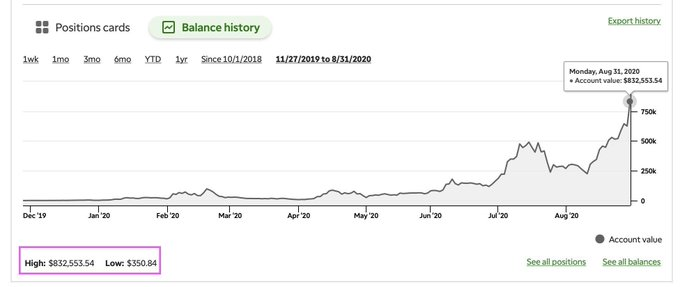

I was able to turn $1000 into $73,000+ when SPY sells off on bad news. The key is to wait for buyers to step in at support.

https://x.com/SuperLuckeee/status/1922695597787656477

History has shown that within a year SPY bounces back up to 40% from when it gets downgraded. This means I'd like to add options for strong companies espcially at my key levels.

#1. The first key level is under $590 closer to $585. This level buyers FOMO beccause they felt the market was going to leave without them. Its likely we get to this level.

#2. There is a massive continuation gap to fill between $570-$577. This is also where 200SMA is at $574. So this will be a magnet for bears to attack. Price will drive towards here if the market panics on the US debt downgrade.

#3. 200SMA is at $574. Its possible the SPY retests this area because of panic selling and Trump talks about tariffs again. I expect the SPY to defend this area this will be 20 point drop from where it is currently at.

#4. This is extremely unlikely to get to this week at $528-$535. But, US debt being downgraded is a very big NEGATIVE trigger so its possible we get here and fill the gap.

4 plays I'm watching closely for if the SPY does crash 5-10% this week:

1. TSLA under $320 for the move back towards $400 so calls Jan 2026 $420 strike

2. NVDA under $125 for ER run up for $140 June 13

3. AAPL under $200 for Oct 2025 $220

4. GOOG under $160 for Jan 2026 $180

1. TSLA under $320 for the move back towards $400 so calls Jan 2026 $420 strike

2. NVDA under $125 for ER run up for $140 June 13

3. AAPL under $200 for Oct 2025 $220

4. GOOG under $160 for Jan 2026 $180

The key here is to wait for SET-UPS right in front of you this week. DO NOT TRY TO PREDICT the moves of the market. The best is to wait for it then execute carefully.

Comment "Help" If you'd like to me to notify you when to add these plays.

Comment "Help" If you'd like to me to notify you when to add these plays.

Follow me @SuperLuckeee for more of my trading lessons, analysis and plays.

- RT to share with your audience and help others.

- Make sure you ❤️the post below

- BOOKMARK this to study later

- RT to share with your audience and help others.

- Make sure you ❤️the post below

- BOOKMARK this to study later

https://twitter.com/superluckeee/status/1924054629949579759

• • •

Missing some Tweet in this thread? You can try to

force a refresh