This man paid $650,000 to learn one idea from Warren Buffett.

That idea helped Monish Pabrai turn $1M into $600,000,000+

His “Dhandho” investing philosophy is so shockingly simple anyone can do it.

Here are 8 of his best investing rules: 🧵

(No. 6 is mind-blowing)

That idea helped Monish Pabrai turn $1M into $600,000,000+

His “Dhandho” investing philosophy is so shockingly simple anyone can do it.

Here are 8 of his best investing rules: 🧵

(No. 6 is mind-blowing)

June 25, 2008.

Monish Pabrai sat across from Warren Buffett at a steakhouse in Omaha.

He had just paid $650,000 for this lunch.

No agenda. No notebook. Just one question on his mind:

“What mental model built Berkshire Hathaway?”…

Monish Pabrai sat across from Warren Buffett at a steakhouse in Omaha.

He had just paid $650,000 for this lunch.

No agenda. No notebook. Just one question on his mind:

“What mental model built Berkshire Hathaway?”…

Buffett answered in his usual style. Simple words, with deep implications.

That conversation changed how Monish approached everything:

• Risk

• Timing

• Bets

• Patience

And it became the foundation of his $600M fortune.

Here are those 8 rules Pabrai lives by:

That conversation changed how Monish approached everything:

• Risk

• Timing

• Bets

• Patience

And it became the foundation of his $600M fortune.

Here are those 8 rules Pabrai lives by:

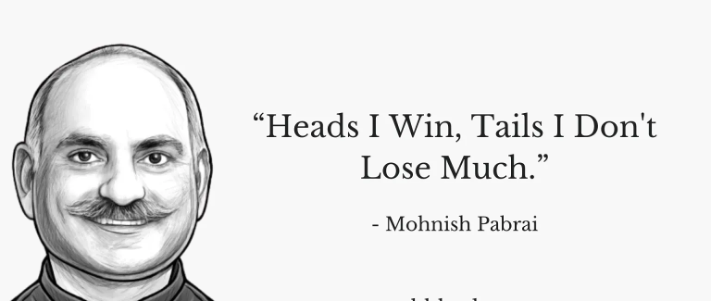

Rule #1:

Great investments feel wrong at first.

Pabrai’s best opportunities all felt “off.”

They looked broken. Risky. Ugly.

But underneath?

• Asymmetric upside

• Very limited downside

• A math equation most people couldn’t see

(video credit @ShaanVP & @myfirstmilpod)

Great investments feel wrong at first.

Pabrai’s best opportunities all felt “off.”

They looked broken. Risky. Ugly.

But underneath?

• Asymmetric upside

• Very limited downside

• A math equation most people couldn’t see

(video credit @ShaanVP & @myfirstmilpod)

Rule #2:

Look for bets that hit you like a 2x4.

He doesn’t look for “good” businesses.

He looks for anomalies. Situations where the price makes no sense.

“If you need Excel to justify the bet, pass.”

If the math isn’t obvious, it’s not worth your money.

Look for bets that hit you like a 2x4.

He doesn’t look for “good” businesses.

He looks for anomalies. Situations where the price makes no sense.

“If you need Excel to justify the bet, pass.”

If the math isn’t obvious, it’s not worth your money.

Rule #3:

Most ideas should go in your “Too Hard” pile.

Buffett keeps a literal box on his desk labeled “Too Hard.”

Monish follows the same principle.

“99% of businesses are too complex to handicap.”

The edge is in ruthless clarity and knowing what to ignore.

Most ideas should go in your “Too Hard” pile.

Buffett keeps a literal box on his desk labeled “Too Hard.”

Monish follows the same principle.

“99% of businesses are too complex to handicap.”

The edge is in ruthless clarity and knowing what to ignore.

Rule #4:

You only need 1 great idea every few years.

Buffett made 12 needle-moving decisions in 58 years.

Monish looks for 1 killer bet every 2–3 years.

“Spend most of your time doing nothing. Then bet hard when the odds tilt.”

Slowness is a superpower.

You only need 1 great idea every few years.

Buffett made 12 needle-moving decisions in 58 years.

Monish looks for 1 killer bet every 2–3 years.

“Spend most of your time doing nothing. Then bet hard when the odds tilt.”

Slowness is a superpower.

Rule #5:

Circle of competence is everything.

Monish calls it being an inch wide, and a mile deep.

One investor made billions buying real estate only within 2 miles of Stanford.

The lesson:

“You don’t need to know everything. You just need to know one thing well.”

Circle of competence is everything.

Monish calls it being an inch wide, and a mile deep.

One investor made billions buying real estate only within 2 miles of Stanford.

The lesson:

“You don’t need to know everything. You just need to know one thing well.”

Rule #6:

Risk is different from uncertainty.

Wall Street punishes companies with uncertainty.

But Monish says:

“High uncertainty with low risk is where the gold is.”

His best investment returned 80x, after everyone thought the business was dead.

Risk is different from uncertainty.

Wall Street punishes companies with uncertainty.

But Monish says:

“High uncertainty with low risk is where the gold is.”

His best investment returned 80x, after everyone thought the business was dead.

Rule #7:

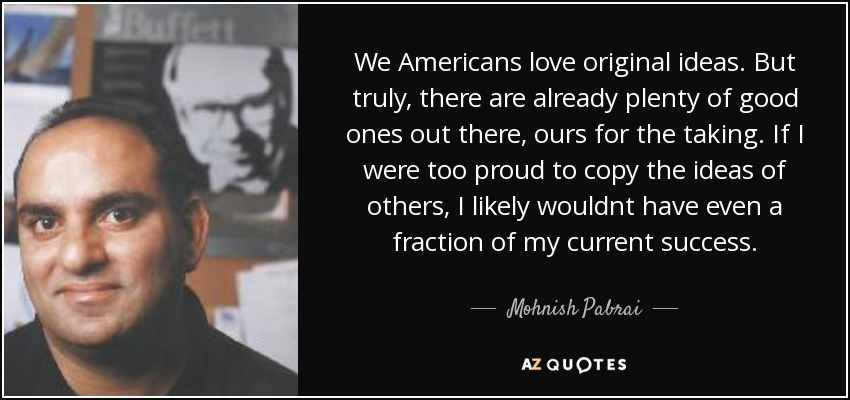

Use the ‘cloning’ mindset.

Don’t reinvent the wheel.

Monish reads 500+ writeups from Value Investors Club and SumZero.

He studies Buffett’s annual letters like scripture.

“Learn from the best. Then wait until their playbook fits your pitch.”

Use the ‘cloning’ mindset.

Don’t reinvent the wheel.

Monish reads 500+ writeups from Value Investors Club and SumZero.

He studies Buffett’s annual letters like scripture.

“Learn from the best. Then wait until their playbook fits your pitch.”

Rule #8:

Avoid leverage. Avoid complexity. Avoid speed.

One of Buffett’s early partners lost everything, because he used margin.

“Charlie and I knew we’d be rich. We just weren’t in a hurry.”

Slow, boring, obvious = unstoppable.

Avoid leverage. Avoid complexity. Avoid speed.

One of Buffett’s early partners lost everything, because he used margin.

“Charlie and I knew we’d be rich. We just weren’t in a hurry.”

Slow, boring, obvious = unstoppable.

Final takeaway:

You don’t need a finance degree.

You don’t need Wall Street connections.

You don’t even need Excel.

You just need:

• Patience

• A clear mind

• The ability to wait for “can’t lose” bets

That’s Dhandho.

You don’t need a finance degree.

You don’t need Wall Street connections.

You don’t even need Excel.

You just need:

• Patience

• A clear mind

• The ability to wait for “can’t lose” bets

That’s Dhandho.

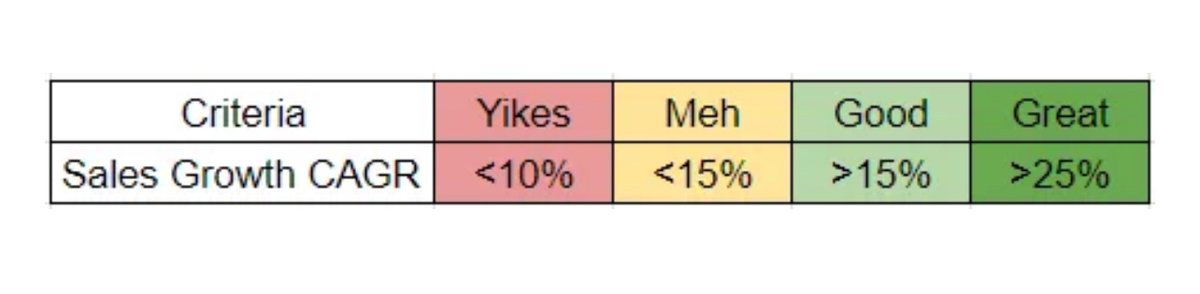

Monish’s strategy is finding gold. Slowly.

Finding the perfect investment that’ll give him up to a 100x return.

I’ve developed a free checklist for finding 100-baggers, compiled from 100s of hours of research.

Get if FREE here:

100bagger.kit.com/checklist

Finding the perfect investment that’ll give him up to a 100x return.

I’ve developed a free checklist for finding 100-baggers, compiled from 100s of hours of research.

Get if FREE here:

100bagger.kit.com/checklist

Check out the awesome:

@MohnishPabrai

@ShaanVP

@myfirstmilpod

For recording this amazing podcast episode & making this thread possible.

@MohnishPabrai

@ShaanVP

@myfirstmilpod

For recording this amazing podcast episode & making this thread possible.

• • •

Missing some Tweet in this thread? You can try to

force a refresh