📕 Building my junior AI-analyst @ https://t.co/HEbKKa48XG

Hunting for small hidden winners ⬇️

How to get URL link on X (Twitter) App

#10: Risk lives in human behavior, not spreadsheets

#10: Risk lives in human behavior, not spreadsheets

The Santa Fe Institute isn't your typical academic institution.

The Santa Fe Institute isn't your typical academic institution.

This is Nick Sleep.

This is Nick Sleep.

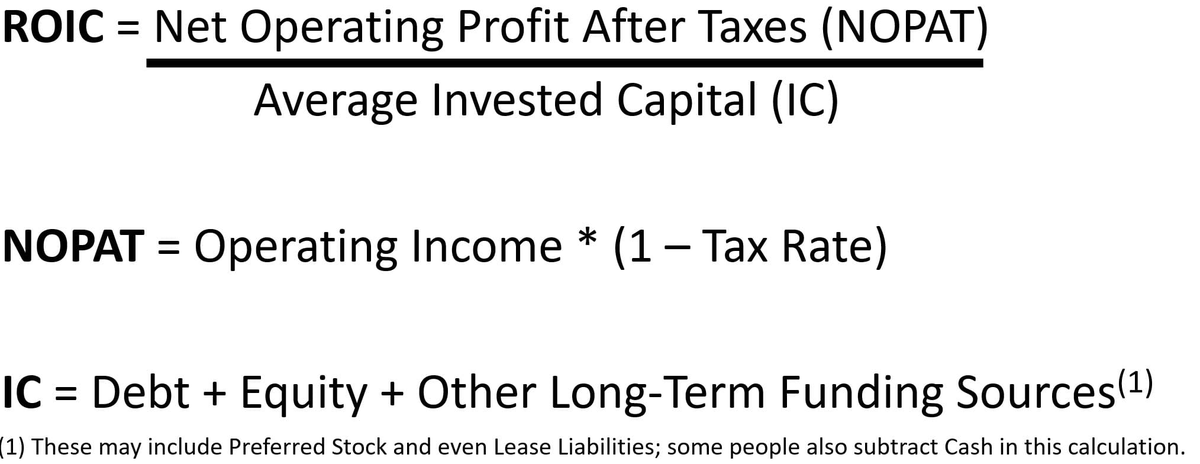

First, let's understand what ROIC actually measures.

First, let's understand what ROIC actually measures.

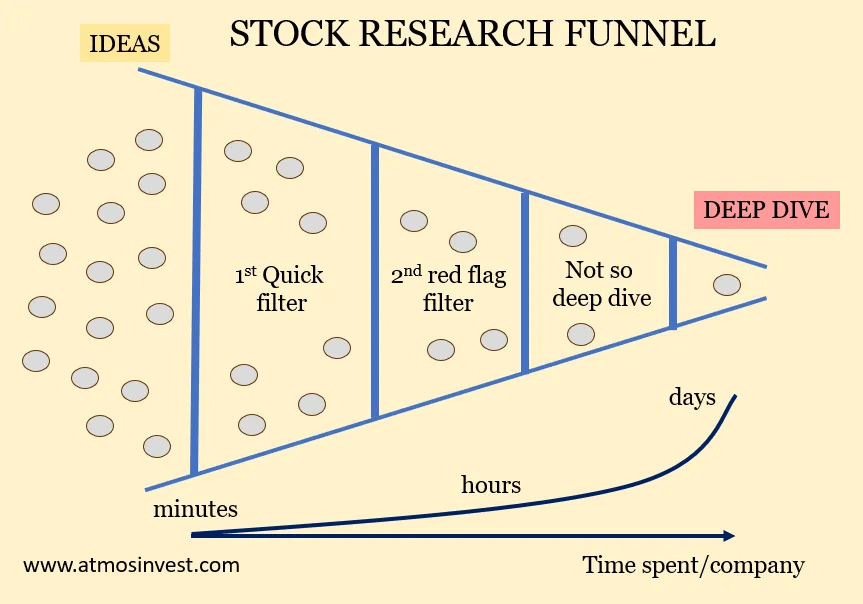

I've been trying to speed up my research process.

I've been trying to speed up my research process.

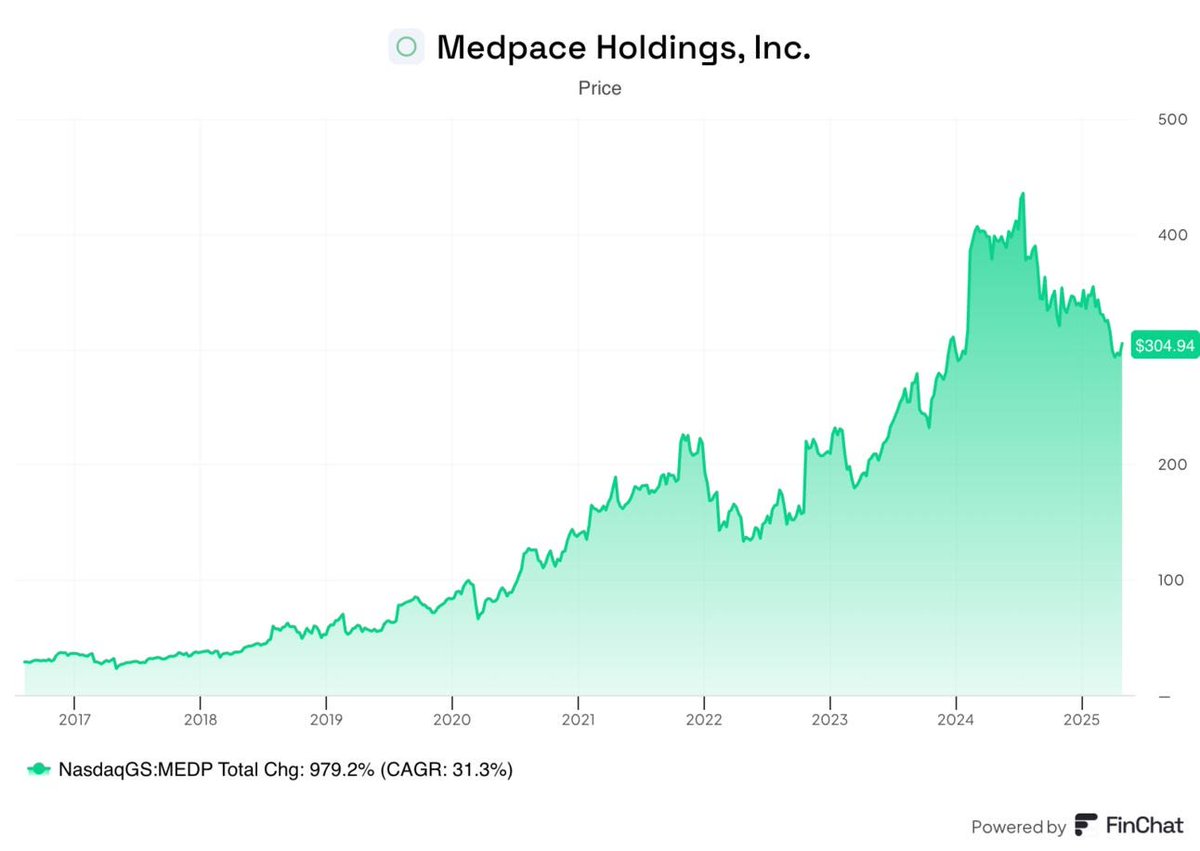

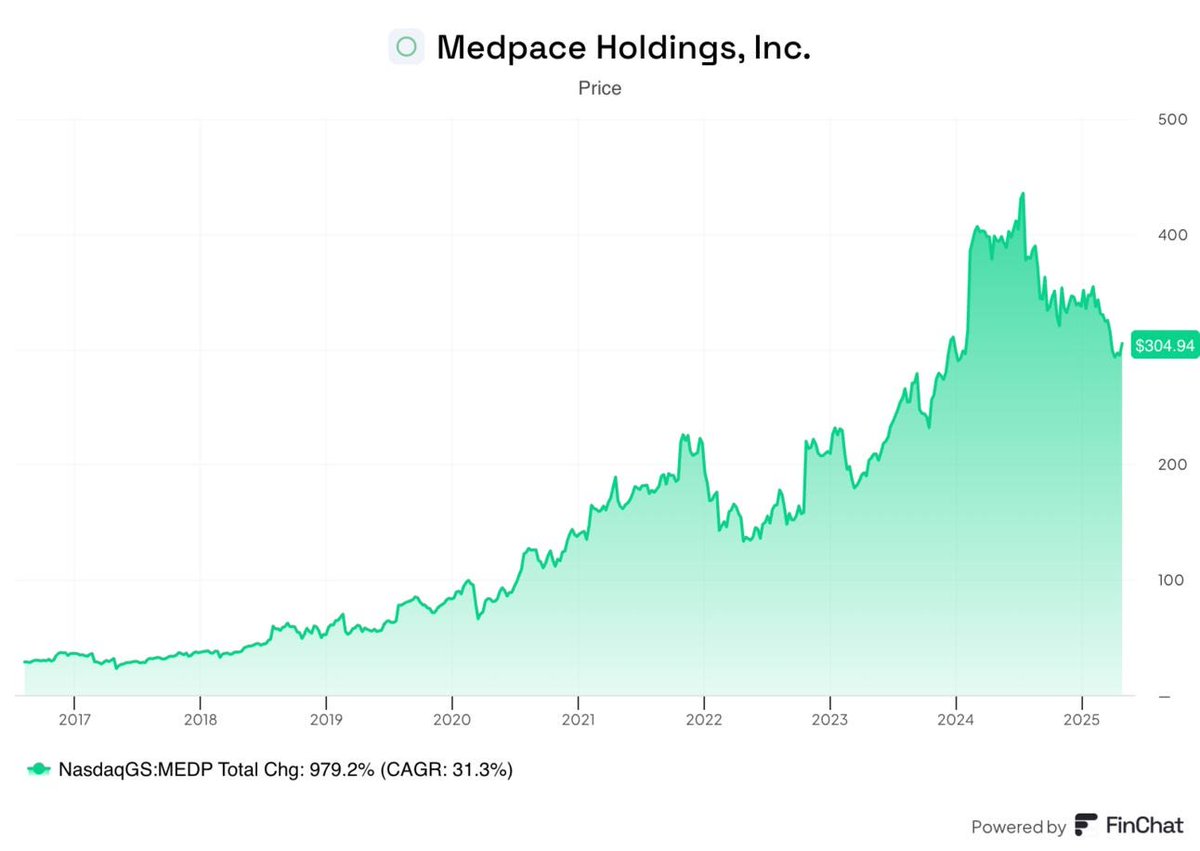

I've been studying this trade for a long time.

I've been studying this trade for a long time.

First, let me set the stage.

First, let me set the stage.

The backstory is fascinating.

The backstory is fascinating.

Here's the thing most investors don't realize:

Here's the thing most investors don't realize:

Lynch discovered Fisher's book early in his Fidelity career and it changed everything.

Lynch discovered Fisher's book early in his Fidelity career and it changed everything.

Most investors are still researching like it's 1995.

Most investors are still researching like it's 1995.

Ray Dalio found Paul Kennedy's book in 1987.

Ray Dalio found Paul Kennedy's book in 1987.

From 1977 to 1990, Peter Lynch managed the Fidelity Magellan Fund.

From 1977 to 1990, Peter Lynch managed the Fidelity Magellan Fund.

1. The "easy money" era is officially over.

1. The "easy money" era is officially over.

1/ Growth is meaningless without MOATS

1/ Growth is meaningless without MOATS

1/ Do the opposite of everyone else

1/ Do the opposite of everyone else

Leonard founded Constellation Software in 1995 after leaving venture capital with just $25M in funding.

Leonard founded Constellation Software in 1995 after leaving venture capital with just $25M in funding.

June 25, 2008.

June 25, 2008.

Carl Icahn was born in 1936 in Queens.

Carl Icahn was born in 1936 in Queens.

As a kid in the 1940s, Jim loved numbers.

As a kid in the 1940s, Jim loved numbers.