These 7 companies have survived EVERY major crisis since 1900:

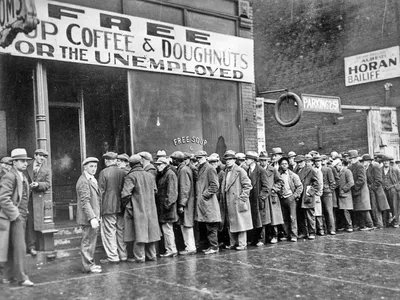

- The Great Depression

- Two World Wars

- Dot-com Crash

- 2008 Financial Crisis

- COVID-19

While 90% of businesses fail within 10 years…

Here’s what 120+ years of data reveals about why they’re unstoppable:🧵

- The Great Depression

- Two World Wars

- Dot-com Crash

- 2008 Financial Crisis

- COVID-19

While 90% of businesses fail within 10 years…

Here’s what 120+ years of data reveals about why they’re unstoppable:🧵

The "cockroach companies" earned their nickname for a simple reason:

Just like the insects, these businesses can survive everything.

Out of the Fortune 500 companies from 1955, only 52 remain on the list today.

But these 7 have been thriving for much longer.

Just like the insects, these businesses can survive everything.

Out of the Fortune 500 companies from 1955, only 52 remain on the list today.

But these 7 have been thriving for much longer.

Meet the immortal seven:

1. Procter & Gamble (1837)

2. IBM (1911)

3. Boeing (1916)

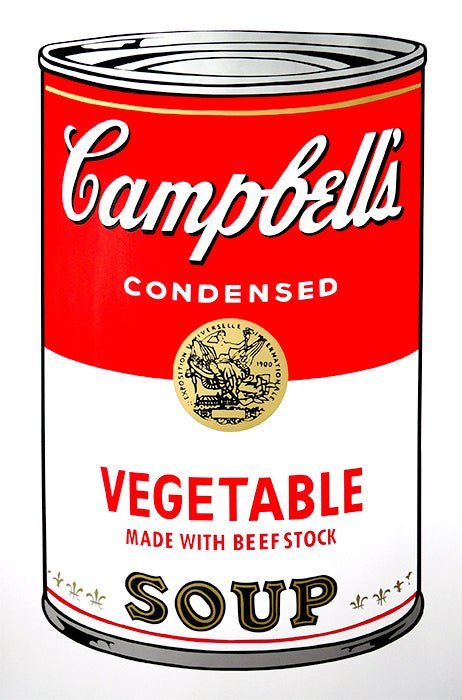

4. Campbell Soup (1869)

5. Colgate-Palmolive (1806)

6. Coca-Cola (1892)

7. Johnson & Johnson (1886)

Each has not only survived but often strengthened during history's worst economic disasters.

1. Procter & Gamble (1837)

2. IBM (1911)

3. Boeing (1916)

4. Campbell Soup (1869)

5. Colgate-Palmolive (1806)

6. Coca-Cola (1892)

7. Johnson & Johnson (1886)

Each has not only survived but often strengthened during history's worst economic disasters.

What separates these companies from the thousands that failed?

The answer isn't what you'd expect.

It's not superior products. Not visionary CEOs. Not even market dominance…

It's a counterintuitive approach to crisis that violates conventional business wisdom:

The answer isn't what you'd expect.

It's not superior products. Not visionary CEOs. Not even market dominance…

It's a counterintuitive approach to crisis that violates conventional business wisdom:

When the Great Depression hit, most companies cut costs and froze innovation.

But IBM's CEO Thomas Watson did the opposite:

In 1932—its darkest year—he spent $1M (6% of revenue) on a world-class research center.

While all factories kept running at full tilt.

The results?

But IBM's CEO Thomas Watson did the opposite:

In 1932—its darkest year—he spent $1M (6% of revenue) on a world-class research center.

While all factories kept running at full tilt.

The results?

While competitors withered, IBM secured the contract to implement America's new Social Security system in 1935—a project that required calculating machines for 26 million Americans.

This single government contract launched IBM into decades of dominance.

This single government contract launched IBM into decades of dominance.

Procter & Gamble followed a similar contrarian playbook.

During the Depression, P&G maintained production and even increased advertising.

They also pioneered "soap operas"—radio dramas targeting homemakers that became an instant hit.

By 1939, P&G was producing 21 radio shows.

During the Depression, P&G maintained production and even increased advertising.

They also pioneered "soap operas"—radio dramas targeting homemakers that became an instant hit.

By 1939, P&G was producing 21 radio shows.

And before World War 1, Pepsi was dominating Coca Cola.

But once the war hit Pepsi instinctively cut costs and lowered their marketing budget.

But Coca Cola?

They doubled down advertising and global expansion.

Pepsi filed for bankruptcy. Coca Cola thrived.

But once the war hit Pepsi instinctively cut costs and lowered their marketing budget.

But Coca Cola?

They doubled down advertising and global expansion.

Pepsi filed for bankruptcy. Coca Cola thrived.

Campbell Soup's strategy?

Become indispensable during hard times.

During every recession since 1900, Campbell's sales have increased while the broader economy contracted.

Become indispensable during hard times.

During every recession since 1900, Campbell's sales have increased while the broader economy contracted.

During the 2008 financial crisis, their U.S. soup sales rose by 12%, continuing a pattern dating back to the Great Depression.

Comfort food became recession-proof.

The 2008 crisis revealed another pattern among these cockroach companies:

Comfort food became recession-proof.

The 2008 crisis revealed another pattern among these cockroach companies:

When competitors slashed R&D budgets, these businesses doubled down on innovation.

And during COVID-19?

Johnson & Johnson leveraged its diversified business model across:

And during COVID-19?

Johnson & Johnson leveraged its diversified business model across:

• Pharmaceuticals

• Medical devices

• Consumer health products

Others struggled with supply chain disruptions, but J&J's decentralized structure allowed divisions to adapt quickly to changes.

Not luck…

It's brilliant strategy.

• Medical devices

• Consumer health products

Others struggled with supply chain disruptions, but J&J's decentralized structure allowed divisions to adapt quickly to changes.

Not luck…

It's brilliant strategy.

The data reveals a mathematical pattern across all seven companies:

In the 24 months following each major crisis, these "cockroach companies" have averaged a 31% higher stock price recovery than the broader market.

The worse the crisis, the stronger their outperformance.

In the 24 months following each major crisis, these "cockroach companies" have averaged a 31% higher stock price recovery than the broader market.

The worse the crisis, the stronger their outperformance.

The "cockroach approach" follows four proven principles:

1. Counter-cycle: Invest when others retreat

2. Long-horizon: Make decisions on 10+ year timeframes

3. Cash reserves: Maintain "survive anything" liquidity

4. Decentralize: Distribute decision-making to respond quickly

1. Counter-cycle: Invest when others retreat

2. Long-horizon: Make decisions on 10+ year timeframes

3. Cash reserves: Maintain "survive anything" liquidity

4. Decentralize: Distribute decision-making to respond quickly

These companies understand a crucial truth about markets:

Crises don't just destroy value—they transfer it.

When competitors falter, they're ready to acquire customers, talent, and market share at fire-sale prices.

They don't just survive crises—they use them as accelerants.

Crises don't just destroy value—they transfer it.

When competitors falter, they're ready to acquire customers, talent, and market share at fire-sale prices.

They don't just survive crises—they use them as accelerants.

The lesson for investors?

During market panics, while others flee, look for businesses following the cockroach playbook:

Those maintaining R&D budgets, keeping teams intact, and prepping for inevitable recovery.

They’re not just survivors—they’re tomorrow’s wealth compounders.

During market panics, while others flee, look for businesses following the cockroach playbook:

Those maintaining R&D budgets, keeping teams intact, and prepping for inevitable recovery.

They’re not just survivors—they’re tomorrow’s wealth compounders.

$45M+ in client assets. 99% reconciliation accuracy.

We build the infrastructure behind smarter & faster decisions—consolidating wealth across banks, real estate, private equity, and more.

If you manage serious capital, let's work together:

assetwis.com

We build the infrastructure behind smarter & faster decisions—consolidating wealth across banks, real estate, private equity, and more.

If you manage serious capital, let's work together:

assetwis.com

I’m Samuel.

I help decision-makers gain clarity through software and systems.

I believe the future belongs to those who prepare—by structuring their data, adopting AI, and thinking long-term.

Follow @Sfuentes005 for lessons from the trenches of tech, business, and beyond.

I help decision-makers gain clarity through software and systems.

I believe the future belongs to those who prepare—by structuring their data, adopting AI, and thinking long-term.

Follow @Sfuentes005 for lessons from the trenches of tech, business, and beyond.

• • •

Missing some Tweet in this thread? You can try to

force a refresh