Founder ASSET | We build data pipelines & dashboards to help HNIs and Family Offices move faster.

How to get URL link on X (Twitter) App

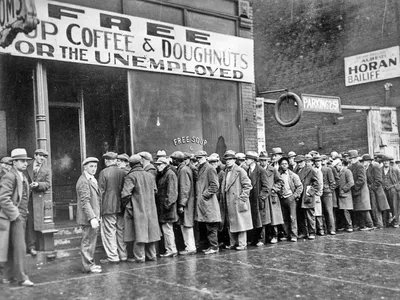

The "cockroach companies" earned their nickname for a simple reason:

The "cockroach companies" earned their nickname for a simple reason:

When John D. Rockefeller became America's first billionaire in 1916 (worth $400B in today's dollars), he faced a crucial challenge:

When John D. Rockefeller became America's first billionaire in 1916 (worth $400B in today's dollars), he faced a crucial challenge:

When Larry Fink co-founded BlackRock in 1988, he was haunted by a $100M trading loss at First Boston—a failure he blamed on poor risk assessment.

When Larry Fink co-founded BlackRock in 1988, he was haunted by a $100M trading loss at First Boston—a failure he blamed on poor risk assessment.

Target's Canadian expansion looked perfect on paper:

Target's Canadian expansion looked perfect on paper:

The Vanderbilt story began in the 1820s with “Commodore” Cornelius Vanderbilt.

The Vanderbilt story began in the 1820s with “Commodore” Cornelius Vanderbilt.

March 2008:

March 2008: