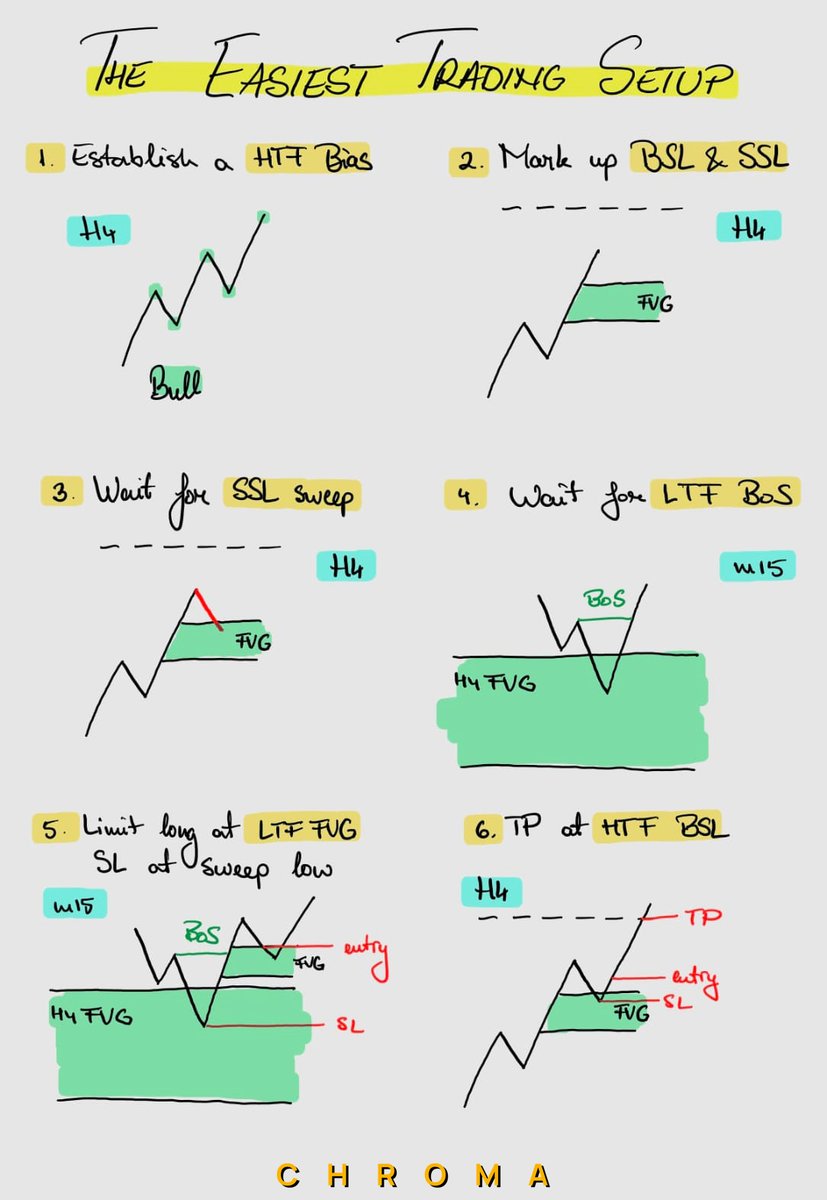

2. Mark up BSL and SSL

SSL are usually FVGs below the current price

BSL are usually highs above the current price

SSL are usually FVGs below the current price

BSL are usually highs above the current price

It's that easy

It can give you many setups on many altcoins

It can give you high RR or low RR setups

Alts or $BTC

Just follow the plan and you will be more consistent! If you enjoyed this thread like it, share it, learn it, use it!

Follow for more educational threads ❤️

It can give you many setups on many altcoins

It can give you high RR or low RR setups

Alts or $BTC

Just follow the plan and you will be more consistent! If you enjoyed this thread like it, share it, learn it, use it!

Follow for more educational threads ❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh