BEST TEACHER ON X 📚

| Analyst at @Chroma_Trading / https://t.co/kAmcqTp15I

| Twitch: https://t.co/kEmDBW4O62

| Partners: @MyCryptoFunding @OfficialApeXdex @Tealstreetio

2 subscribers

How to get URL link on X (Twitter) App

Personally I use the 15 second chart from the default template on

Personally I use the 15 second chart from the default template on

Step 1

Step 1

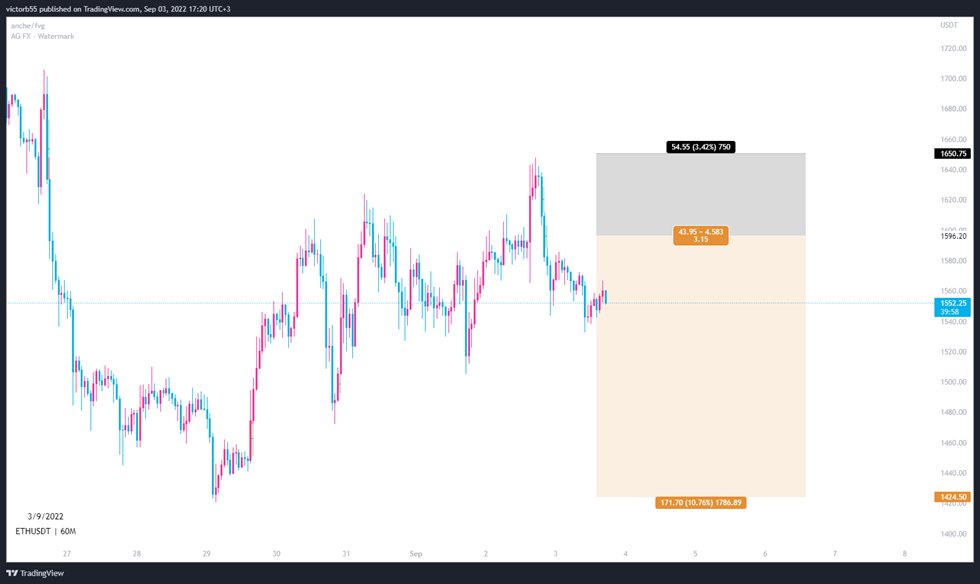

First and foremost, you should not look for any trades while price is inside the range

First and foremost, you should not look for any trades while price is inside the range

Normally, a bearish FVG should act as resistance. A bullish FVG should act as support.

Normally, a bearish FVG should act as resistance. A bullish FVG should act as support.

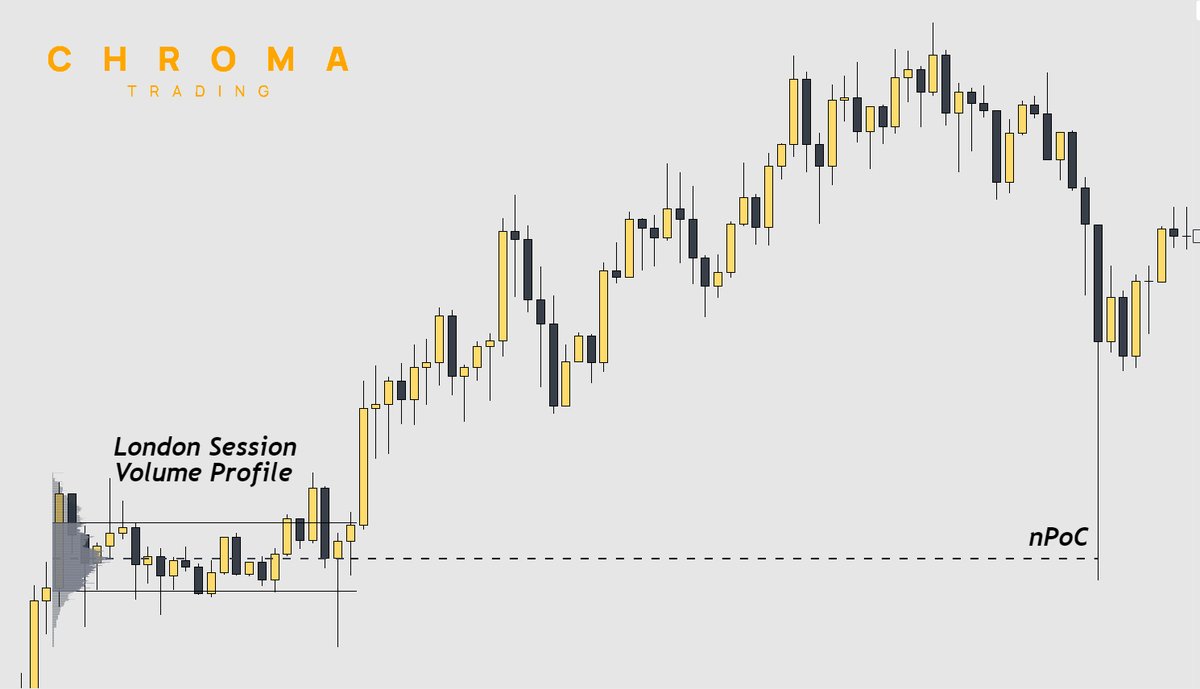

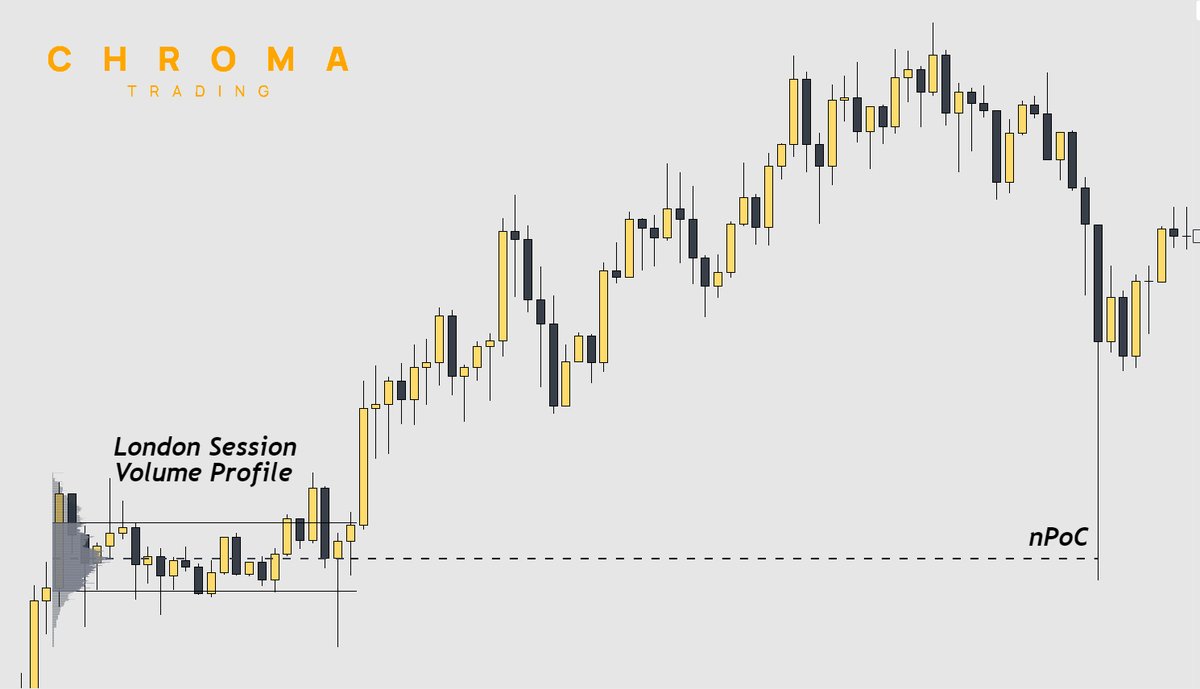

What is a PoC?

What is a PoC?

What is pair trading?

What is pair trading?

Introduction

Introduction

Po3 (power of 3)

Po3 (power of 3)

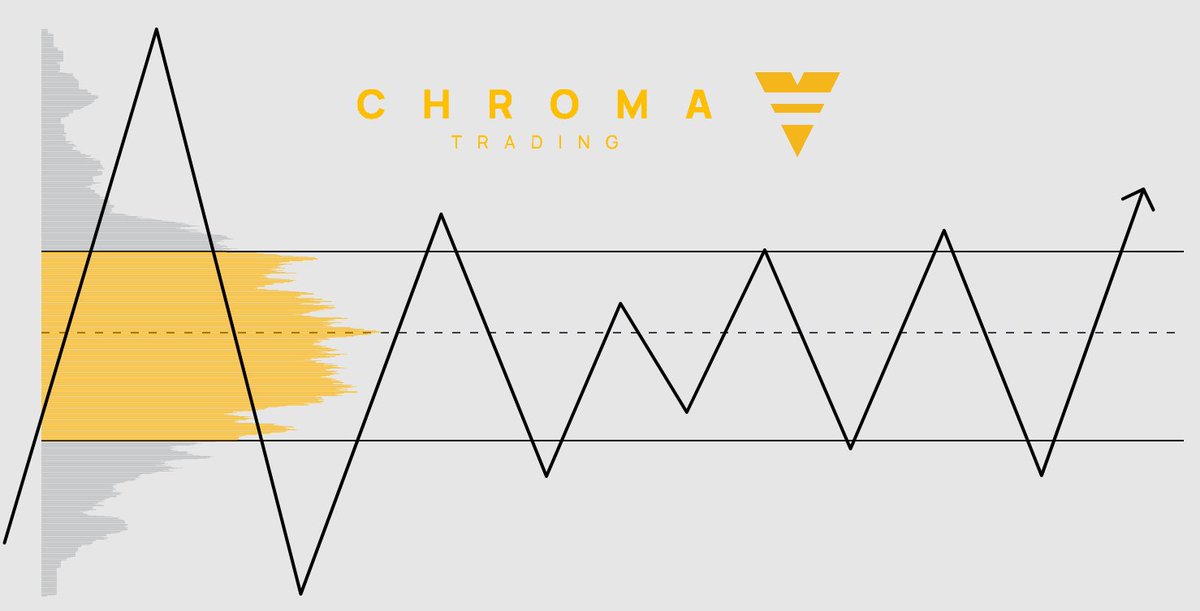

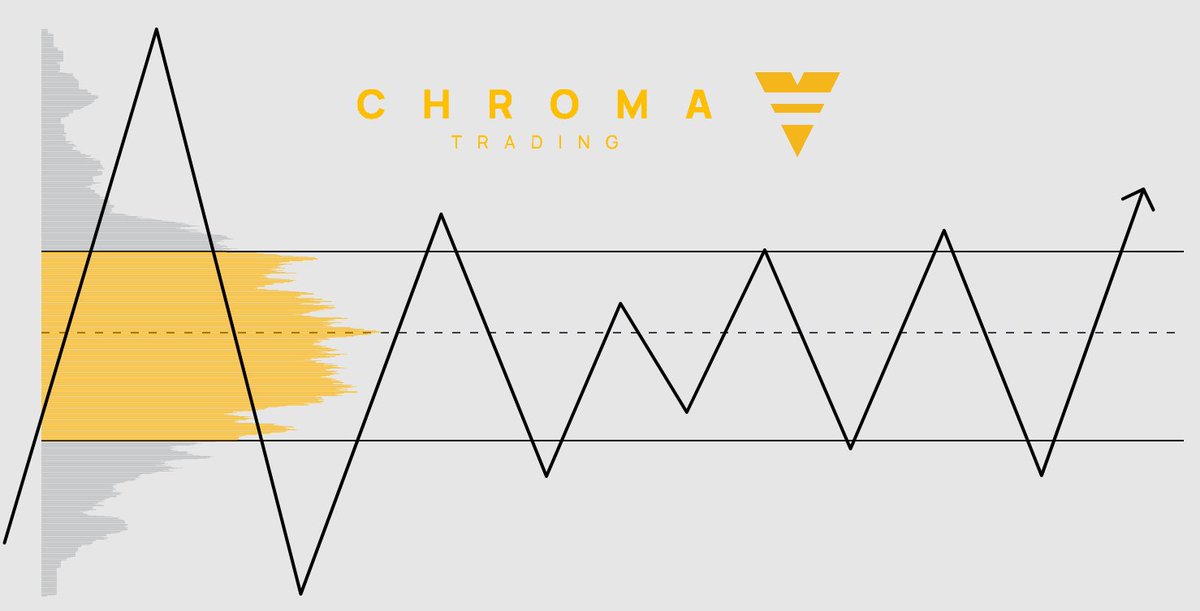

How to identify the setup

How to identify the setup

How to identify the setup

How to identify the setup

Charting on one timeframe where you find your setups, or even two timeframes that work well together like H1-m15 or m5-m1, is obviously very useful, but the best way to do it is to take LTF setups that are in confluence with HTF liquidity sweeps.

Charting on one timeframe where you find your setups, or even two timeframes that work well together like H1-m15 or m5-m1, is obviously very useful, but the best way to do it is to take LTF setups that are in confluence with HTF liquidity sweeps.

To better understand the concepts I am about to use in this thread, please read my guide to the liquidity concepts (if you need to). The most important concepts to understand are MSBs, OBs, Breakers, liquidity sweeps, SSL / BSL, equal highs / lows:

To better understand the concepts I am about to use in this thread, please read my guide to the liquidity concepts (if you need to). The most important concepts to understand are MSBs, OBs, Breakers, liquidity sweeps, SSL / BSL, equal highs / lows:https://twitter.com/victorious__5/status/1572307714818322432?s=20&t=Kjn7SpR9Ku84UEMKxp_dbg

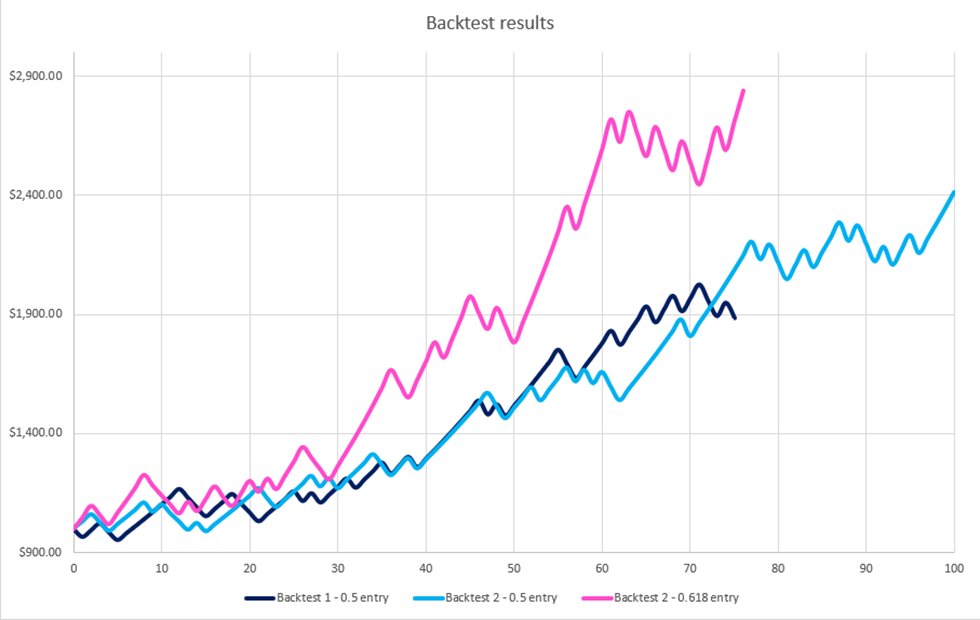

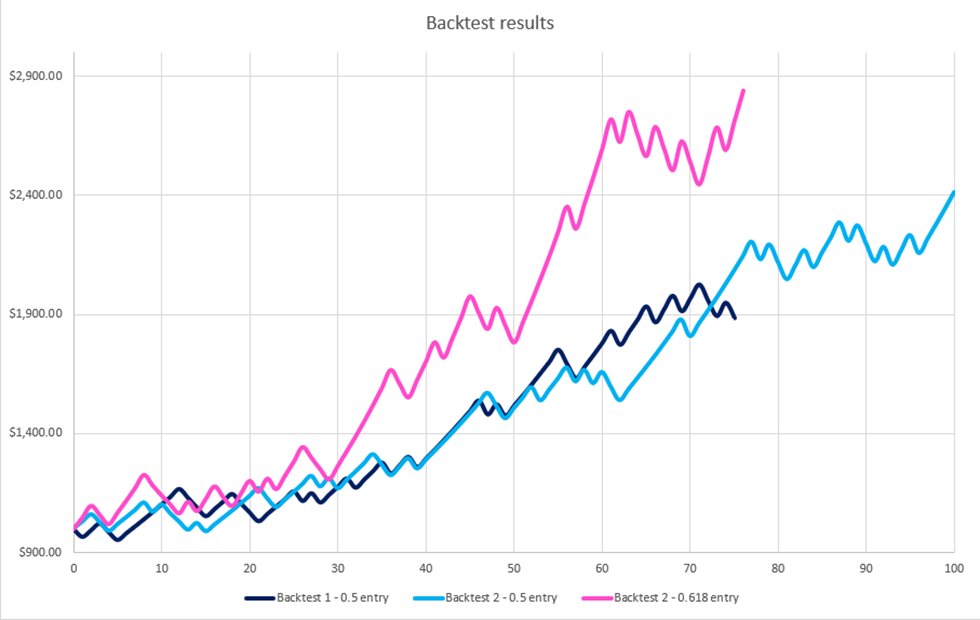

In the following link you will find almost all the trades. Day one I played with FX which was stupid from my part, hence why the 371$ daily loss and the 189$ max loss.

In the following link you will find almost all the trades. Day one I played with FX which was stupid from my part, hence why the 371$ daily loss and the 189$ max loss.

If you don’t know about my 1R setup or need a reminder it is based on entering at 50% retracement after a reversal market structure break (MSB). Here is the link, in case you need it:

If you don’t know about my 1R setup or need a reminder it is based on entering at 50% retracement after a reversal market structure break (MSB). Here is the link, in case you need it: https://twitter.com/victorious__5/status/1560682136906207238?s=20&t=XPzdRgKVzd2fMeGoe6ZhJA

Now for the setup:

Now for the setup:

Updated TP per @jonzitrades suggestion

Updated TP per @jonzitrades suggestion