Through the Optics of War: An analysis of leaked confidential data from Russia’s military-industrial complex by Frontelligence Insight — from thermal scopes and laser anti-UAV programs to Chinese import schemes and production bottlenecks in the optoelectronic sector. 🧵Thread:

2/ Rostec is a state-owned conglomerate that includes much of Russia’s military-industrial complex. One of its key holdings, Shvabe, specializes in optical-electronic technologies for military and dual-use applications. The original files were obtained by the @256CyberAssault

3/ In February 2024, Polyus Scientific Research Institute, part of Shvabe Holding, was tasked with advancing laser technologies to counter UAVs. This includes developing materials like active elements under a program focused on high-power lasers, running through 2033.

4/ Similarly, in 2022, JSC High-Precision Systems and JSC Research Institute "Polyus" were assigned to propose the development of a counter-UAV laser system, potentially integrated with the Pantsir-S1.

5/ In May 2024, company VOMZ, in collaboration with Shvabe, were tasked with assessing the integration of UAVs into tank fire control systems. The goal is to improve reconnaissance and target engagement at extended ranges (up to 15 km), including from concealed firing positions

6/ Concealed/Closed-position firing allows a tank to engage targets without direct line of sight, using its main gun similarly to artillery. This enables fire support at extended ranges while keeping the tank hidden from view and out of reach of conventional anti-tank weapons.

7/ Our team assumes that Russia will continue attempts to integrate various UAV systems in fire control systems across various platforms – not just tanks, in future modernization efforts aiming to increase both the range and accuracy.

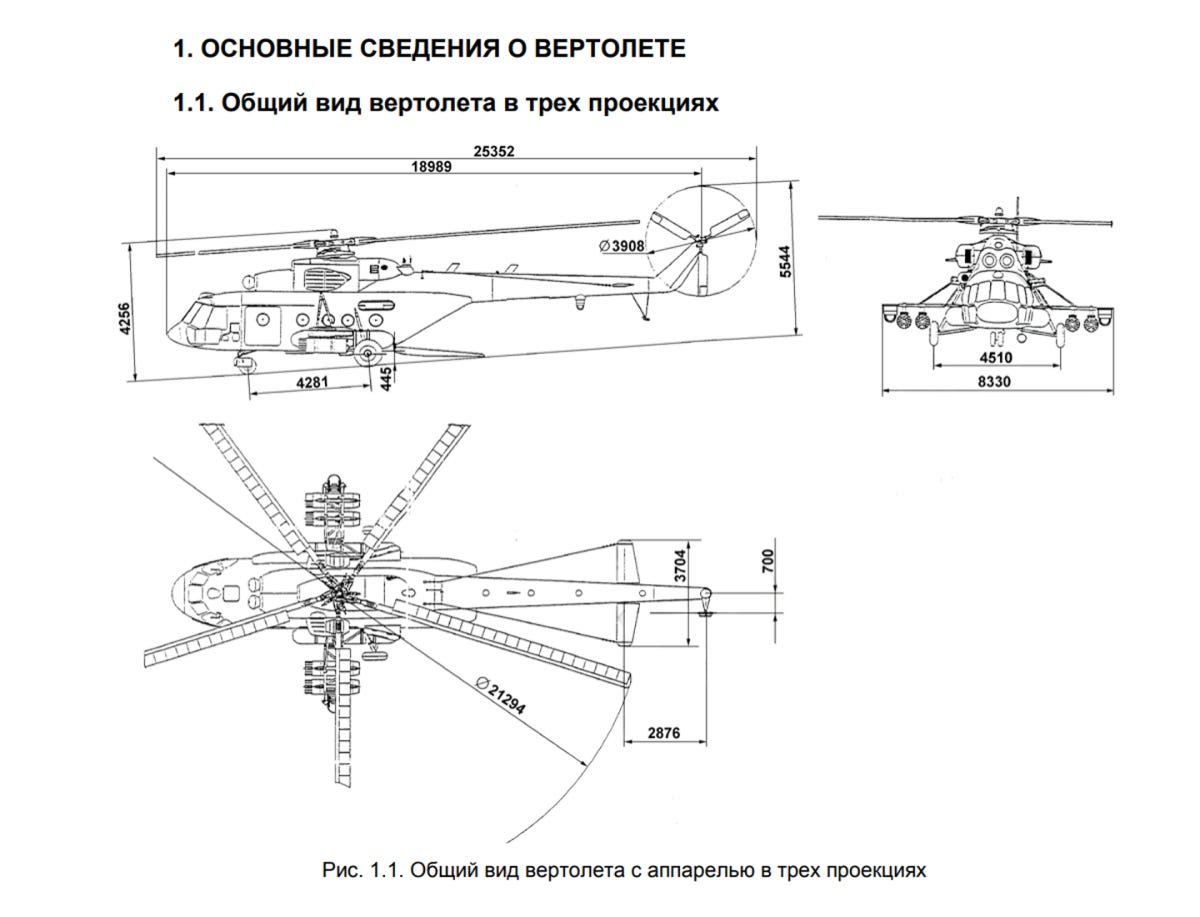

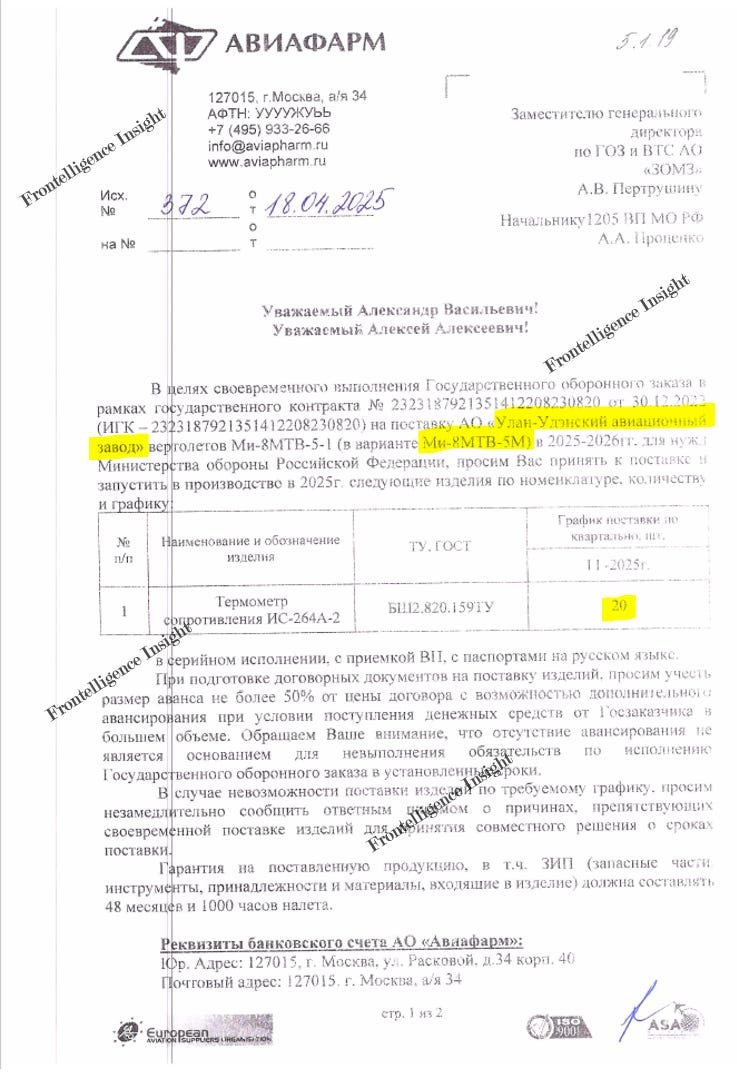

8/ Military plant Krasnogorsky Zavod (KMZ) was participating in OPS-28M production: an electro-optical surveillance and targeting system used on Mi-28NM helicopters. However, an August 2024 report noted that the quality of the supplied OPS-28M units was unsatisfactory.

9/ JSC State Institute of Applied Optics was tasked with import substitution of the Catherine-XP-PCS thermal imaging camera in the T-90M fire control system. But how is Russia handling import substitution? Achieving this appears difficult — if not impossible — without China

10/ According to data from the 256th Cyber Assault Unit shared by @InformNapalm, the company “YUMAK” supplied CNC machines from Chinese firms Push Ningjiang Machine Tool Co and Tianjin No.1 Machine Tool Works to “Zenit-Investprom,” a part of Shvabe holding

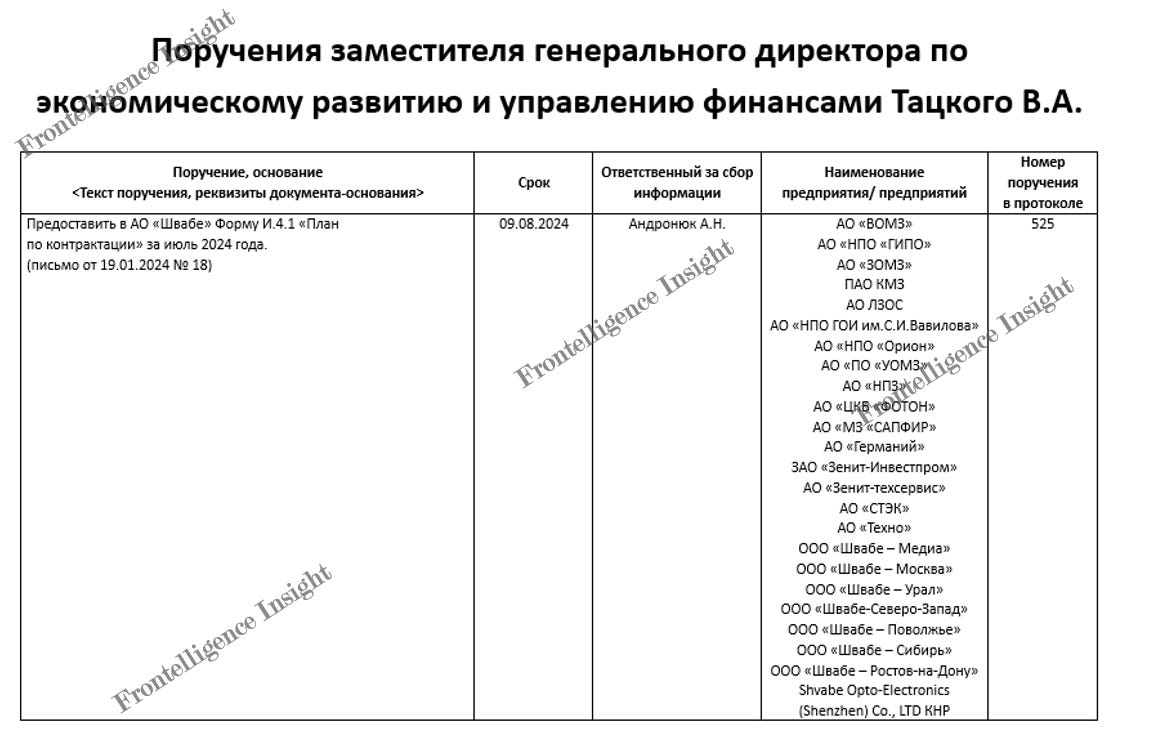

11/ One internal company document, which included a detailed task list, also contained a roster of various firms within the holding, along with their assigned task. Among them, one name stood out: Shvabe Opto-Electronics, based in Shenzhen, China.

12/ According to Trademo export-import data, Shvabe in Shenzhen has consistently supplied components to the Ural Optical and Mechanical Plant and JSC Novosibirsk Instrument-Making Plant—both sanctioned by the West, including the US

13/ Last but not least is the issue of production expansion. As previously mentioned, the company from Shvabe Holding called “Zenit-Investprom” has acquired Chinese industrial equipment to support manufacturing efforts of Rostec.

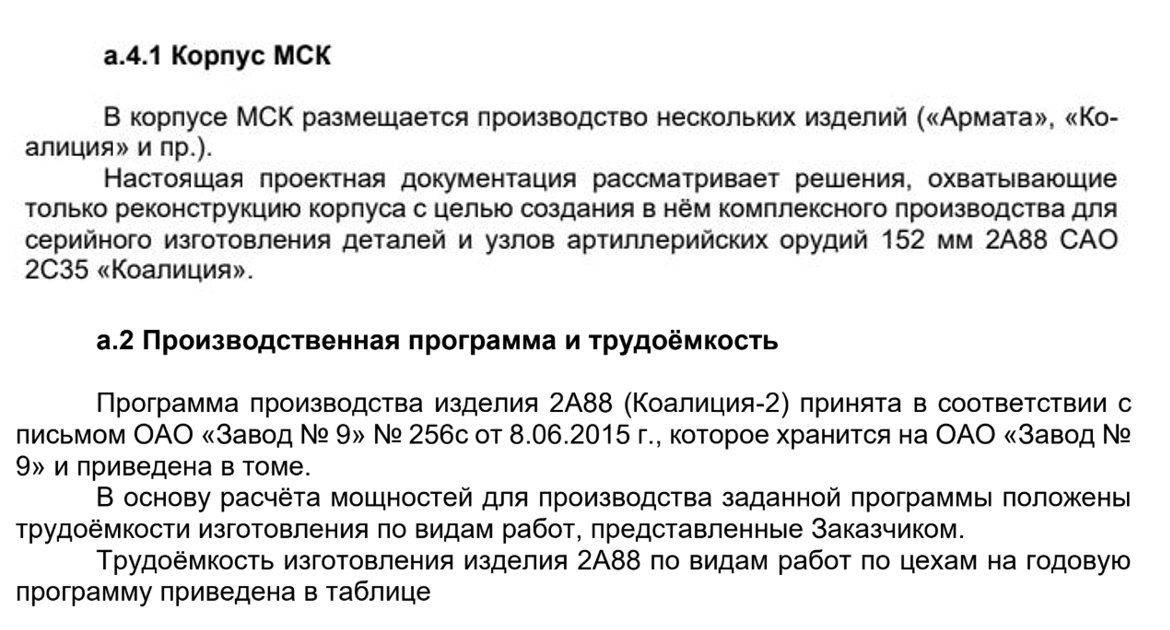

14/ Further investigation into Zenit-Investprom revealed extensive correspondence with Zavod No. 9—which can be translated as “Factory No. 9” — a facility known for producing towed artillery pieces such as the D-30 howitzers, as well as tank guns, including the newer T-90 models

15/ Given that some requested equipment for expansion —like the laser heat-strengthening system—is designed for metalwork, and considering the factory produces barrels for tanks and artillery, Russia likely tries to expand its barrel production

16/ While the deadline for Zenit-Investprom’s part of the project was 2023/12/31, in April 2024 Zavod#9 sent a letter demanding proof of completed work. The letter stated that no documentation had been received and called for comprehensive action within three days

17/ Despite production delays, quality issues, and sanctions, Russia is making a certain progress in manufacturing and deploying updated technologies. The key shift since the pre-war period is integrating battlefield experience into mass production plans

18/ Barring severe economic collapse or major defeat, if Russia spends several years building and stockpiling equipment while leveraging Chinese industry and Western parts, its future military will be more modern and technologically advanced than during the 2022 invasion.

19/ The full investigation, containing extensive data, is available on our website. Please follow the link for more information and access to the files referenced in this report

frontelligence.substack.com/p/through-the-…

frontelligence.substack.com/p/through-the-…

Thank you for reading. It takes considerable time and effort to sift through tens of thousands of records to find and interpret valuable data. We haven’t asked for support in a while, so we kindly invite you to consider financially supporting our work

buymeacoffee.com/frontelligence

buymeacoffee.com/frontelligence

• • •

Missing some Tweet in this thread? You can try to

force a refresh