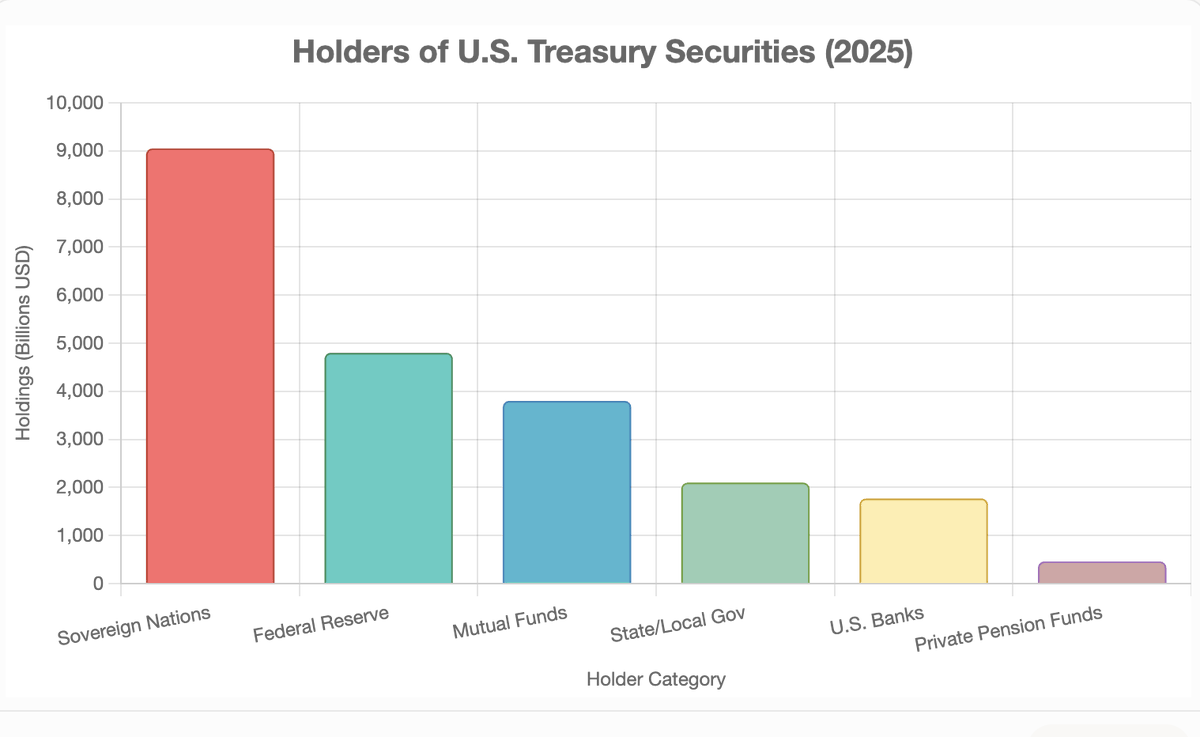

Who owns our debt?

Mainly other countries.

And they are selling our debt.

So how is this going to unfold? 1/N

Mainly other countries.

And they are selling our debt.

So how is this going to unfold? 1/N

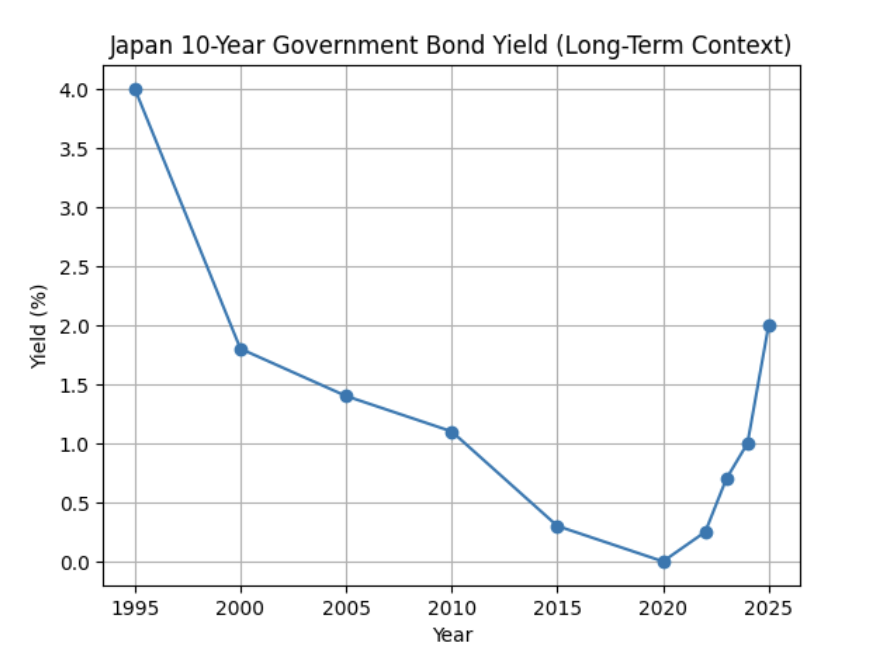

Let's first look at the Sovereigns. 2/N

Japan has already threatened to dump the majority of their treasuries. There are reducing. China is selling for gold. Mainland Europe is not in a position to buy more.

There really is no room to grow here.

Japan has already threatened to dump the majority of their treasuries. There are reducing. China is selling for gold. Mainland Europe is not in a position to buy more.

There really is no room to grow here.

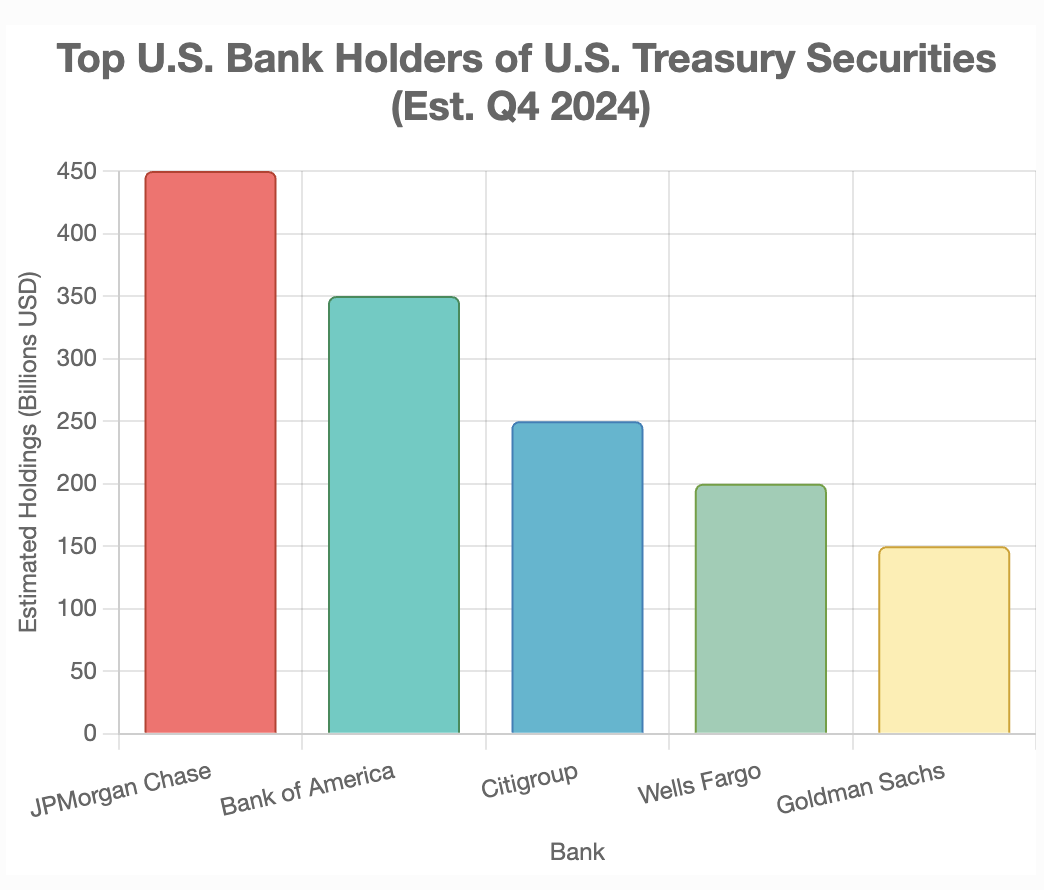

Next obvious category: banks 3/N

But these are reeling from 2020. Bank of America in particular is sitting on 100 Billion of unrealized losses. There is not a lot "growth potential" there. And the numbers are small. Remember we have a 2 Trillion deficit that could easily double in a recession. These numbers are an order of magnitude lower.

But these are reeling from 2020. Bank of America in particular is sitting on 100 Billion of unrealized losses. There is not a lot "growth potential" there. And the numbers are small. Remember we have a 2 Trillion deficit that could easily double in a recession. These numbers are an order of magnitude lower.

Obviously, the big category that is going to have to take over is the Fed itself. 4/N

For 3.5 years, Powell has been pretending like he is the second coming of Paul Volker.

But this charade will soon end. The only way out short term is QE baby. Monetization.

For 3.5 years, Powell has been pretending like he is the second coming of Paul Volker.

But this charade will soon end. The only way out short term is QE baby. Monetization.

But there is one final category. Stablecoins.

And now that the Genius act has passed, this sentence is HIGHLY relevant 5/N

And now that the Genius act has passed, this sentence is HIGHLY relevant 5/N

Indeed. We already have 200 Billion of Stablecoins. The plan is is to 15x this and force them all to buy US Treasuries.

Why 15x? You heard the man. Stablecoins will be the biggest holders. MORE than sovereigns which currently own 3 Trillion. 6/N

Why 15x? You heard the man. Stablecoins will be the biggest holders. MORE than sovereigns which currently own 3 Trillion. 6/N

But were will that 3 Trillion of Stablecoins live?

By definition on a BLOCKCHAIN. 7/N

Here are the candidates

1. ETH

2. Solana

By definition on a BLOCKCHAIN. 7/N

Here are the candidates

1. ETH

2. Solana

Now, my gut feel is Solana will get the majority of this over time. Lets call it 2 Trillion. 8/N

What does that mean for Solana, currently valued at 88 Billion? Probably a 30x.

I leave that number to @BritishHodl and other naysayers who fail to grasp exactly what is going on.

What does that mean for Solana, currently valued at 88 Billion? Probably a 30x.

I leave that number to @BritishHodl and other naysayers who fail to grasp exactly what is going on.

• • •

Missing some Tweet in this thread? You can try to

force a refresh