Investor. Not Financial Advice. Bitcoin and AI maxi. Stanford PhD. "You might want to buy some in case it catches on" https://t.co/DwDqhhtujd

3 subscribers

How to get URL link on X (Twitter) App

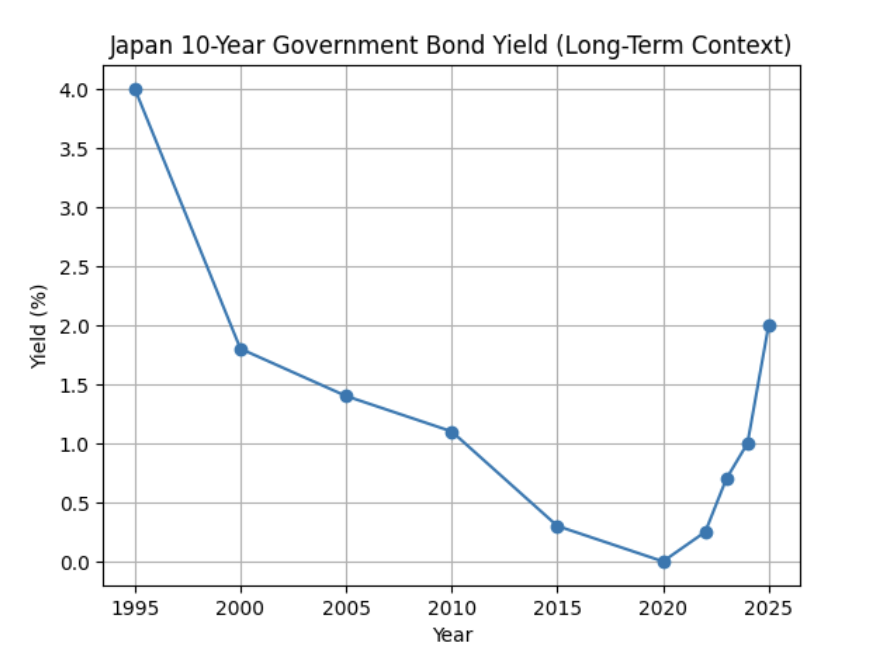

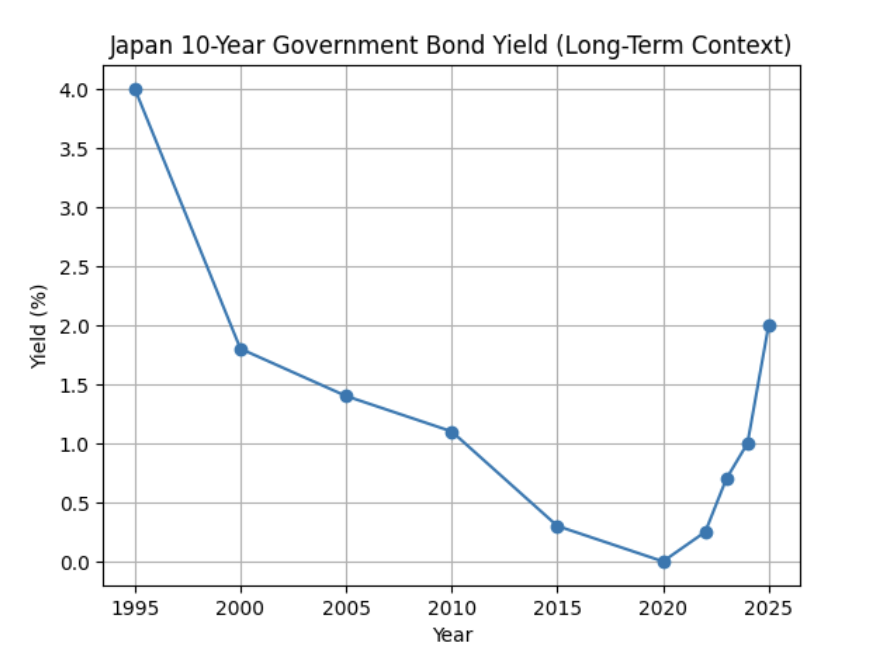

🇯🇵🇺🇸 Japan is a beast of its own and very different from the U.S. For the last two decades, Japan has lived under zero interest rates and QE — effectively a flat yield curve pinned at zero. 2/N

🇯🇵🇺🇸 Japan is a beast of its own and very different from the U.S. For the last two decades, Japan has lived under zero interest rates and QE — effectively a flat yield curve pinned at zero. 2/N

The 100K investment goes to 1.2 MM on average with a standard deviation of 355K.

The 100K investment goes to 1.2 MM on average with a standard deviation of 355K.

Why now?

Why now?

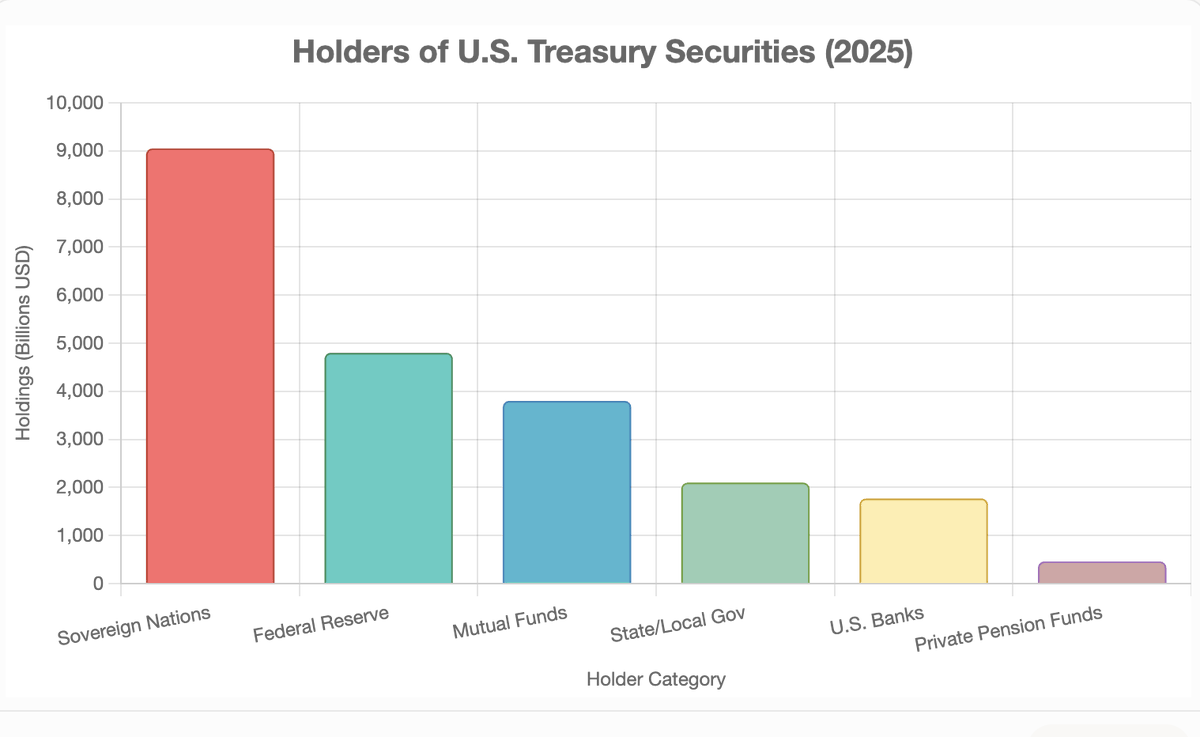

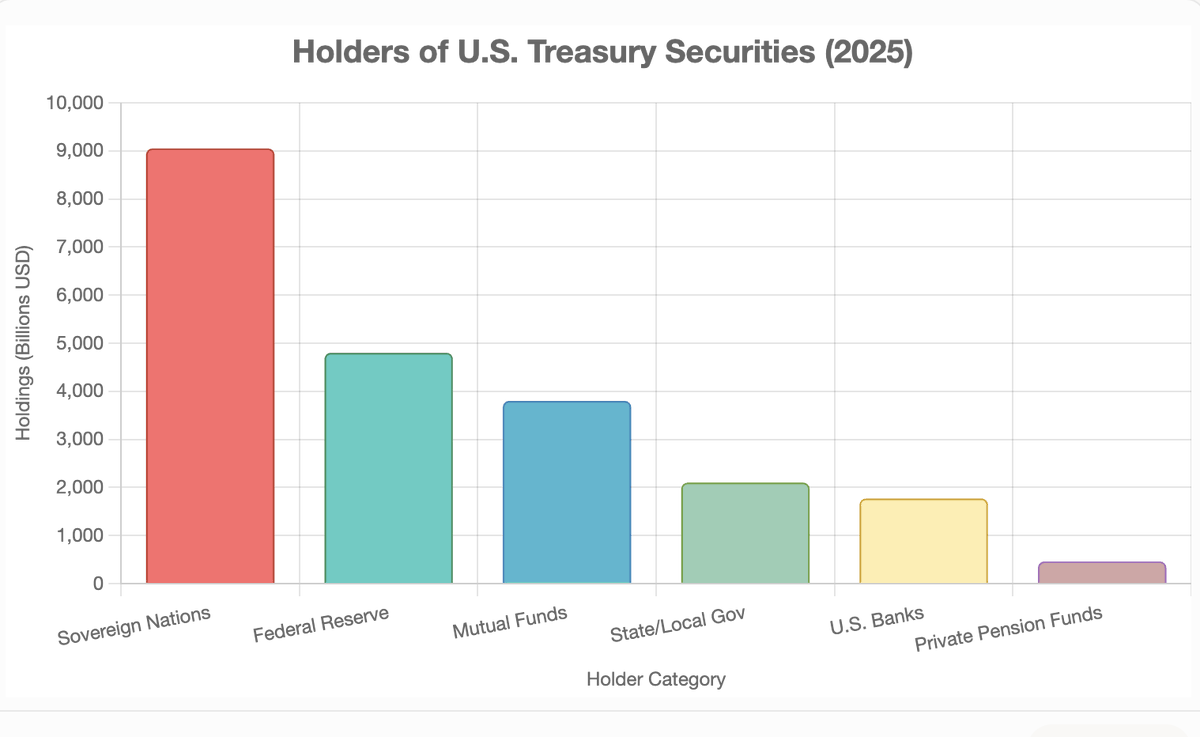

Let's first look at the Sovereigns. 2/N

Let's first look at the Sovereigns. 2/N

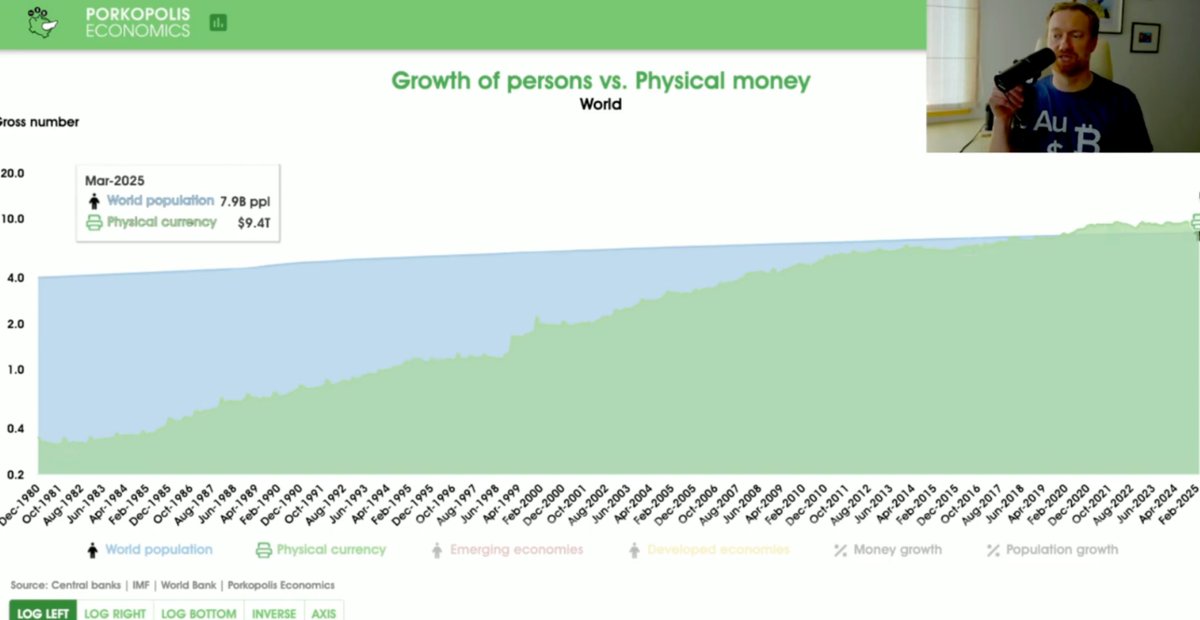

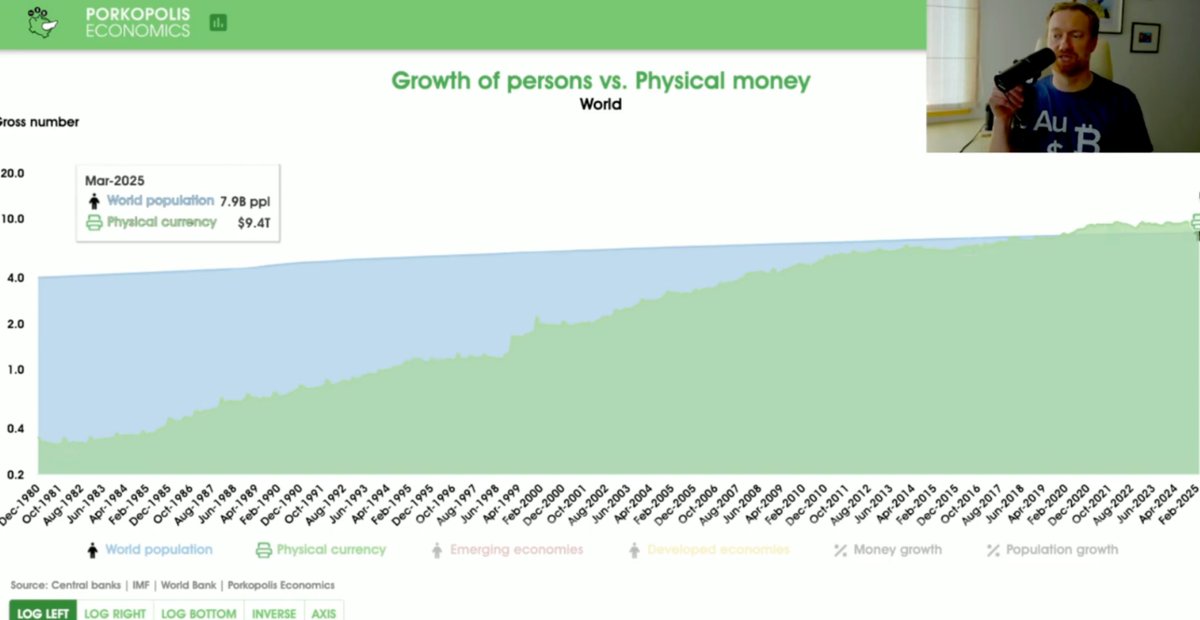

https://twitter.com/1basemoney/status/1912065202419540090First of all, Mathew looks at population growth versus money supply growth over the last 50 years. Money Supply is growing at 13% while population growth is growing at 1-2%.

We spend basically 7 hours a day now wasting time of the Internet. We have become vegetables. 2/N

We spend basically 7 hours a day now wasting time of the Internet. We have become vegetables. 2/N

Observation 2: Vol is estimated at 0.3. So 1 standard deviation is 100% from trend. 2 is 200% of trend.

Observation 2: Vol is estimated at 0.3. So 1 standard deviation is 100% from trend. 2 is 200% of trend.

If you have independent, identically distributed events, such as the number of phone calls you get in an hour, or, as Satoshi was modeling, the number of blocks you can mine in 10 min * z, where z is the amount of confirmations a receiver has been given in advance of a planned double spend.

If you have independent, identically distributed events, such as the number of phone calls you get in an hour, or, as Satoshi was modeling, the number of blocks you can mine in 10 min * z, where z is the amount of confirmations a receiver has been given in advance of a planned double spend.