In Japan's low for long era (with a flat curve out to 10ys, thanks to yield curve control), the Japanese banks loaded up on ultra long bonds & probably are looking to lighten up.

But there are natural buyers long-dated JGBs too

1/

But there are natural buyers long-dated JGBs too

1/

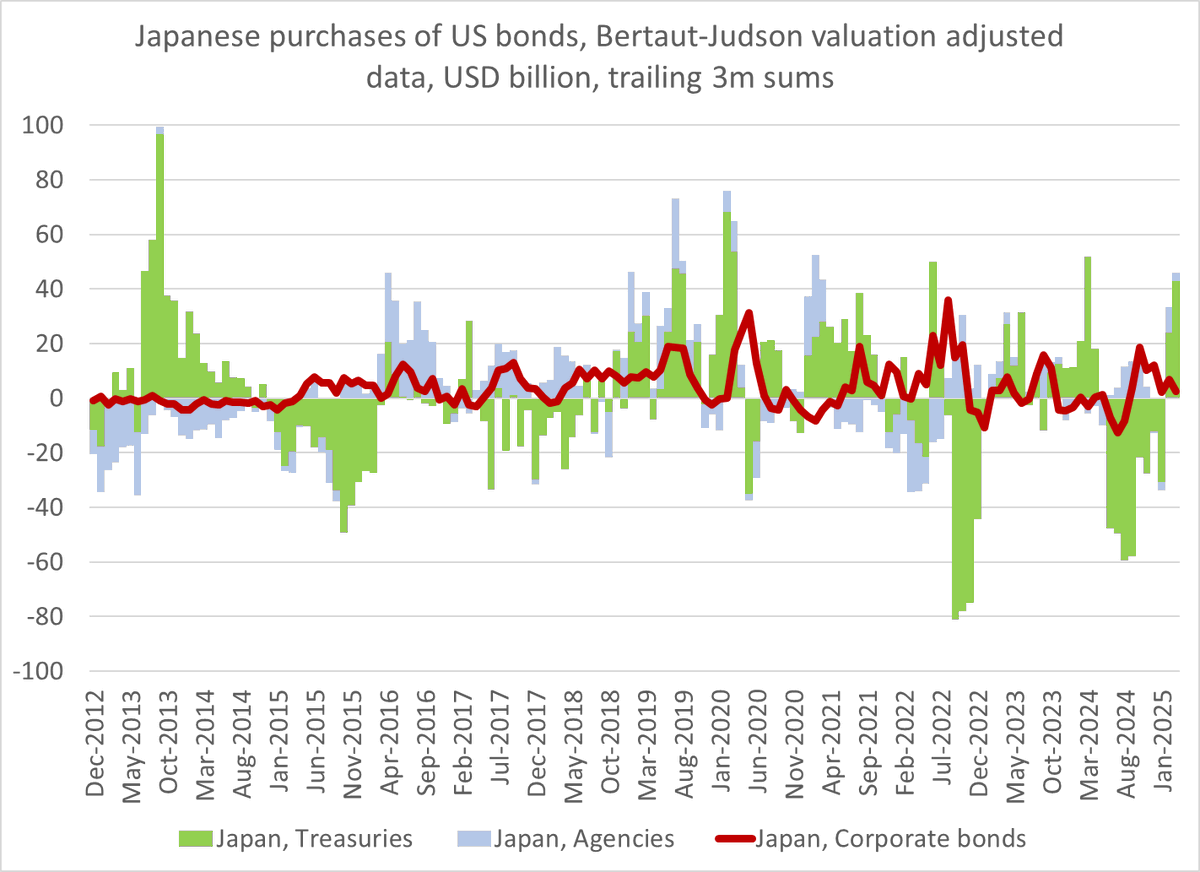

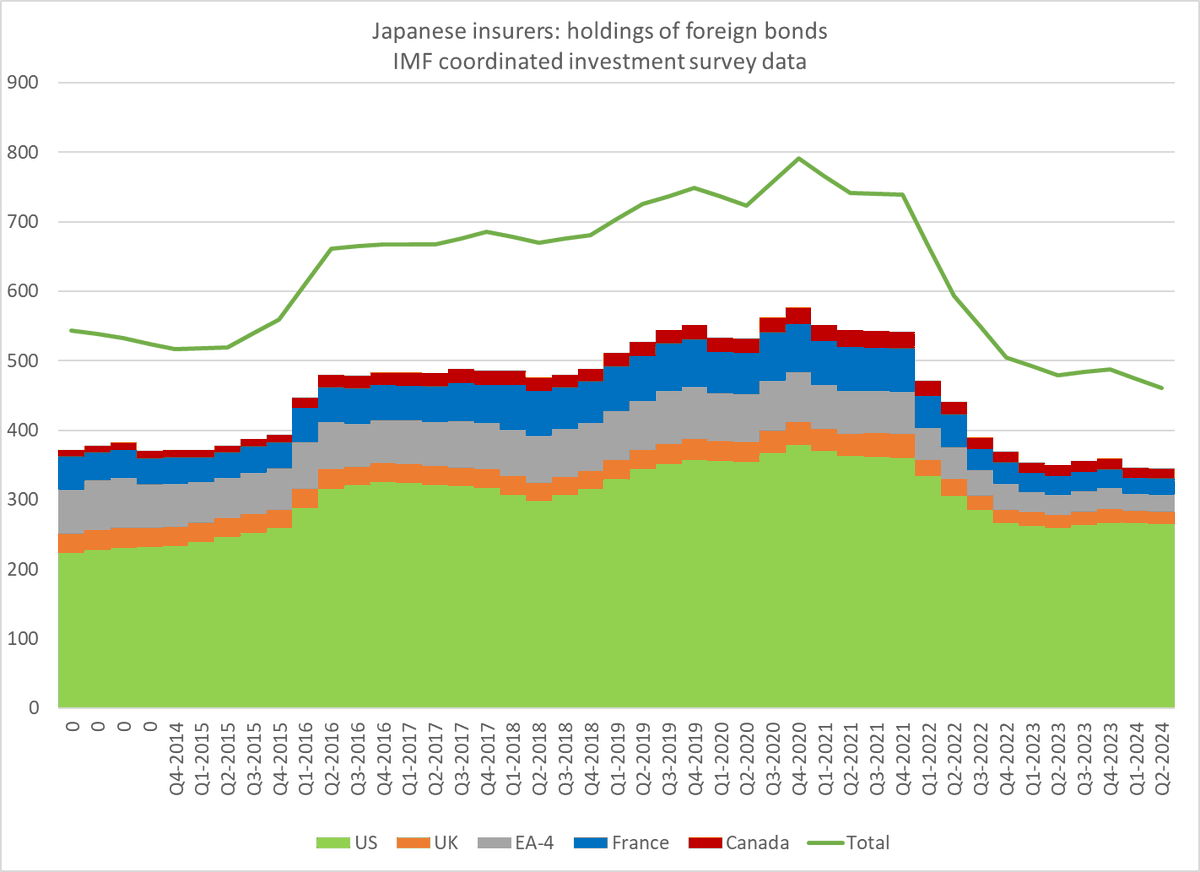

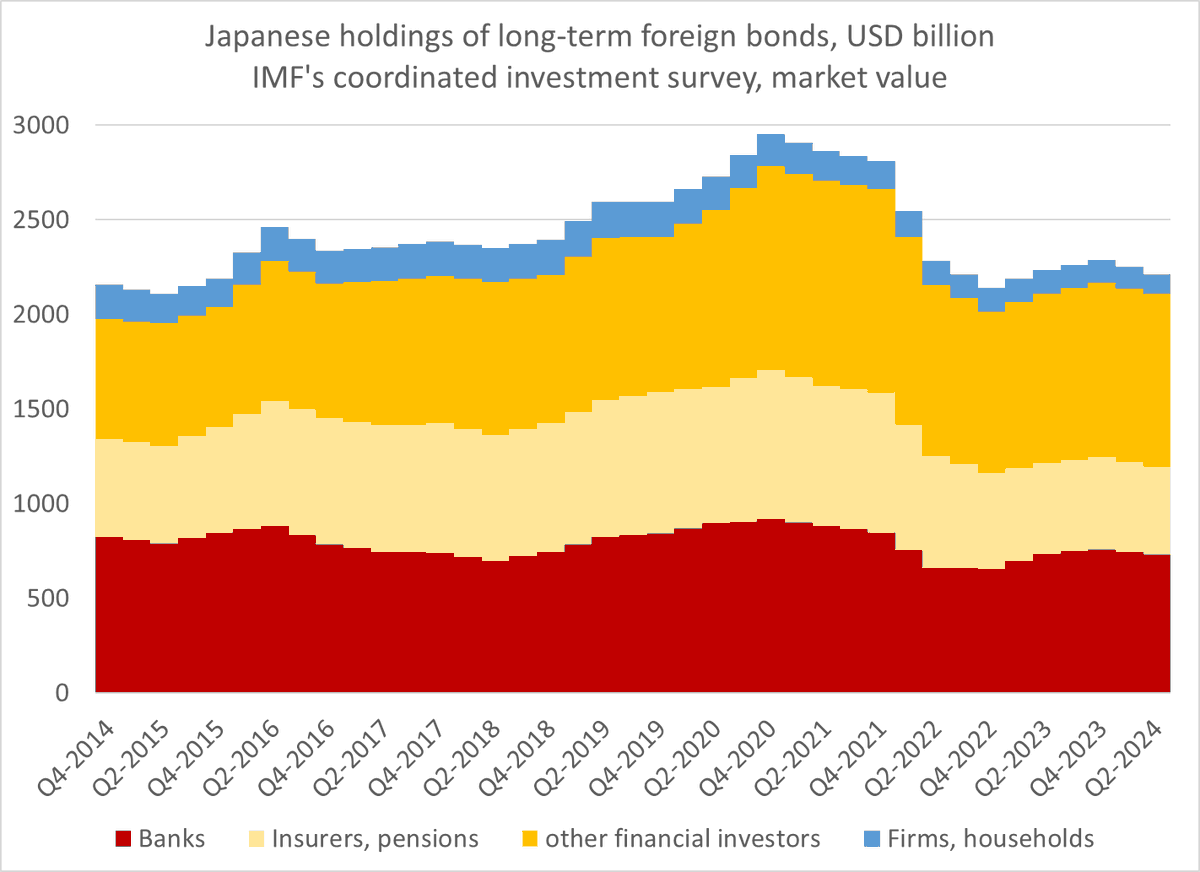

The low for long era (with a different shaped curve in Japan and the US/ Europe) pushed the insurers into foreign bonds & big Japanese institutions like Post bank and Nochu as well. These institutions have yen liabilities, and thus naturally would match with yen bonds

2/

2/

The main constraint I suspect is that many of the insurers took large mark to market losses on their foreign bonds in 22 and 23 (hence the fall in the market value of their portfolio) and selling the bonds may mean realizing losses

3/

3/

The insurers also reduced their ratio (now only ~ 40% hedged per the BoJ) as hedging costs rose

With $500b in bonds and $300b or so unhedged, they have a lot of firepower -- and a 20y JGB is a great match for their liabilities.

4/

With $500b in bonds and $300b or so unhedged, they have a lot of firepower -- and a 20y JGB is a great match for their liabilities.

4/

Post bank and Nochu are massive, with $700-800b in foreign bonds (mostly hedged) on the asset side and only yen liabilities -- they were forced by the flat curve abroad (and into the ultralongs) but could come home

5/

5/

The big players were mostly hedged (tho maybe the held funds in third party managers who played some games) so this repatriation would not necessarily be a yen positive flow. But at some stage they can lock in a lot of flow profits by doing what they were set up to do .... 6/

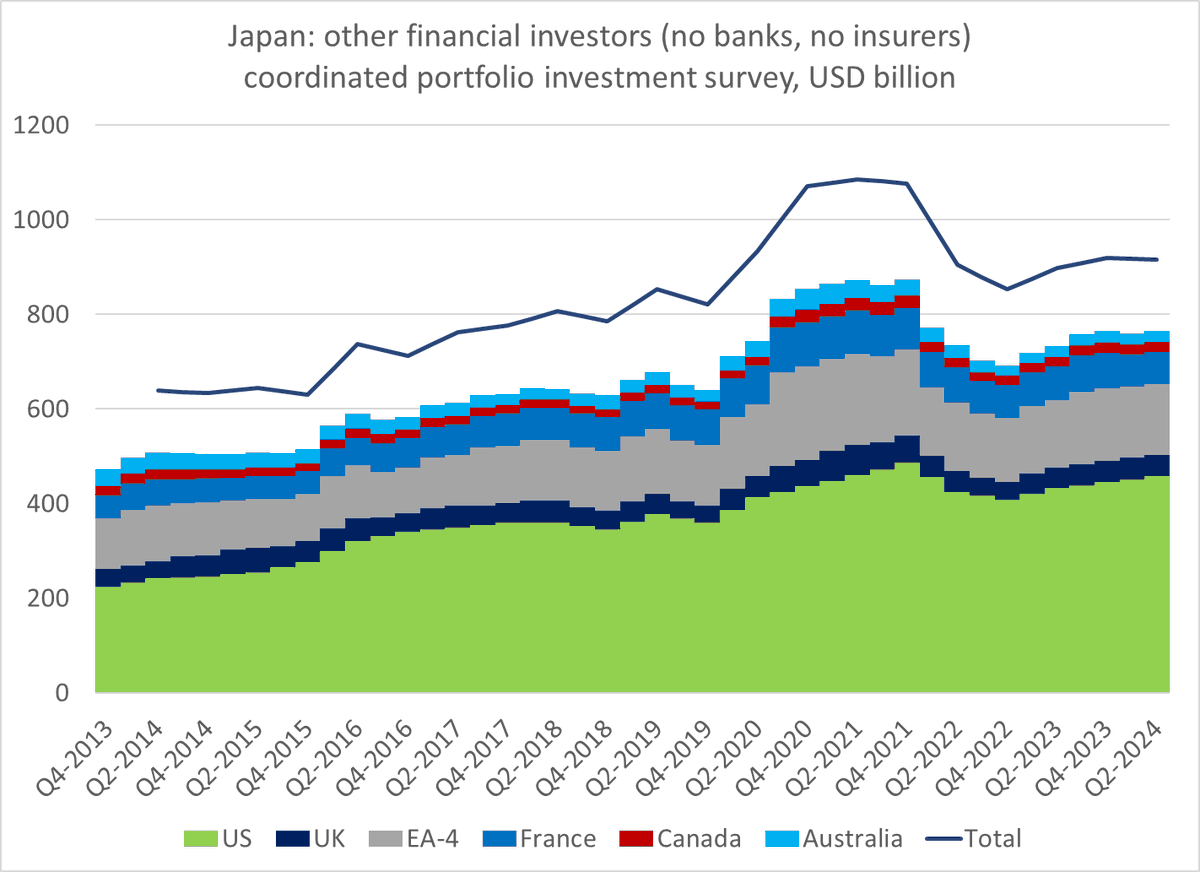

Nochu and Postbank show up in the "other financial investors" category of the IMF portfolio survey b/c of their heavy use of external fund managers. So does the GPIF ...

7/

7/

Japanese friends and close watchers of its markets tell me that GPIF isn't nimble and it cannot easily adjust its portfolio allocation ...

8/

8/

But it is huge, and its portfolio now is only 1/4 domestic bonds (1/4 is foreign bonds, 1/4 is foreign equities). Selling foreign equities (at a very attractive valuation) to buy long-dated JGBs (with a nice real yield) would be a good trade imo ...

9/

9/

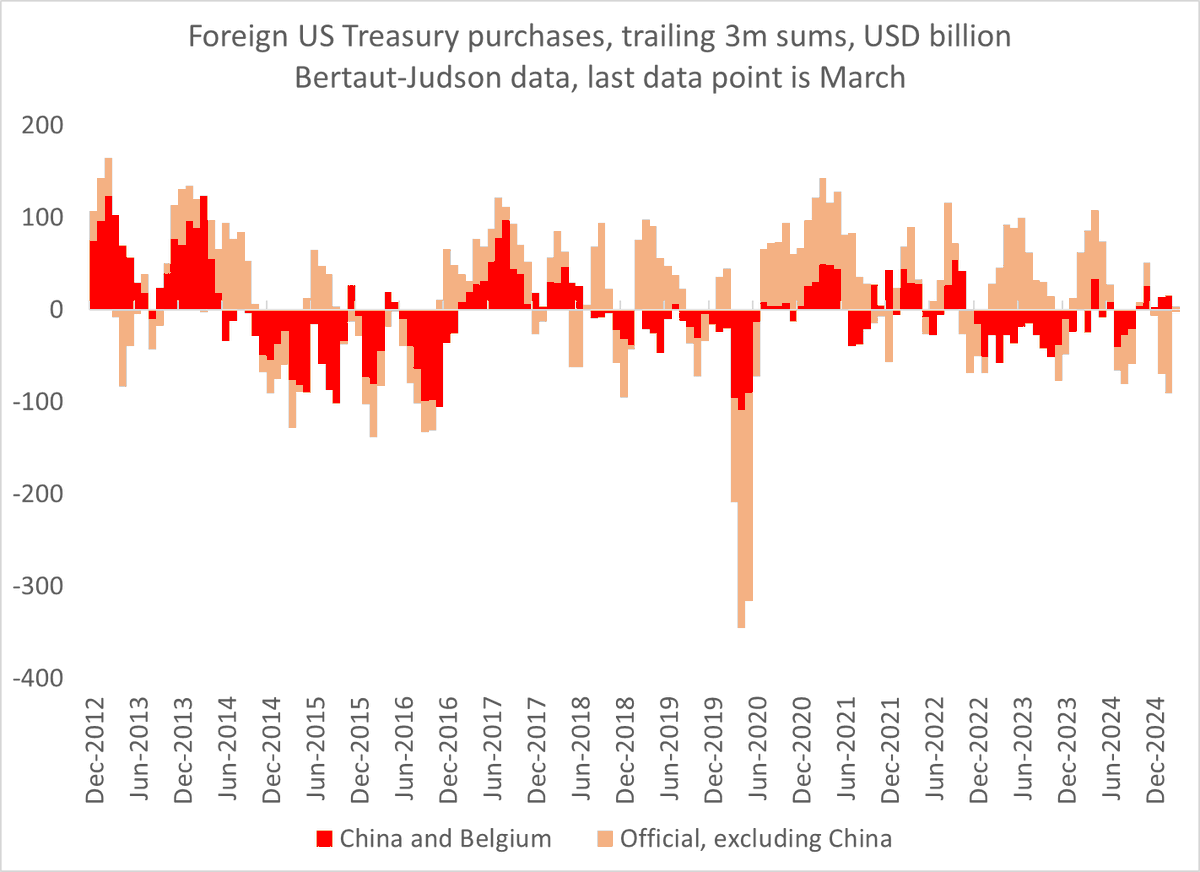

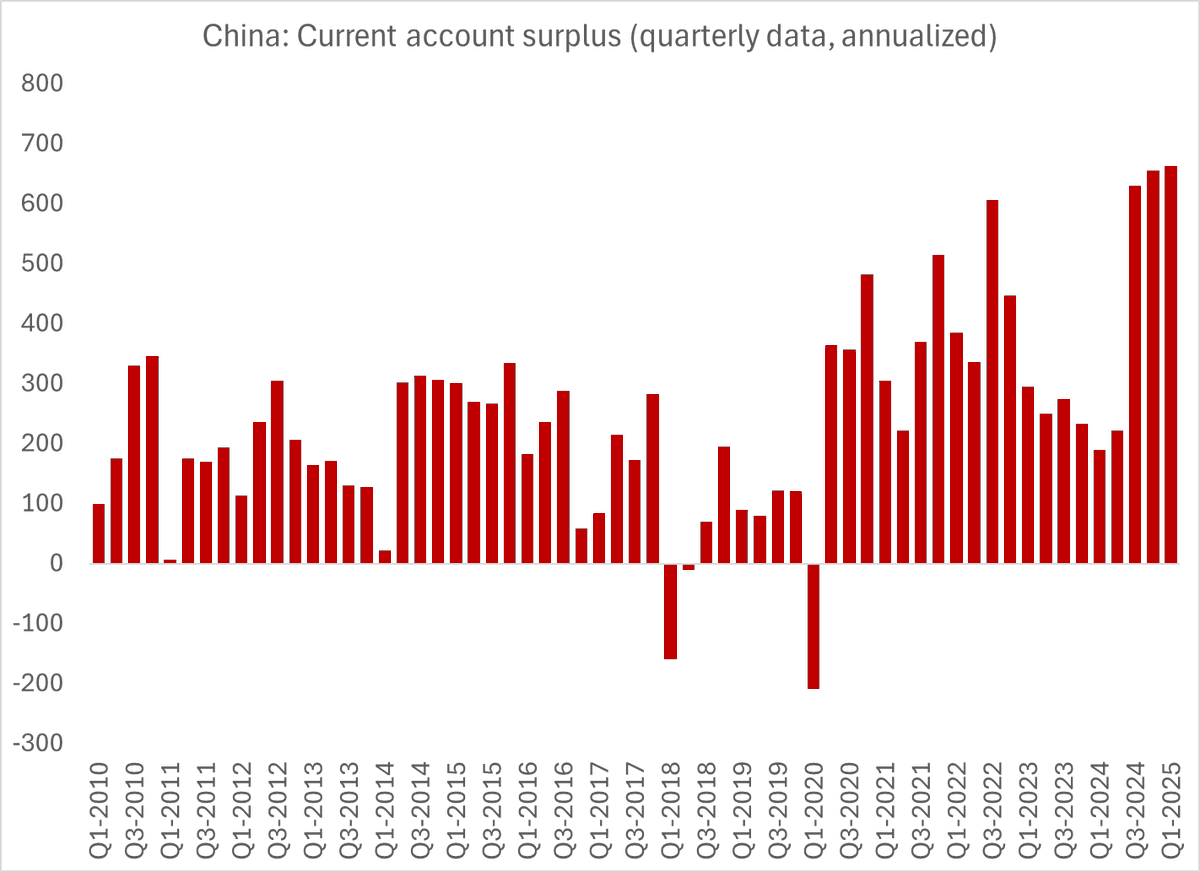

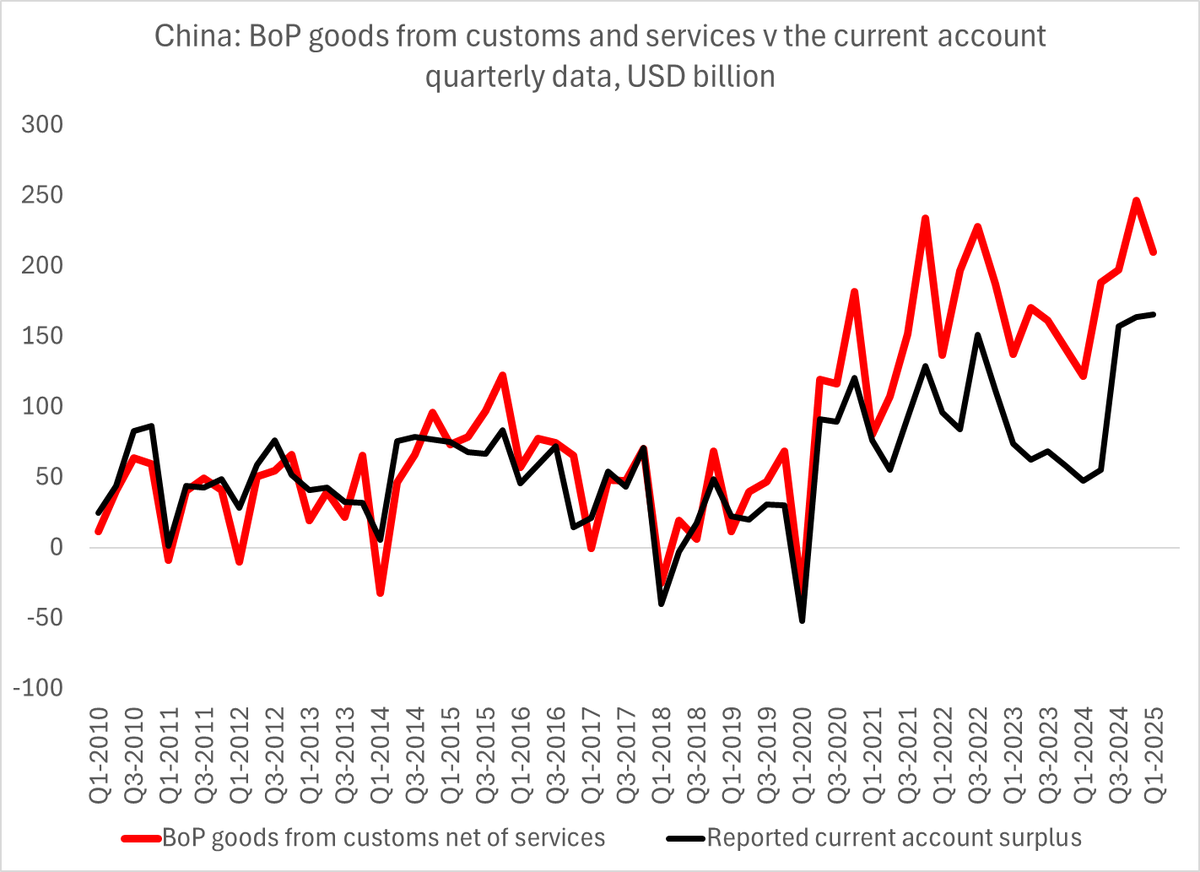

Point being that Japan's massive (50% of GDP) foreign bond holdings and the fact that most of these bonds are held by a small set of public or quasi public institutions gives Japan a unique set of options --

10/

10/

There are constraints on a reallocation back to Japan (probably ones other than those I identified) -- and such a flow would mostly be a yen positive flow, which creates another problem for the lifers and others with open positions ...

11/

11/

But at the end of the day there is a strong potential domestic bid for long-dated JGBs other than the BoJ ... Japan isn't the US, it is a big net creditor, and a lot of institutions were forced into foreign bonds by YCC. That flow could reverse ...

12/12

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh