[1/🧵] Bonjour 🇪🇺 and Bom dia 🇧🇷!

Two new stablecoins just launched on the XRP Ledger:

🔸 EURØP (EUR-backed by Schuman Financial)

🔸 USDB (USD-backed by Braza Group)

A quick peek behind the curtain. 👇

Two new stablecoins just launched on the XRP Ledger:

🔸 EURØP (EUR-backed by Schuman Financial)

🔸 USDB (USD-backed by Braza Group)

A quick peek behind the curtain. 👇

[2/14] — 🇪🇺 Overview —

EURØP ✖ Schuman Financial

🔸 MiCA-compliant regulated e-money token

🔸 Fully backed by €-denominated assets

🔸 Held in segregated accounts, separate from their corporate accounts

🔸 Supervised by Autorité de Contrôle Prudentiel et de Résolution (ACPR)

EURØP ✖ Schuman Financial

🔸 MiCA-compliant regulated e-money token

🔸 Fully backed by €-denominated assets

🔸 Held in segregated accounts, separate from their corporate accounts

🔸 Supervised by Autorité de Contrôle Prudentiel et de Résolution (ACPR)

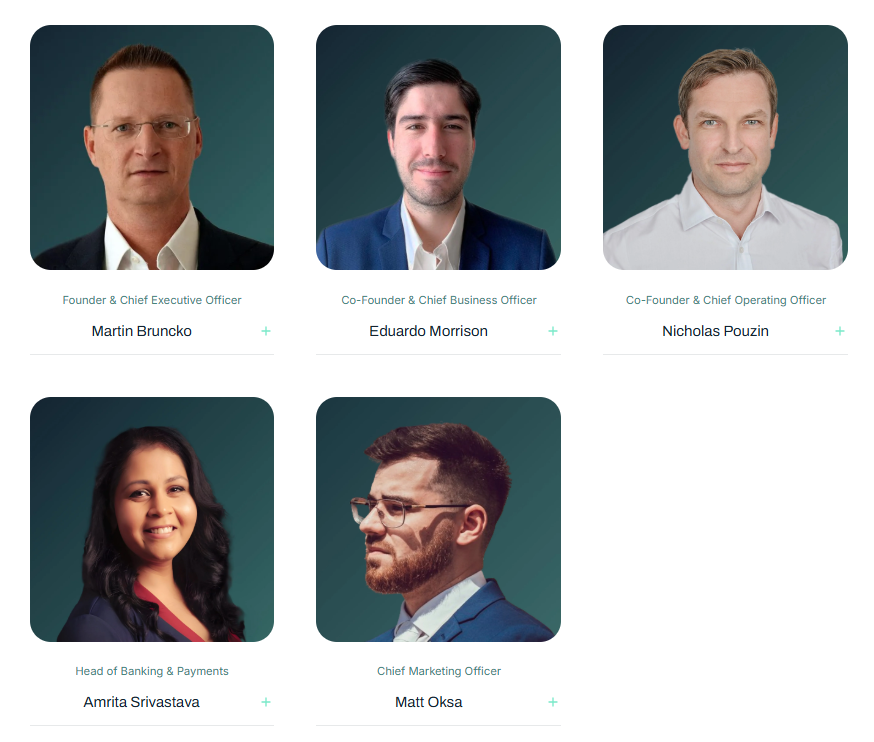

[3/14] — 🇧🇷 Overview —

USDB ✖ Braza Group

🔸 Expected to be MiCA regulated in 2025

🔸 Fully backed by $-denominated assets

🔸 Reserves held by Braza Bank Banco de Câmbio S.A.

🔸 A bank licensed and regulated by the Brazilian Central Bank

USDB ✖ Braza Group

🔸 Expected to be MiCA regulated in 2025

🔸 Fully backed by $-denominated assets

🔸 Reserves held by Braza Bank Banco de Câmbio S.A.

🔸 A bank licensed and regulated by the Brazilian Central Bank

[4/14] — 🇪🇺 Structure —

The issuer behind EURØP is actually Salvus SAS, a majority-owned & fully controlled company by Schuman Financial AG (registered in Zug, Switzerland)

Salvus' sole activity is the issuance & redemption of EURØP as a non-hybrid electronic money institution.

The issuer behind EURØP is actually Salvus SAS, a majority-owned & fully controlled company by Schuman Financial AG (registered in Zug, Switzerland)

Salvus' sole activity is the issuance & redemption of EURØP as a non-hybrid electronic money institution.

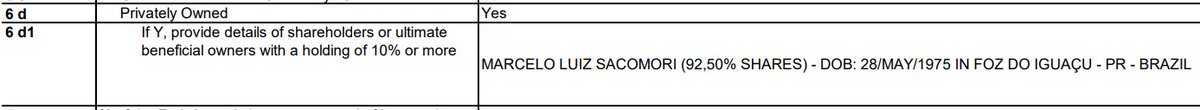

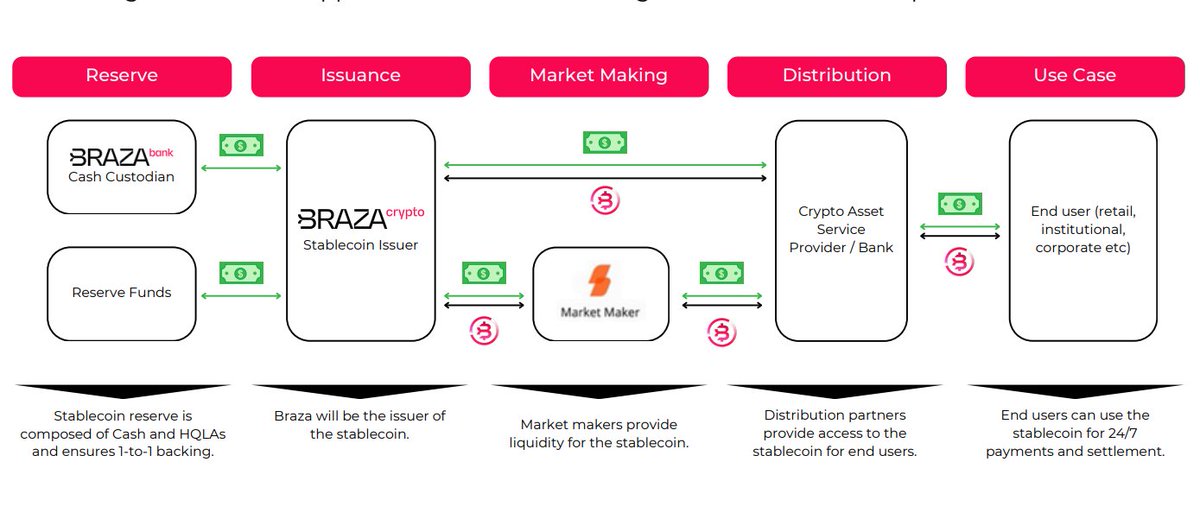

[5/14] — 🇧🇷 Structure —

Braza Group consists of a consortium of various companies that govern USDB.

🔸 Braza Crypto — Issuing & burning USDBs

🔸 Braza Bank — Custodian of the USDB reserves

🔸 Braza UK — Custodian of the tokens held by Braza’s clients in Europe

Braza Bank 👇

Braza Group consists of a consortium of various companies that govern USDB.

🔸 Braza Crypto — Issuing & burning USDBs

🔸 Braza Bank — Custodian of the USDB reserves

🔸 Braza UK — Custodian of the tokens held by Braza’s clients in Europe

Braza Bank 👇

[6/14] — 🇪🇺 Tech / Multi-Signature —

In their official whitepaper they state they are using multi-signature, but no signer list has been set up yet to keep the promise.

I expect them to set up multi-sig before minting more EUROP tokens in the future.

In their official whitepaper they state they are using multi-signature, but no signer list has been set up yet to keep the promise.

I expect them to set up multi-sig before minting more EUROP tokens in the future.

[7/14] — 🇧🇷 Tech / Multi-Signature —

No signer list has been put in place and nothing in their whitepaper suggests that this will change in the near future.

I'm in the hope that this will still happen and also before more tokens are minted (2,000 USDB in circulation so far)

No signer list has been put in place and nothing in their whitepaper suggests that this will change in the near future.

I'm in the hope that this will still happen and also before more tokens are minted (2,000 USDB in circulation so far)

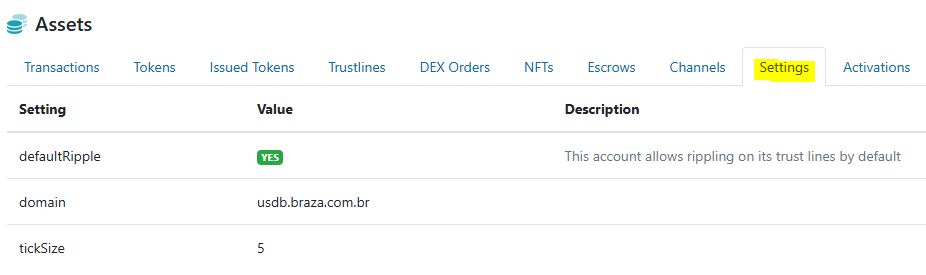

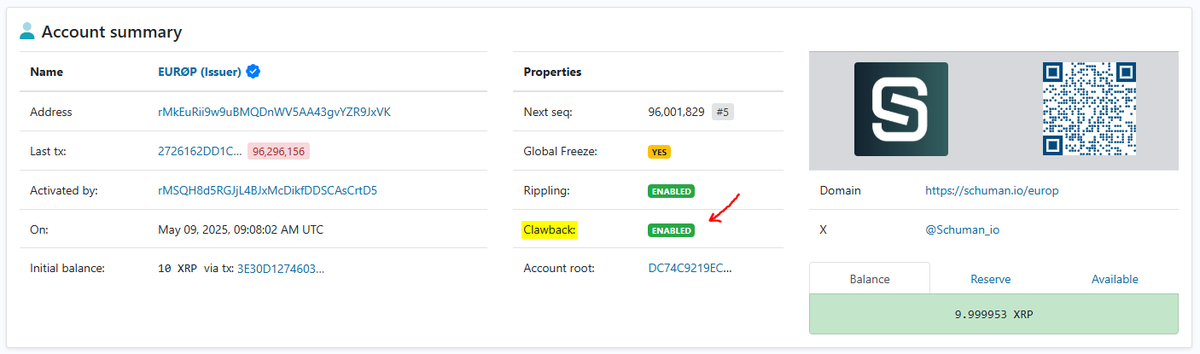

[8/14] — 🇪🇺 Tech / Compliance —

Clawback got setup initially to give them the permanent ability to react to sanctioned accounts using their tokens or illegal activity.

Amusingly, they've enabled Global Freeze, probably to test out a few things on the XRPL in the initial phase.

Clawback got setup initially to give them the permanent ability to react to sanctioned accounts using their tokens or illegal activity.

Amusingly, they've enabled Global Freeze, probably to test out a few things on the XRPL in the initial phase.

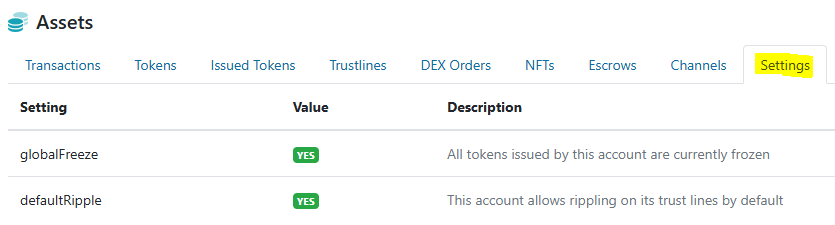

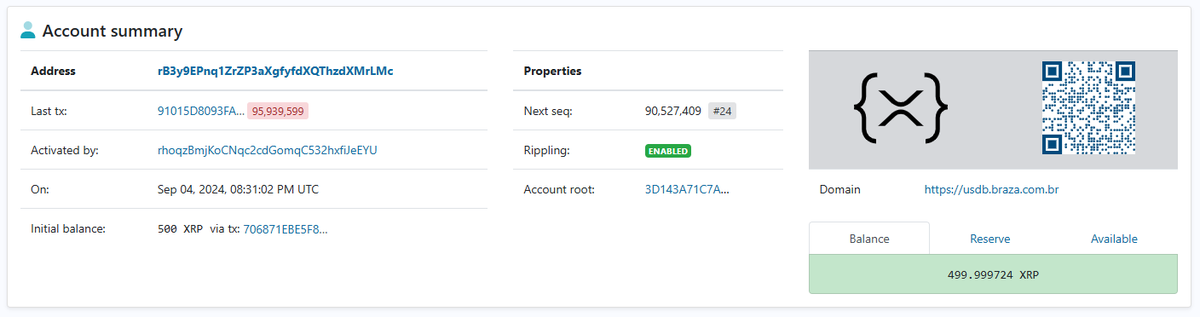

[9/14] — 🇧🇷 Tech / Compliance —

Here, Clawback isn't enabled and tokens have already been issued and sent out.

A pretty "empty" account in general with not much set up yet. I assume they are still evaluating all the options before moving forward.

Here, Clawback isn't enabled and tokens have already been issued and sent out.

A pretty "empty" account in general with not much set up yet. I assume they are still evaluating all the options before moving forward.

[10/14] — 🇪🇺 Transparency —

— Audits —

🔸 Entire circulating supply audited by KPMG on a quarterly basis

🔸 Security audits by Certik

— Attestations —

🔸 Monthly attestations about the reserves held in Société Générale

🔸 2% extra reserve on top to mitigate market volatility.

— Audits —

🔸 Entire circulating supply audited by KPMG on a quarterly basis

🔸 Security audits by Certik

— Attestations —

🔸 Monthly attestations about the reserves held in Société Générale

🔸 2% extra reserve on top to mitigate market volatility.

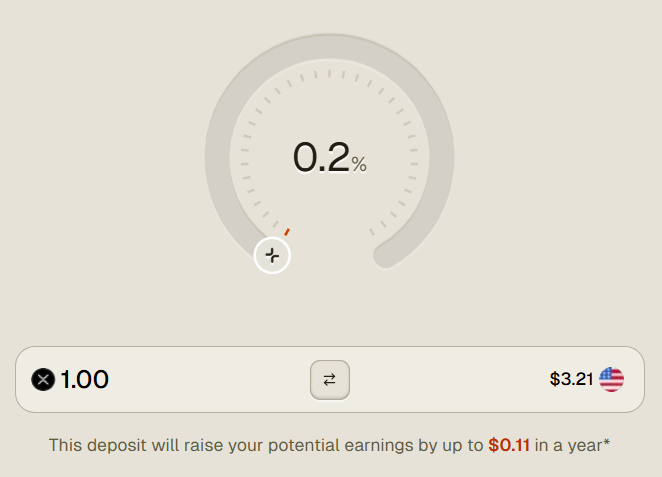

[11/14] — 🇧🇷 USDB’s Lifecycle —

The flowchart shows how the reserves are held in “Braza Bank”, while “Braza Crypto” is responsible for issuing the tokens.

Some more highlights:

🔸 Reserves are segregated in a dedicated fiduciary estate

🔸 Details updated daily on their website

The flowchart shows how the reserves are held in “Braza Bank”, while “Braza Crypto” is responsible for issuing the tokens.

Some more highlights:

🔸 Reserves are segregated in a dedicated fiduciary estate

🔸 Details updated daily on their website

[12/14] — Summary —

🔸 Early-stage setup & testing ongoing

🔸 Some promises in the whitepapers not yet kept

🔸 No multi-sig signer lists configured yet

🔸 USDB is NOT a clawback enabled token

🔸 EUROP is a clawback enabled token

🔸 Early-stage setup & testing ongoing

🔸 Some promises in the whitepapers not yet kept

🔸 No multi-sig signer lists configured yet

🔸 USDB is NOT a clawback enabled token

🔸 EUROP is a clawback enabled token

[13/14] — Krippenreiter —

I write about DLT and crypto, but primarily about XRP and the XRPL-ecosystem. 🔥

If this interests you and you want to learn more, please follow me here:

@krippenreiter

Feel free to contribute by sharing here 👇

I write about DLT and crypto, but primarily about XRP and the XRPL-ecosystem. 🔥

If this interests you and you want to learn more, please follow me here:

@krippenreiter

Feel free to contribute by sharing here 👇

https://x.com/krippenreiter/status/1925677351536414744

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh