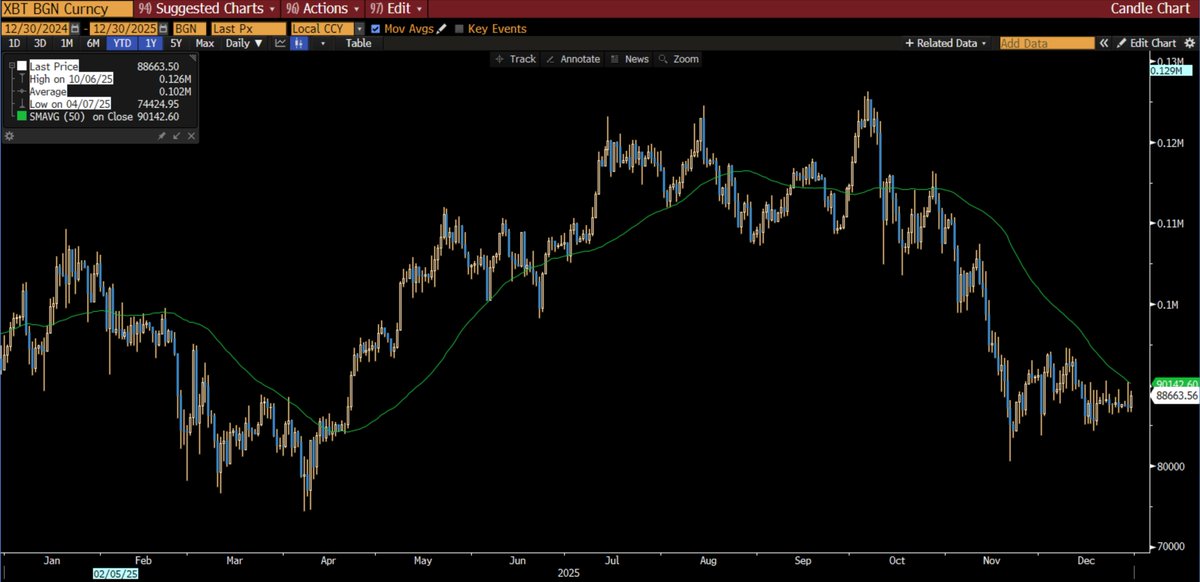

1/ Bitcoin is back at all-time highs. Last time up here, talk centered on a strategic BTC reserve. This time, macro stress is pulling in new investors seeking an alternative to a system that’s clearly breaking down.

Thread 🧵

Thread 🧵

2/ Bessent “The market and the economy have become hooked, become addicted, to excessive government spending and there’s going to be a detox period.”

https://x.com/Geiger_Capital/status/1897995482300891580

3/ And now after Moody's downgrade and the Tax Bill, "We can both grow the economy and control the debt. What is important is that the economy grows faster than the debt."

https://x.com/SecScottBessent/status/1925910800394232082

5/ but this is not just US yields rising, "There is a global element to the move in interest rates. 10Y yields are above nominal GDP in France, Germany, Italy, Austria, Finland and Australia, amongst other places. Hard to pin it just on US fiscal dynamics."

https://x.com/RenMacLLC/status/1924553493140144197

6/ and now Bessent with 30y yields back above 5% comes to the rescue with what would be the first verbal liquidity

9/ I listened to two podcasts today about capital controls and the news is starting to talk more about it

10/ and Arthur Hayes is talking about capital controls

https://x.com/BanklessHQ/status/1924434867925778626

12/ and Bessent: "The Trump Administration is going big on digital assets."

https://x.com/SecScottBessent/status/1925967578540781743

15/ and now private equity and long duration assets with no liquidity are in the spotlight - Bill Ackman: "One thing I believe is that the private equity, venture capital and real estate portfolios are mismarked"

https://x.com/BoringBiz_/status/1925697667390210071

16/ FT Robin Wigglesworth - “IRR” is private equity’s favourite measure of returns, but it is tragicomically flawed and often used to bamboozle investors.

https://x.com/RobinWigg/status/1925903534756712685

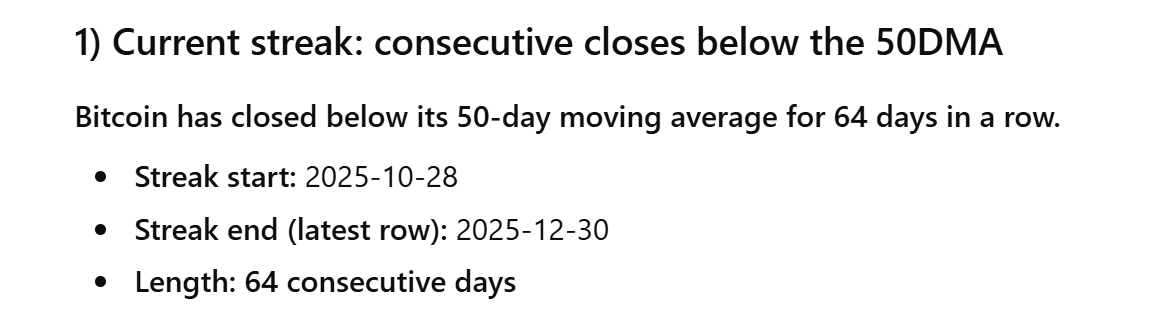

17/ I have said on Pomp and reiterated this week that I believe there will be a short squeeze this year at some point and it appears others are thinking the same thing.

18/ Global bond yields are going higher and Asia is showing signs of repatriation as the Asian Dollar index rises while TLT makes new lows this week. Moody's downgrades US. The current system is broken and investors are looking for diversification. BTC

• • •

Missing some Tweet in this thread? You can try to

force a refresh