Over the past few months, Russians have focused on disrupting Ukrainian logistics, using a mix of drones, including fiber-optic. Once EW is neutralized or forced to withdraw by fiber-optic drones, it clears the way for drones like the Molniya, which can fly over 20 km. Thread:

2/ Cutting off supply lines has made vehicle transport nearly impossible. In some cases, individual soldiers must walk more than 10 km at night to deliver basic supplies: an unsustainable way for supporting any sizable unit, or even rotating troops.

3/ Despite growing logistical problems, Ukrainian command has made bad choices to launch Russian-modelled assaults. The attempt to capture positions while already struggling to hold current ones, with fewer troops and less equipment, lead to predictably poor outcome

4/ At the same time, Russia has sharply increased production of Geran drones (upgraded Shahed variants), with daily output likely exceeding 100 units. Our Satellite imagery analysis shows a clear rise in drone deployment - not from stockpiling, but from steady manufacturing.

5/ Russia’s position has improved thanks to successful efforts to disrupt Ukrainian supply lines across several frontline areas, including near Kostyantynopil and Pokrovsk. Still, their reliance on small-unit tactics allows for grinding advances but falls short of breakthroughs.

6/ Russian forces appear confident in their chances of making substantial gains in the summer of 2025. Meanwhile, despite clear fatigue, Ukrainian forces also remain firm and confident in their ability to hold the line and prevent Russia from achieving a strategic shift.

7/ Whether Russia sees major gains - or fails to advance - this summer and early fall could heavily influence its broader decision-making. A stalled offensive might force a reassessment of the war’s overall cost-benefit outlook.

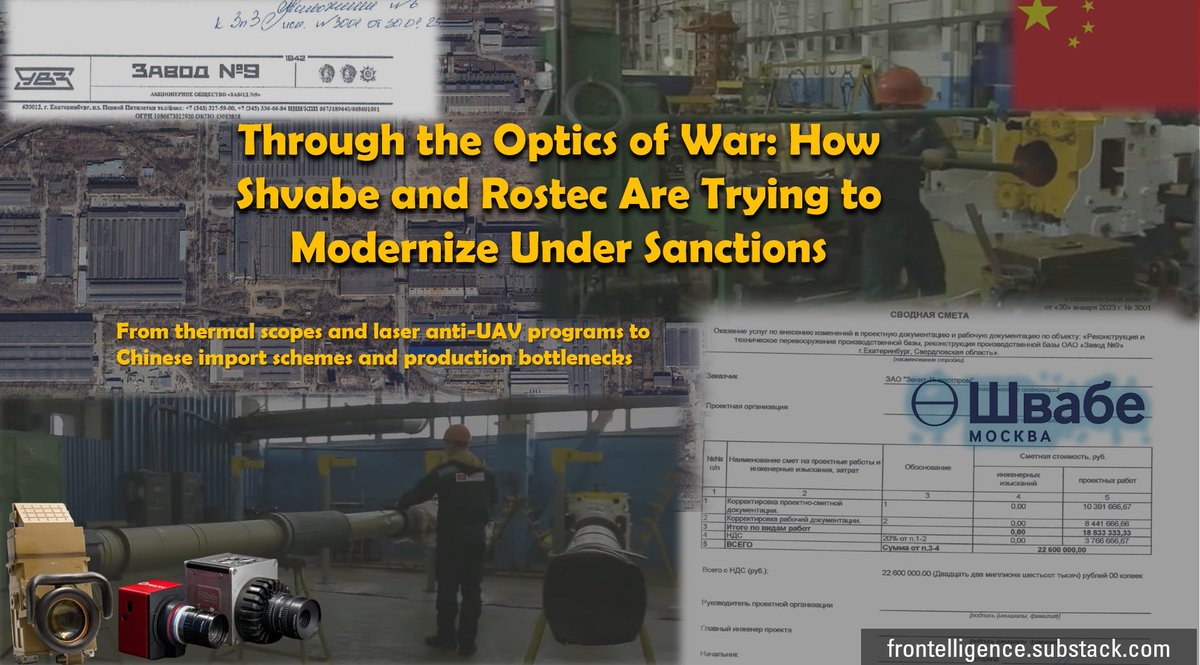

Thank you for reading. As mentioned earlier, our team is working on a few projects involving leaked Russian confidential documents. Last time we asked for support, but very few responded. Please consider supporting us through BuyMeACoffee - it helps a lot

buymeacoffee.com/frontelligence

buymeacoffee.com/frontelligence

• • •

Missing some Tweet in this thread? You can try to

force a refresh