There is, at least in my view, a lot of sloppy analysis about the role the dollar's reserve currency "status" plays in financing the US external deficit.

I understand how reserve accumulation funds the deficit, but not how the "status" of the dollar does ...

1/ many

I understand how reserve accumulation funds the deficit, but not how the "status" of the dollar does ...

1/ many

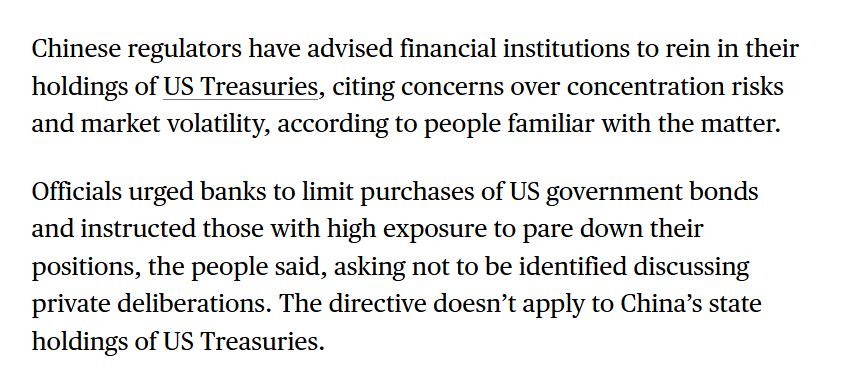

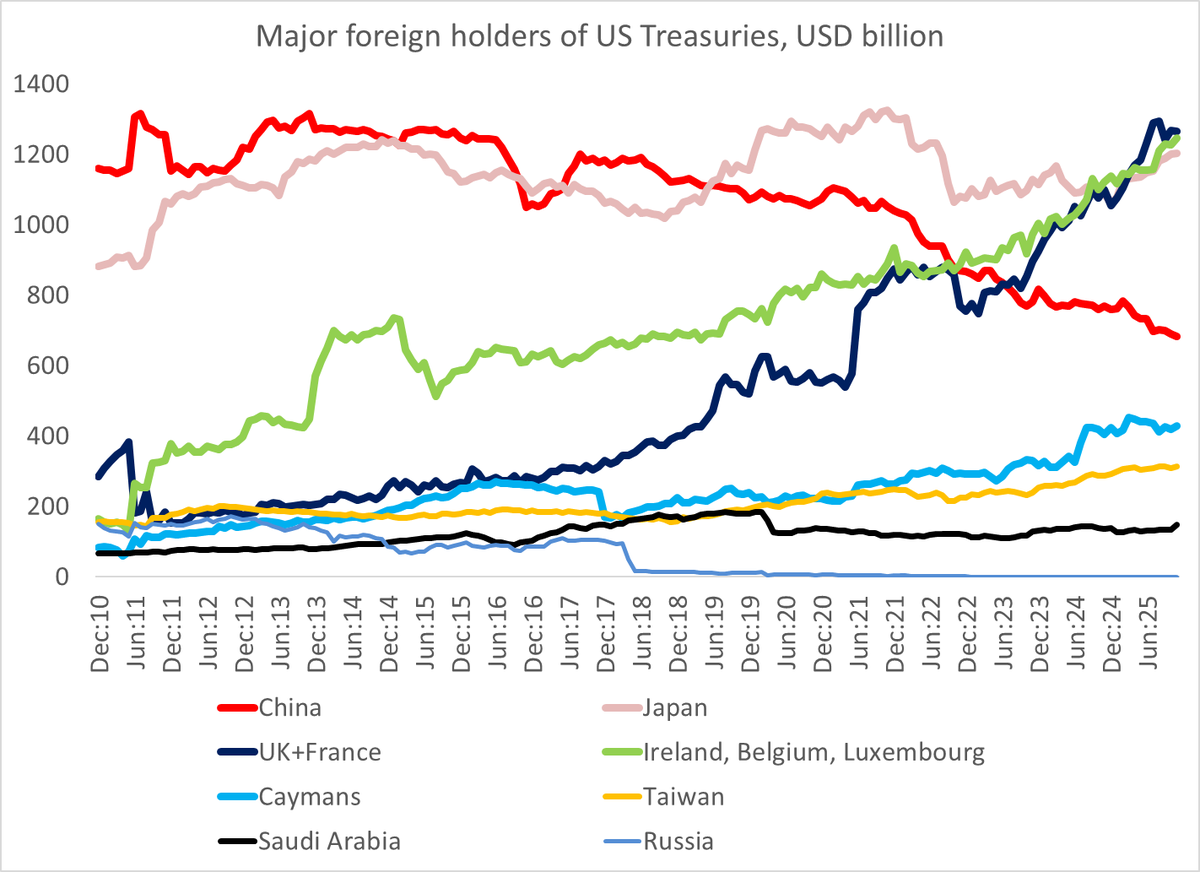

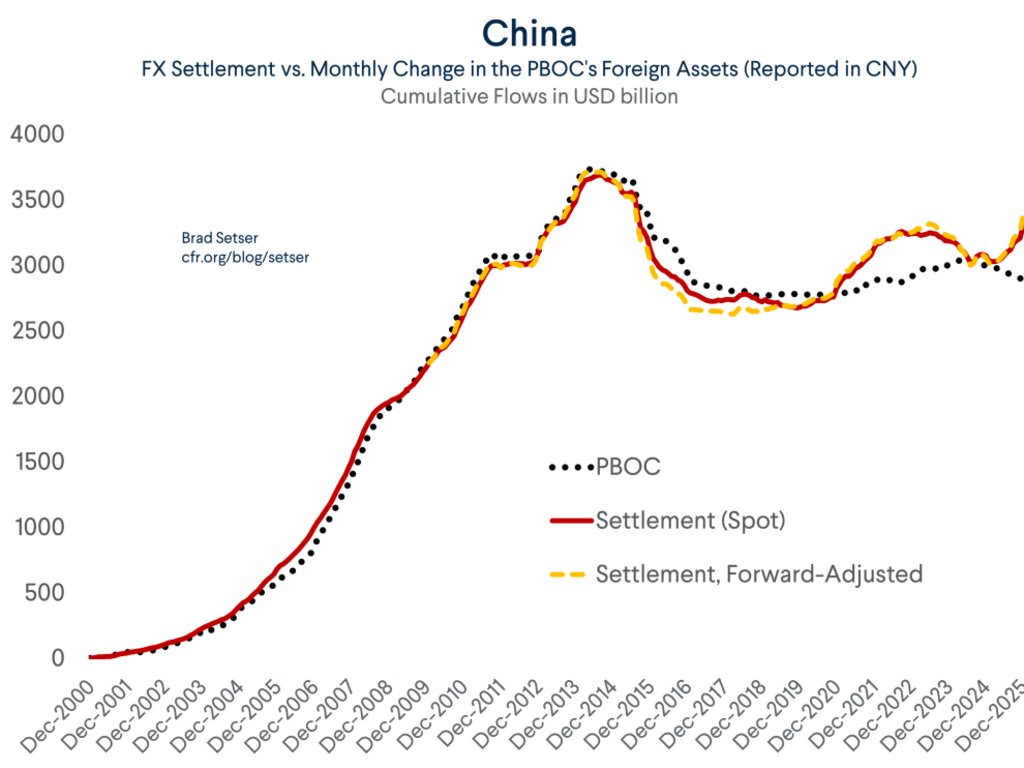

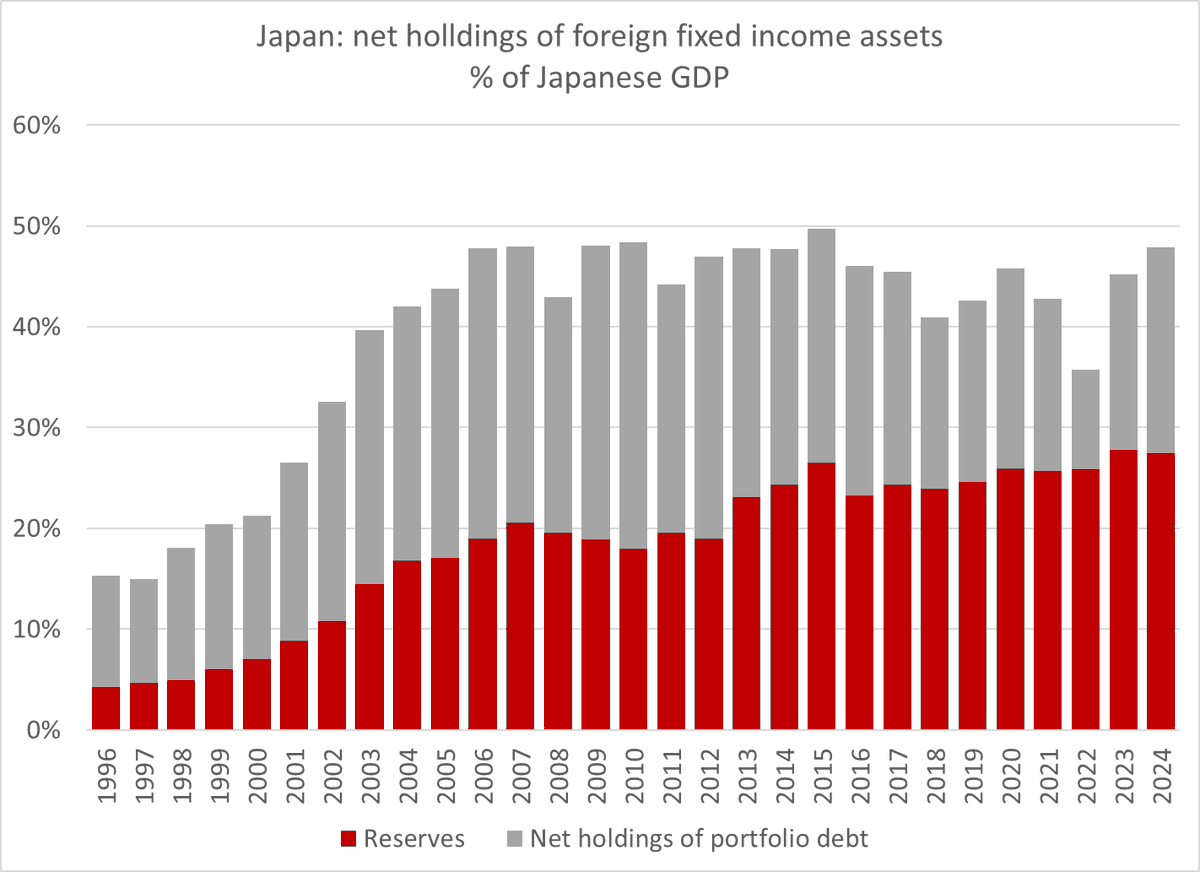

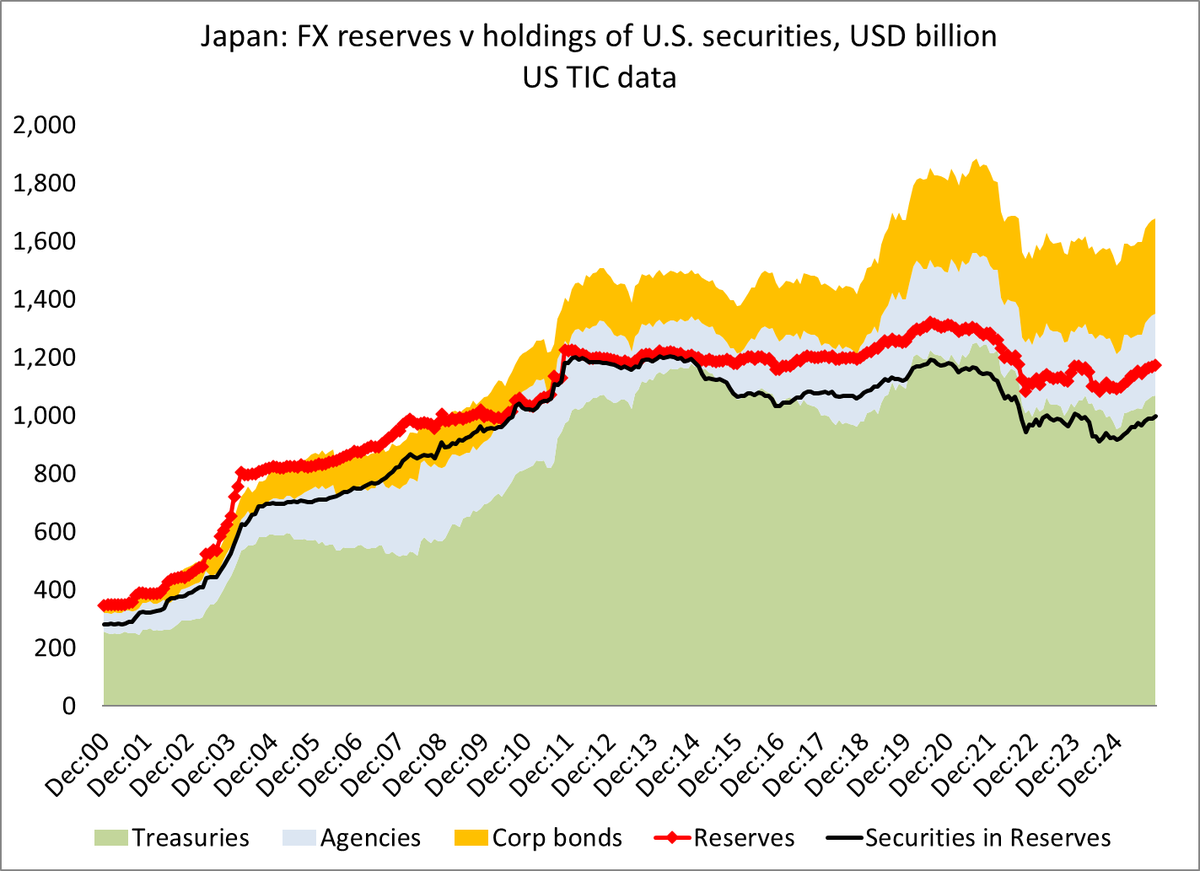

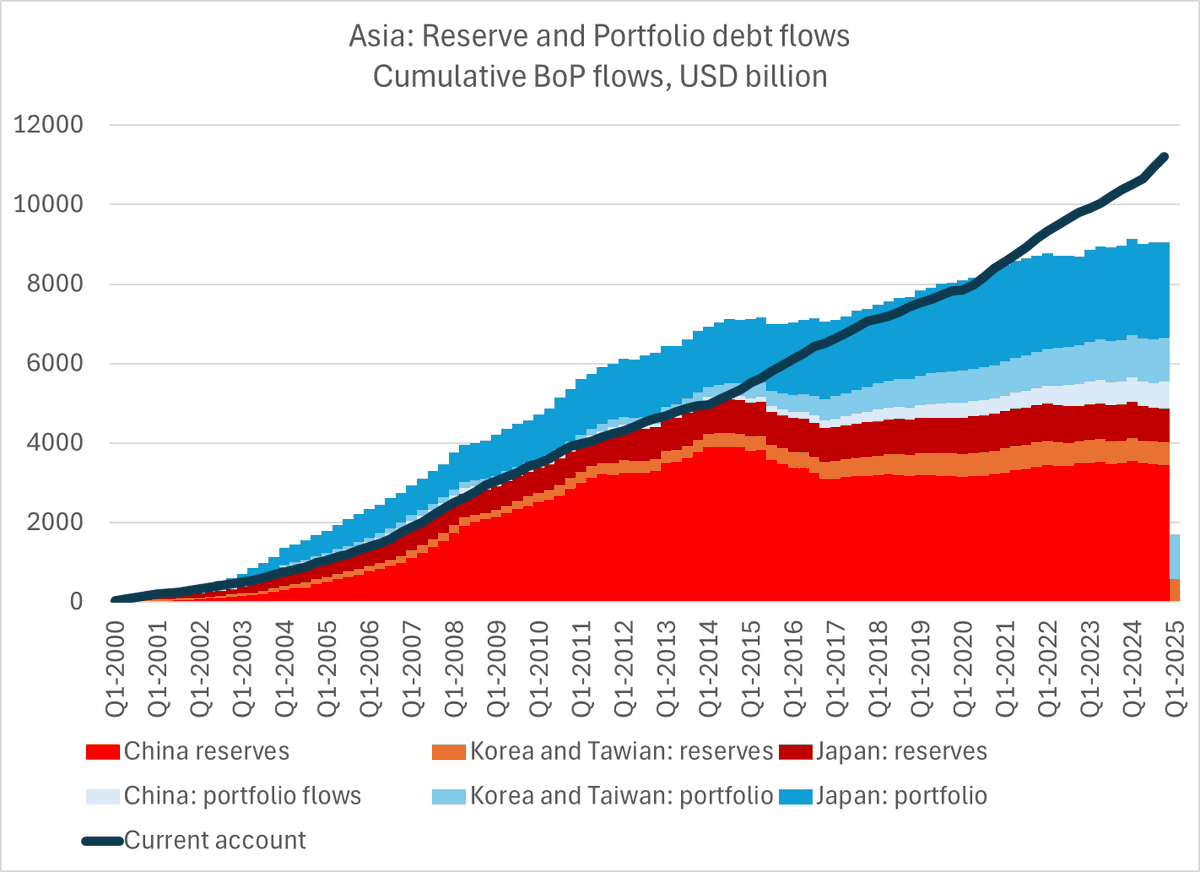

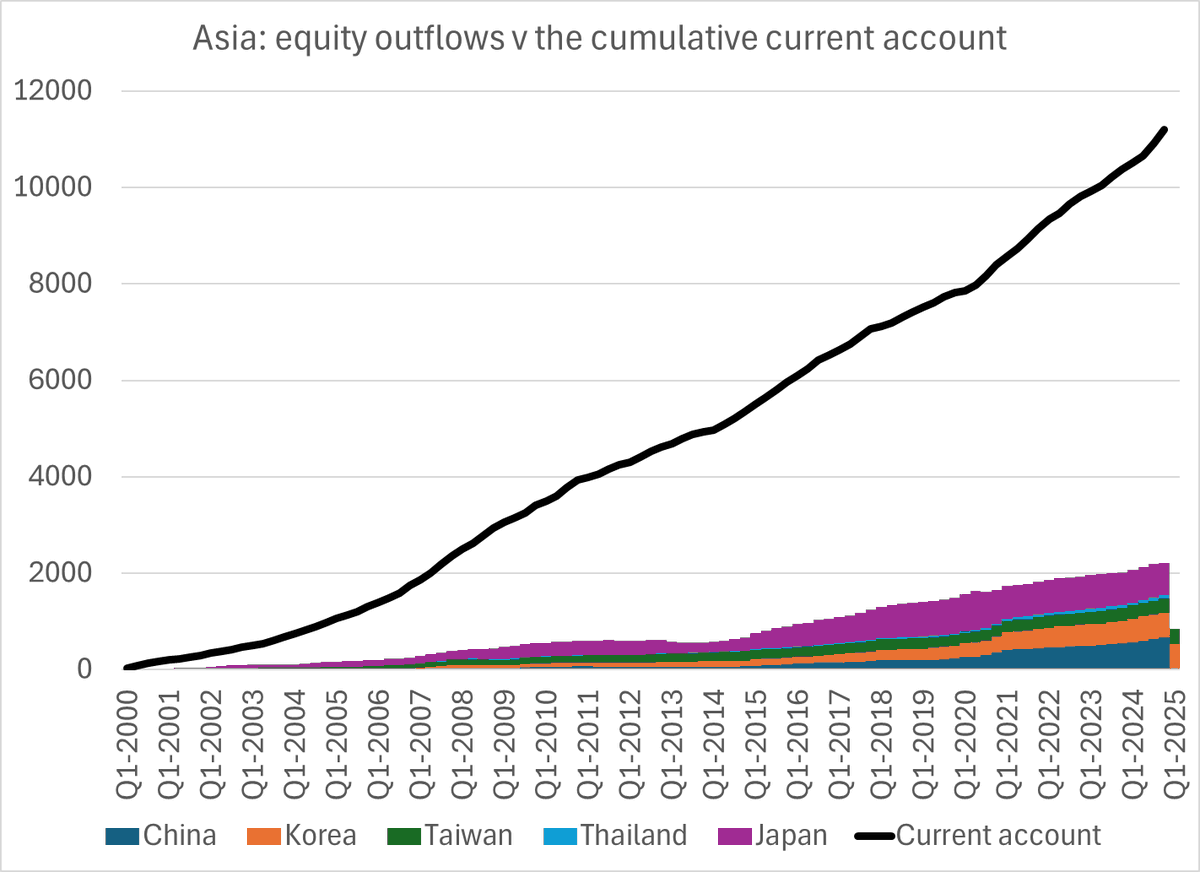

There was a time when reserve accumulation by the large surplus countries in Asia mapped perfectly to their external surplus, and their reserve accumulation really did generate large financial inflows into the US

2/

2/

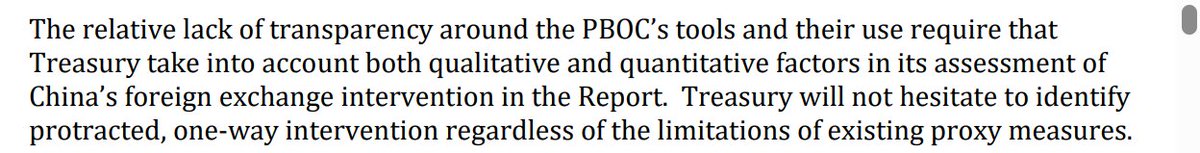

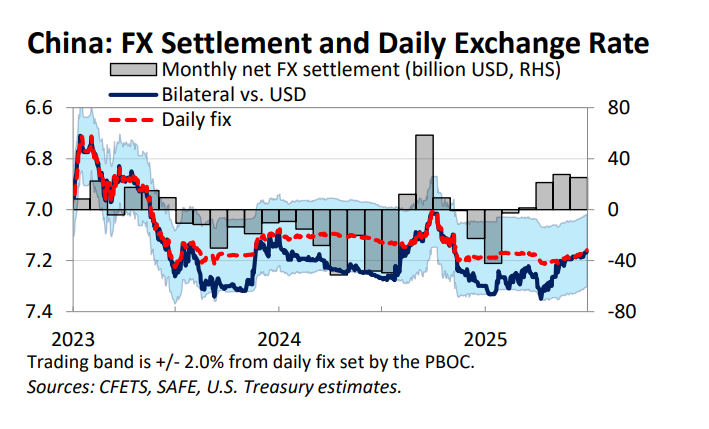

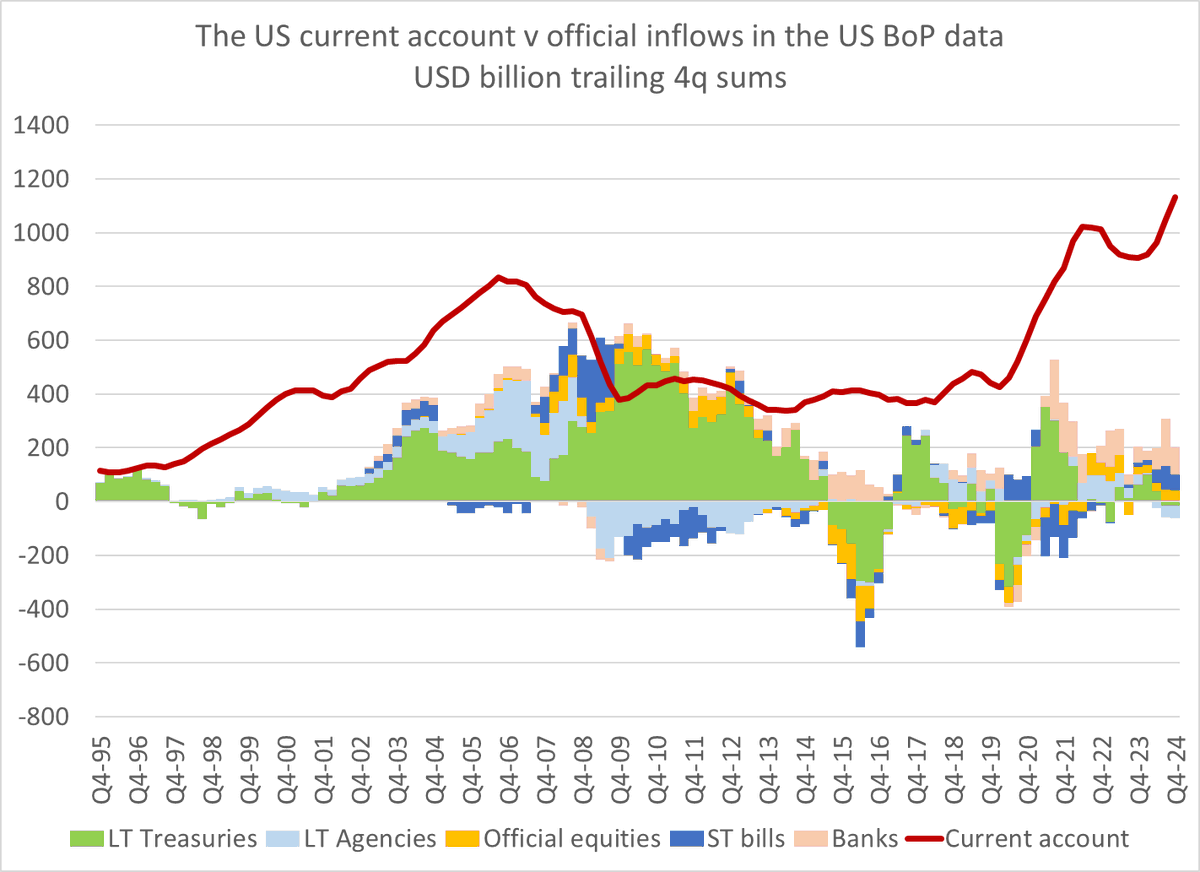

At the time my sense was that the economic conventional wisdom was that fx intervention didn't matter that much; many argued that reserve accumulation wasn't fundamental to the financing of the US external deficit (I disagreed at the time)

3/

centerforfinancialstability.org/iceland/setser…

3/

centerforfinancialstability.org/iceland/setser…

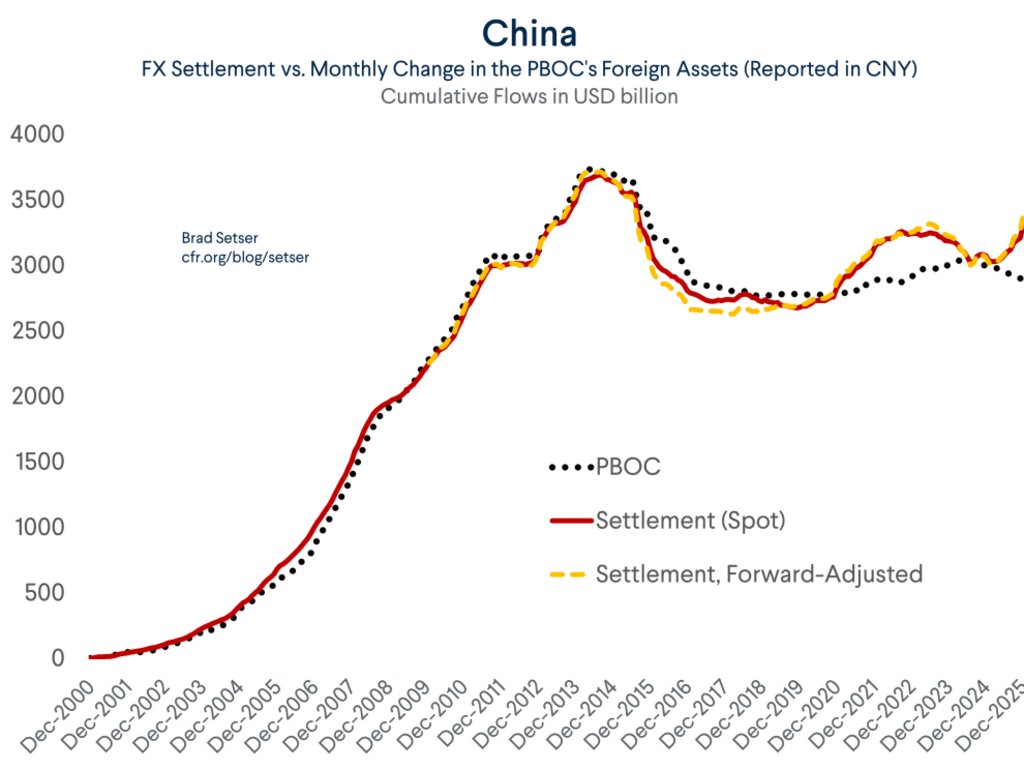

Now the CW (even more outside the US than inside the US) attributes the financing of the US external deficit to the dolllar's reserve currency "status" even tho reserve accumulation hasn't driven the Asian surplus flow over the last 10 years

4/

4/

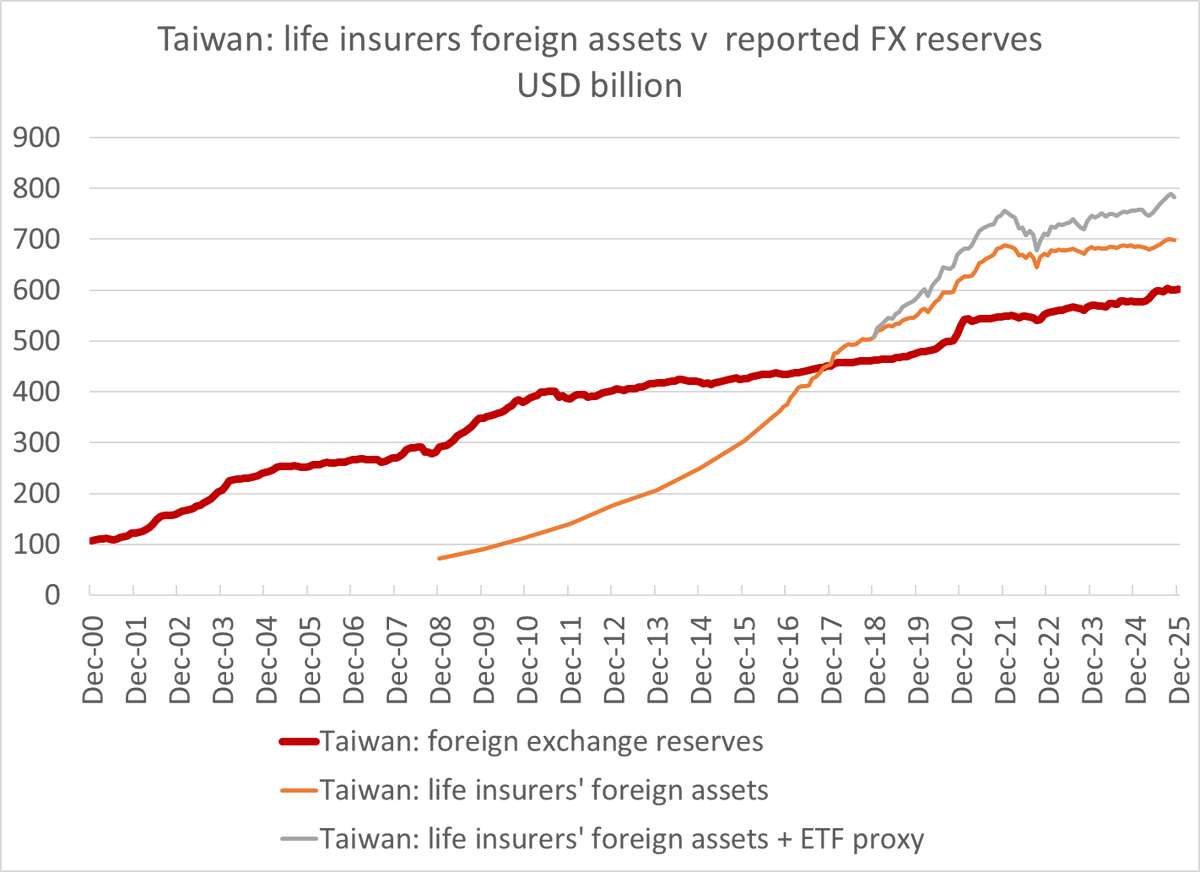

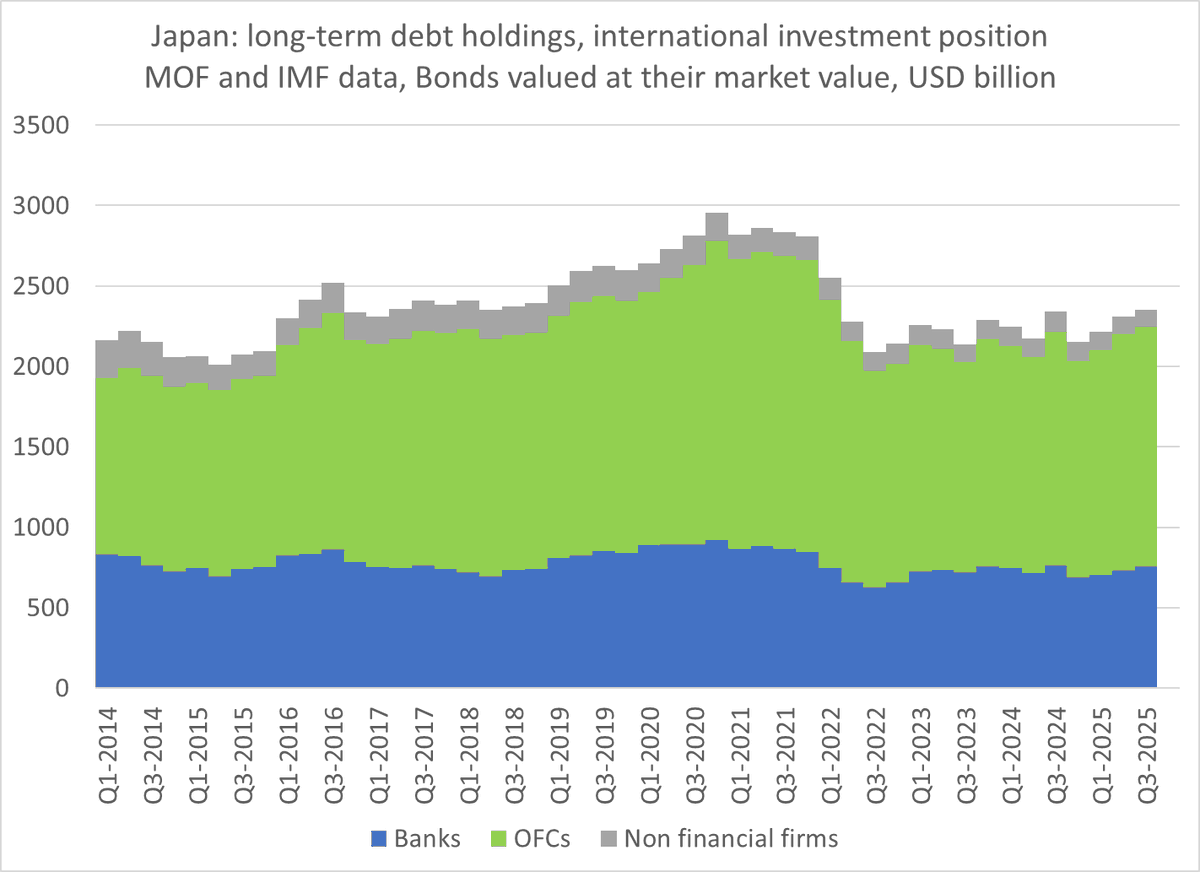

Even portfolio debt outflows (the Taiwan lifers, the Japanese banks, lifers and the GPIF, etc) don't fully match the Asian surplus -- balance has take some equity flows too

5/

5/

I would be among the first to acknowledge that "private" portfolio outflows from Asian surplus countries often some from government entities -- China's state banks, Korea's NPS, Japan's GPIF and Postbank ...

6/

6/

But the fact remains that reserve related flows are playing a smaller role in the financing of the US current account deficit than at almost any point in the last 25 years ... yet all anyone talks about is the dollar's reserve currency role!

7/

7/

• • •

Missing some Tweet in this thread? You can try to

force a refresh